-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Index Prints Lower Low for Fifth Session

Highlights:

- Treasury rally continues, denting front-end rates

- Futures on track for sizeable positive open on Wall Street

- Eurozone PPI surges to new record high

Key Links: RBA Taps the Brakes / MNI RBNZ Preview / EZ & UK Bond Auction Calendar

US TSYS: Treasuries Rally Further, Supporting Risk Assets

- Cash Tsys see a continuation of yesterday’s sizeable rally, this time with the 2Y taking the outperformance reins from the 5Y with further decline in terminal and end’23 rate expectations for the Fed and the concentration in real yield space further supportive for risk assets.

- Treasuries underperform European FI, particularly Gilts and BTPs, whilst we wait to see whether the US coming in drives a further acceleration as was the case yesterday.

- 2YY -11.4bps at 4%, 5YY -10.4bps at 3.775%, 10YY -6.9bps at 3.57%, and 30YY -4bps at 3.639%.

- TYZ2 trades 20+ ticks higher at 113-27 only just off an overnight high of 113-30 having cleared resistance at the 20-day EMA of 113-27+. With the correction extends, the next resistance is eyed at 114-31+ (38.2% retrace of Aug 2 – Sep 28 bear leg).

- Data: August releases factory orders/final core durables and JOLTS

- Fedspeak: Logan, Williams, Mester, Jefferson, Daly

- Bill issuance: US Tsy $34B 52-W bills auction – 1130ET

STIR FUTURES: Fed 2023 Rate Expectations Slide Further

- Fed Funds implied hikes hold at 67bps for Nov having dipped earlier on a dovish RBA 25bp hike.

- Larger declines further out in a continuation of yesterday: 4.19% for Dec’22 (-3bp), terminal 4.36% Mar’23 (-9bp) and 4.02% for Dec’23 (-12bp).

- Those 2023 rates are down from Sep 26 overnight highs of 4.83% for the terminal (then seen in May) and 4.57% for Dec'23.

- Five Fed speakers including the first from Gov. Jefferson since his confirmation to the Board with text and Q&A.

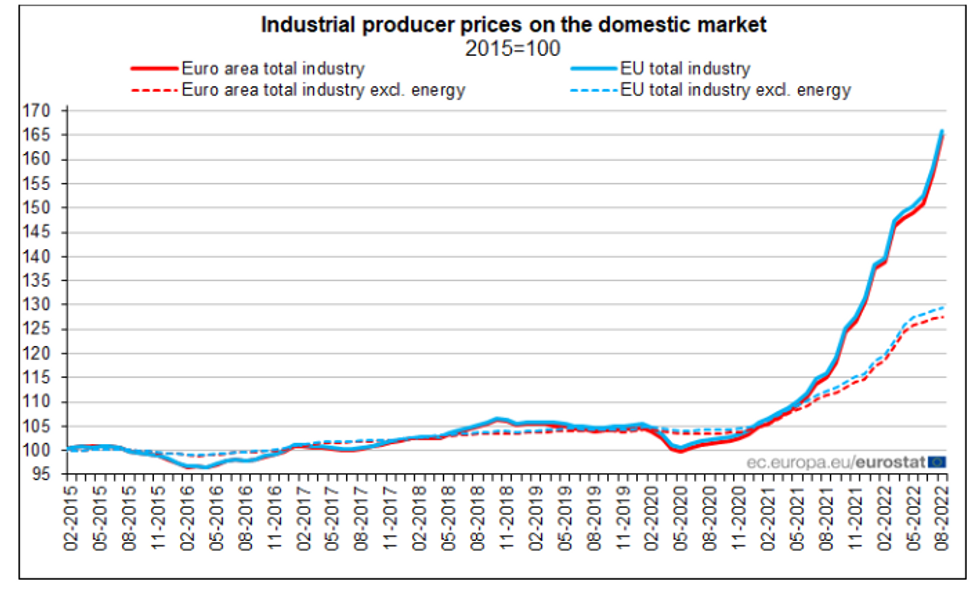

August Energy Shock Pushes PPI to 43.3% y/y

EUROZONE AUG PPI +5.0% M/M (FCST +5.0%); JUL +4.0% M/M

EUROZONE AUG PPI +43.3% Y/Y (FCST 43.2%); JUL +38.0%r Y/Y

- Euro area factory-gate inflation accelerated to a fresh record high of +43.3% y/y in August, surging +5.0% m/m alone.

- This was largely in line with expectations, flagged by national PPIs following the renewed commodity price jump in August which has cooled again into September. August energy sector prices jumped a massive 11.8% m/m, whilst PPI ex. energy increased a more modest 0.3% m/m.

- Energy-price policy intervention continues to heavily impact headline inflation prints. The recent introduction of renewed measures in Germany and other states should cap off headline inflation from surging further for now.

