-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Bank Stocks Under Pressure

EXECUTIVE SUMMARY:

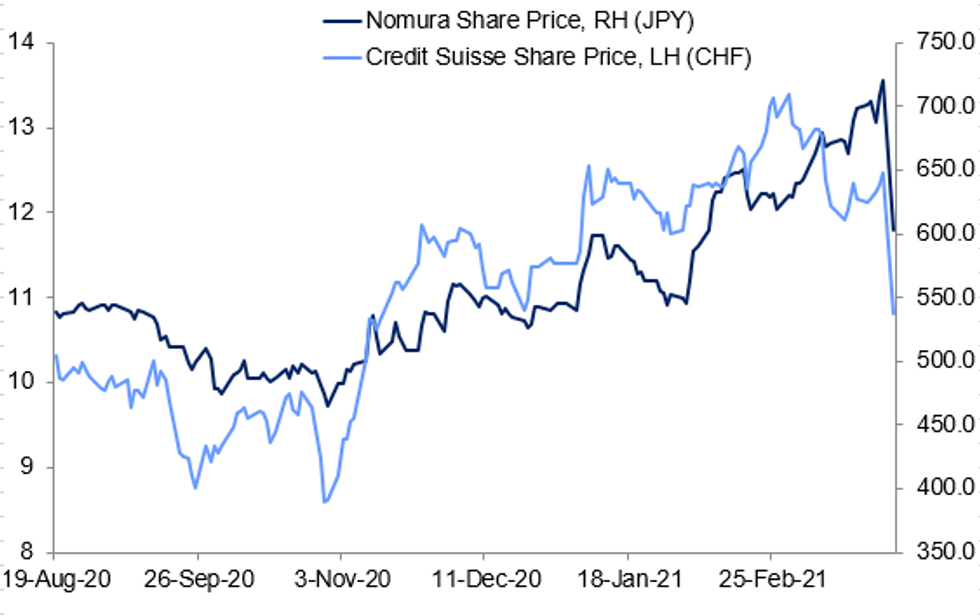

- CREDIT SUISSE, NOMURA TUMBLE AS BANKS TALLY ARCHEGOS DAMAGE

- DEUTSCHE BANK'S ARCHEGOS EXPOSURE A FRACTION OF WHAT OTHERS HAVE (RTRS SOURCES)

- SUEZ TRAFFIC CANAL TO RESUME TODAY, SHIP SET FOR FULL FLOTATION

Fig. 1: Banks Tested By Archegos Blow-Up

BBG. MNI

BBG. MNI

NEWS:

ARCHEGOS (BBG): Nomura Holdings Inc. and Credit Suisse Group AG both plunged more than 14% after saying they face potentially "significant" losses as some of the world's biggest banks tally their exposure to wrong-way bets by Archegos Capital Management. Lenders to Bill Hwang's New York-based family office have been racing to contain the fallout after Archegos failed to meet margin calls last week. The forced liquidation of more than $20 billion of positions linked to Archegos has roiled stocks from Baidu Inc. to Viacom CBS Inc. and cast a spotlight on the opaque world of leveraged trading strategies facilitated by some of the biggest names on Wall Street. While the turmoil has so far had only a limited impact on broader financial markets, banks and people familiar with the matter indicated the unwinding of of Archegos-related bets may have further to go.

CREDIT SUISSE: Credit Suisse note that "a significant US-based hedge fund defaulted on margin calls made last week by Credit Suisse and certain other banks. Following the failure of the fund to meet these margin commitments, Credit Suisse and a number of other banks are in the process of exiting these positions. While at this time it is premature to quantify the exact size of the loss resulting from this exit, it could be highly significant and material to our first quarter results, notwithstanding the positive trends announced in our trading statement earlier this month. We intend to provide an update on this matter in due course."

CREDIT SUISSE (BBG): Swiss banking regulator Finma is aware of the Archegos hedge-fund case involving several banks, was informed by Credit Suisse and is in contact with the bank, a Finma spokesman told Bloomberg in an email.

NOMURA (BBG): It's very rare for a borrower to wind up scrapping a bond deal once it's priced. But that's exactly what Nomura Holdings Inc. has done. The Japanese bank said in a statement Monday that it had canceled a sale of notes priced on March 23, as it warned of a "significant" potential loss from an unnamed U.S. client. People familiar with the matter say the warning is related to the unwinding of trades by Bill Hwang's Archegos Capital Management.

DEUTSCHE BANK (RTRS): Deutsche Bank's exposure to Archegos Capital is a fraction of what others have, a source familiar with the matter said on Monday. The German lender as of the end of Friday had not incurred any losses and was in the process of managing its position, the source added.

