-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US MARKETS ANALYSIS: Dollar Correction Continues

Highlights:

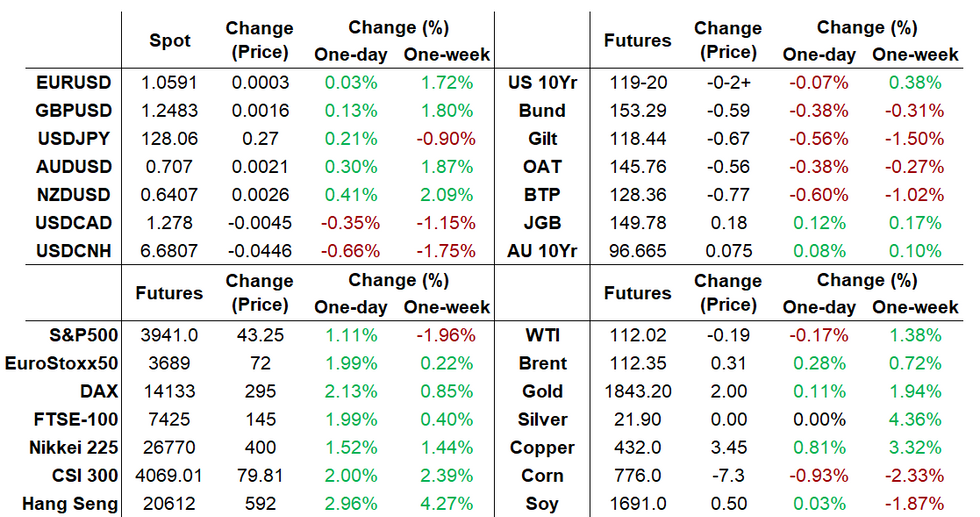

- BoE rate hike pricing rose, supporting GBP, as UK retail sales data surprised to the upside.

- Equities are firmer, with tech stocks leading gains. USD continues to correct lower.

- A light calendar for US data and speakers Friday, with St Louis Fed Bullard the only scheduled event.

US TSYS: Modest Risk-On

- Cash Treasuries have sold off modestly as equities firm, after slight fluctuations overnight on mixed China Covid-related headlines with Shanghai starting to ease some lockdown restrictions but fresh restrictions elsewhere.

- 2YY +2.3bps at 2.631%, 5YY +2.2bps at 2.862%, 10YY +2.7bps at 2.864% and 30YY +2.2bps at 3.071% in only a minor retracement of the past two days of rallies.

- TYM2 sits 3 ticks lower at 119-19+, in a tight range on below average volumes. Initial resistance is formed at yesterday’s high of 120-10, shortly followed by the important short-term level of 120-18+ (Apr 27 high) but the trend direction is still down.

- Particularly light docket with only Bullard’s FOX Business interview at 1300ET, leaving unscheduled headlines likely drivers for the session.

- No issuance. Next note issuance not until Tuesday with $47B of 2Y.

EGB/Gilt: Hawkish ECB Momentum Continues To Build

European government bonds have traded weaker alongside gains for equities, marking a reversal from yesterday's risk-off move.

- Adding to the increasingly hawkish chorus at the ECB, Madis Muller stated today that there needs to be focus on fighting high inflation, Martins Kazakhs said he 'hopes' an interest rate increase occurs in July, while Ignazio Visco argued that rates can rise gradually in the coming months and that a June hike is not out of the question.

- Bunds have sold off and the curve has bear steepened. Cash yields are up 3-8bp while the 2s30s spread has widened 5bp.

- OATs have slightly underperformed bunds on the day, particularly at the longer end.

- BTPs have underperformed core EGBs with yields up 5-10bp.

- UK retail sales data for April came in better than expected (Ex Fuel, 1.4% M/M vs -0.2% expected & -6.1% Y/Y vs -8.3%), while the GfK consumer confidence series hit a new record low of -40 in May.

- Gilt gilts are 6-7bp higher with the curve trading close to flat overall.

- Supply this morning came from the UK (UKTBs, GBP2.0bn)

STIR FUTURES: Bullard Headlines A Light Docket

- Fed Funds implied hikes sit unchanged from yesterday’s decline for upcoming meetings (52bp Jun, 102bp Jul) but firm slightly further out (142bp Sep, 196bp Dec).

- Bullard (’22 voter) interview with FOX Business at 1300ET. He last spoke on May 17 noting the Fed has a good plan in place to tackle inflation, is on course for 50bp hikes at coming meetings with tighter Fed policy already in markets and that must monitor the impact of global QT.

- Kashkari (’23) late yesterday: “We know we have to get inflation down, we're going to do everything we can to achieve a quote-unquote soft landing, but I'll be honest with you, I don't know the odds of us pulling that off.”

