-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Focus On CPI

EXECUTIVE SUMMARY:

- US MAY CPI: HEADLINE SEEN ACCELERATING; CORE SET TO MODERATE

- ECB'S HOLZMANN: SEPTEMBER RATE HIKE WILL BE AT LEAST 25 BPS

- SHANGHAI RETURNS TO LOCKDOWN FOR MASS TESTING ON COVID FEARS

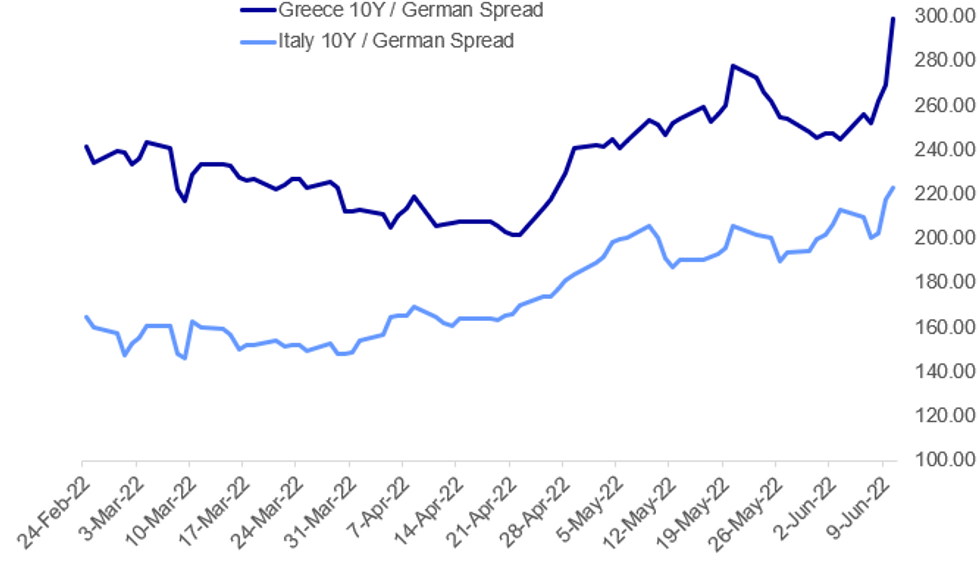

Fig. 1: Periphery EGB Spreads Widen Further Post-ECB

Source: BBG, MNI

Source: BBG, MNI

NEWS:

US DATA (FULL MNI PREVIEW HERE): Consensus has headline May CPI inflation rising +0.7% M/M from +0.3% M/M as energy rebounds with large rises seen in both gasoline and the less heavily weighted gas component. Core inflation is seen dipping to +0.5% M/M (av 0.4%) from the surprisingly strong +0.57% M/M in April, in part as airfares slow from their record 19% M/M rise. Few categories are expected to materially accelerate but instead could maintain similar strength. As has been the case under this recent Fed guidance of 2x50bp hikes, greater focus will be on implications for the rate path further out determined by the breadth of sequential inflation and changes in the particularly sticky rent components.

ECB (BBG): European Central Bank Governing Council member Robert Holzmann says a rate hike in September will be at least 25 basis points and could be twice that size. He spoke a day after the ECB committed to a quarter-point increase in interest rates in July and signaled a bigger hike two months later -- a win for Holzmann, who heads the Austrian central bank, and his hawkish colleagues on the Governing Council. “A rate journey always starts with a small step,” Holzmann told reporters in Vienna on Friday, echoing similar remarks from ECB President Christine Lagarde a day earlier.

CHINA/COVID (BBG): Shanghai will briefly lock down most of the city this weekend for mass testing as Covid-19 cases continue to emerge, causing more disruption and triggering a renewed run on groceries days after exiting a grueling two-month shutdown. The plan emerged from one area with a handful of cases, then spread in hours to 15 of the financial hub’s 16 districts. It encompasses almost all of the city’s 25 million residents as health officials use testing to root out any silent transmission of the virus, a key tool in China’s Covid Zero arsenal.

RBA (MNI INSIGHT): Forecasts made in the May Statement on Monetary Policy and comments by RBA Governor Philip Lowe on the likely path of interest rate rises have been overtaken by more recent events and made credible forward guidance impossible, MNI understands. For full article contact sales@marketnews.com

UK (RTRS): The British public's expectations for the rate of inflation in a year's time have risen to their highest in records going back to 1999, a quarterly survey by the Bank of England showed on Friday. The public's median inflation expectation for 12 months' time rose to 4.6% in May, up from 4.3% in February's survey. Expectations for two- and five years' time rose to 3.4% and 3.5%, the highest since 2013 and 2019 respectively.

