-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Asia Newsflow Dampens Sentiment

EXECUTIVE SUMMARY:

- ISRAELI AIR STIKES HIT GAZA AS FIGHTING ENTERS SECOND WEEK

- CHINA MACRO INDICATORS SLOW IN APRIL

- INDIA COVID CASES DECLINE, BUT WHO EXPERT SAYS POSITIVE TESTS OMINOUSLY HIGH

- HONG KONG, SINGAPORE PUT TRAVEL BUBBLE ON HOLD FOR 2ND TIME AMID SPIKE IN CASES

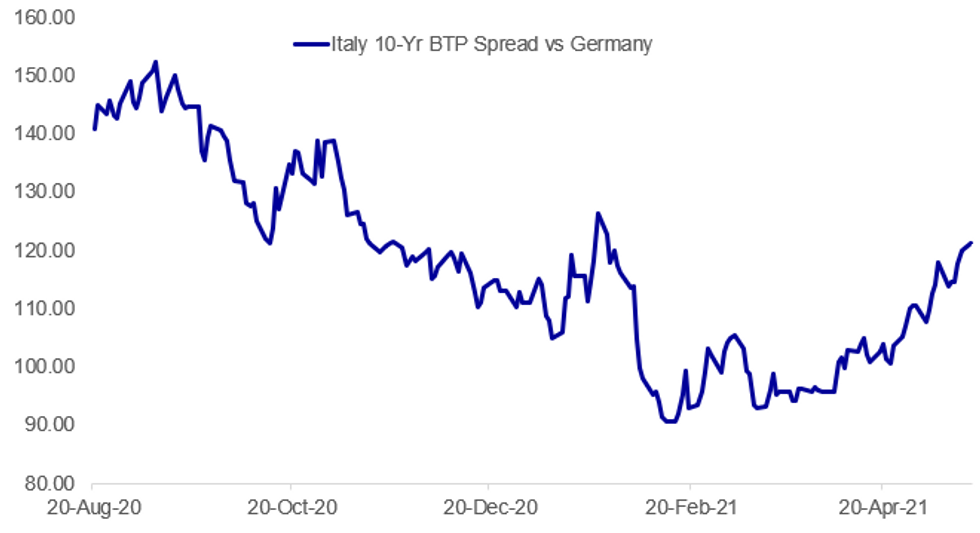

Fig. 1: Italian Spreads Continue To Widen

BBG, MNI

BBG, MNI

NEWS:

MIDDLE EAST (RTRS): Israel bombed what it said were underground tunnels used by Hamas and Palestinian militants fired rocket barrages at Israeli cities as fighting spilled into a second week on Monday and international calls for a ceasefire mounted. After a night of heavy Israeli air strikes on areas across the Islamist Hamas-run enclave, Israel's military said Gaza militants had fired about 60 rockets towards Israeli cities overnight, down from 120 and 200 the two previous nights. A Palestinian sponge factory in northern Gaza was hit in a morning air strike and firefighters battled to quell the blaze, which sent plumes of smoke into the air. One Palestinian was killed in an air strike later in the morning, medics said. After rockets were fired from Gaza at the Israeli cities of Beersheba and Ashkelon, Israeli jets bombed what the military said were 15 km (nine miles) of underground tunnels used by Hamas. It also struck nine residences belonging to high-ranking Hamas commanders, it said.

CHINA: U.S. Trade Representative Katherine Tai is likely to meet her Chinese counterpart next month, policy advisors in Beijing told MNI, adding that the two may negotiate a fresh two-year trade pact but punitive tariffs on its goods would remain given Washington's hardening stance. For full article contact sales@marketnews.com

CHINA: China's macroeconomic indicators slowed in April as the comparison base rebounded from the lows of the Covid-19 outbreak, data released by the National Bureau of Statistics on Monday showed. All figures were weaker than median forecasts. Industrial production grew 9.8% y/y in April, down from the 14.1% gain in March. The average growth for the past two years was 6.8%. The 20.3% y/y growth for the first four months was slower than 24.5% in Q1 and missed the projection of 21.1%. Retail sales rose 17.7% y/y in April, below March's 34.2% gain, underperforming the 25.0% projection. The average growth for two years was 4.3%. The measure grew 29.6% in Jan-Apr, slower than 33.9% in Q1.

COVID/INDIA (RTRS): India reported a further decline in new coronavirus cases on Monday, but daily deaths remained above 4,000 and experts said the count was unreliable due to a lack of testing in rural areas where the virus is spreading fast. For months now, nowhere in the world has been hit harder than India by the pandemic, as a new strain of the virus fuelled a surge in infections that has risen to more than 400,000 daily. Even with a downturn over the past few days, experts said there was no certainty that infections had peaked, with alarm growing both at home and abroad over the highly contagious B.1.617 variant first found in India. "There are still many parts of the country which have not yet experienced the peak, they are still going up," World Health Organization Chief Scientist Soumya Swaminathan was quoted as saying in the Hindu newspaper. Swaminathan pointed to the "very high" national positivity rate, at about 20% of tests conducted, as a sign that there could be worse to come. Testing is still inadequate in a large number of states. And when you see high test positivity rates, clearly we are not testing enough.

