-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Dollar Strength Pauses Ahead Of Retail Sales

EXECUTIVE SUMMARY:

- CHINA Q2 GDP SURPRISINGLY SLOWS TO 0.4% ON COVID HIT

- ITALY'S DRAGHI STAYS ON, PREPARES FOR "DAY OF TRUTH" NEXT WEDNESDAY

- EU SET TO SANCTION RUSSIAN GOLD, CHEMICALS, MACHINERY

- MORDAUNT AND TRUSS LEAD UK TORY LEADER ODDS, SUNAK 3RD

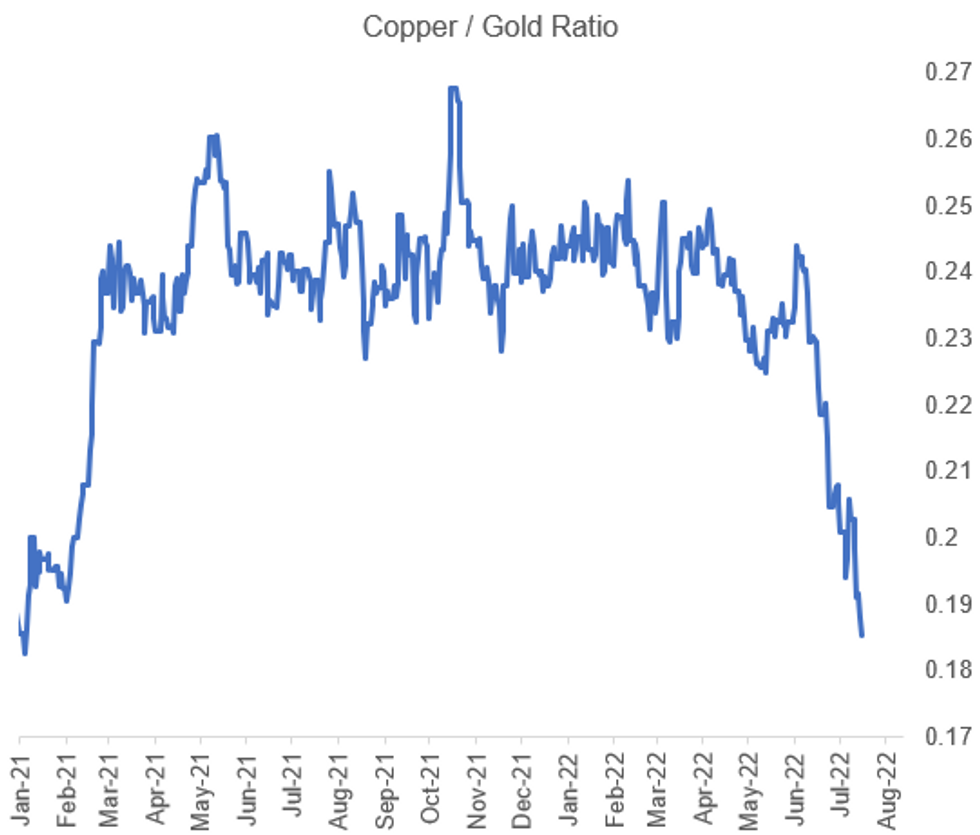

Fig. 1: Copper Prices Plunge Further On China Growth Fears (But Gold Up)

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ITALY POLITICS: Italy is bracing for at least a few more days of intense political turmoil after Prime Minister Draghi's resignation was declined by President Mattarella.

- Local media report that Draghi is planning to travel to Algeria on Monday for important intergovernmental talks, as Italy seeks alternative sources of gas supply amid uncertainty surrounding imports from Russia.

- Upon his return to Italy, Draghi will make a key speech to parliament on Wednesday, but it is unclear if it will be followed by a vote of confidence.

- The M5S National Council held a meeting yesterday evening and the party is expected to make an update on its position later today.

