-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Tech Stocks Lead Risk-On Equity Bounce

EXECUTIVE SUMMARY:

- CHINA FACES SLOW RECOVERY FROM COVID LOCKDOWNS (MNI)

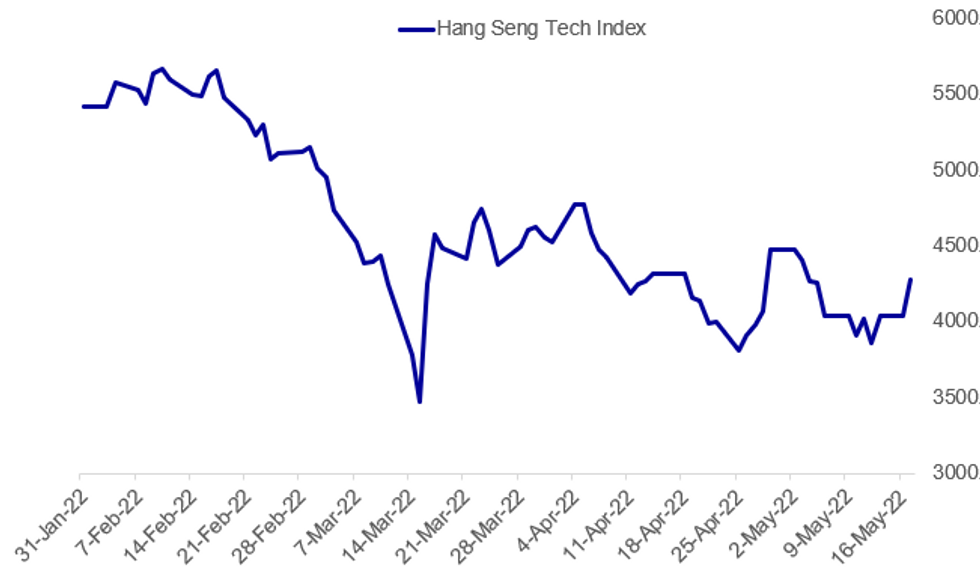

- HONG KONG'S HANG SENG TECH INDEX SURGES ON BETS CRACKDOWN TO EASE

- MUSK SAYS TWITTER MUST PROVE BOT CLAIMS FOR DEAL TO PROCEED

- GERMAN DEF. MIN.: NEED INTENSIVE NATO DIALOGUE WITH TURKEY

- UK MARCH NOMINAL EARNINGS SURGE TO RECORD HIGH

Fig. 1: Hang Seng Tech Stocks Jump

Source: BBG, MNI

Source: BBG, MNI

NEWS:

CHINA (MNI): A near-term rebound will be slow in China even as Shanghai could soon emerge from nearly two months of lockdown after key data this week showed the economy was hit the hardest since the initial outbreak of Covid-19 pandemic two years ago, according to analysts. For full article contact sales@marketnews.com

TECH STOCKS (BBG): Chinese tech stocks jumped as traders bet a key meeting Tuesday between the nation’s top regulators and corporate giants would result in Beijing dialing back its yearlong clampdown of the industry. The Hang Seng Tech Index rallied 5.8%, the most this month, with Sunny Optical Technology Group and Li Auto Inc. the top performers. JD.com Inc. also traded higher ahead of its earnings later in the day. China’s top political advisory body is hosting a symposium related to the digital economy, according to state media. While the outcome wasn’t released within trading hours, a Reuters report showed Chinese Vice Premier Liu He is scheduled to speak at the meeting also attended by private-sector executives like Baidu Inc. founder Robin Li.

TWITTER (BBG): Elon Musk declared he won’t proceed with his $44 billion takeover of Twitter Inc. unless the social media giant can prove bots make up fewer than 5% of its users, casting yet more uncertainty over the deal. The billionaire tweeted “this deal cannot move forward” unless Twitter provides proof of its claims, reiterating his own view that the ratio is far higher. Musk’s latest online pronouncement complicates an already chaotic takeover, potentially one of the largest acquisitions the internet industry has ever seen. Twitter’s shares fell another 3.2% in pre-market trading in New York, after sliding more than 8% the previous day.

MARKETS (BBG): Investors are “extremely bearish,” with allocations to cash at the highest level since 9/11 and the biggest tech “short” since Aug. 2006, according to Bank of America’s May global fund manager survey. Cash levels surged to 6.1% from 5.5%, marking a 20-year high, while investors are most underweight equities since May 2020 (net 13%); market is not yet at “full capitulation” as investors expect rate hikes not cuts, according to strategists led by Michael Hartnett. “Stocks prone to imminent bear rally but ultimate lows not yet reached,” they write, adding Fed “put” is seen at the 3,529 mark on S&P 500, ~12% below current levels.

