-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: GBP Up As UK PM Johnson Faces Leadership Vote

EXECUTIVE SUMMARY:

- JOHNSON TO FACE VOTE ON UK TORY LEADERSHIP

- CHINA TO CONCLUDE DIDI PROBE, LIFT BAN ON NEW USERS: DJ

- ECB TO OVERCOME OBSTACLES TO NEW CRISIS TOOL (MNI INTERVIEW)

- INFLATION TO DRIVE ANOTHER RBA HIKE (MNI STATE OF PLAY)

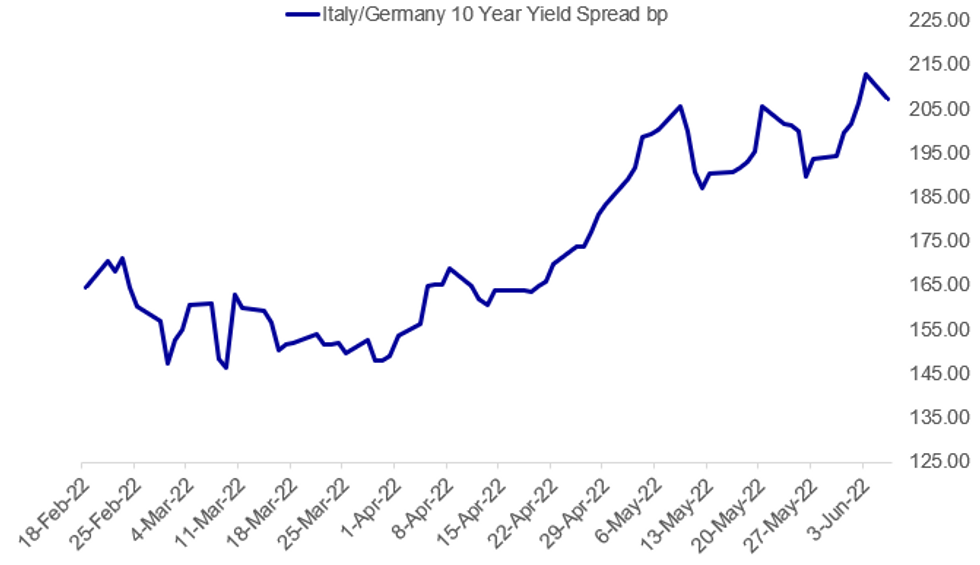

Fig. 1: ECB Mulls New Crisis Tool

Source: BBG, MNI

Source: BBG, MNI

NEWS:

UK (BBG): Boris Johnson will face a leadership vote in his ruling Conservative Party on Monday following a series of scandals, including becoming the first sitting prime minister found to have broken the law. Senior Tory MP Graham Brady said in a televised statement the threshold of at least 54 MPs -- 15% of the Conservative total -- has been met to trigger a confidence vote in Johnson. The vote take place for two hours from 6 p.m., with a result shortly after, Brady said.

UK: On betting odds ahead of this evening's no confidence vote, Boris Johnson is highly favoured to win this evening, with betting markets pricing a ~73% chance of victory for the Prime Minister.

- Nonetheless, the betting markets surrounding an exit date for the PM make for pessimistic reading for No.10. The most likely exit date for Boris remains '2023 or later', but the implied odds have fallen sharply - to ~51% from over 80% in mid-May.

- The implied odds for Q3 this year have been rising steadily, and are now at ~30% from ~15% in mid-May.

CHINA/TECH STOCKS (WSJ): Chinese regulators are concluding yearlong probes into ride-hailing giant Didi Global Inc. and two other U.S.-listed tech firms, preparing as early as this week to lift a ban on their adding new users, people familiar with the discussion said. The regulators plan as well to allow the mobile apps of Didi, logistics platform Full Truck Alliance Co. and online recruitment firm Kanzhun Ltd. back on domestic app stores, also as early as this week, the people said. The apps were removed last July when Chinese authorities opened data-security probes into the companies, citing national security reasons.

