-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: ECB Eyeing Half-Point Hike This Week?

EXECUTIVE SUMMARY:

- ECB REPORTEDLY CONTEMPLATING 50BP HIKE THIS WEEK (BBG AND RTRS SOURCES)

- CHINA WARNS TAIWAN VISIT BY PELOSI WOULD HAVE "GRAVE IMPACT"

- EU COMMISSION DOESN'T EXPECT NORD STREAM TO RESTART

- UK REAL INCOMES DECLINED AT RECORD PACE IN MAY

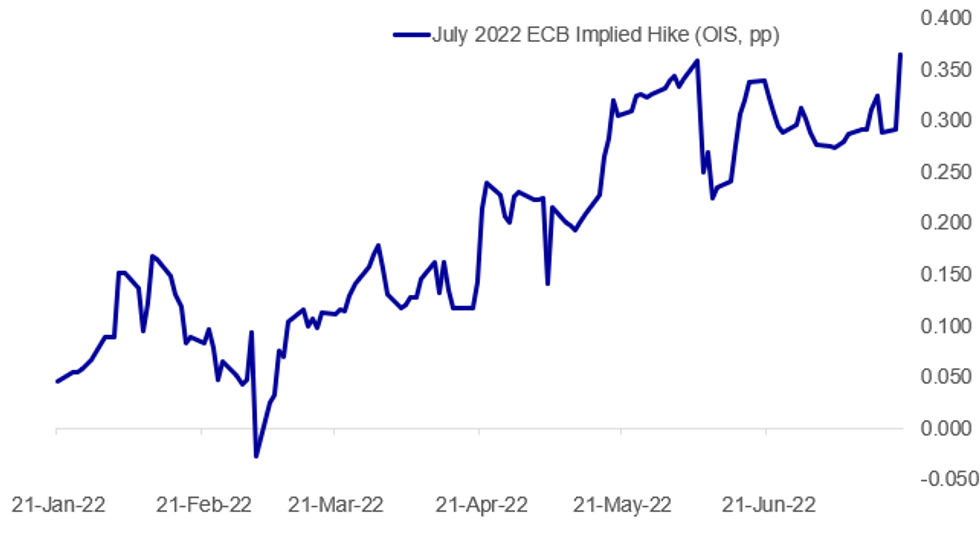

Fig. 1: ECB 50bp July Hike Speculation Rises

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (RTRS): European Central Bank policymakers will discuss whether to raise interest rates by 25 or 50 points at their meeting on Thursday to tame record-high inflation, two sources with direct knowledge of the discussion told Reuters. The sources, who spoke on condition of anonymity because the deliberations are private, said policymakers were also homing in on a deal to provide help for indebted countries like Italy on the bond market if they stick to European Commission rules on reforms and budget discipline.

ECB (BBG): The European Central Bank may consider raising interest rates on Thursday by double the quarter-point it outlined just last month because of the worsening inflation backdrop, according to people familiar with the situation. As officials lift rates this week for the first time in more than a decade, it’s unclear whether there’ll be sufficient support for a 50 basis-point increase, the people stressed, who asked not to be named discussing private deliberations. Chief Economist Philip Lane will make the official policy proposal at the meeting.

US-CHINA (BBG): China vowed to take a “resolute and strong” response to any Taiwan visit by US House speaker Nancy Pelosi, setting the stage for a possible showdown over the reported landmark trip. Pelosi’s plan to lead a delegation to Taipei next month, which was reported by the Financial Times, would have a “grave impact” on US-China ties, Foreign Ministry spokesman Zhao Lijian said Tuesday. China had issued a similar warning about a planned Pelosi visit in April, before she contracted Covid-19 and canceled the trip. “China firmly opposes this as it will have a grave impact on the political foundation of bilateral relations,” Zhao told a regular news briefing in Beijing. “If the US were to insist on going down the wrong path, China will take resolute and strong measures to safeguard its sovereignty and territorial integrity. All the ensuing consequences shall be borne by the US side.”

EU / ENERGY (DJ): The European Commission doesn't expect gas supplies to Europe from Russia through the Nord Stream pipeline to restart when scheduled maintenance ends this week, Commissioner Johannes Hahn said Tuesday. "We're working on the assumption that it doesn't return to operation," he told reporters on the sidelines of a conference in Singapore.

UK POLITICS: The result of the fourth round of the Conservative leadership contest is expected at 1500BST (1000ET, 1600CET), with voting taking place among Conservative MPs between 1200-1400BST. * Betting markets have somewhat stabilised in last 24 hours. Former Chancellor Rishi Sunak still favourite on 49.5% implied probability of winning. Foreign Sec Liz Truss second on 30.3%. Trade minister Penny Mordaunt third on 16.1%, and former Equalities minister Kemi Badenoch in fourth on 4.4%.

RBA: Reserve Bank of Australia Deputy Governor Michelle Bullock says that the strong labour market is key to households coping with increased mortgage rates and along with inflation will be a critical factor in determining the size and pace of rate hikes ahead. In a speech on Tuesday in Brisbane, Bullock said that while some households were vulnerable there had been a $260 billion increase in household savings through the pandemic and the sector had "large liquidity buffers" with most households holding substantial equity. Much of the debt was held by high-income households which had the ability to service their debt.

DATA:

MNI BRIEF: UK Real Incomes Declined At Record Pace In May

Real wages in the UK fell again in May, as pay deals and bonus payments failed to keep pace with soaring inflation, data released by the Office for National statistics showed, dipping even very slightly below analysts' expectations..