Source: Bloomberg

Source: Bloomberg

EUROPE BILL AUCTION RESULTS

UK sells 1/3/6-month bills:

- Jun 20, 2022, GBP0.5bln, 3.52x cover

- Aug 22, 2022, GBP0.5bln, 3.86x cover

- Nov 21, 2022, GBP1.0bln, 3.20x cover

BOND / RATES OPTIONS

EUROPE

- RXN2 149/147/146.5p ladder, bought for 1 in 1.5k

- ERU2 99.125/99.375/99.875/100.125c condor, bought for 19.25 in 3k

- ERZ2 99.25/99.50/99.75c fly, bought for 4.75 in 8k

- ERZ2 98.75/98.25ps 1x1.25 bought for 5.5 in 14k (ref 99.21, 12d)

FOREX: The Dollar remains mixed in G10

- A mixed start for FX and across assets, with USD up against JPY, NOK, EUR and CHF, down versus NZD, CAD, AUD, GBP and SEK.

- There's been no spillovers onto the USD from the Risk tilted to the upside this morning.

- European Equities are leading the US higher, but moves have been limited in very low volumes.

- EURUSD looks to challenge yesterday's high at 1.0607 High May 19.

- AUD tested a new session high against the USD and the EUR.AUDUSD saw yesterday's high at 0.7073 holding so far, printed 0.7074 high.

- Yesterday's low in EURAUD comes at 1.4950, but better would be seen towards 1.48882.

- AUDNZD has pared most of yesterday afternoon bounce and now target 1.0982, the 12th May low and the lowest level since the 3rd May.

- USDCAD is down 0.33%, still well within range, trading at 1.2780 at the time of typing, but note that further push lower will highlight the large option expiry at 1.2730, with 2.63bn.

- Looking ahead, the only notable data for the session will be the EU Consumer Confidence.

- Speakers, sees ECB de Cos and Centeno, and on the other side of the pond Fed Bullard interview on Fox.

FX OPTION EXPIRY

Of note:

USDCAD 2.63bn at 1.2730

USDJPY 1.72bn at 128.17 (Monday)

AUDNZD 1.87bn at 1.0965 (Monday)

- EURUSD: 1.0500 (429mln), 1.0550 (619mln), 1.0575 (670mln), 1.0600 (430mln).

- GBPUSD: 1.2405 (360mln), 1.2490 (211mln).

- USDCAD: 1.2730 (2.63bn), 1.2775 (450mln), 1.2800 (510mln).

- AUDUSD: 0.7050 (545mln).

Price Signal Summary - USD Correction Still In Play

- In the equity space, S&P E-Minis found resistance Wednesday at 4095.00. This leaves initial key resistance - 4099.00, the May 9 high - intact. The reversal lower Wednesday signals a resumption of the primary downtrend and attention is on support and bear trigger at 3855.00, May 12 low. A break would resume the downtrend and open 3843.25, the Mar 25 2021 low (cont). Gains are considered corrective and a break of 4099.00 is required to alter the short-term picture. The primary trend direction in EUROSTOXX 50 futures is down. However, the contract remains in a corrective cycle following the recovery from 3466.00, May 10 low. Price has probed resistance at 3732.00, the 50-day EMA. A clear break of this average would improve a short-term bullish theme. On the downside, key support and the bear trigger is unchanged at 3466.00.

- In FX, EURUSD traded higher Thursday and breached resistance at the 20-day EMA. The average intersected at 1.0569 and the move above this level suggests scope for a stronger short-term recovery. This has opened the next key resistance at 1.0642, the May 5 high. Note that the recent bounce from 1.0350, May 13 low, also marks a recovery from the base of a bear channel, drawn from the Feb 10 high. The channel top is at 1.0866. Initial support is at 1.0461, May 18/19 low. Yesterday, GBPUSD reversed Wednesday’s bear leg. The pair has probed resistance at the 20-day EMA, at 1.2492. A clear break of this average would signal scope for a stronger short-term recovery and open 1.2638, the May 4 high and a key resistance. Initial support lies at 1.2317, the May 17 low. USDJPY traded lower Thursday. 127.52, the May 12 low has been breached and this exposes the next key support at 126.95, Apr 27 low. The current pullback is likely a correction, and this is allowing a recent overbought trend reading to unwind. A break of 126.95 would signal scope for an extension towards the 50-day EMA, at 125.69. A reversal higher and a move above 130.05, May 9 high would be bullish.

- On the commodity front, Gold remains vulnerable and short-term gains are considered corrective. The yellow metal traded through $1800.0 on Monday. The focus is on $1780.4, the Jan 28 low. In the Oil space, WTI futures maintain a firm note, following recent gains, and despite the latest pullback. The contract has this week breached resistance at $110.07, Mar 24 high. A resumption of gains would open $116.43, the Mar 7 trend high. Initial support is at $103.24, the May 19 low.

- In the FI, Bund futures resistance has been defined at $155.33 May 12 high. The trend direction remains down and an extension lower would open 150.49, the May 9 and the bear trigger. The broader trend condition in Gilts remains down. The contract has found resistance at 121.07, May 12 high. The bear trigger is at 116.87, May 9 low.

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 20/05/2022 | 1200/1400 |  | EU | ECB Lane in Discussion at Stockholm Uni | |

| 20/05/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/05/2022 | 1400/1000 | * |  | US | Services Revenues |

| 20/05/2022 | 1700/1300 |  | US | St Louis Fed's James Bullard (on Fox Business) | |

| 21/05/2022 | - |  | AU | Australian Federal Election | |

| 23/05/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 23/05/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 23/05/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 23/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/05/2022 | 1615/1715 |  | UK | BOE Governor Bailey Panels Discussion |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.