EU-RUSSIA SANCTIONS: Wires reporting comments from an EU Commission sources stating that the seventh round of sanctions against Russia in response to its invasion of Ukraine is set to include sanctions on the export of Russian gold, chemicals, and machinery.

- Gold represents Russia's biggest non-energy export, however the action is unlikely to have any major ramifications for the country's economy given that European and US markets are already largely closed off due to previous rounds of sanctions, making any ban largely symbolic. Story first reported yesterday by Euractiv.

- The Euractiv article states that "...the new sanctions package would aim to include closing loopholes to previously approved punitive measures, such as by adding certain products to the list of banned goods. It also could include a reference to the recently published European Commission clarification of sanctioned goods’ transit to Kaliningrad in Russia, some EU diplomats suggested."

UK POLITICS: Foreign Secretary Liz Truss is now in second place in the betting market stakes for next Conservative party leader, overtaking former Chancellor Rishi Sunak. According to data from Smarkets, Truss has a 27.0% implied probability of becoming Conservative leader, with Sunak on 21.3%.

- Trade Minister Penny Mordaunt maintains her lead in the betting market stakes with a 46.3% implied probability of being the eventual victor.

- Sunak's slip to third comes in spite of him topping the ballot in the second round of the Conservative leadership contest held yesterday. Sunak won the support of 101 MPs, while Mordaunt was second with 83, and Truss third on 60. Former Equalities Minister Kemi Badenoch came in fourth with 49 MPs, and centrist Chair of the Foreign Affairs Select Committee Tom Tugendhat was fifth with 32 backers. Hardline brexiteer Attorney General Suella Braverman was eliminated from the contest with the support of 27 MPs. She has since lent her support to Truss' campaign.

- The first televised leadership hustings takes place tonight, broadcast on Channel 4 at 1900BST (1400ET, 2000CET).

CHINA: Economic recovery in regions hit by the pandemic in China accelerated since June, with industrial output and unemployment significantly improved in Shanghai city and Jilin province, said Fu Linghui, spokesman of the National Bureau of Statistics at a briefing on Friday. In June as restrictions were eased, industrial production in Shanghai and Jilin rose 13.9% and 6.3% y/y, respectively, compared with May's 30.9% and 4.9% declines. The surveyed unemployment rate also dropped by 9.7 and 0.8 percentage points, respectively, from the previous month, said Fu.

DATA:

MNI BRIEF: China Q2 GDP Surprisingly Slows To 0.4% On Covid Hit

The Chinese economy slowed to 0.4% y/y in the second quarter, the weakest since a historic contraction in the first three months of 2020 when the pandemic first hit, lower than a median forecast of 1.2%, given the damage of Covid lockdowns during April and May, data by the National Bureau of Statistics on Friday showed. SEE: MNI: China’s Q2 GDP Growth Pace May Disappoint On Covid Hit

Retail sales unexpectedly jumped by 3.1% y/y in June, reversing May's 6.7% decline and outshining the forecast 0.3% gain, to hit a four-month high.

Industrial production rose 3.9% y/y in June, rebounding from May's 0.7% but underperforming the forecast 4.3%.

Fixed-asset investment eased slightly to 6.1% y/y in H1, from the 6.2% gain in the Jan-May period, better than the 5.8% forecast. Property investment fell 5.4% y/y to hit the lowest level since March 2020, sliding further from the previous 4.0% fall. Infrastructure investment accelerated to 7.1% y/y from May's 6.7% growth, while manufacturing investment decelerated to 10.4% from the previous 10.6% growth.

The surveyed urban unemployment rate was 5.5% in June, down 0.4 percentage point from May.

FIXED INCOME: Looking ahead to US retail sales

Core fixed income has drifted higher this morning, reversing much of yesterday's selloff. Focus is squarely on US data later today with a European session largely devoid of big market moving events.

