-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI US MARKETS ANALYSIS - Traders Contemplate UK Bank Rate Above 6.00%

Highlights:

- UK market tumult continues, with GBP hitting record low against USD

- Implied UK Bank rate for mid-2023 shows above 6.00%

- Fed speak on deck, with Mester, Bostic, Collins and Logan due

US TSYS: New Cycle High For 2Y Yields On UK Woes Spillover

- Cash Tsys see a sizeable cheapening but nevertheless large outperformance to the huge moves in Gilts with no sign of a stepping back from Chancellor Kwarteng’s push for unfunded tax cuts and less so the politics-induced sell-off in BTPs.

- The result has been front end yields touching fresh cycle highs of 4.345% although this has since retraced to 4.2779% (+7.7bps), followed by 5YY +8.3bps at 4.062%, 10YY +7.4bps at 3.759% and 30YY +4.2bps at 3.648%.

- TYZ2 trades 16 ticks lower at 112-04 on above average volumes. The bearish outlook remains, with support eyed at Friday’s low of 111-25 and then 111-08+ (3.0% Lower Bollinger Band), whilst resistance is seen at 114-00 (Sep 22 high).

- A heavy week for Fedspeak is kickstarted by Collins (’22 voter), Bostic (’24), Logan (’23) and Mester (’22), likely overshadowing the Chicago and Dallas Fed activity indices.

- Bond issuance: US Tsy $43B 2Y Note auction (91282CFN6) – 1300ET

- Bill issuance: US Tsy $54B 13W, $42B 26W bill auction – 1130ET

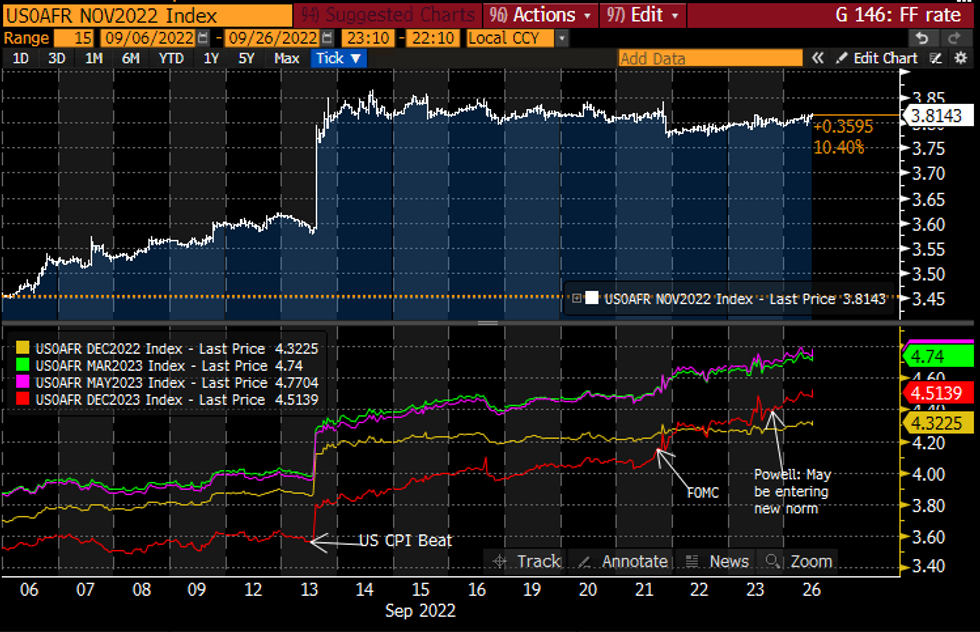

STIR FUTURES: Fed Terminal ~4.75%, End-2023 4.5%

- Fed Funds implied hikes are off session and cycle highs but continue to trend higher with notable spillover from BoE expectations.

- Showing 71bps for Nov (+2bp), 4.31% for Dec (+4bp), a terminal 4.76% for May’23 (+5bp) and 4.50% for end’23 (+8bps).

- Post-FOMC Fedspeak starts in earnest: Two meetings left for ’22 voters Collins and Mester, plus Logan (‘23) and Bostic (’24), the latter saying Sunday that a soft landing is not going to be easy. Follows Powell saying Friday the economy may be entering a 'new normal' after the pandemic.

FOMC-dated Fed Funds implied hikes at specific meetingsSource: Bloomberg

FOMC-dated Fed Funds implied hikes at specific meetingsSource: Bloomberg

FOREX: GBP Downdraft Erased, Cable Little Changed

- Another session of monumental price action for GBP, with the currency spiralling in early Asia trade to put GBP/USD at record lows of 1.0350. The extension of weakness after last week's BoE Decision / Mini-budget had prompted unparalleled volumes spikes across Asia-Pac futures markets early Monday, with data suggesting a flurry of smaller orders were responsible, larger than one or two large trades.

- Price action has largely reversed ahead of the NY open Monday, with GBP/USD recouping losses to trade just below the $1.08 handle. Sentiment still clearly remains weak however, but a strong technically oversold condition could limit losses from here.