- There will be no surprises in the data for the ECB, as it largely lags the September CPI data. However, the eye-watering headline numbers will not make deliberations any more comfortable for the Governing Council.

Is the BOE less willing to accept offers at a small premium to midprice?

- We asked the question yesterday of why the volumes of rejected offers were so high in yesterday's BOE long-dated purchase operation and noted that the only accepted offer saw a highest accepted price of 91.400 - below the mid-price of 91.700.

- The Bank of England released another Market Notice towards the end of yesterday's trading session noting that "reserve prices / yields are reviewed ahead of each auction to ensure consistency with the backstop nature of the scheme."

- The Bank has reiterated that the maximum size of the operations are GBP5bln/day, and in operations last week it seemed to be happy to buy at a reasonable spread over the mid-price. Yesterday's operation either saw no offers at that level or saw the Bank more explicitly using the operation as a backstop and only accepting offers at lower levels.

- The Bank of England has also announced that it has asked GEMMs to begin notifying them of who the offers are from - whether they are from the GEMM directly or from a client. If they are from a client, they have asked for details of who the client is. Although in the short-term this is unlikely to determine whether offers are accepted or not the Bank notes that "The details of this collection of end user information will be incorporated in the APF Operating Procedures for purchase operations in due course."

FOREX: Risk-On Backdrop Tilts USD Index to Lower Low

- JPY is the poorest performing currency in G10 so far Tuesday, helping keep USD/JPY uncomfortably close to the weekly highs and levels last seen when the MoF intervened in currency markets on Sep 22. This leaves 145.30 as the first upside level.

- Equities are trading well, with US stock futures in firm positive territory as the e-mini S&P extends the recovery off the Monday lows to 150 points. European indices are similarly strong, with the tech sector a particular source of positivity - the Stoxx600 tech sector sits higher by over 3% at typing.

- The USD Index sits lower, touching a lower low for the fifth consecutive session. US curves have steepened slightly, with the front-end led lower, prompting 2y yields to shed as much as 10bps.

- Meanwhile, AUD trades softer following the RBA rate decision, at which the bank raised rates by 25bps to 2.60%, against expectations for a 50bps move. AUD/USD traded a low of 0.6451, leaving Monday's 0.6402 as support.

- Final durable goods data crosses later today but is unlikely to move the needle ahead of the larger releases later in the week, most notably the September jobs report. Central bank speakers due Tuesday include Fed's Logan, Williams, Mester, Jefferson and Daly. ECB's Lagarde is also on the docket, speaking at a central bank of Cyprus event.

FX OPTIONS: Expiries for Oct4 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9645-55(E2.1bln), $0.9700(E835mln), $0.9750(E830mln), $0.9800-05(E679mln)

- USD/JPY: Y142.00($546mln), Y145.00($562mln)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 04/10/2022 | 0900/1100 | ** |  | EU | PPI |

| 04/10/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 04/10/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 04/10/2022 | 1300/0900 |  | US | Dallas Fed's Lorie Logan | |

| 04/10/2022 | 1315/0915 |  | US | Cleveland Fed's Loretta Mester | |

| 04/10/2022 | 1400/1000 | ** |  | US | factory new orders |

| 04/10/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 04/10/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 04/10/2022 | 1500/1700 |  | EU | ECB Lagarde Q&A with Students Event | |

| 04/10/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 04/10/2022 | 1545/1145 |  | US | Fed Governor Philip Jefferson | |

| 04/10/2022 | 1700/1300 |  | US | San Francisco Fed's Mary Daly | |

| 05/10/2022 | 2200/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

| 05/10/2022 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Services PMI |

| 05/10/2022 | 0100/1400 | *** |  | NZ | RBNZ official cash rate decision |

| 05/10/2022 | 0600/0800 | ** |  | DE | Trade Balance |

| 05/10/2022 | 0645/0845 | * |  | FR | Industrial Production |

| 05/10/2022 | 0715/0915 | ** |  | ES | IHS Markit Services PMI (f) |

| 05/10/2022 | 0745/0945 | ** |  | IT | IHS Markit Services PMI (f) |

| 05/10/2022 | 0750/0950 | ** |  | FR | IHS Markit Services PMI (f) |

| 05/10/2022 | 0755/0955 | ** |  | DE | IHS Markit Services PMI (f) |

| 05/10/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (f) |

| 05/10/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 05/10/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 05/10/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 05/10/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 05/10/2022 | 1230/0830 | * |  | CA | Building Permits |

| 05/10/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 05/10/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (final) |

| 05/10/2022 | 1400/1000 | *** |  | US | ISM Non-Manufacturing Index |

| 05/10/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 05/10/2022 | 2000/1600 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.