-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI US OPEN: Swiss Stunner Ahead Of BoE

EXECUTIVE SUMMARY:

- SNB SURPRISES WITH 50BP RATE HIKE, SIGNALS MORE POSSIBLE

- BANK OF ENGLAND DECISION: CONSENSUS FOR 25BP HIKE, FOCUS ON FORWARD GUIDANCE

- EUROPEAN GAS SURGES AS RUSSIAN CUTS ESCALATE ENERGY CRISIS

- VILLEROY BACKS GRADUAL, SUSTAINED ECB RATE HIKES

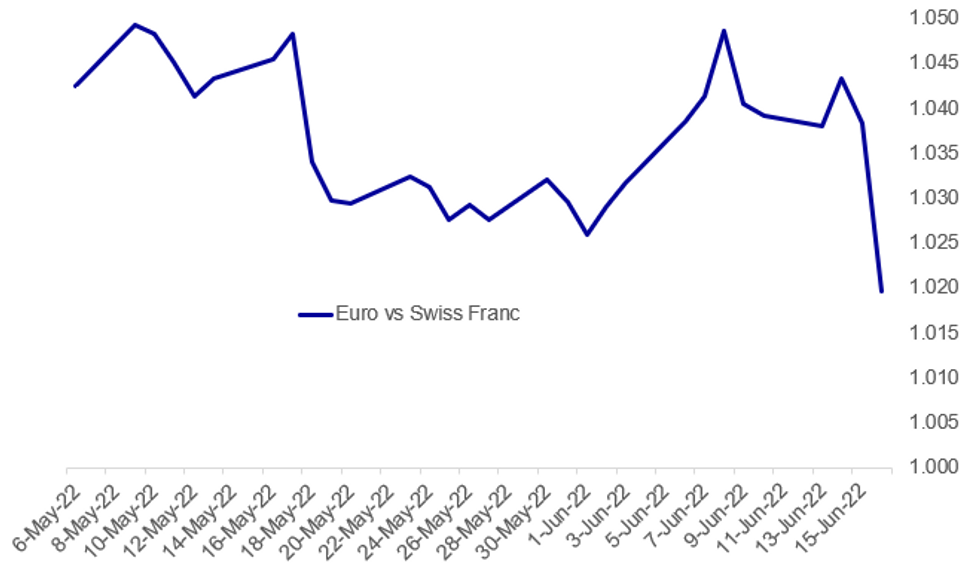

Fig. 1: Swiss Franc Flies After SNB Shock Hike

Source: BBG, MNI

Source: BBG, MNI

NEWS:

SNB: The Swiss National Bank raised interest rates by 50 bps Thursday, putting the benchmark policy rate at -0.25%. The move was of a greater magnitude than many expected, with analysts largely split between unchanged an a 25 bps hike. Further hikes in rates could not be ruled out 'in the foreseeable future', the SNB's statement said. Citing increased inflationary pressure, the central bank said the rate hikes were aimed at preventing a broadening of prices rises from goods to services.

SNB: On FX language for SNB, they've entirely dropped the reference to the CHF value - at the past rate decision they saw the CHF as "highly valued" - this no longer appears in the statement. In the post rate decision speech, SNB President Jordan adds further clarity to the bank's approach to currency, stating that the SNB would be prepared to purchase foreign currency in the event of excessive appreciation, however if the CHF were to weaken, the bank would also consider selling FX.

BOE MEETING PREVIEW: The sell-side consensus unanimously looks for a 25bp hike with none of the 21 previews that we have read looking for more than 3 MPC members voting for 50bp in their base case (although some do acknowledge the risk of a 50bp move today). If we see a 25bp hike today, the focus will be on whether the forward guidance remains in its current form or is altered in any way. As of yesterday's close, markets were pricing 83bp of hikes by August (cumulatively), 125bp by September (3 meetings) and 163bp by November (4 meetings). Whether the BOE attempts to use its statement to talk down these rate expectations remains to be seen. The market thinks the BOE will be influenced by the more aggressive moves by the Fed (and potentially by the ECB) but we are not sure that MPC members themselves believe that to be the case yet given that the BOE started hiking before many of the others. For the full MNI BOE preview click here.

HUNGARY: This morning, the NBH surprised the market by hiking its 1W depo rate by 50bps to 7.25%; not a single economist (among the 5 on BBG) was expecting the NBH to act today. This follows the Fed’s 75bps hike yesterday, which could add pressure to EM FX as ‘hawkish’ Fed and elevated market uncertainty should continue to support the ‘safe’ US Dollar in the near term.

EUROPE GAS (BBG): Natural gas prices in Europe jumped after Russia stepped up an energy war by cutting supplies through the largest link to the continent to less than half of its usual volumes. Benchmark futures increased more than 12%, adding to the 44% rise in the previous two sessions. The cuts are rippling through Europe with Engie SA, Uniper SE and OMV AV saying they’re getting less supply. Germany has called the reductions through the Nord Stream pipeline “politically motivated” and aimed at unsettling markets, challenging Gazprom PJSC’s statement that the halt was due to technical issues.

ECB (BBG): The European Central Bank will raise interest rates from historic lows in a gradual and sustained fashion to bring inflation back to the 2% target, according to Governing Council member Francois Villeroy de Galhau. The Bank of France chief spoke at a conference in Milan that features other ECB officials, with investors on the lookout for comments on a new tool being developed to prevent bond-market panic as borrowing costs rise for the first time in more than a decade.

