-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - US 10y Yields Lower For Third Consecutive Session

Highlights:

- Riksbank hikes 50bps, points to front-loading of tighter policy

- USD/JPY dragged off cycle highs by softer equity picture

- US 10y yields lower for third consecutive session

US TSYS SUMMARY: Treasuries Follow Europe Richer, Real Yields Nudge Lower

- Cash Tsys have seen a belly-led rally amidst broad risk-off sentiment, lagging moves seen in Eurozone members. The market could be particularly sensitive to growth implications in upcoming US data.

- Early trade shows most of the decline in long-end nominal yields has been in real space, a break from the past couple days when real yields proved particularly sticky as breakevens slid.

- 2YY -4.9bps at 2.990%, 5YY -5.3bps at 3.090%, 10YY -3.0bps at 3.059% and 30YY -2.5bps at 3.194%.

- TYU2 trades 10+ ticks higher at 117-27, extending its bounce from Tuesday’s low on marginally above average volumes. It closes in on a key short-term resistance level at 118-08 (Jun 24 high) where a break would signal a resumption of recent gains.

- Data: Important releases with personal income/spending & PCE inflation for May, the MNI Chicago PMI for June and usual weekly jobless claims.

- Bill issuance: US Tsy $35B 4W, $30B 8W bill auctions (1130ET).

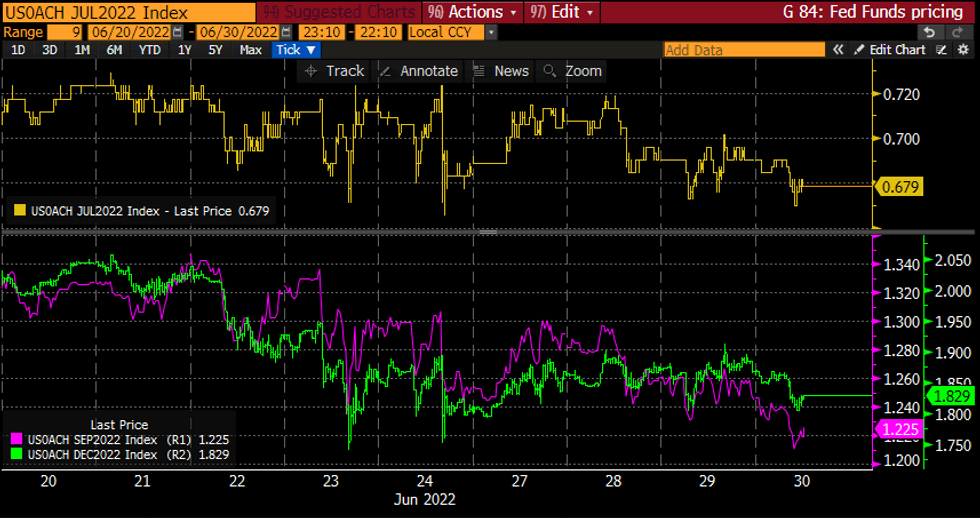

STIR FUTURES: Near-Term Fed Hikes Close To Post-FOMC Lows

- Hikes implied by FOMC-dated Fed Funds have dipped in the European session with risk-off sentiment, with 68bps for July and 122bps for Sep near post-FOMC lows.

- The 182.5bp for the four meetings to Dec is down from 188bp late yesterday but above the 174bps touched after last week’s PMI misses.

- This trimming continues further out, with the peak in Fed Funds seen at 3.55% with the Mar’23 meeting after yesterday’s intraday high of 3.66%.

Source: Bloomberg

Source: Bloomberg

EGB/GILT SUMMARY: Riksbank Delivers 50bp Hike

European government bonds have rallied this morning alongside a broad sell-off in stocks.

- The Riksbank raised the main policy rate by 50bp to 0.75%, in line with expectations. The central bank's forecast for the policy rate was also revised higher and will be close to 2% at the start of next year.

- The UK reported the largest current account deficit on record of GBP51.7bn during the first quarter widening from GBP7.3bn in the final quarter of 2021.

- The gilt curve has twist steepened with the 2s30s spread trading up 7bp.

- Bunds have rallied with the curve bull steepening. Cash yields are down 8-15bp on the day.

- It is a similar story for OATs where the long end of the curve is 4bp steeeper.

- BTPs have underperformed core EGBs with yields down 2-6bp on the day.

- Supply this morning came from Italy (BTP, EUR7bn).

FOREX: USD/JPY Fading Alongside Equities

- USD/JPY has faded off the cycle highs posted yesterday at 137.00, but still holds comfortably above yesterday's lows. Nonetheless JPY is the strongest currency across G10, moving in sympathy with fading equity markets. This puts the e-mini S&P on track to test first support at 3757.8 - the 61.8% Fib retracement for the late June rally.

- Elsewhere, the SEK trades weaker, with EUR/SEK toward the top end of the daily range following the Riksbank rate decision. There were mixed messages in the release, with the bank hiking 50bps (potentially disappointing markets that had seen a decent chance of a 75bps move) and pointing to an elevated rate path across 2023 - this puts the repo rate path north of 2% by mid-2023.

- The USD Index is inching higher, mirroring the general risk-off theme so far present in markets Thursday, with 105.229 the next upside level ahead of June's cycle high of 105.788.

