-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Thursday, December 12

MNI BRIEF: Beijing To Protect Firms From U.S. Bill - MOFCOM

MNI BRIEF: SNB Cuts Policy Rate By 50 BP To 0.5%

MNI US MARKETS ANALYSIS: BoE In The Spotlight

Highlights:

- The BoE decision is due at midday with consensus expecting a 50bp hike

- China has proceeded to hold live-fire drills near to Taiwan following Nancy Pelosi's departure yesterday.

US TSYS SUMMARY: 2s10s See Fresh Post 2000 Flats Ahead Of BoE

- Cash Tsys have cheapened through the European session ahead of the BoE decision with a 50bp hike eyed to leave a modest bear flattening on the day after the huge ranges over the past two days, pushing 2s10s to new post-2000 flats of -36bps.

- 2Y yields currently sit in the middle of yesterday’s 19bp range yesterday, comfortably off the high of 3.198%, a range that extends almost to 40bps had a 19bp range yesterday, extending to 38bps over the past two days with Tuesday’s low of 2.815%.

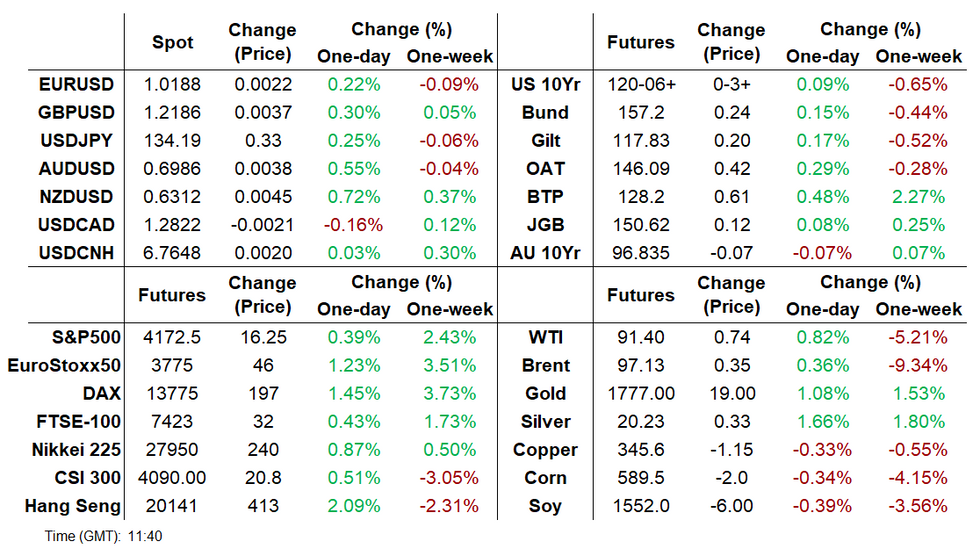

- 2YY +3.5bps at 3.100%, 5YY +2.9bps at 2.855%, 10YY +2.5bps at 2.730% and 30YY +2.5bps at 2.970%.

- TYU2 trades 3+ ticks higher at 120-06+ with bullish short-term technical trend conditions and below average volumes. Key support is seen at the 50-day EMA of 119-03 whilst resistance is eyed at 122-02 (Aug 2 high).

- Fedspeak: Cleveland Fed Mester economic outlook, no text, Q&A (1200ET)

- Data: Limited docket with challenger job cuts, weekly jobless claims and international trade.

- Bill issuance: US Tsy $55B 4W, $50B 8W bill auctions (1130ET)

STIR FUTURES; Fed Hikes Keeping To Significant Re-Pricing Of Larger Hikes

- Fed Funds implied hikes have firmed slightly through the European session to sit in the middle of yesterday’s wide ranges, consolidating a significant re-pricing of larger hikes with Fedspeak on terminal rates higher than market pricing and pushing back against rate cuts.

- Yesterday’s ISM service beat spurred further increases but pricing is now back to where it was prior to the release.

- There is currently 61bps for the Sept FOMC having yesterday tipped to more than a 50% chance of a 75bp hike, with a cumulative 107bps to year-end and 113bps to the current peak of 3.46% in Mar’23.

- Implied rates out to end-2023 have increased back to post-US CPI levels but still imply 47bps of cuts.

- Mester (’22 voter) set to discuss the economic outlook at 1200ET (Q&A with no text) after noting on Tue that inflation hasn’t yet peaked and wants to see compelling evidence of sustained or several months of it cooling.

EGB/GILT SUMMARY: BoE Expected To Ratchet Up Fight Against Inflation

European government bonds have traded broadly firmer this morning, with the gilt curve twist flattening heading into the BoE meeting.

- The Bank of England is due up at midday (GMT) and is expected to deliver a 50bp hike as it ratchets up the fight against inflation.