DATA:

FIXED INCOME: Core FI retracing; peripheral spreads widening further

Retracement from yesterday's big ECB-induced falls has been the name of the game in the morning session in core fixed income, but not the story in peripherals - with GGB and BTP spreads in particular continuing to notably move to new multi-year highs.

- In terms of events to watch later, the US CPI print is the highlight of the US session. Consensus has headline CPI inflation rising +0.7% M/M from +0.3% M/M as energy rebounds with large rises seen in both gasoline and the less heavily weighted gas component. Core inflation is seen dipping to +0.5% M/M (av 0.4%) from the surprisingly strong +0.57% M/M in April, in part as airfares slow from their record 19% M/M rise. Few categories are expected to materially accelerate but instead could maintain similar strength. As has been the case under this recent Fed guidance of 2x50bp hikes, greater focus will be on implications for the rate path further out determined by the breadth of sequential inflation and changes in the particularly sticky rent components. For our full CPI Preview including 10 sell side summaries click here.

- TY1 futures are up 0-3 today at 118-00+ with 10y UST yields down -1.3bp at 3.031% and 2y yields up 3.3bp at 2.846%.

- Bund futures are up 0.32 today at 148.12 with 10y Bund yields down -2.0bp at 1.406% and Schatz yields up 1.6bp at 0.841%.

- Gilt futures are up 0.09 today at 114.08 with 10y yields down -0.9bp at 2.313% and 2y yields up 2.5bp at 1.865%.

- BTP futures are down -0.48 today at 119.37 with 10y yields up 4.7bp at 3.643% and 2y yields up 15.0bp at 1.542%.

FOREX: JPY Firmer for Second Session as Authorities Step Up Jawboning

- USD/JPY slipped to a session low following the release of a joint statement made by the MoF, FSA and BoJ. The statement clarified that the authorities had a meeting after the sudden move in the JPY, stressing that the authorities will watch the FX moves even more carefully, and with a sense of urgency.

- The statement is just jawboning for now, but looked like a modest step-up in language/urgency. The phrasing on intervention, however, looked broadly inline with the communication on currency back in late April, when the MoF stressed that recent FX moves warrant extreme concern, and will respond appropriately on FX if needed.

- Elsewhere, EUR/USD is extending the post-ECB pullback, with the pair showing below 1.06 for the first time since mid-May. The step lower in the currency remains dislocated from the run higher in rate expectations, with year-end rate expectations hitting a contract high yesterday at 0.89%.

- Focus turns to the US CPI release, with markets expecting CPI to pick up to 0.7% on the month, although core prices are seen moderating on a M/M and Y/Y basis. Full MNI preview here: https://marketnews.com/mni-us-cpi-preview-moderati...

- Preliminary Uni of Michigan confidence also crosses, as well as Canada's May jobs report.

EQUITIES: European Stocks Continue Weakening Post-ECB

- Asian markets closed mixed: Japan's NIKKEI closed down 422.24 pts or -1.49% at 27824.29 and the TOPIX ended 25.96 pts lower or -1.32% at 1943.09. China's SHANGHAI closed up 45.88 pts or +1.42% at 3284.834 and the HANG SENG ended 62.87 pts lower or -0.29% at 21806.18.

- European stocks continue to weaken after Thursday's ECB decision, with the German Dax down 226.99 pts or -1.6% at 13972.01, FTSE 100 down 73.6 pts or -0.98% at 7402.02, CAC 40 down 86.78 pts or -1.36% at 6271.58 and Euro Stoxx 50 down 59.6 pts or -1.6% at 3665.14.

- U.S. futures are flat, with the Dow Jones mini down 33 pts or -0.1% at 32230, S&P 500 mini down 0.25 pts or -0.01% at 4016, NASDAQ mini up 21.5 pts or +0.18% at 12296.

COMMODITIES: Precious Metals Slip As USD Rebounds From Overnight Lows

- WTI Crude up $0.2 or +0.16% at $121.71

- Natural Gas up $0.03 or +0.38% at $8.997

- Gold spot down $3.28 or -0.18% at $1844.67

- Copper down $0.9 or -0.21% at $437.2

- Silver down $0.07 or -0.33% at $21.6185

- Platinum down $0.89 or -0.09% at $974.16

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/06/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 10/06/2022 | 1230/0830 | *** |  | US | CPI |

| 10/06/2022 | 1345/1545 |  | EU | ECB Lagarde Message for Goethe Uni Law & Finance Institute | |

| 10/06/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/06/2022 | 1400/1000 | * |  | US | Services Revenues |

| 10/06/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 10/06/2022 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.