COVID/ASIA (SCMP): The long-awaited travel bubble between Singapore and Hong Kong has been put on hold for a second time amid a sharp resurgence in untraceable Covid-19 cases in the city state, the two governments have said. Monday's decision to suspend the quarantine-free corridor, which had been set to launch on May 26, followed a morning meeting between Hong Kong commerce minister Edward Yau Tang-wah and Singapore transport minister S. Iswaran. A further announcement will be made on or before June 13, when Singapore's current round of anti-pandemic measures are due to expire. The two cities will continue to exchange data and closely review developments, a Hong Kong government statement said.

GERMANY: Germany is facing severe material shortages in the construction sector, triggering an April slowdown in activity, according to Felix Leiss, a survey expert at the ifo Institute, noting there hadn't been a "bottleneck like this since 1991." Data published Monday by the Ifo institute pointed to 23.9% of companies reporting problems procuring construction materials, compared to 5.6% in March. In civil engineering, 11.5% noted difficulties in April compared to 2.8% in March.

IRELAND (BBG): It will cost "tens of millions" of euro to repair the damage from a cyberattack, the head of Ireland's health service said, and disruption is likely to continue through at least this week.Ireland's Health Service Executive has shut down most of its computer systems since last week, after a so-called ransomware attack. Most virtual appointments are going ahead but outpatient appointments in hospitals are largely canceled. The coronavirus vaccine program continues as planned, but there maybe delays in getting test results."This will be tens of millions in terms of impact on our systems," health service Chief Executive Officer Paul Reid told RTE Radio. "This is really a very serious hit."

CHINA: China should push insurance companies to use their policy premiums to fund green technologies and help hit the goal of carbon neutrality by 2060, advisors and officials said at the 2021 Annual Meeting on Financing Green Technologies. Eco-friendly tech projects need long-term capital commitment, dovetailing nicely with life insurance policies that often span 30 years or more, Ma Jun, a former member of the People's Bank of China monetary policy committee, told the forum over the weekend.

CBR (RTRS): Russia's loose monetary policy has contributed to economic recovery and should now return to neutral, Central Bank Deputy Governor Alexei Zabotkin said on Monday. Zabotkin said monetary policy steps affect inflation with a lag of three to six quarters, adding that recovery in demand in Russia leads to higher inflation. The central bank, which last raised the key interest rate to 5% in April, will next meet on rates on June 11.

DATA:

FIXED INCOME: Focus on Fed speakers again

It has been a mixed morning for core fixed income so far. Treasuries have continued their ascent and have moved above Friday's highs. Gilts opened above Friday's highs but have since moved back below (albeit still higher than Friday's close). Bunds also moved through Friday's highs in early trading but have also retraced most of their gains.

- Peripheral spreads have widened this morning, led by BTPs and GGBs (10-year spreads for both 1.9bp wider at the time of writing).

- The main events of today will focus around Fed speakers with Clarida and Bostic both due ass well as Kaplan after the close.

- Looking ahead central bank speakers will dominate this week along with PMIs on Friday and a slew of UK data (inflation, labour market data and retail sales).

- TY1 futures are up 0-3+ today at 132-16+ with 10y UST yields down -1.1bp at 1.619% and 2y yields down -0.2bp at 0.146%.

- Bund futures are up 0.09 today at 169.07 with 10y Bund yields up 0.2bp at -0.129% and Schatz yields down -0.1bp at -0.663%.

- Gilt futures are up 0.16 today at 127.59 with 10y yields down -0.3bp at 0.853% and 2y yields up 0.6bp at 0.080%.

FOREX: Mixed Start For USD

A mix start for the USD, after being better bid overnight, led by small risk off during the Asian session after Chinese data missed expectation.

- The dollar is up against most G10, besides the JPY, EUR and GBP.

- The British Pound has been supported, as the UK enters the next steps of re-opening when the rule of 6 ends.

- Groups of up to 6 people or people from two households can meet up indoors.

- Outdoors, groups of up to 30 are also allowed., a green light for pubs and restaurants to serve indoors, and hotels, museums, theaters, cinemas and stadiums are reopening.

- Kiwi is under pressure this morning, a continuation from the Asian session, with desk reporting leverage fund selling interest, unwinding some of last Friday's rally.

- NZD has since pared some of its overnight losses against the Dollar.

- But the Kiwi is till down 0.51% on the session, but off the lows.

- Further pullback would eye Friday's high at 0.7256 (0.7251 is today's high), now at 0.7212.

