-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Bank Of England Goes Bigger On QE

EXECUTIVE SUMMARY:

- BANK OF ENGLAND EXPANDS Q.E. BY GBP150BLN

- BIDEN ON BRINK OF DEFEATING TRUMP WITH FEW STATES LEFT TO REPORT

- EUROZONE RETAIL SALES FALL AS COVID CASES RISE

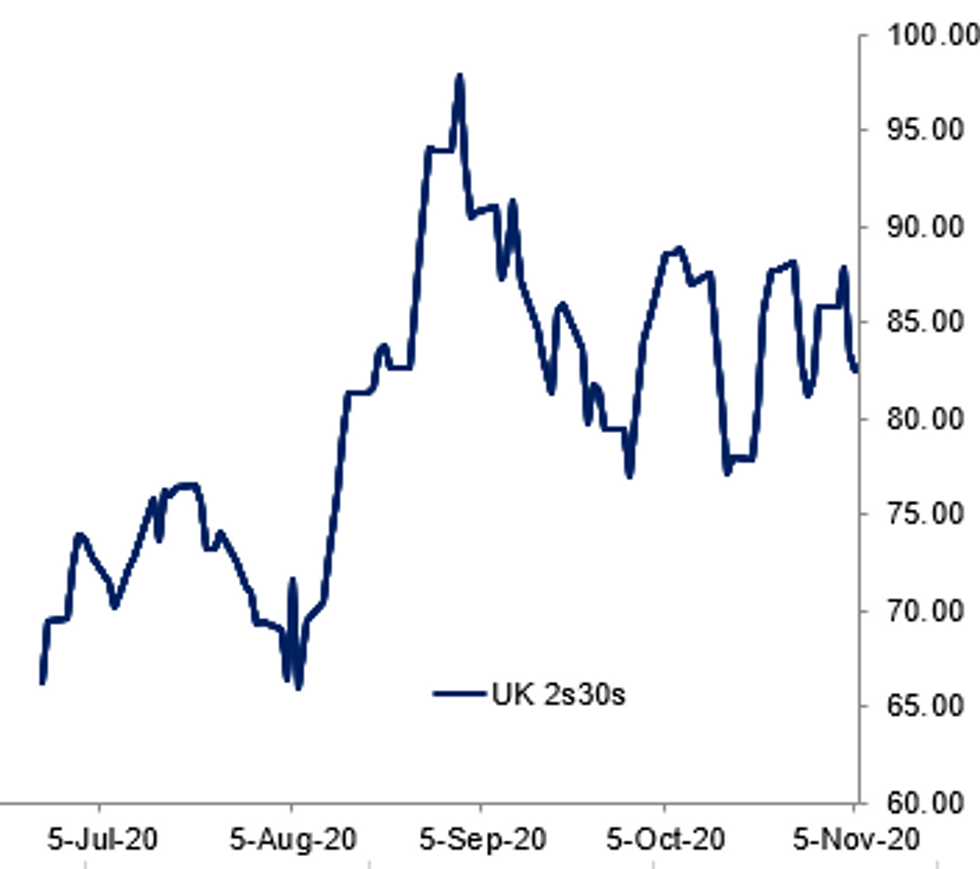

Fig. 1: UK Gilt 2 Yr / 30 Yr Spread (bps)

BBG, MNI

BBG, MNI

NEWS:

BOE: To sum up today's BoE decision:

- GBP150bln of QE rather than the GBP100bln expected by consensus. However, purchases will continue until end 2021, longer than expected to be announced at this meeting (but it was very likely QE would have been extended before it finished anyway). The pace of QE is left unchanged - which is the key here. That stops the higher number being a very dovish development. Also, the Bank left in the line in about being able to increase the pace of QE if markets become dysfunctional but also noted that the pace could be lowered as the operation was flexible. MNI calculations estimate at the current pace the QE envelope would be exhausted by the first week of November 2021, so a slowing of the pace, probably in mid-year seems likely.

- Growth forecasts revised lower (expected), inflation forecast still at target in 2 and 3 years time (expected). The growth forecast no longer has a V trajectory, technically more of a W but the second dip of the W is much, much smaller than the first. Growth looks roughly back to Q4 2019 level by Q4 2021 (that still probably faster than the market expects).

- So QE to last longer but pace is as expected (so only marginally dovish) and growth forecasts still a bit better than the market (largely expected).

US ELECTION (BBG): Joe Biden stood on the brink of claiming the presidency from Donald Trump on Thursday, with a handful of states expecting to complete their vote counts despite Republicans opening legal fights to stop counting in at least two states. Biden held 264 Electoral College votes out of the 270 needed to win the White House, according to the Associated Press. Trump has 214.

