-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA MARKETS ANALYSIS:Waiting For Next Inflation Shoe Drop

MNI US OPEN: EUR Jumps On Lagarde's ECB Guidance

EXECUTIVE SUMMARY:

- ECB'S LAGARDE EYES JULY HIKE, EXITING NEGATIVE RATES BY END Q3

- BIDEN MISSPEAKS ON TAIWAN, SAYS U.S. MILITARY WOULD INTERVENE

- BIDEN SAYS CONSIDERING LIFTING SOME CHINA TARIFFS

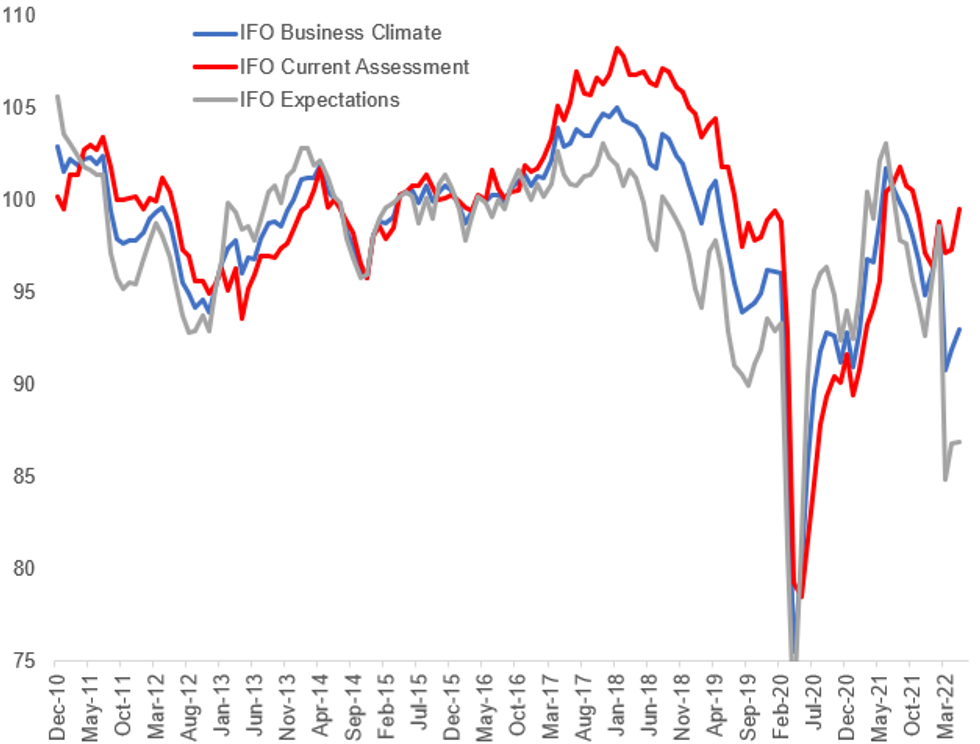

- GERMAN BUSINESS MORALE UNEXPECTEDLY RISES IN MAY: IFO

- NEAR-TERM INFLATION RISKS RISE: EX-BOJ ECONOMIST (MNI INTERVIEW)

Fig. 1: German IFO Confidence Unexpectedly Rises

Source: IFO, BBG, MNI

Source: IFO, BBG, MNI

NEWS:

ECB: The Bund drops sharply and Euro tests May's highs vs the USD on a blog post by ECB Pres Lagarde whose "purpose" as she writes is to "clarify the path of policy normalisation that lies ahead of us":

- She explicitly guides to APP ending "very early" in Q3, with a July rate hike and exiting negative rates by the end of Q3 ("based on the current outlook").

- Beyond that, "policy normalisation has to be carefully calibrated to the conditions we face":

- "If we see inflation stabilising at 2% over the medium term, a progressive further normalisation of interest rates towards the neutral rate will be appropriate. But the speed of policy adjustment, and its end point, will depend on how the shocks develop and how the medium-term inflation outlook evolves as we move forward."

ECB: Pres Lagarde's blog post touches on a potential new tool to mitigate fragmentation risks. Note MNI's sources piece last week pointing out that discussions on such a new instrument are still at an early stage ("ECB Mulls Crisis Tool As Debate Spreads"):

- Lagarde: "Any future decisions on the balance sheet will have to be consistent with both the evolving medium-term inflation outlook and our pledge to ensure policy transmission – especially as flexible reinvestment of the PEPP portfolio is a tool we have made available to mitigate fragmentation risks."

- "If necessary, we can design and deploy new instruments to secure monetary policy transmission as we move along the path of policy normalisation, as we have shown on many occasions in the past."