ECB (BBG): European Central Bank Vice President Luis de Guindos said he’s sure policy makers will agree on a new instrument to prevent bond-market panic as borrowing costs rise for the first time in more than a decade. Guindos spoke alongside other ECB officials at a conference in Milan, where investors are watching out for clues on how any new tool to tackle unwarranted moves on government debt markets -- so-called fragmentation -- may look.

RBNZ (MNI INTERVIEW): A member of a "shadow board' of the Reserve Bank of New Zealand believes the outlook for the NZ economy is "darkening" and that the central bank may not raise official interest rates to the forecast high of 3.9% by 2024.For full interview contact sales@marketnews.com

FIXED INCOME: SNB throws a curveball and Bobl yields move more than 20bp higher

This morning's session was supposed to see us digest yesterday's ECB fragmentation announcement, the Fed's 75bp hike and look ahead to the UK MPC decision. However, markets have instead been thrown a curve ball by another central bank, the SNB, which unexpectedly hiked 50bp this morning and caused a kneejerk move lower in Euribor and Bund futures.

- Schatz yields are up 16.7bp on the day, Bobl yields up 20.6bp, before the curve then flattens a bit more.

- Peripheral spreads are a little tighter than yesterday's close.

- Looking ahead to the BOE markets are pricing in around a 1/3 probability of a 50bp hike today (but 25bp fully priced). The sell-side consensus unanimously looks for a 25bp hike with none of the 21 previews that we have read looking for more than 3 MPC members voting for 50bp in their base case (although some do acknowledge the risk of a 50bp move today). If we see a 25bp hike today, the focus will be on whether the forward guidance remains in its current form or is altered in any way. Markets are pricing 81bp of hikes by August (cumulatively), 120bp by September (3 meetings) and 160bp by November (4 meetings). Whether the BOE attempts to use its statement to talk down these rate expectations remains to be seen. The market thinks the BOE will be influenced by the more aggressive moves by the Fed (and potentially by the ECB) but we are not sure that MPC members themselves believe that to be the case yet given that the BOE started hiking before many of the others. For the full MNI BOE preview click here.

- TY1 futures are down -0-1+ today at 115-03+ with 10y UST yields up 11.6bp at 3.404% and 2y yields up 13.2bp at 3.327%.

- Bund futures are down -2.23 today at 142.38 with 10y Bund yields up 16.3bp at 1.802% and Schatz yields up 16.8bp at 1.232%.

- Gilt futures are down -0.59 today at 112.10 with 10y yields up 4.5bp at 2.510% and 2y yields down -0.1bp at 1.947%.

FOREX: SNB Stuns Consensus With 50bps Hike

- CHF is surging against all others in G10 to be the best performing currency globally following the SNB rate decision. The Bank surprised markets by raising rates by 50bps to -0.25%, a move markets had seen the SNB waiting until September to execute. As such, market pricing has rushed higher, with SARON futures now seeing a further 50bps hike (taking rates to +0.25%) in September.

- The bank tightened policy to counter inflationary pressure in Switzerland, which is now seen above target until the second half of 2023 and also dropped their view that the CHF is "highly valued", adding considerable two-way risk to the exchange rate.

- In response, EUR/CHF has traded through 1.02 for the first time since early May, opening support at 1.0179, the 61.8% retracement of the March - May upleg as well as 1.0088 - marking the April low.

- Elsewhere, risk sentiment is fragile, evident in weakness across the SEK and NOK so far Thursday, while JPY trades well. USD/JPY has shown below the Y133.00 handle, with equity markets also heading south. The bear market in the E-mini S&P has extended, putting the index 23% off the January high.

- Focus turns to the Bank of England rate decision, at which the Bank are seen raising rates by 25bps to 1.25% - the highest rate since the financial crisis in 2008.

EQUITIES: Tech, Cyclical Stocks Lead Broad Losses

- Asian markets closed mixed: Japan's NIKKEI closed up 105.04 pts or +0.4% at 26431.2 and the TOPIX ended 11.88 pts higher or +0.64% at 1867.81. China's SHANGHAI closed down 20.021 pts or -0.61% at 3285.385 and the HANG SENG ended 462.78 pts lower or -2.17% at 20845.43.

- European stocks are off sharply, with the German Dax down 368.86 pts or -2.74% at 13115.44, FTSE 100 down 107.63 pts or -1.48% at 7166.13, CAC 40 down 99.6 pts or -1.65% at 5929.68 and Euro Stoxx 50 down 88.29 pts or -2.5% at 3444.12.

- U.S. futures are dropping sharply with tech stocks leading lower, with the Dow Jones mini down 600 pts or -1.96% at 30061, S&P 500 mini down 94.25 pts or -2.49% at 3694.75, NASDAQ mini down 358 pts or -3.09% at 11236.

COMMODITIES: Metals Slip As Dollar Gains In Risk-Off Trade

- WTI Crude down $0.08 or -0.07% at $115.3

- Natural Gas up $0.2 or +2.68% at $7.619

- Gold spot up $0.26 or +0.01% at $1834.02

- Copper down $3 or -0.72% at $415.25

- Silver down $0.09 or -0.43% at $21.5908

- Platinum down $7.93 or -0.84% at $935.63

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/06/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 16/06/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 16/06/2022 | - |  | JP | Bank of Japan policy meeting | |

| 16/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 16/06/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/06/2022 | 1400/1000 | *** |  | US | Housing Starts |

| 16/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 16/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/06/2022 | 0830/0930 |  | UK | BOE Tenreyro Opens BOE Household Finance Workshop | |

| 17/06/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 17/06/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/06/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 17/06/2022 | - |  | JP | Bank of Japan policy meeting | |

| 17/06/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/06/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/06/2022 | 1430/1530 |  | UK | BOE Pill Panels BOE Household Finance Workshop |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.