-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, July 12

MNI US OPEN - Harris Overtakes Biden in Democratic Nomination Betting Odds

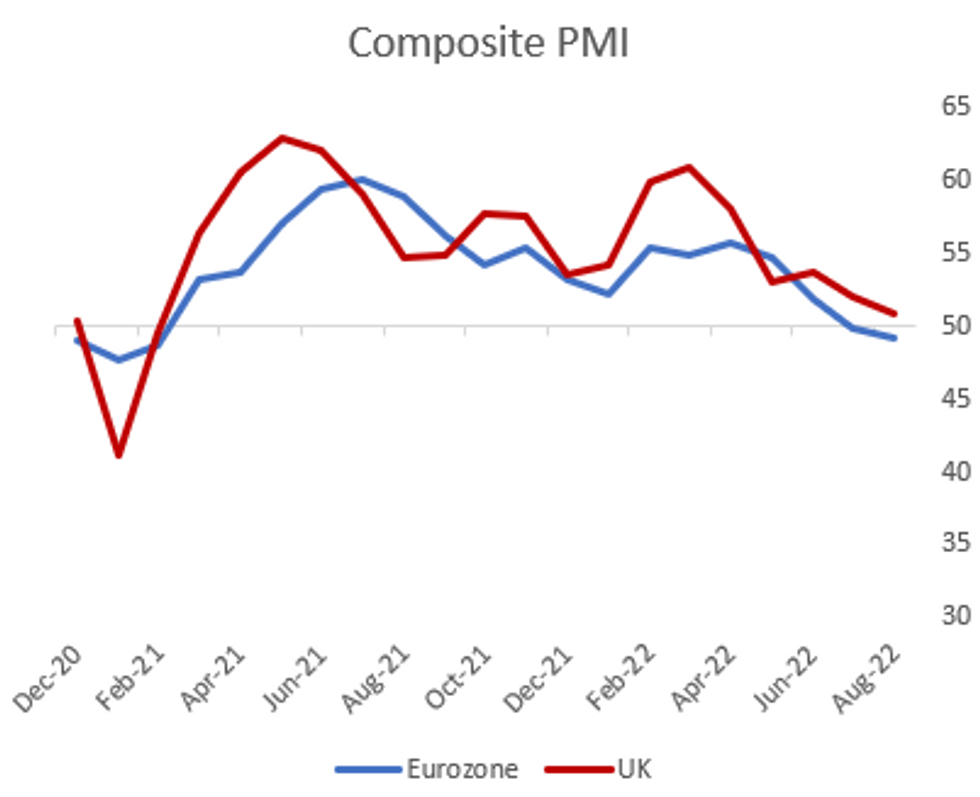

MNI US OPEN: Europe PMIs Point To Stagnation

EXECUTIVE SUMMARY:

- EUROZONE PMIS MIXED; UK SERVICES HOLD UP BUT MANUFACTURING WEAK

- IRAN HAS DROPPED SOME DEMANDS FOR NUCLEAR DEAL: U.S. OFFICIAL (RTRS)

- BANK INDONESIA SURPRISES WITH 1ST RATE HIKE SINCE 2018

- GLOBAL GAS PRICES SURGE ON CONTINUED SUPPLY DISRUPTIONS

Fig. 1: Eurozone Composite PMI Slightly Above Expectations But Still Sub-50; UK In Line

SourcE: S&P Global, MNI

SourcE: S&P Global, MNI

IRAN NUCLEAR DEAL (RTRS): Iran has dropped some of its main demands on resurrecting a deal to rein in Tehran's nuclear program, including its insistence that international inspectors close some probes of its atomic program, bringing the possibility of an agreement closer, a senior U.S. official told Reuters on Monday. The official, speaking on condition of anonymity because of the sensitivity of the matter, said that although Tehran has been saying Washington has made concessions, Iran has dropped some of its key demands. "They came back last week and basically dropped the main hang-ups to a deal," the official said.

BANK INDONESIA (BBG): Indonesia’s central bank unexpectedly raised borrowing costs for the first time since 2018 as policy makers conceded that inflation pressures have risen, revising their price forecasts higher. Bank Indonesia raised its seven-day reverse repurchase rate by 25 basis points to 3.75% on Tuesday, a move predicted by only seven of 31 economists in a Bloomberg survey. BI raised its forecasts for headline and core inflation this year and said it sees risks that average price gains could exceed the 2%-4% target not just this year but also in 2023. “This decision is a preemptive and forward looking step to mitigate the risk of rising core inflation and inflation expectations due to the increase in non-subsidized fuel prices and volatile food inflation, as well as to strengthen the rupiah exchange rate stabilization policy amid high global uncertainty and increasingly strong domestic economic growth,” Governor Perry Warjiyo said at a livestreamed briefing.

GLOBAL ENERGY: Global gas prices surge led by European TTF due to Russian gas supply disruptions. Natural gas prices in Europe are about seven times higher than they were a year ago as soaring energy costs are impacting economic output. Energy Aspects said gas prices could rise to 400€/MWh if flows via Nord Stream stop in September. Poland’s largest chemicals company, Azoty, is temporarily suspending making some key fertiliser products because of record natural gas prices.