U S- CHINA - TAIWAN (BBG): President Joe Biden said the US military would intervene to defend Taiwan in any attack from China, a statement condemned by Beijing that was later walked back by White House officials. Asked during a press briefing on Monday in Tokyo whether the US would be willing to get involved militarily to defend Taiwan, Biden said “yes -- it’s a commitment we made.” “We agree with the One-China policy, we signed onto it and all the attendant agreements made from there,” Biden added. “But the idea that it could be taken by force, just taken by force, is just not -- it’s just not appropriate. It will dislocate the entire region and be another action similar to what happened in Ukraine.”

US - CHINA - TAIWAN (BBG): Earlier in the briefing, Biden had said that US policy toward Taiwan “has not changed at all.” A White House spokeswoman repeated that comment after Biden’s remarks, saying the president reiterated the US’s “One China Policy” and its commitment under the Taiwan Relations Act to provide Taiwan with the military means to defend itself.White House officials later said that Biden simply meant the US would provide military equipment to Taiwan, not send troops to defend the island if China attacks, which would constitute a landmark shift in policy.

CHINA (BBG): China’s offshore yuan extended its advance after US President Joe Biden said he’ll discuss tariffs on Chinese imports with Treasury Secretary Janet Yellen upon return from his Asia trip. The currency jumped as much as 0.7% to 6.6549 per dollar, the strongest level since May 5. It had risen 1.5% last week, the most since 2020, in response to easing lockdowns in Shanghai. Sentiment was also boosted by the reduction of a key interest rate for long-term loans on Friday by Chinese banks.

GERMANY (RTRS): German business morale rose unexpectedly in May, as Europe's largest economy shows resilience in the face of high inflation, supply chain problems and the war in Ukraine, a survey showed on Monday. The Ifo institute said its business climax index rose to 93.0 in May following a revised reading of 91.9 in April. A Reuters poll of analysts had pointed to a May reading of 91.4.

BOJ (MNI INTERVIEW): Yen weakness and price hikes by food manufacturers mean short-term upside risks to inflation are greater than forecast by the Bank of Japan in April, recently-departed BOJ chief economist Seisaku Kameda told MNI, adding that the central bank's current 2% price stability target remains appropriate. On MNI Policy MainWire now, for more details please contact sales@marketnews.com

GREECE (BBG): “The European Commission may not prolong enhanced surveillance after its expiration on 20 August 2022,” Commission says in its report on Greece. The report also concludes that Greece has taken the necessary actions to achieve agreed commitments, despite the challenging circumstances triggered by the economic implications of new waves of the pandemic as well as of Russia’s invasion of Ukraine. The report “could serve as a basis for the Eurogroup to decide on the release of the next set of policy-contingent debt measures”.EU (BBG): Germany supports a plan to suspend European Union rules limiting deficits and debt by an additional year to the end of 2023, according to officials familiar with the government’s stance. The European Commission, the EU’s executive arm, proposed on Monday to maintain the so-called general escape clause of the bloc’s Stability and Growth Pact until the end of next year due to the uncertain economic environment created by Russia’s war in Ukraine.

UKRAINE-RUSSIA: Russian state-run Interfax carrying comments from Russian Deputy Foreign Minister Sergei Ryabkov stating that Russia will return to negotiations with Kyiv when Ukraine 'demonstrates a constructive response'. The Zelenskyy gov't in Kyiv has refused to agree to conceding any territory to Russia, with the president's chief of staff tweeting that "The war must end with the complete restoration of Ukraine's territorial integrity and sovereignty".

BOE (MNI INTERVIEW): National Institute of Economic and Social Research Deputy Director Stephen Millard speaks to MNI about BOE monetary policy --On MNI Policy MainWire now, for more details please contact sales@marketnews.com

BANK INDONESIA: Indonesia's central bank meets this week and momentum for inflation and a weakened rupiah are likely to be top of the agenda. While Bank Indonesia's Board of Governors are not expected to hike the benchmark seven day reverse repo rate from 3.5%, a pre-emptive rate rise should not be ruled out.

DATA:

MNI: GERMANY MAY IFO CURRENT ASSESSMENT 99.5; APR 97.3

- GERMANY MAY IFO EXPECTATIONS 86.9; APR 86.8

- GERMANY MAY IFO BUSINESS CLIMATE +93

FIXED INCOME: Lagarde leads Schatz yields higher

- The main event of the morning session has been the release of a blog post by ECB President Christine Lagarde in which she explicitly stated that she expected the APP to end "very early" in Q3 with a July rate hike and an end to negative rates by the end of Q3. This is the most explicit policy steer from an ECB Executive Board member to date and has seen the Euribor curve steepen and Schatz yields increase more than 2-year UST or gilt yields. Lagarde was actually confirming something that is more than fully priced into the market - but the market will see this as the base case, with the prospect of more being needed if inflation moves even higher.