CHINA/TECH STOCKS (BBG): Didi surged about 50% in pre-market trading in New York and the Hang Seng Tech Index gained 4.6% in Hong Kong. Investors have been awaiting the outcome of the probe into Didi, launched in July after the ride-hailing firm proceeded with its $4.4 billion US IPO despite Beijing’s objections.

ECB (MNI INTERVIEW): Current spreads between eurozone government bond yields are "quite some way" from levels which could prompt the European Central Bank to take action to rein them in, former director general of ECB market operations told MNI, adding that legal obstacles to the development of a new tool to compress yields are not insuperable. For full article contact sales@marketnews.com

ECB (BBG/FT): The European Central Bank is set to strengthen commitment to support vulnerable euro-area debt markets if they are hit by a selloff, Financial Times reports, citing unidentified people involved in the discussions. Many of the 25 governing council members are expected to support this week a proposal to create a new bond-buying program -- if needed -- to counter borrowing costs for member states, such as Italy, spiraling out of control. ECB declined to comment to FT.

BOJ (MNI): MNI looks at new price measurement tools being brought in by the Bank of Japan -- On MNI Policy MainWire now, for more details please contact sales@marketnews.com

DATA:

No key data released in the European morning.

FIXED INCOME: New multi year high Yields

- New multi year highs in German Yields across the board as futures continues to fall ahead of the main event this week, the key ECB meeting.

- Italy is outperforming Germany, following a FT piece, on the ECB's plan to support vulnerable European debt markets.

- Many of the Governing council members are expected to support proposals to create a new bond buying program, to counter borrowing for states, such as Italy.

- BTP/Bund spread has tightened this morning, on the FT piece, after the spread traded at widest level since May 2020 on Friday.

- Gilt underperforms, as its catches up with the European price action, after the UK were closed last Thursday/Friday.

- Gilt/Bund spread is 2.5bps wider.

- Main news for the UK, is Boris Johnson facing a vote of no confidence, from 18.00BST.

- US Treasuries have dipped lower, once again led by Germany, but TYU2 is still short of Friday's low at 118.11+, printed a 118.15+ low so far today.

- Looking ahead, there's no data nor speakers of note for the start of the week.

- Focus remains on Govies and Yields.

FOREX: GBP on Top Ahead of No Confidence Vote

- GBP has been the focal point for G10 currency markets so far Monday, with the PM Boris Johnson facing a no confidence vote from his lawmakers this evening. Johnson is expected to win the vote, which requires 180 of his lawmakers voting against him to be upheld. This would make the PM immune from further no confidence votes for the next 12 months - potentially removing an element of political uncertainty.

- EUR/GBP has reversed off this morning's 0.8590 multi-week high to turn lower - narrowing in on the Friday low of 0.8540. A break below here opens the next key levels of support at 0.8506/8433, marking the 20-day EMA and May 23 low.

- The greenback is the weakest currency in G10, prompting the USD Index to partially reverse last Friday's gains. This puts the index back on course to test the key support at the 50-dma, which today sits at 101.71.

- Lastly, commodity-tied currencies are trading well, putting CAD and NOK near the top of the G10 pile. Oil-tied FX continue to take a lead from oil prices, with Brent futures holding either side of the $120/bbl level.

- Looking ahead, data and central bank speakers are few and far between, with markets now in the media blackout periods for both the ECB as well as the Fed.

EQUITIES: Tech Stocks Rallying

- Asian markets closed stronger: Japan's NIKKEI closed up 154.32 pts or +0.56% at 27915.89 and the TOPIX ended 5.97 pts higher or +0.31% at 1939.11. China's SHANGHAI closed up 40.914 pts or +1.28% at 3236.372 and the HANG SENG ended 571.77 pts higher or +2.71% at 21653.9.