GLOBAL ENERGY (BBG):US natural gas prices rose above $10 per million British thermal units for the first time since 2008, extending a scorching rally driven by persistent concern that global stockpiles of the heating and power-plant fuel aren’t enough to meet winter demand.Gas prices have surged all over the world after Russia’s invasion of Ukraine intensified a global energy crunch, leaving countries scrambling to secure scarce cargoes of liquefied natural gas. European gas supplies are a concern after an unusually hot summer, leaving the region more reliant on cargoes from exporters including the US to shrink the shortfall.

DATA:

MNI: FRANCE AUG FLASH MANUF PMI 49.0 (FCST 49.0); JUL 49.5

- FRANCE FLASH AUG SERVICES PMI 51.0 (FCST 51.9); JUL 53.2

- FRANCE FLASH AUG COMPOSITE PMI 49.8 (FCST 50.0); JUL 51.7

FRANCE PMI: Poor details, but price pressures easing further

No real bright spots in the French PMI data - apart from prices. Input prices grew at the slowest for six months and output prices raised the least YTD. Highlights from the press release:

- "The headline Flash France PMI Composite Output Index fell below the vital 50.0 threshold in August that separates expansion from contraction. At 49.8, this signalled the first reduction in private sector output levels across."

- "Broad-based drop in new business intakes that was the sharpest since November 2020. Employment growth subsequently softened, undermined also by a further deterioration in business confidence. Overall, French companies were at their least optimistic in almost two years. "

- "There was a further softening of both input cost and output price inflation in August. The increase in input prices was the slowest for six months, while output charges were raised to the weakest extent in the year to date. Weaker price pressures coincided with fewer incidences of supplier delivery delays. According to August PMI data, input lead times lengthened to the least marked extent since January 2021."

GERMANY FLASH AUG MANUF PMI 49.8 (FCST 48.0); JUL 49.3

- GERMANY FLASH AUG SERVICES PMI 48.2 (FCST 49.0); JUL 49.7

- GERMANY FLASH AUG COMPOSITE PMI 47.6 (FCST 47.3); JUL 48.1

GERMANY PMI: Mixed report

Input price inflation eased but factory gate prices picked up more than last month (despite service output inflation falling further). Confidence picked up a somewhat, however, in a mixed report (albeit with all headline numbers below 50). Highlights from the press release below:

- "Firms’ expectations meanwhile ticked up from July’s recent low, amid a further easing of rates of increase in businesses’ costs and output prices, although confidence remained historically subdued"

- "Third straight monthly decline in inflows of new business across Germany’s private sector economy in August. The rate of decline eased slightly compared to the previous month, a trend evident across both manufacturing and services, although it remained solid overall and quicker than that of business activity. Weaker export sales were once again a key driver of the downturn, with goods producers recording the steepest drop in new business from abroad for over two years midway through the third quarter."

- "Whilst remaining well above its historical series average, the overall rate of input cost inflation eased for the fourth month in a row to the weakest since September last year"

- "Average prices charged for goods and services continued to rise sharply but the rate of inflation eased for the fourth month running in August, down to its lowest since February. The slowdown owed exclusively to the service sector, with factory gate charges rising at a slightly quicker rate than in the previous month."

MNI: EUROZONE FLASH AUG MANUF PMI 49.7 (FCST 49.0); JUL 49.8

- EUROZONE FLASH AUG SERVICES PMI 50.2 (FCST 50.5); JUL 51.2

- EUROZONE FLASH AUG COMPOSITE PMI 49.2 (FCST 49.0); JUL 49.9

EUROZONE PMI: Output increased "marginally" outside of Germany and France

Inflationary pressures continued to ease, while the suervey noted that output continued to "marginally" increase outside of Germany and France.

- "Rates of inflation at businesses slowed again over the month. Input costs increased at the softest pace in close to a year, while output charge inflation was the weakest in the year-to-date. Softer inflationary pressures were recorded across both the manufacturing and service sectors."

- "Although improving slightly from July, confidence in the year-ahead outlook for activity remained relatively muted amid worries of an economic downturn. Sentiment was the second-lowest since the initial wave of the COVID-19 pandemic."

- "The overall reduction in business activity in the euro area was mainly centred on the largest national economies... Outside of the ‘big-two’, output continued to increase, albeit only marginally"

UK FLASH AUG MANUF PMI 46.0 (FCST 51.0); JUL 52.1

- UK FLASH AUG SERVICES PMI 52.5 (FCST 51.6); JUL 52.6

- UK FLASH AUG COMPOSITE PMI 50.9 (FCST 51.0); JUL 52.1

UK PMI: Services PMI holds up well but manufacturing looking weak

- UK services seem to be holding up pretty well, albeit with the manufacturing PMI falling much faster than expected. Interestingly for the BOE too, despite the cost pressures coming down service providers are noting higher salary payments. There was also divergence between services and manufacturing on the outlook. More from the press release:

- "Though sharp, the pace of increase was the softest seen for nearly a year. The rate of cost inflation softened notably at manufacturers to hit the lowest since November 2020, with survey respondents often stating that lower prices for some commodities such as metals had helped to ease overall cost pressures. In the service sector, the rate of cost inflation picked up slightly on the month. Service providers typically noted higher salary payments, often spurred by rising living costs, though greater expenses for energy and fuel were also widely cited."