- Looking ahead there is a policy panel at an Austrian National Bank event. The panel topic will be "Monetary policy, policy interaction and inflation in a post-pandemic world with severe geopolitic altensions" with panelists including Holzmann, Bundesbank's Nagel and BOE Governor Bailey.

- We are also due to hear from ECB's de Cos and Villeroy and the Fed's Bostic while this morning's German IFO survey was slightly stronger than expected.

- TY1 futures are down -0-7+ today at 119-28+ with 10y UST yields up 4.1bp at 2.824% and 2y yields up 3.2bp at 2.616%.

- Bund futures are down -0.56 today at 153.37 with 10y Bund yields up 4.0bp at 0.981% and Schatz yields up 5.3bp at 0.380%.

- Gilt futures are down -0.38 today at 118.50 with 10y yields up 2.6bp at 1.918% and 2y yields up 2.4bp at 1.518%.

FOREX: EUR boosted by ECB Lagarde

- Early mover in FX, was in Asia, with USDCNY and USDCNH falling close to 3 big figures, after Biden said that Chinese tariffs imposed by the Trump administration were under consideration.

- Although not all good news regarding potential relations, after Biden replied "yes" when asked if he was willing to defend Taiwan.

- CNY and CNH are now off their highs at the time of typing.

- In G10, the Pound extended gains, with over pips range, as the Dollar trades on the back foot, helped by some recovery in Equities, but note that risk is edging back towards their session lows.

- Next upside target for Cable is at 1.2600, followed by 1.2638 High May 4 and a key resistance.

- EUR found some support and has seen some broader base buying, following ECB Lagarde's Hawkish comments.

- "I expect net purchases under the APP to end very early in the third quarter. This would allow us a rate lift-off at our meeting in July, in line with our forward guidance. Based on the current outlook, we are likely to be in a position to exit negative interest rates by the end of the third quarter."

- The currency test session high versus CHF, USD, CAD, JPY, CNH, GBP, and pare some of its losses against the Kiwi and AUD.

- Looking ahead, focus is on speakers, with no tier 1 data to start the week.

- Today includes, ECB de Cos, Holzmann, Nagel, Villeroy, BoE Bailey, and Fed Bostic.

EQUITIES: Energy Leads Early Europe Gains, Consumer Stocks Lag Again

- Asian markets closed mixed: Japan's NIKKEI closed up 262.49 pts or +0.98% at 27001.52 and the TOPIX ended 17.2 pts higher or +0.92% at 1894.57. China's SHANGHAI closed up 0.29 pts or +0.01% at 3146.857 and the HANG SENG ended 247.18 pts lower or -1.19% at 20470.06.

- European equities are slightly higher, with energy stocks leading and consumer stocks once again lagging: the German Dax up 84.59 pts or +0.61% at 14071.1, FTSE 100 up 49.26 pts or +0.67% at 7439.49, CAC 40 up 7.3 pts or +0.12% at 6292.26 and Euro Stoxx 50 up 5.47 pts or +0.15% at 3664.39.

- U.S. futures have edged higher, with the Dow Jones mini up 112 pts or +0.36% at 31325, S&P 500 mini up 15 pts or +0.38% at 3914.5, NASDAQ mini up 37.5 pts or +0.32% at 11878.25.

COMMODITIES: Metals Jump As Dollar Fades Further

- WTI Crude up $0.53 or +0.48% at $110.76

- Natural Gas up $0.05 or +0.57% at $8.129

- Gold spot up $14.09 or +0.76% at $1860.49

- Copper up $0.35 or +0.08% at $427.5

- Silver up $0.31 or +1.43% at $22.085

- Platinum up $15.66 or +1.64% at $972.79

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 23/05/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 23/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/05/2022 | 1615/1715 |  | UK | BOE Governor Bailey Panels Discussion | |

| 24/05/2022 | 2300/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 23/05/2022 | 2330/1930 |  | US | Kansas City Fed's Esther George | |

| 24/05/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 24/05/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 24/05/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/05/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/05/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/05/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/05/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 24/05/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 24/05/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 24/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/05/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 24/05/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/05/2022 | 1715/1815 |  | UK | BOE Tenreyro Panels Discussion |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.