SUEZ CANAL: Wires and social media reporting that following the partial refloating of the Ever Given in the Suez Canal earlier today, a full refloatation attempt will be made in the next five hours, with operations on the Canal set to resume later today. Despite this, Maersk have warned that the backlogs caused by the ship's grounding could take months to resolve, and that the incident may cause a shift in global supply chains.

GERMANY (BBG): Chancellor Angela Merkel threatened to assert federal authority over measures to stem the Covid-19 pandemic, as the increasingly embattled German leader attempts to reverse the latest surge in infections threatening Europe's biggest economy. The unexpected turn of events highlights Merkel's struggle to maintain control over pandemic strategy in the face of intransigence from the country's powerful state leaders -- who in some cases have opted not to enforce restrictions agreed with her administration.

ECB (BBG): European Central Bank policy maker Pablo Hernandez de Cos says at an event in Madrid that the institution should maintain its accommodative monetary policy. Extension of pandemic bond-buying program and pledge to increase the pace of buying "lead me to emphasize the importance of maintaining a high level of accommodative monetary policy so that fiscal policy can, in turn, continue its high level of support for the economy until a solid recovery is assured"

GERMANY: The latest FGW poll shows Bavaria's Minister-President and head of the centre-right Christian Social Union Markus Soeder as respondents preferred choice for chancellor, beating the potential chancellor candidates from the Greens, Social Democrats and crucially, the Christian Democratic Union, the CSU's nationwide sister party.

GERMANY: German exporters are more optimistic in March with expectations rising to the highest level since January 2011, the Ifo Institute said Monday, as strong activity overseas and growing momentum in the euro area boosted the outlook. Ifo's export expectations index rose to 24.9 in March, up from 11.9 seen in February, boosted mainly by strong economic activity in China and the US.

CRYPTOCURRENCY (BBG): Visa Inc. said its payments network will use a stablecoin backed by the U.S. dollar to settle transactions, as cryptocurrencies and blockchain technology gain more acceptance in the established financial system. As part of a pilot program, Visa is using USD Coin to settle transactions over Ethereum, with the help of the Crypto.com platform and Anchorage, a digital-asset bank, according to a statement Monday by the San Francisco-based payments giant. Visa will offer the service to more partners later this year.

DATA:

UK Mortgage Market Remains Strong

FEB MORTGAGE APPROVALS 87,669 VS JAN 97,350

FEB NET CONSUMER CREDIT -GBP1.246BN VS JAN -GBP2.651BN

FEB NET CHANGE SECURED LENDING GBP6.171BN VS JAN GBP5.283BN

The UK mortgage market remained strong in Feb with mortgage borrowing registering at GBP 6.2bn, which is the highest level since Mar 2016 and was boosted by the expected end of the stamp duty tax relief. Mortgage approvals stood at 87,669 in Feb, easing compared to Jan, but they remained above the level seen in Feb 2020. Approvals for remortgages ticked up to 34,300 in Feb. The effective rate on new mortgages rose to 1.91% in Feb, up from 1.85% seen in Jan. Households continued to make net repayments of consumer credit, recording GBP 1.246bn in Feb, which is slightly lower than at the start of the pandemic when net repayments registered at GBP 1.8bn in Mar 2020. As a result, the annual growth rate of consumer credit dropped further to -9.9%, again marking a new series low (began in 1994). The effective interest rate on new consumer credit ticked down to 5.16% in Feb, while the cost of credit card borrowing rose to 18.18%, its highest since May 2020.

FIXED INCOME: Risk recovery after a bullish start

After drifting higher through the Asian session, core fixed income has come under pressure as optimism has swept through the fixed income market after headlines that Deutsche Bank had more limited exposure to Archegos than some other banks - reducing pessimism about the fall-out across the wider banking sector.