- Alongside the weekly jobless claims data, personal income/spending data is due as well as Monthly Canadian GDP. The MNI Chicago PMI follows, expected to show a drop to 58.0 from 60.3.

FX OPTIONS: Expiries for Jun30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0400(E503mln), $1.0500(E619mln), $1.0550-60(E1.2bln), $1.0750-75(E1.2bln)

- EUR/GBP: Gbp0.8650(E702mln)

- USD/CAD: C$1.2750($1.5bln), C$1.3000($585mln)

- USD/CNY: Cny6.6700($1.6bln), Cny6.70($515mln), Cny6.7500($608mln), Cny6.8000($1.4bln)

Price Signal Summary - S&P E-Minis Bear Leg Extends

- In the equity space, S&P E-Minis continue to weaken and extend this week’s bearish cycle and the pullback from Tuesday’s high of 3950.00. The next support lies at 3735.00, the Jun 23 low. A breach of this level would expose key support at 3639.00, the Jun 17 low. A breach of resistance at 3950.00 is required to reinstate a bullish theme. EUROSTOXX 50 futures are down sharply today and this highlights a stronger reversal from Monday’s high of 3584.00. The move lower exposes the key support and bear trigger at 3384.00, Jun 16 low. A break would resume the primary downtrend. On the upside, clearance of 3584.0 is required to reinstate a short-term bullish theme.

- In FX, EURUSD continues to pull away from its most recent highs and a key resistance at 1.0609 - the top of a bear channel drawn from the Feb 10 high. The primary trend direction is down and attention on 1.0350, May 13 low and the bear trigger. A clear break of 1.0609 resistance would alter the picture. GBPUSD is trading at this week’s lows. The outlook is bearish and attention is on the bear trigger at 1.1934, Jun 14 low. Resistance to watch remains 1.2406, the Jun 16 high. USDJPY delivered a fresh cycle high Wednesday, confirming a resumption of the primary uptrend. The high marks the best levels since 1998. Sights are on 137.30 next, 1.50 projection of the Feb 24 - Mar 28 - 31 price swing. Initial firm support is 134.27, the Jun 23 low.

- On the commodity front, the outlook in Gold is unchanged and remains bearish. The focus is on $1787.0, May 16 low, where a break would resume the downtrend. Key trendline resistance to watch is at $1866.7. The trendline is drawn from the Mar 8 high and a break would likely signal a reversal. In the Oil space, WTI futures found resistance at Wednesday’s high of $114.05. A break of this resistance is required to confirm a resumption of the recent recovery and open $116.58, the Jun 17 high. For bears, a stronger reversal lower would signal the end of the recent climb and open key support at $101.53, the Jun 22 low.

- In the FI space, Bund futures key short-term resistance has been defined at 149.00, the Jun 24 high, where a break is required to signal scope for a stronger recovery - towards 150.06, 61.8% retracement of the May 12 - Jun 16 bear leg. First support lies at 144.72, Tuesday’s low. Recent price action in Gilts has defined resistance at 114.55, Jun 24 high where a break would highlight potential for a stronger short-term recovery. Initial support is at 111.72, the Jun 29 low.

EQUITIES: S&P Futs Below 3,800 Again As Global Stocks Struggle

- Asian markets closed weaker: Japan's NIKKEI closed down 411.56 pts or -1.54% at 26393.04 and the TOPIX ended 22.75 pts lower or -1.2% at 1870.82. China's SHANGHAI closed up 37.098 pts or +1.1% at 3398.616 and the HANG SENG ended 137.1 pts lower or -0.62% at 21859.79.

- European equities are down sharply in a broad risk-off move (cyclicals leading the way lower, with tech and consumer discretionary stocks underperforming): the German Dax down 254.93 pts or -1.96% at 12723.14, FTSE 100 down 122.84 pts or -1.68% at 7174.75, CAC 40 down 121.27 pts or -2.01% at 5885.88 and Euro Stoxx 50 down 65.39 pts or -1.86% at 3442.74.

- U.S. futures are also pointing lower, with the Dow Jones mini down 260 pts or -0.84% at 30739, S&P 500 mini down 42 pts or -1.1% at 3779.25, NASDAQ mini down 163 pts or -1.39% at 11528.

COMMODITIES: Renewed Growth Concerns Sends Copper Lower Again

- WTI Crude up $0.18 or +0.16% at $109.51

- Natural Gas up $0.01 or +0.11% at $6.509

- Gold spot down $1.91 or -0.11% at $1816.37

- Copper down $4.5 or -1.19% at $374.25

- Silver down $0.01 or -0.07% at $20.803

- Platinum down $3.69 or -0.4% at $916.98

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/06/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/06/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/06/2022 | 1330/1530 |  | EU | ECB Lagarde Speech at Simone Veil Pact | |

| 30/06/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/06/2022 | 1600/1200 | *** |  | US | USDA Acreage - NASS |

| 30/06/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 01/07/2022 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/07/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/07/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0800/1000 | * |  | NO | Norway Unemployment Rate |

| 01/07/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 01/07/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 01/07/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 01/07/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 01/07/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 01/07/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/07/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/07/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 01/07/2022 | 1400/1000 | * |  | US | Construction Spending |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.