- European equities have posted strong gains, with tech stocks (and to a lesser extent energy) leading the way on speculation that the China tech company crackdown is past the worst: the German Dax up 151.79 pts or +1.05% at 14605.84, FTSE 100 up 91.83 pts or +1.22% at 7629.64, CAC 40 up 74.45 pts or +1.15% at 6559.77 and Euro Stoxx 50 up 51.48 pts or +1.36% at 3834.75.

- U.S. futures are higher, also led by tech, with the Dow Jones mini up 283 pts or +0.86% at 33171, S&P 500 mini up 46.75 pts or +1.14% at 4153.75, NASDAQ mini up 189.75 pts or +1.51% at 12743.

COMMODITIES: Silver Leads Gains As Dollar Slips

- WTI Crude up $0.42 or +0.35% at $119.9

- Natural Gas up $0.31 or +3.58% at $8.84

- Gold spot up $0.36 or +0.02% at $1851.32

- Copper down $3.35 or -0.75% at $443.6

- Silver up $0.32 or +1.47% at $22.2412

- Platinum up $12.43 or +1.22% at $1028.87

LOOK AHEAD:

| Date | GMT/Local | Impact | Period | Flag | Country | Release | Prior | Consensus | |

| 06/06/2022 | 1530/1130 | * | 10-Jun |  | US | Bid to Cover Ratio | -- | -- | |

| 06/06/2022 | 1530/1130 | * | 10-Jun |  | US | Bid to Cover Ratio | -- | -- | |

| 07/06/2022 | 2301/0001 | * | May |  | UK | BRC Like-for-Like Sales y/y | -1.7 | -- | % |

| 07/06/2022 | 2301/0001 | * | May |  | UK | BRC Total Sales y/y | -0.3 | -- | % |

| 07/06/2022 | 0430/1430 | *** |  | AU | Interest Rate | 0.35 | 0.75 | % | |

| 07/06/2022 | 0430/1430 | *** |  | AU | Interest Rate Change | 0.25 | 0.40 | % | |

| 07/06/2022 | 0600/0800 | ** | Apr |  | DE | manufacturing orders y/y wda | -3.1 | -4.7 | % |

| 07/06/2022 | 0600/0800 | ** | Apr |  | DE | manufacturing orders m/m | -4.7 | -0.6 | % |

| 07/06/2022 | 0700/0900 | ** | Apr |  | ES | Industrial Production y/y | 0.1 | -0.2 | % |

| 07/06/2022 | 0730/0930 | ** | May |  | EU | IHS Markit Construction PMI | -- | -- | |

| 07/06/2022 | 0830/0930 | ** | May |  | UK | IHS Markit/CIPS Services PMI (Final) | 51.8f | 51.8 | |

| 07/06/2022 | 0900/1000 | ** | 10-Jun |  | UK | Bid to Cover Ratio | -- | -- | |

| 07/06/2022 | 1230/0830 | ** | Apr |  | CA | Prev Trade Balance, Rev | 3.081 | -- | CAD (b) |

| 07/06/2022 | 1230/0830 | ** | Apr |  | CA | Trade Balance | 2.486 | -- | CAD (b) |

| 07/06/2022 | 1230/0830 | ** | Apr |  | US | Previous Trade Deficit Revised | -89.8 | -- | USD (b) |

| 07/06/2022 | 1230/0830 | ** | Apr |  | US | Trade Balance | -109.8 | -89.2 | USD (b) |

| 07/06/2022 | 1255/0855 | ** | 04-Jun |  | US | Redbook Retail Sales y/y (month) | 12.4 | -- | % |

| 07/06/2022 | 1255/0855 | ** | 04-Jun |  | US | Redbook Retail Sales y/y (week) | 12.6 | -- | % |

| 07/06/2022 | 1400/1000 | * | May |  | CA | Ivey PMI (SA) | 66.3 | -- | |

| 07/06/2022 | 1700/1300 | *** | Jun |  | US | Bid to Cover Ratio | -- | -- | |

| 07/06/2022 | 1900/1500 | * | Apr |  | US | consumer credit | 52.4 | 32.75 | USD (b) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.