- Yields at the short-end of the gilt curve have pushed higher while the longer end has firmed. The 2s30s spread has narrowed 8bp.

- German factory orders for June were a touch better than expected while still contracting on the month (-0.4% M/M vs -0.9% expected).

- Similar to gilts, the bund curve has twist flattened with the 2s30s spread narrowing 3bp.

- The OAT curve has shifted in the same manner and has flattened 3bp at the long end.

- BTPs have broadly firmed with the curve bull flattening. Cash yields are 1-3bp lower on the day.

- Following US House Speaker Nancy Pelosi's departure from Taiwan, China has proceeded to hold live-fire military drills near to the island. The Taiwanese defence ministry has further claimed that it's website was hit with a cyber attack.

- Supply this morning came from France (OATs, EUR5.998bn) and Spain (Oblis/Obli-Ei, EUR5.15bn).

US-CHINA: "Taiwan Policy Act" Causes Headache For White House

Tensions have increased between the White House and the Senate Foreign Relations Committee as committee chair Senator Bob Menendez (D-NJ) leads a public drive towards “the most comprehensive restructuring of US policy toward Taiwan since the Taiwan Relations Act of 1979.”

- The Foreign Relations Committee met behind closed doors yesterday to consider the Menendez-[Senator Lindsay] Graham (R-SC) Taiwan Policy Act 2022.

- The planned vote progress the bill was delayed and Taiwan's Liberty Times reported that the bill is "stuck in limbo," speculating that the Senate is "holding off from advancing the bill to avoid further angering China."

- According to Bloomberg, the Biden administration is lobbying Democrat Senators to “put the brakes” on the “counterproductive” bill which would, “interfere with the decades-old approach of “strategic ambiguity,”” towards Taiwan.

- Senator Chris Murphy (D-CT) who also sits on the Committee said: “The White House has significant concerns. I have significant concerns. I’m not sure this is the moment to throw out 40 years of policy.”

- Menendez published an op-ed in the New York Times yesterday outlining why US policy towards Taiwan must be revised. According to Menendez, China’s “plan of attack [is] eerily reminiscent of Mr. Putin’s in Ukraine,” and “accordingly, the United States needs less ambiguity to guide our approach to Taiwan.”

- Menendez continued: “We saw the warning signs for Ukraine in 2014 and failed to take action that might have deterred further Russian aggression. We cannot afford to repeat that mistake with Taiwan.”

- The Taiwan Policy Act '22 would “reinforce the security of Taiwan,” recognise Taiwan as a “major non-NATO ally,” and “expand Taiwan’s diplomatic space through its participation in international organizations and in multilateral trade agreements.”

- According to Menendez, his legislation would also “impose crippling economic costs if Beijing takes hostile action against Taiwan.”

EUROPEAN ISSUANCE UPDATE

Spain auction results:

- E1.026bln of the 1.30% Oct-26 Obli. Avg yield 1.061% (bid-to-cover 2.03x).

- E1.755bln of the 0.80% Jul-29 Obli. Avg yield 1.552% (bid-to-cover 1.6x).

- E1.787bln of the 2.55% Oct-32 Obli. Avg yield 1.982% (bid-to-cover 1.71x).

- E582mln of the 0.70% Nov-33 Obli-Ei. Avg yield -0.112% (bid-to-cover 1.76x).

France auction results:

- E4.131bln of the 2.00% Nov-32 OAT. Avg yield 1.43% (bid-to-cover 2.47x).

- E1.867bln of the 1.25% May-34 OAT. Avg yield 1.57% (bid-to-cover 2.31x).

EUROPE OPTION FLOW SUMMARY

ERZ2 98.75/98.50/98.25p fly, bought for 3 in 3k

ERV2 98.875/98.75 ps vs 99.25c, bought the ps for 0.75 in 5k

SX5E (21/10/22) 4075c, bought for 21.50 and 21.60 in 25k

SX7E (16/06/23) 82.5 puts, bought for 10.65 and 10.70 in 50k vs 12.5k at 81.80

FOREX: Attention turns to the BoE

- Market participants await the BoE decision.

- Early European flows have seen the EUR gaining this morning on the margin, with the USD mostly offered, driven by a tilted Risk On tone.

- EU cash Equities opened higher and dragged futures on the follow, but upside momentum has lost some steam, and price action has been more mixed.

- Yen has in turn seen selling interest, and at session low against USD, EUR, AUD. GBP.

- USDJPY eye 134.55 High Aug 3 next.

- EUR is mostly in the green against G10, besides the AUD and NZD.

- The EUR tested intraday high vs CAD, JPY, GBP, and NOK, but off its best levels at the time of typing.

- USD sits in the red in G10s, besides the Yen, and circa flat against the NOk and Swissy.

- Looking ahead, there's no Tier 1 data left for the session, out of the US sees IJC, but no longer a market mover, with ALL EYES on NFP tomorrow.