Biden needs only to win an additional outstanding state, such as Nevada where he is leading, or Georgia, where his campaign believes absentee votes will push him over the top.EUROZONE DATA: M/M retail sales fell by 2.0% in Sep amid a resurgence of infection numbers, coming in slightly weaker than expected (BBG: -1.5%).* Sep's downtick followed an increase in Aug where sales grew by 4.2% on amonthly basis.* Annual sales increased again in Sep, although at a slower pace of 2.2% afterrising by 4.4% in the previous month.* Sep's downtick was mainly driven by non-food products which dropped to -2.6%following an increase in Aug.* Within non-food product sales, clothing and footwear showed the largestdecline, slipping to -7.6%.* Sales of food, drinks and tobacco eased as well in Sep, edging down by 1.4%.

* Among the member states, the largest declines were observed in Belgium(-7.4%), France (-4.5%) and Germany (-2.2%), while Portugal (+1.9%), Romania (+1.7%) and Slovakia (+1.5%) posted the biggest gains.EU: Council, Parliament Reach Deal On Rule Of Law To Allow Progress On LT Budget

The European Parliament and European Council have reached an agreement on rule of law provisions relating to the EU's long-term budget (multiannual financial framework, MFF) that should allow some progress to the MFF, and its associated COVID-19 recovery package's, approval.

* The rule of law provisions are set to link the distribution of funds throughthe MFF to the upholding of 'EU values'. This has been a bugbear forcountries such as Hungary and Poland, where their governments do notsubscribe to the same set of social values as EU leaders in Brussels. * The main provisions agreed are that there can be no EU money without anindependent judiciary, and the vaguer restriction that that funds can be cutalso when governmental decisions risk affecting rule of law.* It should be noted that even with the rule of law mechanism resolved, thereare still a number of issues holding up the full approval of the MFF:* Top-ups to the MFF amounting to EUR39bn are being demanded by theParliament. Germany has tried to broker a compromise of EUR10bn, but thishas been rejected.* Conditionality attached to the Recovery and Resilience Facility (theCOVID-19 support package).

DATA:

EZ OCT CONSTRUCTION PMI 44.9; SEP 47.5

UK OCT CONSTRUCTION PMI 53.1; SEP 56.8

FIXED INCOME: BOE expands QE GBP150bln, Sunak's furlough scheme and FOMC in focus

Treasuries and Bunds have ground gradually higher this morning but the real story has been in gilts with the BOE meeting this morning and expanding QE by GBP150bln. This was more than the GBP!00bln expected by the market but the pace of purchases was in line with the current and in line with expectations. We have seen gilts rally on the open and then largely retrace these moves at the 10-year level but the flattening impact remains. We note that Chancellor Rishi Sunak will deliver a statement on the changes to the furlough scheme later today.

- * In cash terms, the gilt curve has pivoted around the 7-year point. Shorter-dated gilts having moved lower (and indeed short sterling options markets have seen a number of upside trades going through). However, longer dated gilts have moved a little higher.

- * This has led to the 2s10s curve flattening by 1.7bp at writing, but 10s30s is little changed on the day.

- * The FOMC meeting later will also be closely watched. The meeting is largely important to set up expectations for the December meeting but we note that any references to changing expectations of fiscal stimulus would be very important.

- * TY1 futures are up 0-5 today at 139-04+ with 10y UST yields down -3.5bp at 0.730% and 2y yields up 0.1bp at 0.148%.

- * Bund futures are up 0.06 today at 176.46 with 10y Bund yields down -0.7bp at -0.646% and Schatz yields up 0.3bp at -0.796%.

- * Gilt futures are up 0.05 today at 136.32 with 10y yields down -0.4bp at 0.202% and 2y yields up 1.2bp at -0.66%.

FOREX: Dollar on the Decline for Third Session

The BoE's decision to boost the size of their QE programme took markets by surprise, with the Bank adding a further Gbp150bln in bond buys, which may make the path easier for Chancellor Rishi Sunak to later today unveil a sizeable stimulus package on the first full day of the second UK lockdown. GBP rallied in response, pressuring EUR/GBP to 0.9006, with GBP/USD also gaining amid a generally USD-weak environment.

Implied vols remain in retreat, with the front-end of the AUD/USD vol curve slipping to their lowest levels since mid-September as markets make peace with the increased likelihood of a Biden victory. This pattern's pretty uniform across development markets, with USD/JPY and USD/CAD vols also under pressure.

Focus turns to the further trickle through of US election results. A handful of states are still yet to be called, including key races in Pennsylvania, Arizona and Georgia.

The Fed rate decision is due later today. The FOMC aren't seen making any major changes to policy, but the press conference will likely draw focus given the eventful election this week.