- Looking ahead, very little in terms of data, speakers include US Fed Clarida and Kaplan

EQUITIES: Soft Start To The Week

- Asian markets traded mixed overnight, with Japan's NIKKEI down 259.64 pts or -0.92% at 27824.83 and the TOPIX down 4.56 pts or -0.24% at 1878.86. China's SHANGHAI closed up 27.24 pts or +0.78% at 3517.616 and the HANG SENG ended 166.52 pts higher or +0.59% at 28194.09

- European stocks are flat/lower, with the German Dax up 3.71 pts or +0.02% at 15406.81, FTSE 100 down 18.96 pts or -0.27% at 7036.36, CAC 40 down 4.45 pts or -0.07% at 6380.21 and Euro Stoxx 50 down 4.85 pts or -0.12% at 4006.38.

- U.S. futures are a little weaker, with the Dow Jones mini down 60 pts or -0.17% at 34258, S&P 500 mini down 5.75 pts or -0.14% at 4163.25, NASDAQ mini down 27.75 pts or -0.21% at 13359.

COMMODITIES: Silver Leads Gains

- WTI Crude up $0.15 or +0.23% at $65.52

- Natural Gas up $0.07 or +2.43% at $3.034

- Gold spot up $9.99 or +0.54% at $1853.69

- Copper up $1.35 or +0.29% at $466.2

- Silver up $0.34 or +1.23% at $27.7074

- Platinum up $2.61 or +0.21% at $1234.6

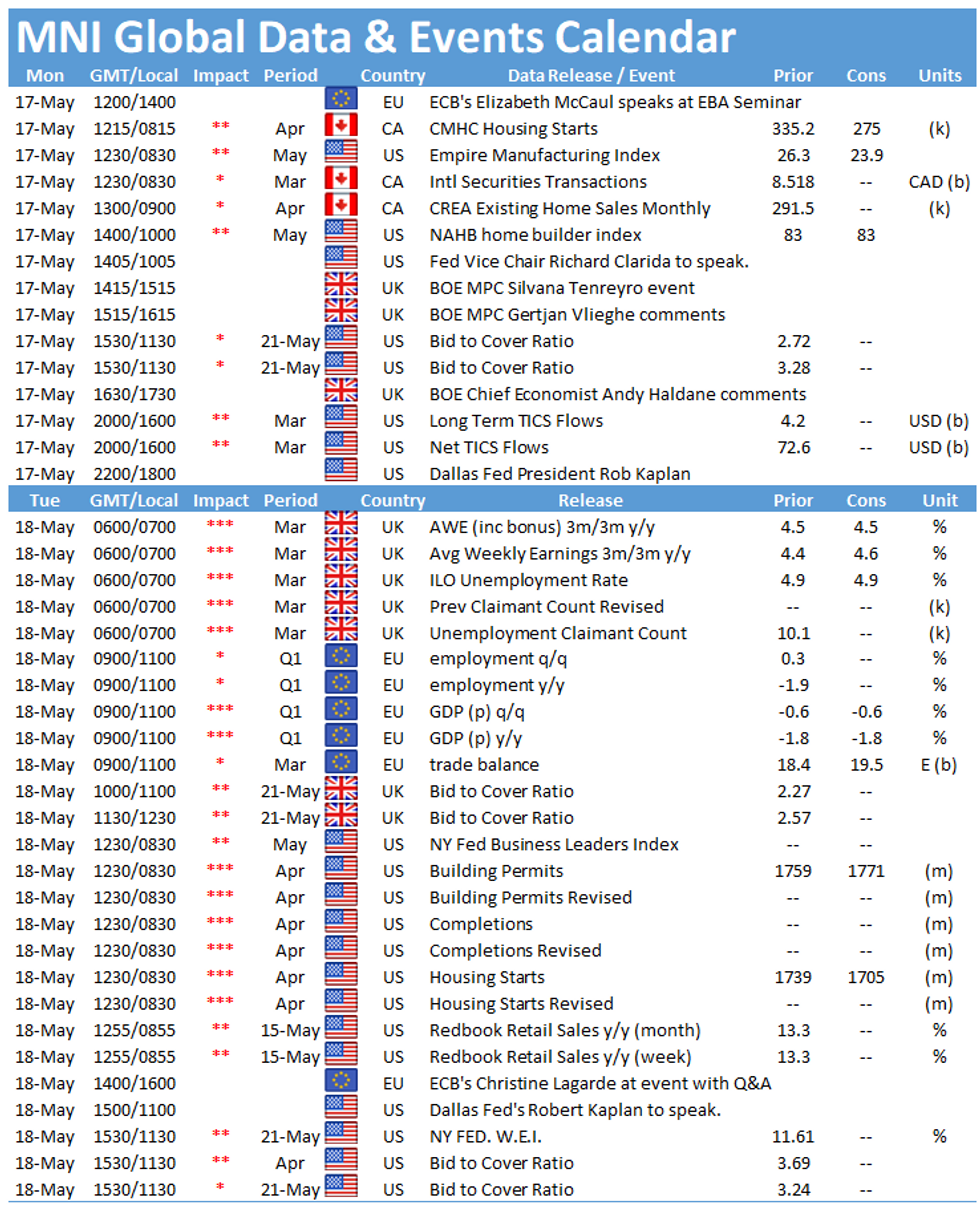

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.