- All the attention is now on the BoE decision, with most sell side going for a 50bps hike.

- This is also widely expected by Economist's estimates, with 13 out of 43 economists surveyed by Bloomberg going for a 25bps hike.

- A 50bps hike to 1.75% is the median call.

- The decision, statement and MPR will be released at 12:00BST / 13:00CET with the press conference due to begin at 12:30BST / 13:30CET.

Price Signal Summary - Oil Futures Remain Vulnerable

- In the equity space, S&P E-Minis traded higher Wednesday to reinforce current bullish conditions. The break of Monday’s 4147.25 high confirms a resumption of recent gains and maintains a bullish theme. This opens 4204.75 next, May 31 high and the next key resistance. Initial trend support has been defined at 3913.25, the Jul 26 low. EUROSTOXX 50 futures trend conditions remain bullish and yesterday’s high print reinforces current conditions. The contract has breached the 76.4% retracement of the Jun 6 - Jul 5 downleg, at 3722.40. Initial firm support to watch is 3586.00, the 50-day EMA.

- In FX, the EURUSD short-term outlook is bullish, as long as support at 1.0097, the Jul 27 low, remains intact. A resumption of gains would signal scope for an extension higher within the bull channel - the top intersects at 1.0388. Weakness below 1.0097 would alter the picture. A bullish short-term theme in GBPUSD is still intact. Price has recently traded above the 50-day EMA. This reinforces bullish conditions with the next objective at 1.2332, the Jun 27 high. Potential is also seen for a climb towards 1.2406, the Jun 16 high and a key resistance. Initial firm support to watch lies at 1.2063, the Jul 29 low. USDJPY remains above support at 130.41, Tuesday’s low. Gains are - for now - considered corrective. A resumption of weakness would open 130.00. Initial resistance is at 135.32, the 20-day EMA.

- On the commodity front, Gold maintains a firmer tone. Attention is on resistance at the 50-day EMA, at $1783.10. The average has been pierced, a clear break would suggest potential for a bullish extension and expose trendline resistance at $1804.6. The trendline is drawn from the Mar 8 high. In the Oil space, WTI futures remain vulnerable. The contract has recently failed to clear key resistance around the 50-day EMA - the average intersects at $99.87. The break lower opens $88.23, Jul 14 low and a key support.

- In the FI space, a short-term bull cycle in Bund futures remains intact. Scope is seen for a climb to 159.79 next, the Apr 4 high (cont). Initial firm support is 154.44, the 20-day EMA. The trend condition in Gilts remains bullish is bullish and pullbacks are considered corrective. A resumption of gains would open 120.00. Support is at 116.80 20-day EMA.

EQUITIES: Off Session Highs Ahead Of BoE

- Asian stocks closed higher: Japan's NIKKEI closed up 190.3 pts or +0.69% at 27932.2 and the TOPIX ended 0.04 pts lower or 0% at 1930.73.China's SHANGHAI closed up 25.365 pts or +0.8% at 3189.039 and the HANG SENG ended 406.95 pts higher or +2.06% at 20174.04.

- European equities are fading earlier highs, with tech and consumer discretionary stocks leading, and defensives lagging: German Dax up 100.68 pts or +0.74% at 13688.96, FTSE 100 down 17.65 pts or -0.24% at 7427.36, CAC 40 up 25.99 pts or +0.4% at 6496.96 and Euro Stoxx 50 up 16.55 pts or +0.44% at 3749.02.

- U.S. futures are a touch lower, with the Dow Jones mini down 26 pts or -0.08% at 32745, S&P 500 mini down 4 pts or -0.1% at 4152.25, NASDAQ mini down 16 pts or -0.12% at 13255.5.

COMMODITIES: Copper Lags Broader Gains

- WTI Crude up $0.38 or +0.42% at $91.03

- Natural Gas up $0.07 or +0.82% at $8.334

- Gold spot up $11.34 or +0.64% at $1776.63

- Copper down $2.65 or -0.76% at $344.05

- Silver up $0.08 or +0.4% at $20.1444

- Platinum up $6.18 or +0.68% at $908.44

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/08/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 04/08/2022 | 1130/1230 |  | UK | BOE Press Conference | |

| 04/08/2022 | 1230/0830 | * |  | CA | Building Permits |

| 04/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 04/08/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 04/08/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 04/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 04/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 04/08/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester | |

| 05/08/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 05/08/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/08/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 05/08/2022 | 0645/0845 | * |  | FR | Current Account |

| 05/08/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/08/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 05/08/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency Briefing | |

| 05/08/2022 | 1200/0800 |  | US | Richmond Fed's Tom Barkin | |

| 05/08/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/08/2022 | 1230/0830 | *** |  | US | Employment Report |

| 05/08/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 05/08/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.