-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US OPEN: Wary Market Optimism Ahead Of CPI

EXECUTIVE SUMMARY:

- US INFLATION EXPECTED TO HAVE SLOWED IN JULY (MNI CPI PREVIEW)

- CHINA ENDS TAIWAN MILITARY DRILLS, PLANS REGULAR PATROLS

- TRUMP SAYS HE'S TESTIFYING WEDNESDAY IN NY PROBE: AP

- NORWAY INFLATION SEES SURPRISE ACCELERATION IN JULY

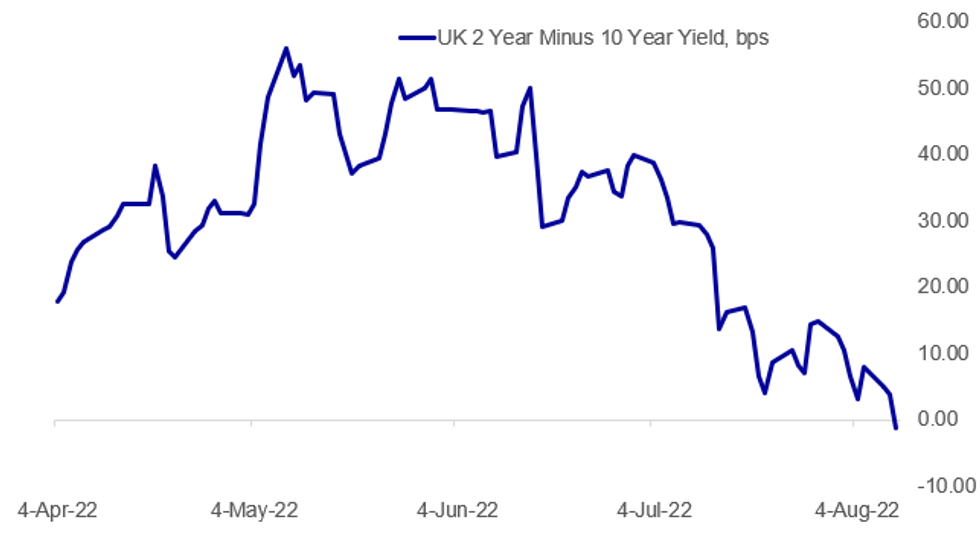

Fig. 1: UK 2s10s Inversion

Source: BBG, MNI

Source: BBG, MNI

NEWS:

MNI US CPI PREVIEW: Consensus has headline CPI slowing to just 0.2% M/M from an unwind in energy prices, whilst core CPI is seen easing from 0.7% to 0.5% M/M but after three sizeable beats. Analysts see various driving forces for the moderation in core CPI but only a limited easing in shelter after once again surprising to the upside in June at multi-decade M/M highs. The market reaction to Friday’s payrolls beat shows the potential for large moves, with significant two-sided risk to this release. More, including MNI analysis plus forecasts from nine analysts, here.

CHINA / TAIWAN (BBG): PLA’s Eastern Theater Command has completed tasks in its military drill near Taiwan, and will conduct regular patrols in the region, the regional military headquarters says in a statement.

US-CHINA: Speaking in the port city in Qingdao, Chinese Foreign Minister Wang Yi has stated that the recently-passed US CHIPS and Science Act 'disrupts international trade'. The legislation is intended to boost US manufacturing of semiconductors and microchips (to reduce reliance on Asian supply chains) and to enhance US competitiveness against China in other high-tech areas. Wang speaking on perceived US interference in Taiwan: ""If we overlook US interference in our domestic politics, this world will return to the laws of the jungle, and Washington will become even more unscrupulous in using force to suppress other countries."

US (AP): Former President Donald Trump will be questioned under oath Wednesday in the New York attorney general’s long-running civil investigation into his dealings as a real estate mogul, he confirmed in a post on his Truth Social account. Trump’s testimony comes amid a flurry of legal activity surrounding him, taking place just days after FBI agents searched his Mar-a-Lago estate in Florida as part of an unrelated federal probe into whether he took classified records when he left the White House.