CHINA / BONDS (BBG): China’s main bond trading platform for foreign investors has quietly stopped providing data on their transactions, a move that may heighten concerns about transparency in the nation’s $20 trillion debt market after record outflows. Daily trades by overseas investors were last provided for May 11 by the China Foreign Exchange Trade System, according to people familiar with the matter, who asked not to be identified discussing private information. The data showed sizable net foreign outflows that day, with some selling also seen for most days in April, the people said. It’s unclear why CFETS stopped publishing the figures, which are typically updated one day later, the people said. There was also no indication of whether the move was temporary or related to the lockdown of Shanghai, the nation’s onshore financial capital.

NATO: Speaking ahead of a meeting of European Union defence ministers, German Defence Minister Christine Lambrecht states that NATO must hold an 'intensive dialogue' with Turkey regarding Sweden and Finland's applications to join the alliance. Yesterday, Turkish President Recep Tayyip Erdogan doubled down on his earlier comments that Turkey would not back membership for either Nordic nation.

RUSSIA/NATO: Speaking at the 'New Horizons Educational Marathon' Russian Foreign Minister Sergey Lavrov stating that there would be 'no big difference' if Sweden and Finland join NATO as both had 'long participated in NATO military drills'. Language much softer than that used by other Russian gov't officials. Lavrov also stated that NATO did not respect its 'promises' not to enlarge further, stating that "NATO wants a unipolar world. They promised Russia they won't enlarge, even in 2009, and that they won't threaten us, but they tricked us....No country can strengthen its security on the backs of others...The Atlantic organization cannot claim to have dominance over security,"

US-UKRAINE (BBG): US Treasury Secretary Janet Yellen issued a call for large-scale economic assistance to Ukraine, warning that the amounts of help pledged to date won’t even meet short-term needs as the nation struggles with the devastation wrought by Russia’s invasion.“Eventually, Ukraine will need massive support and private investment for reconstruction and recovery, akin to the task of rebuilding in Europe after 1945,” Yellen said in a speech in Brussels Tuesday. “What’s clear is that the bilateral and multilateral support announced so far will not be sufficient to address Ukraine’s needs, even in the short term.”

US-CHINA-EUROPE (BBG): Treasury Secretary Janet Yellen said that western democracies have become “too vulnerable” to countries that use their market positions as geopolitical leverage, and called for the US and Europe to coordinate their approach toward China after having united against Russia.“We have a common interest in incentivizing China to refrain from economic practices that have disadvantaged us all,” Yellen said in a speech in Brussels on Tuesday. “These practices range from those affecting trade and investment, to development and climate policies, to approaches to provide debt relief to countries facing unsustainable debt burdens.”

COMMODITIES: India's Ministry of Commerce and Industry has confirmed that it will partially relax the almost-total wheat export ban, tweeting: "Government announces some relaxation in wheat export notification; Allows wheat consignment already registered with Customs prior to the order"

UK-EU (BBG): Ireland’s Foreign Minister Simon Coveney says he spoke to UK Foreign Secretary Liz Truss on Monday night and made clear that “breaking international law is not the answer to solving Protocol issues,” according to a tweet.“The EU/UK negotiating teams haven’t met since Feb. Time to get back to the table”

BANKS / RATINGS (BBG): Ratings for Credit Suisse Group AG were cut by S&P Global Ratings, on the basis that the bank’s turnaround plans will be even more difficult to achieve in the currently deteriorating economic and business environment. The long term issuer credit rating on the bank’s holding company was lowered to BBB and the bank’s core operating subsidiaries were downgraded to A, according to a statement on Tuesday. S&P said it sees management targets to restore profitability as ambitious, particularly in the context of the broad changes to the executive team.

DATA:

MNI BRIEF: UK March Nominal Earnings Surge To Record High

UK nominal total earnings rose by 9.9% in March, the biggest rise on record, taking first quarter earnings to 7.0% above the level a year ago, far exceeding analysts’ expectations. The surge in earnings comes as the jobless rate fell further to 3.7%, the lowest rate since the fourth quarter of 1974. Employment, as measured by the Labour Forces Survey, rose by 83,000, also outpacing forecasts.

The employment rate rose slightly, but the inactivity rate was unchanged at 21.4%, after rising over the past few months. Hours worked rose to 32.0 from 31.9 in the three months to February, matching pre-pandemic levels for the first time. Evidence of a hot labour market, along with the jump in nominal earnings, is likely to cause some consternation amongst members of the Bank of England’s MPC.

Regular earnings rose by a more subdued 4.2% in the first quarter, up from 4.1% in the three months to February, but that increase far undershot the rate of inflation. Adjusted by CPIH, real regular earnings fell by 1.2%, the biggest decrease since the first quarter of 2013, while real total earnings rose by an annual rate of 1.4%. The fall in real earnings is more dramatic when adjusted by CPI, as regular earnings decreased by 2.0%. the biggest fall since Q3 2013.

FIXED INCOME: Core FI down on the day, but off earlier lows

- After a risk-on Asian session (helped by rescinding Chinese covid concerns and an easing of restrictions in Hong Kong), core fixed income started the European session on a similar downward path. There was also very strong UK labour market data and core fixed income markets hit their intraday lows within 10 minutes of the gilt open (see the gilt comment at 9:43BST for more). Since then we have drifted sideways a bit, but maintaining most of the early losses.