- Yesterday, the Fed's Waller stated that the Fed probably needs to raise rates by 75bp this meeting, but he could support a larger hike if demand doesn't show signs of slowing. He noted that "We have important data releases on retail sales and housing coming in before the July meeting. If that data come in materially stronger than expected it would make me lean towards a larger hike at the July meeting to the extent it shows demand is not slowing down fast enough to get inflation down." And with those comments, today's retail sales data takes on added importance. We will also see Empire manufacturing and import / export price updates released simultaneously.

- Later in the day we will then see industrial production data as well as Michigan confidence data -the inflation expectations component of the latter of particular interest.

- In addition we will hear from the Fed's Bullard, Bostic and Daly.

- TY1 futures are up 0-6+ today at 118-22+ with 10y UST yields down -3.0bp at 2.932% and 2y yields down -2.0bp at 3.115%.

- Bund futures are up 1.02 today at 153.19 with 10y Bund yields down -6.2bp at 1.112% and Schatz yields down -8.6bp at 0.400%.

- Gilt futures are up 0.35 today at 115.98 with 10y yields down -4.3bp at 2.056% and 2y yields down -7.1bp at 1.865%.

FOREX: China GDP Data Crimps AUD, NZD Progress

- Chinese GDP data crossed overnight, coming in well below forecast at 0.4% Y/Y vs. Exp. 1.2% as the rolling lockdowns across major cities through Q2 hampered economic performance. As a result, currency markets trade with a general risk-off feel, leading the likes of AUD and NZD lower. AUD is among the session's worst performers, lower against most others but AUD/USD has so far steered clear of any test on the week's cycle lows at $0.6682.

- Nonetheless, equity futures are more stable, with the e-mini S&P holding the bulk of the late recovery posted on Thursday. The greenback is offered, putting the USD Index off the week's best levels posted yesterday.

- The dollar moves have moderated the pressure on EUR/USD, with the rate back above the parity level that gave way earlier this week.

- Focus turns to the June US retail sales reading as well as the import/export price indices. The prelim read for University of Michigan sentiment data will be a highlight considering the Fed's focus on the inflation expectations element of the survey.

- Central bank speakers today include Fed's Bostic, Bullard & Bailey as well as ECB's Rehn.

EQUITIES: Strong Europe Stock Bounce, With Tech And Energy Leading

- Asian markets closed mixed: Japan's NIKKEI closed up 145.08 pts or +0.54% at 26788.47 and the TOPIX ended 0.63 pts lower or -0.03% at 1892.5. China's SHANGHAI closed down 53.683 pts or -1.64% at 3228.061 and the HANG SENG ended 453.49 pts lower or -2.19% at 20297.72.

- European equities are stronger across the board alongside a pullback in the USD, with tech and energy names leading higher: the German Dax up 206.86 pts or +1.65% at 12653.8, FTSE 100 up 82.59 pts or +1.17% at 7138.78, CAC 40 up 50.37 pts or +0.85% at 5957.96 and Euro Stoxx 50 up 39.17 pts or +1.15% at 3425.01.

- U.S. futures are a little higher, with the Dow Jones mini up 76 pts or +0.25% at 30680, S&P 500 mini up 9.75 pts or +0.26% at 3803, NASDAQ mini up 30.25 pts or +0.26% at 11827.5.

COMMODITIES: Copper Drops Further After China Growth Disappointment

- WTI Crude up $0.24 or +0.25% at $94.08

- Natural Gas up $0.04 or +0.65% at $6.826

- Gold spot down $6.09 or -0.36% at $1726.17

- Copper down $4.55 or -1.42% at $323.45

- Silver down $0.12 or -0.65% at $18.3911

- Platinum down $1.62 or -0.19% at $848.32

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/07/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 15/07/2022 | - |  | EU | ECB Lagarde & Panetta at G20 CB Meeting | |

| 15/07/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 15/07/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/07/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/07/2022 | 1245/0845 |  | US | Atlanta Fed's Raphael Bostic | |

| 15/07/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/07/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 15/07/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 15/07/2022 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 15/07/2022 | 1400/1000 | * |  | US | Business Inventories |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.