EQUITIES: Rally Continues

Global equities continue to rally.

- Japan's NIKKEI up 410.05 pts or +1.73% at 24105.28 and the TOPIX up 22.69 pts or +1.39% at 1649.94. China's SHANGHAI closed up 42.693 pts or +1.3% at 3320.133 and the HANG SENG ended 809.78 pts higher or +3.25% at 25695.92

- European stocks are stronger, with the German Dax up 182.7 pts or +1.48% at 12491.76, FTSE 100 up 28.77 pts or +0.49% at 5910.76, CAC 40 up 47.98 pts or +0.97% at 4968.36 and Euro Stoxx 50 up 45.18 pts or +1.43% at 3202.24.

- U.S. futures continue to rally, with the Dow Jones mini up 423 pts or +1.53% at 28157, S&P 500 mini up 71.25 pts or +2.07% at 3506.5, NASDAQ mini up 345 pts or +2.93% at 12107.

COMMODITIES: Gold, Silver Higher

Precious metals are outperforming, with the dollar taking a risk-on leg lower.

- WTI Crude down $0.15 or -0.38% at $39.01

- Natural Gas up $0.02 or +0.69% at $3.06

- Gold spot up $15.4 or +0.81% at $1917.56

- Copper down $2.4 or -0.77% at $309

- Silver up $0.67 or +2.82% at $24.5459

- Platinum up $18.17 or +2.08% at $890.24

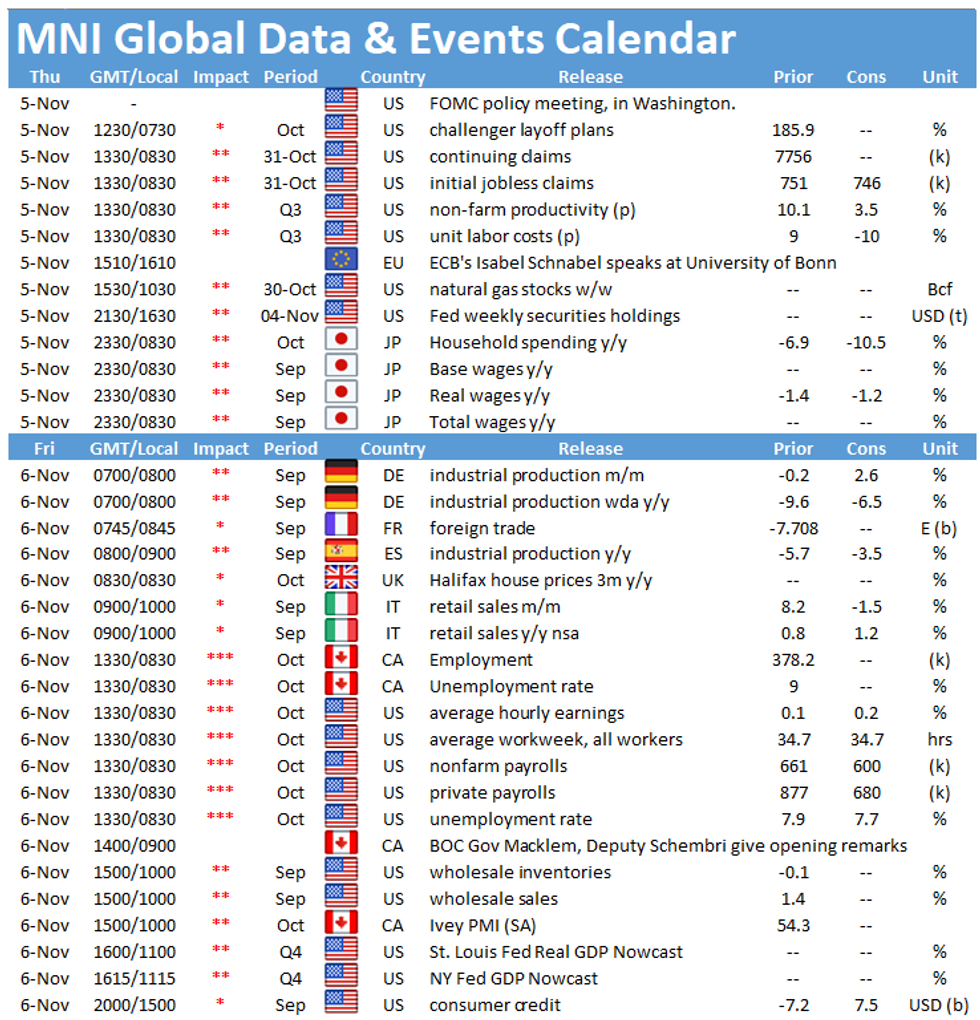

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.