FEDERAL RESERVE (BBG): Republicans on the Senate Banking Committee are vowing to pursue legislation mandating more transparency from the Federal Reserve after learning the central bank had documents regarding former Fed nominee Sarah Bloom Raskin that the bank never divulged to Congress. In a letter sent Tuesday to Fed Chair Jerome Powell, 11 GOP members of the committee complained the bank never complied with a February request by ranking Republican Pat Toomey for correspondence about Reserve Trust, a fintech firm that received a Fed master account while Raskin, an ex-Fed governor, served as a company director. A Fed spokesperson declined to comment.

OIL - RUSSIA - HUNGARY (BBG): Hungarian refiner Mol says it paid Ukraine a transfer fee to restart crude oil flows from Russia to central and eastern Europe. “Mol has conducted negotiations with the Ukrainian and Russian parties on the resumption of transport through the Friendship pipeline, and transferred the fee due for the use of the Ukrainian section of the pipeline,” the refiner said in an emailed statement. Russian crude flows via the Southern Druzhba pipeline through Ukraine to Hungary, Slovakia and the Czech Republic were halted this week because sanctions prevented payment of a transit fee.

GERMANY (BBG): German Finance Minister Christian Lindner set out 10 billion-euros ($10.2 billion) of tax adjustments to ease the burden on people suffering from high inflation. “To allow for a tax increase during these times is not fair, and is dangerous for economic development,” Lindner told reporters Wednesday in Berlin. He referred to a phenomenon known as “bracket creep,” when inflation pushes workers’ pay into higher tax brackets without any real changes in purchasing power. Not adjusting the tax code in such a situation would not be fair, Lindner argued.

SWEDEN (BBG): Sweden’s economic outlook has worsened during the summer and the largest Nordic economy will enter a recession next year, according to Sweden’s National Institute of Economic Research (NIER). NIER forecast the country’s CPIF rate to increase to 7.2% in 2022, up from the previous forecast of 6.8% in June, according to updated projections published Wednesday; sees CPIF at 3.4% next year vs 3.2%. NIER now expects GDP growth of 2.4% this year vs 1.9% seen in June, for 2023 it sees 0.5% growth vs 1.2%.

DATA:

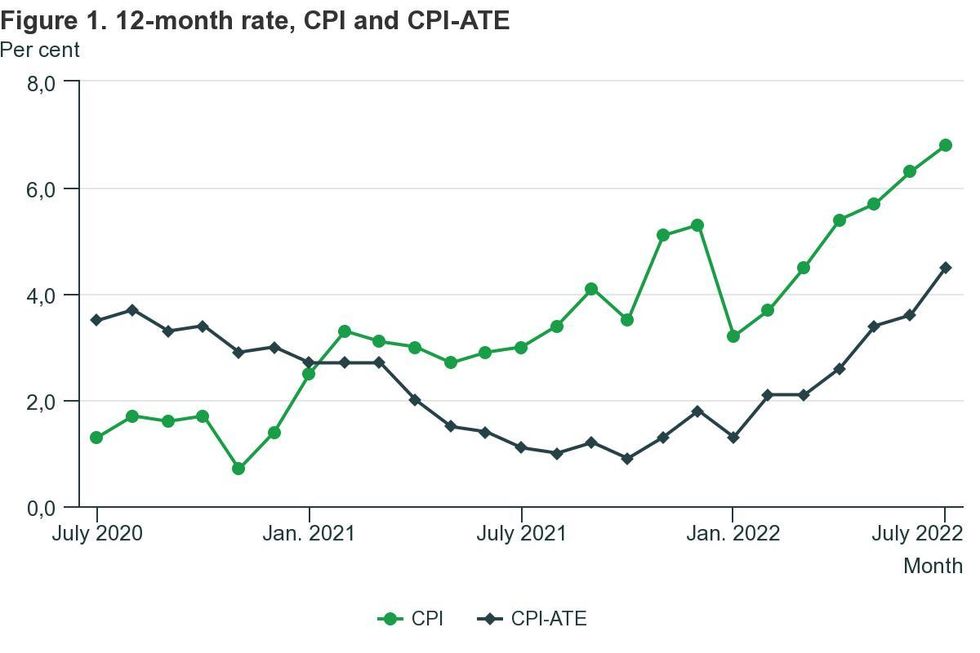

NORWAY: CPI Sees Surprise Acceleration to 6.8% in July

NORWAY JUL CPI +1.3% M/M (FCST +0.9%); JUN +0.9% M/M

NORWAY JUL CPI +6.8% Y/Y (FCST +6.3%); JUN +6.3% Y/Y

NORWAY JUL UNDERLYING CPI +4.5% Y/Y (FCST +3.8%); JUN +3.6% Y/Y

- Norwegian CPI saw a surprise 0.5pp acceleration to +6.8% y/y in the July data, beating consensus expectations of unchanged CPI at +6.3% y/y. Prices increased by +1.3% m/m (vs +0.9% anticipated). This is the highest annual rate since 1998.

- The hottest upticks were across food, which jumped by 7.6% m/m and household equipment, up 2.8% m/m.

- The underlying CPI-ATE index closely watched by the Norges Bank ticked up 0.7pp to +4.5% y/y, expanding by +1.5% m/m in July.

- With CPI running substantially hotter than the core target of 2.0%, and inflationary pressures showing little signs of easing, this data could improve the chance of another 50bp hike for Norges Bank next week. The bank's June forward guidance signalled a softer 25bp hike.

Source: Statistics Norway

MNI BRIEF: China July CPI At 2-Year High On Rising Pork Prices

China's July consumer price index rose 2.7% y/y, accelerating from June's 2.5% and hitting the highest level since July 2020, though underperforming a 2.9% forecast, data from the National Bureau of Statistics on Wednesday showed.

The increase was mainly driven by rising pork prices, which rose 20.2% y/y to reverse the previous 6% fall. Core CPI, excluding food and energy prices, rose 0.8% y/y, narrowing by 0.2 percentage point from June. On a monthly basis, CPI increased 0.5%, compared with the previous 0.0%.

The producer price index measuring factory gate prices further eased for the ninth straight month to 4.2% y/y from June's 6.1%, hitting the lowest since February 2021, though lower than the 4.9% forecast. On a monthly basis, PPI fell 1.3%, reversing June's 0.0%, following price falls in global crude oil and non-ferrous metals.

*GERMANY JUL CPI FLASH NUMBERS CONFIRMED

*GERMANY FINAL JUL HICP +0.8% M/M, +8.5% Y/Y; JUN +8.2% Y/Y

*MNI: GERMANY FINAL JUL CPI +0.9% M/M +7.5% Y/Y; JUN +7.6% Y/Y

MNI BRIEF: Japan July CGPI Rises 8.6% Y/Y Vs. +9.4% in June

The year-on-year rise in Japan's corporate goods price index slowed to +8.6% in July from June's revised +9.4% in the wake of smaller rises for lumber and wood products, and petroleum and coal products, data released by the Bank of Japan Wednesday showed. July's gain was the 17th straight y/y rise. April's record high of +9.9% was revised up to +10.0%.

FIXED INCOME: Looking ahead to US CPI

- Core fixed income has moved higher this morning, but remains in yesterday's range. The main headlines have concerned the impact of the hot weather across Europe with the Rhine river not impassible at a key point that could affect energy imports into Germany, as well as other international trade.

- However, the focus remains on US CPI. Consensus has headline CPI slowing to just 0.2% M/M from an unwind in energy prices, whilst core CPI is seen easing from 0.7% to 0.5% M/M but after three sizeable beats. Analysts see various driving forces for the moderation in core CPI but only a limited easing in shelter after once again surprisingly to the upside in June at multi-decade M/M highs. The market reaction to Friday’s payrolls beat shows the potential for large moves, with significant two-sided risk to this release. The full MNI CPI preview is available here.

- Fed's Evans and Kashkari are due to speak at 16:00BST / 11:00ET and 19:00BST / 14:00ET respectively to discuss the economy and inflation. These will both be worth watching after today's CPI print. BOE Chief Economist Pill will be holding an online Q&A on the BOE's reaction to the rising cost of living at 17:00BST / 12:00ET.

- TY1 futures are up 0-8 today at 119-23+ with 10y UST yields down -1.5bp at 2.765% and 2y yields down -3.4bp at 3.238%.