- "Optimism around the 12-month outlook for output remained relatively subdued in August, with the overall degree of positive sentiment staying only slightly above June’s 25- month low. Services companies expressed slightly stronger confidence compared to July, with growth forecasts often attributed to investment in the development and release of new products, ongoing recovery from COVID-19 and projected increases in customer demand. On the other hand, manufacturing companies were the least optimistic since April 2020, with firms concerned that rising costs, reduced client spending and a weaker economic climate could all drag on performance"

FOREX: PMIs dominate European morning session

- PMIs have been the talking point of the European morning session for core FI.

- Bund futures spiked to an intraday high of 152.40 around the release of the French flash PMI print which saw the services number come in two points weaker than expected and the composite print fall below the 50 breakeven level.

- The moves were quickly reversed and on the release of a better-than-expected German manufacturing PMI reading, Bunds moved over 50 ticks lower. Since then we have seen a Eurozone print closer to expectations and UK manufacturing PMI disappointing but service PMI holding up well.

- This has translated to the German curve steepening a little (with little movement of Schatz yields) with bear flattening in the gilt and US Treasury curves.

- Looking ahead we have the US flash PMI later today as well as Richmond Fed and Conference Board consumer confidence data and new home sales.

- TY1 futures are up 0-5 today at 117-28 with 10y UST yields down -0.2bp at 3.015% and 2y yields up 1.7bp at 3.329%.

- Bund futures are down -0.40 today at 150.96 with 10y Bund yields up 1.2bp at 1.315% and Schatz yields up 0.2bp at 0.880%.

- Gilt futures are down -0.35 today at 112.03 with 10y yields up 2.2bp at 2.534% and 2y yields up 2.9bp at 2.633%.

FOREX: USD Hits August High, But Fades Into NY Hours

- The USD Index briefly printed a new August high in early European hours, putting the gauge at 109.27 before fading. The mid-July highs of 109.294 remain the cycle high for now, and a break above would put the USD at its strongest since 2002.

- The EUR continues to trade heavy, with EUR/USD briefly printing 0.9901 before slightly firmer than expected German manufacturing PMI shored up the rate ahead of the NY crossover.

- Equity futures are distinctly mixed, with no firm market direction so far Tuesday. US stock indices sit slightly higher, indicating a positive open on Wall Street after the sharp pullback noted through Monday's session.

- Over-arching USD strength continues to work against the CHF, putting the pair higher today for the seventh consecutive session. USD/CHF is now above the 100-dma at 0.9653 and sits at the highest levels since late July. 0.9689 marks the next key upside level, the 61.8% retracement for the July - August downleg.

- US prelim August PMI data takes focus going forward, expected to slow to 51.8 from 52.2 in July. Richmond Fed manufacturing also crosses as well as new home sales for July. Nonetheless, focus remains elsewhere, with the beginning of the Jackson Hole policy symposium later this week - and Fed's Powell speaking on Friday.

EQUITIES: Bouncing Off Session Lows, Energy Leading

- Asian markets closed weaker: Japan's NIKKEI closed down 341.75 pts or -1.19% at 28452.75 and the TOPIX ended 21.15 pts lower or -1.06% at 1971.44. China's SHANGHAI closed down 1.571 pts or -0.05% at 3276.223 and the HANG SENG ended 153.73 pts lower or -0.78% at 19503.25.

- European equities are a little higher for the most part, with Eurostoxx up about 1% from the session lows, and energy stocks leading: German Dax up 14.49 pts or +0.11% at 13847.56, FTSE 100 down 32.47 pts or -0.43% at 7521.73, CAC 40 up 11.98 pts or +0.19% at 6573.53 and Euro Stoxx 50 up 2.77 pts or +0.08% at 3795.33.

- U.S. futures are a little higher: Dow Jones mini up 43 pts or +0.13% at 33100, S&P 500 mini up 5.25 pts or +0.13% at 4146.5, NASDAQ mini up 16.25 pts or +0.13% at 12925.25.

COMMODITIES: NatGas Prices Surge Amid Continued Supply Disruptions

- WTI Crude up $1.6 or +1.77% at $89.92

- Natural Gas up $0.23 or +2.4% at $9.673

- Gold spot up $3.26 or +0.19% at $1774.56

- Copper up $0.9 or +0.25% at $364

- Silver up $0.02 or +0.09% at $19.0457

- Platinum down $0.06 or -0.01% at $877.31

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/08/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 23/08/2022 | 1100/1300 |  | EU | ECB Panetta at ECB Policy Panel at EEA Annual Congress | |

| 23/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/08/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/08/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/08/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 23/08/2022 | 2300/1900 |  | US | Minneapolis Fed's Neel Kashkari | |

| 24/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/08/2022 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/08/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 24/08/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 24/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 24/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.