- Elsewhere, the USD Index continues to creep higher, with the gauge printing a fifth consecutive session of higher highs. EUR/USD holds below the $0.97 level, with $0.9554 printed overnight and marking the new low watermark for the pair.

- Focus turns to the central bank speakers slate, with EC's Lagarde, Centeno and de Cos on the docket as well as Fed's Collins, Bostic, Logan and Mester. BoE's Teneyro also makes an appearance - comments that will likely be carefully watched given the volatility in UK rates expectations so far Monday.

UK: What Happened in GBP Markets Overnight?

- GBP remains comfortably the poorest performer in G10, with GBP/USD spiralling lower to touch 1.0350 overnight, as markets continue the downdraft after last week’s BoE/Mini-budget. But what actually happened in currency markets?

- At 0159BST, GBP futures saw a considerable spike in volumes. 5,175 contracts traded inside 60 seconds, amounting to a cash equivalent of ~$345mln – some serious volumes for a normally sleepy overnight market. Bloomberg’s quote recap shows relatively few single, large trades crossing at that time, suggesting instead a flurry of smaller orders, rather than one single order driving this particular market at that time.

- As such, headed into the NY open, GBP futures volumes have traded over four times the average for this time of day, meaning today’s action already has topped a full day of average volumes.

UK: 2/5-year yields remain close to the day's highs

- 2-year yields continue to hover around their day highs (which printed 4.5781% at 11:05BST / 6:05ET). For reference we closed Thursday at 1.7102% - so that is over we are 287bp higher in the space of less than one and a half trading sessions.

- It's a similar story for 5-year gilts, with yields around 4.2bp off the day's highs - seen at a similar time to 2-year gilt yields - and up 47bp on the day.

- 10-year gilts have not moved back to the highs seen shortly after the open and are now around 9.5bp off those highs (but still up 27bp on the day.

- It's a similar story for 30-year yields: around 10bp off the day's highs of 4.369%.

- Note that from the Sep-23 gilt through to the 2060 gilt, yields remain above 4%.

- The moves are all on continued concerns on the fiscal side, gilt supply and the prospects for MPC hiking to offset further inflationary pressures.

BOE: What happens if an APF gilt sales operation isn't filled?

- Lots of market talk as to what happens if there is an uncovered BOE APF gilt sales auction - and whether the BOE would accept a big discount if there were not enough acceptable bids to clear the whole GBP580mln auction amount.

- The answer is: there a minimum prices the BOE will accept, any unallocated sales proceeds are rolled over to future auctions, and the BOE also retains the right to cancel and re-schedule any sales operation to either later in the day or a future day before the publication of results - note that the latter has been used previously in terms of technical difficulties when the BOE was buying rather than selling gilts.

- The following details are from BOE Market Notices:

- "The Bank intends to set minimum levels for the bid prices / maximum yields it is willing to accept, as a backstop, in support of its objective not to disrupt the functioning of financial markets. This backstop will be set at a level such that it would not be expected to bind regularly, but would allow the Bank to respond to evidence of particularly weak demand within the auction by reducing the amount it supplies in those conditions."

- "Any unallocated sales proceeds in an auction will be incorporated into the sales proceeds target for future auctions in order that the MPC’s target reduction in the stock of gilts will still be met."

- "The Bank reserves the right to cancel an auction at any time before the results are published, at its sole discretion. If an auction is cancelled it may be re-scheduled to take place later the same day, or on a future date. "

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/09/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 26/09/2022 | 1300/1500 |  | EU | ECB Lagarde Intro at ECON Hearing | |

| 26/09/2022 | 1400/1000 |  | US | Boston Fed's Susan Collins | |

| 26/09/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 26/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 26/09/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 26/09/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 26/09/2022 | 1600/1700 |  | UK | BOE Tenreyro Speaks on Climate Change | |

| 26/09/2022 | 1630/1230 |  | US | Dallas Fed's Lorie Logan | |

| 26/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 26/09/2022 | 2000/1600 |  | US | Cleveland Fed's Loretta Mester | |

| 27/09/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/09/2022 | 0800/1000 | ** |  | EU | M3 |

| 27/09/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 27/09/2022 | 1015/0615 |  | US | Chicago Fed's Charles Evans | |

| 27/09/2022 | 1100/1200 |  | UK | BOE Pill Panels CEPR Barclays Monetary Policy forum | |

| 27/09/2022 | 1130/1330 |  | EU | ECB Lagarde in Panel at Banque de France | |

| 27/09/2022 | 1130/0730 |  | US | Fed Chair Jerome Powell | |

| 27/09/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 27/09/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 27/09/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 27/09/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 27/09/2022 | 1300/1500 |  | EU | ECB de Guindos Speaks at Barclays-CEPR Forum | |

| 27/09/2022 | 1355/0955 |  | US | St. Louis Fed's James Bullard | |

| 27/09/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 27/09/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 27/09/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 27/09/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.