- Bund futures are up 0.69 today at 156.87 with 10y Bund yields down -3.4bp at 0.883% and Schatz yields down -2.4bp at 0.547%.

- Gilt futures are up 0.41 today at 117.67 with 10y yields down -2.8bp at 1.940% and 2y yields up 4.1bp at 1.931%.

FOREX: NOK Surges as Norges Bank Pricing Bumped Higher on CPI

- The greenback again trades softer ahead of NY hours Wednesday, mimicking the price action seen on Tuesday, albeit within a more muted range. EUR/USD continues to hold just above the 1.02 handle, but is yet to make any meaningful test on the Tuesday European high of 1.0247. Among the crosses however, EUR is faring less well, with headlines this morning concerning the impassability of the Rhine river hampering supply chains further on the continent. EUR/NZD is testing the 1.62 handle in response.

- Risk sentiment is generally improving, with both equities and high beta currencies on the front foot. The e-mini S&P has improved over the past hour so, erasing a modest Asia-Pac session drift to narrow in on 4155.00, the overnight Tuesday high. As a result, the likes of NZD and CAD are edging higher - although volumes and activity remain light at this stage.

- NOK's strength so far Wednesday follows a bumper inflation print for July, coming in at 1.3% on the month vs. Exp. 0.9%. This has prompted a wide range of analysts to bring forward expectations for tightening from the Norges Bank, with consensus shifting to a 50bps rise next week, from a 25bps rise previously.

- Chinese inflation data overnight could fuel further calls for PBOC easing across the second half of this year as both CPI and PPI data came in below expectations. While CPI rose to 2.7% Y/Y, the pace of increase slowed and fell short of forecast. Similarly, PPI fell well below expectations, and dropped to the lowest level since early 2021 - leaving CNH as one of the worst performers so far Wednesday.

- US CPI takes focus going forward, with markets expecting headline and core CPI M/M to slow to 0.2% and 0.5% respectively. The speakers slate could be similarly interesting, with Fed's Evans & Kashkari and BoE's Pill on the docket.

EQUITIES: Financials Lead Early European Gains

- Asian markets closed weaker: Japan's NIKKEI closed down 180.63 pts or -0.65% at 27819.33 and the TOPIX ended 3.37 pts lower or -0.17% at 1933.65. China's SHANGHAI closed down 17.412 pts or -0.54% at 3230.02 and the HANG SENG ended 392.6 pts lower or -1.96% at 19610.84.

- European stocks are mostly higher, with financials leading gains and consumer staples/health care lagging: the German Dax up 43.19 pts or +0.32% at 13578.28, FTSE 100 down 1.51 pts or -0.02% at 7486.54, CAC 40 up 3.62 pts or +0.06% at 6492.84 and Euro Stoxx 50 up 6.78 pts or +0.18% at 3722.22.

- U.S. futures are pointing higher, with the Dow Jones mini up 85 pts or +0.26% at 32822, S&P 500 mini up 14 pts or +0.34% at 4138.5, NASDAQ mini up 59.25 pts or +0.45% at 13090.75.

COMMODITIES: Copper Edges Higher, Precious Lower

- WTI Crude down $0.19 or -0.21% at $90.3

- Natural Gas up $0.01 or +0.13% at $7.843

- Gold spot down $1.66 or -0.09% at $1792.6

- Copper up $1.35 or +0.38% at $359.85

- Silver down $0.09 or -0.42% at $20.4348

- Platinum down $2.46 or -0.26% at $934.28

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/08/2022 | 1230/0830 | *** |  | US | CPI |

| 10/08/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 10/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 10/08/2022 | 1500/1100 |  | US | Chicago Fed's Charles Evans | |

| 10/08/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/08/2022 | 1800/1400 | ** |  | US | Treasury Budget |

| 10/08/2022 | 1800/1400 |  | US | Minneapolis Fed's Neel Kashkari | |

| 11/08/2022 | 2301/0001 | * |  | UK | RICS House Prices |

| 11/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 11/08/2022 | 1230/0830 | *** |  | US | PPI |

| 11/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 11/08/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/08/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.