Total average earnings rose 6.2% y/y in the three months to May, driven in large part by bonus payments, while pay deals excluding bonuses rose by 4.3% y/y. However, when adjusted for inflation, real wages fell 0.9% y/y and by 2.9% excluding bonuses. Excluding bonuses, "real pay is now dropping faster than at any time since records began in 2001,” according to David Freeman, head of labour market and household statistics at the ONS said.

The jobs and wages data remains key to the Bank of England's reading of the UK economy and the latest data will offer mixed signals, but probably doesn't add further fuel to the need for a 50 bps rate hike at the August meeting.

“Following recent increases in inflation, pay is now clearly falling in real terms both including and excluding bonuses. Excluding bonuses, real pay is now dropping faster than at any time since records began in 2001.”

FIXED INCOME: ECB 50bp talk hitting German curve; UK labour market data helping gilts

There has been some divergence between core fixed income markets this morning.

- The biggest moves have been seen in EGBs following first a Reuters and then a Bloomberg sources story that suggested the ECB would discuss both 25bp and 50bp hikes at its meeting this week. This follows forward guidance that had pretty explicitly signalled a 25bp hike this week (although the hawks have been a lot more open to a 50bp hike this week in their recent public commentary). Market pricing for this week's meeting has increased from a less than 20% probability of a 50bp hike to around a 40% probability. This has led to a bear flattening of the German curve. Schatz yields had at one point been move than 10bp higher on the day.

- Gilts on the other hand are higher today after slightly disappointing UK labour market data. The very front-end of the SONIA strip has been pulled lower since the ECB sources story, with 51bp now priced for the August meeting (from 48bp yesterday) but the terminal rate has not shifted, gilt yields are lower across the curve, although off the more extreme levels seen at the open.

- Against this backdrop, US Treasuries have seen the smallest moves with the curve steepening marginally today.

- Looking ahead we have US housing data as well as the Mansion House speeches (from BOE's Bailey and Chancellor Zahawi) as well as the next round of the Conservative leadership contest where we will be whittled down to three candidates.

- TY1 futures are down -0-7+ today at 118-07+ with 10y UST yields down -0.5bp at 2.982% and 2y yields down -2.7bp at 3.151%.

- Bund futures are down -0.33 today at 151.59 with 10y Bund yields up 2.1bp at 1.232% and Schatz yields up 5.1bp at 0.548%.

- Gilt futures are up 0.26 today at 115.27 with 10y yields down -2.8bp at 2.127% and 2y yields down -2.3bp at 1.943%.

FOREX: EUR Makes Light Work of Monday High

- The EUR sits close to the top of the G10 pile Tuesday, with the release of several sources reports to Bloomberg and Reuters making a 50bps rate hike at this Thursday's ECB a certain topic for discussion - although the median consensus still looks for a smaller 25bps rise this week.

- EUR/USD made light work of the Monday highs upon release, turning attention to resistance at 1.0258, the 20-day EMA. A breach of the average would strengthen bullish conditions and signal scope for an extension within the bear channel.

- The greenback is among the poorest performers early Tuesday, extending the weakness noted on Monday as the USD Index extends the pullback off last week's cycle high. The USD Index is now near 2.5% off the best levels of last week.

- As was the case pre-market yesterday, US equity futures are firmer, indicating a positive open on Wall Street later today after the late downdrift in markets into the close. The firmer risk backdrop is helping AUD and NZD shore up recent strength, while WTI back above $102/bbl helps oil-tied FX outperform.

- US housing data takes focus going forward, with housing starts and building permits data on the docket. ECB's Makhlouf is due to speak, although policy comments are likely few and far between given the proximity to Thursday's rate decision. BoE's Bailey is also scheduled to speak, delivering the Mansion House speech alongside Chancellor Zahawi.

EQUITIES: Europe Stocks Pare Gains On ECB 50bp Hike Speculation

- Asian stocks closed mixed (Japan returned from a Monday holiday): Japan's NIKKEI closed up 173.21 pts or +0.65% at 26961.68 and the TOPIX ended 10.29 pts higher or +0.54% at 1902.79. China's SHANGHAI closed up 1.328 pts or +0.04% at 3279.431 and the HANG SENG ended 185.12 pts lower or -0.89% at 20661.06.

- European stocks pared earlier modest gains after multiple media reports that the ECB was considering hiking by 50bp in July; tech stocks are lagging, with defensives (utilities) leading: the German Dax down 62.77 pts or -0.48% at 12959.81, FTSE 100 down 11.14 pts or -0.15% at 7218.69, CAC 40 down 39.08 pts or -0.64% at 6091.91 and Euro Stoxx 50 down 21.72 pts or -0.62% at 3511.86.

- U.S. futures are a little stronger, with the Dow Jones mini up 90 pts or +0.29% at 31135, S&P 500 mini up 16.25 pts or +0.42% at 3850, NASDAQ mini up 51 pts or +0.43% at 11958.

COMMODITIES: Precious Metals Benefit From Weaker USD But Copper Retreats

- WTI Crude down $0.4 or -0.39% at $101.77

- Natural Gas down $0.01 or -0.11% at $7.519

- Gold spot up $3.78 or +0.22% at $1710.43

- Copper down $5 or -1.49% at $334.7

- Silver up $0.15 or +0.79% at $18.8595

- Platinum up $7.45 or +0.86% at $873.39

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/07/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/07/2022 | 1700/1800 |  | UK | BOE Bailey at Mansion House Dinner | |

| 19/07/2022 | 1835/1435 |  | US | Fed Vice Chair Lael Brainard | |

| 20/07/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 20/07/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 20/07/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 20/07/2022 | 0600/0800 | ** |  | DE | PPI |

| 20/07/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 20/07/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 20/07/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 20/07/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 20/07/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/07/2022 | 1400/1000 | *** |  | US | NAR existing home sales |

| 20/07/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 20/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.