- Gilt and UST curves have bear flattened while the German curve has steepened.

- Gilts continue to underperform the German and UST curve after the stronger than expected labour market data this morning. The curve has bear flattened, led by a sell-off at the front-end with 2-year yields up 10.2bp at writing to 1.324% with 10-year yields up 8.0bp (so the 2s10s curve flattening by 2.3bp to 48.4bp).

- It remains a big week for data in the UK with inflation data due tomorrow morning and then GfK consumer confidence and retail sales data both due Friday.

- Looking ahead, the most notable upcoming data release will be US retail sales.

- There are a number of speakers again today. In terms of speakers we will hear from ECB's Lagarde and Centeno, BOE's Cunliffe, Fed's Powell, Bullard, Harker, Kashkari, Mester and Evans.

- TY1 futures are down -0-9+ today at 119-12 with 10y UST yields up 2.8bp at 2.913% and 2y yields up 3.4bp at 2.607%.

- Bund futures are down -0.75 today at 153.28 with 10y Bund yields up 5.3bp at 0.988% and Schatz yields up 4.0bp at 0.168%.

- Gilt futures are down -0.70 today at 119.57 with 10y yields up 7.8bp at 1.807% and 2y yields up 10.5bp at 1.327%.

FOREX: Risk On lead FX

- Story of the European morning session, has been the Risk On tone driving the USD lower across the board.

- Although the Dollar still holds small gains vs the Yen.

- The JPY has been under pressure again, led by Risk.

- Most notable moves has been in the Pound, following the Employment data beat on the Govie open.

- Cable has gained over 1.2% and heading towards 1.2500, with next resistance seen at 1.2512 High May 9.

- GBPJPY is up 1.53%, and next upside target is seen at 162.01, the 50% short term retrace of the April/May fall.

- EURGBP is clear through the 0.8415 50-day EMA, and test below 0.8400.

- Best performer against the USD, is the NOK, helped by the Risk On tone and higher Oil.

- Immediate support in USDNOK is at 9.6117.

- Looking ahead, US Retail Sales and IP are the notable Data.

- Speakers include, ECB Lagarde, Centeno, BoE Cunliffe, Fed Powell, Bullard, Harker, Kashkari, Mester and Evans.

EQUITIES: Tech Stock Rally (Led By Hang Seng)

- Asian markets closed higher: Japan's NIKKEI closed up 112.7 pts or +0.42% at 26659.75 and the TOPIX ended 3.45 pts higher or +0.19% at 1866.71. China's SHANGHAI closed up 19.948 pts or +0.65% at 3093.697 and the HANG SENG ended 652.31 pts higher or +3.27% at 20602.52 - led by the Tech Index (up 6%).

- European equities are also gaining, with the German Dax up 180.62 pts or +1.29% at 14154.95, FTSE 100 up 55.93 pts or +0.75% at 7518.07, CAC 40 up 95.77 pts or +1.51% at 6443.76 and Euro Stoxx 50 up 52.5 pts or +1.42% at 3741.6.

- U.S. futures are higher, led by tech stocks: Dow Jones mini up 330 pts or +1.03% at 32489, S&P 500 mini up 58 pts or +1.45% at 4062.75, NASDAQ mini up 254.25 pts or +2.08% at 12499.

COMMODITIES: Copper Leads Gains On China Reopening Hopes

- WTI Crude up $0.34 or +0.3% at $114.45

- Natural Gas up $0.16 or +2.05% at $8.118

- Gold spot up $3.82 or +0.21% at $1826.33

- Copper up $6.9 or +1.65% at $426

- Silver up $0.13 or +0.59% at $21.7228

- Platinum up $0.56 or +0.06% at $948.68

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/05/2022 | 1200/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/05/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 17/05/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/05/2022 | 1315/0915 |  | US | Philadelphia Fed's Patrick Harker | |

| 17/05/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/05/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/05/2022 | 1505/1605 |  | UK | BOE Cunliffe Fireside Chat | |

| 17/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 17/05/2022 | 1630/1230 |  | US | Minneapolis Fed's Neel Kashkari | |

| 17/05/2022 | 1700/1900 |  | EU | ECB Lagarde Speech at Soroptimist International Club | |

| 17/05/2022 | 1800/1400 |  | US | Fed Chair Jerome Powell | |

| 17/05/2022 | 1830/1430 |  | US | Cleveland Fed's Loretta Mester | |

| 17/05/2022 | 2245/1845 |  | US | Chicago Fed's Charles Evans | |

| 18/05/2022 | 0130/1130 | *** |  | AU | Quarterly wage price index |

| 18/05/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 18/05/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 18/05/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 18/05/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 18/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 18/05/2022 | 1230/0830 | *** |  | CA | CPI |

| 18/05/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 18/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 18/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/05/2022 | 2000/1600 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.