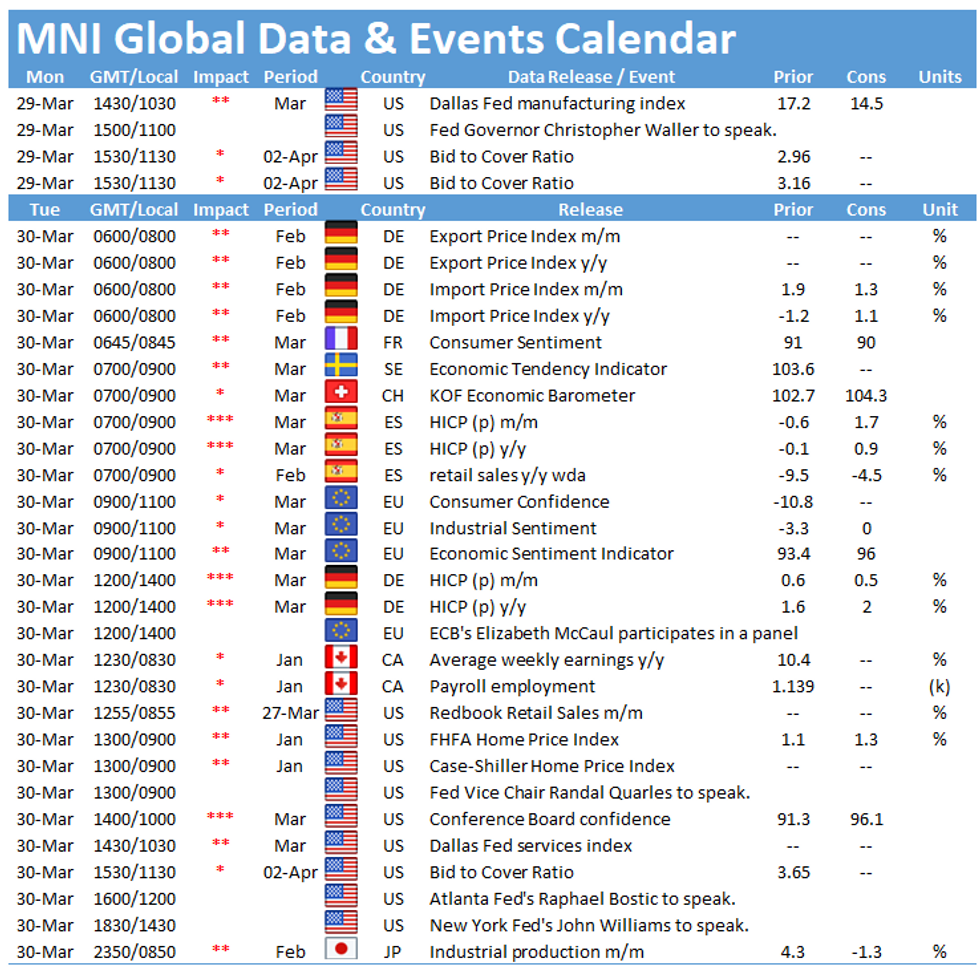

- There is not much on the calendar today so markets will look ahead to data later this week. Payrolls are released on Good Friday (which is a holiday across the UK and much of Europe). Eurozone inflation data and the MNI China Liquidity Index are the other main data points worth watching this week.

- TY1 futures are up 0-01 today at 131-25+ with 10y UST yields down -1.7bp at 1.661% and 2y yields down -0.3bp at 0.138%.

- Bund futures are down -0.21 today at 171.91 with 10y Bund yields up 1.0bp at -0.338% and Schatz yields up 0.6bp at -0.718%.

- Gilt futures are down -0.15 today at 128.34 with 10y yields up 0.9bp at 0.764% and 2y yields down -0.1bp at 0.053%.

FOREX: GBP Bounces Further From Last Week's Low

- GBP is the strongest currency so far in G10, buoyed as the UK takes its first step in unwinding Coronavirus restrictions after a lengthy lockdown. GBP/USD is again testing the 50-dma at 1.3838 after a protracted spell of weakness at the beginning of last week. The GBP strength has pressured EUR/GBP to new 2021 lows, narrowing the gap with 2020's bottom at 0.8282.

- US equity futures are lower, rolling off the sharp rally into the Friday close. This has helped support CHF this morning, rising against most other majors.

- SEK trades poorly, extending the general downtrend seen since the beginning of 2021, helping put EUR/SEK and USD/SEK at the best levels of the year.

- No tier one data crosses Monday, with just a speech from Fed's Waller due. Waller joined the FOMC in December last year, and today's speech will be his first public comments in the role.

EQUITIES: Financials Lag On Archegos Fallout

- Asian stocks closed higher, with Japan's NIKKEI up 207.82 pts or +0.71% at 29384.52 and the TOPIX up 9.18 pts or +0.46% at 1993.34. China's SHANGHAI closed up 16.969 pts or +0.5% at 3435.296 and the HANG SENG ended 1.87 pts higher or +0.01% at 28338.3.

- European stocks are mixed, with the German Dax up 17.06 pts or +0.12% at 14780.71, FTSE 100 down 22.05 pts or -0.33% at 6755.41, CAC 40 up 6.07 pts or +0.1% at 6012.08 and Euro Stoxx 50 up 5.07 pts or +0.13% at 3875.22.

- U.S. futures are lower, with the Dow Jones mini down 179 pts or -0.54% at 32775, S&P 500 mini down 24 pts or -0.61% at 3940.75, NASDAQ mini down 80.25 pts or -0.62% at 12886.5.

COMMODITIES: Oil Dips As Suez Canal Blockage Seen Easing

- WTI Crude down $0.51 or -0.84% at $60.16

- Natural Gas up $0 or +0.12% at $2.565

- Gold spot down $7.34 or -0.42% at $1726.98

- Copper down $2.85 or -0.7% at $405.9

- Silver down $0.28 or -1.11% at $24.8432

- Platinum down $13.53 or -1.14% at $1178.31

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.