-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Big Numbers For European Bond Issuance

EXECUTIVE SUMMARY:

- B.O.J. TO EXTEND LENDING FACILITIES AFTER STIMULUS PACKAGE (MNI INSIGHT)

- E.U. SOCIAL BOND OFFERING SEES ORDER BOOKS IN EXCESS OF E233BLN

- EUROPE BOND SALES SURGE PAST E1.5TRN TO SET NEW RECORD (BBG)

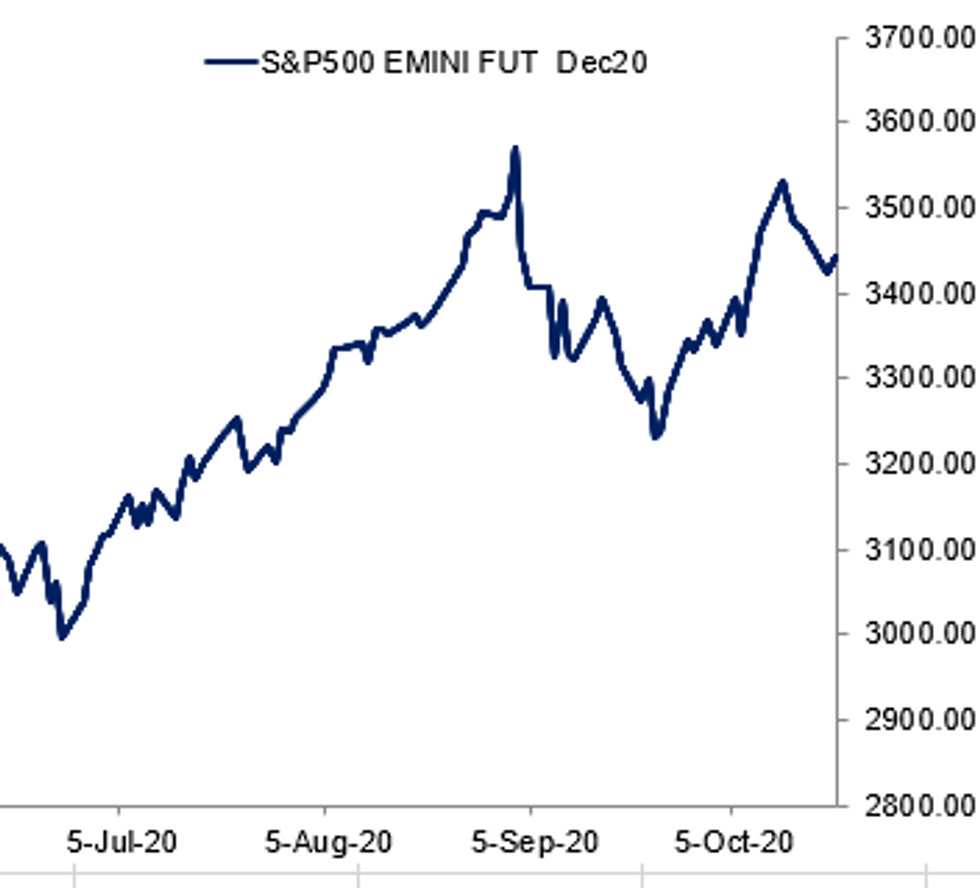

Fig.1: Stocks Clawing Back Monday's Losses

Source: BBG, MNI

Source: BBG, MNI

NEWS:

B.O.J. (MNI INSIGHT): The Bank of Japan is expected to announce an extension to its lending facilities, which are due to expire end-March, after the government drafts an additional stimulus package most likely in November, MNI understands. For full article contact sales@marketnews.com

EUROZONE ISSUANCE: EU SURE syndication update

- Size for the 10-year Oct-30 set at EUR10bln spread set at MS+3bps - Reuters/DJ

- Size for the 20-year Oct-40 set at EUR7bln, spread set at MS+14bps - Reuters/DJ

- Combined orderbooks over EUR233bln - Bloomberg

ISSUANCE: Europe's primary bond market has surpassed 1.5 trillion euros ($1.77 trillion) of annual sales for the first time after coronavirus concerns prompted a record surge in borrowing.A two-part 17 billion-euro offering from the European Union helped lift sales for the year to at least 1.51 trillion euros, according to data compiled by Bloomberg.

SWAPS (BBG): Clearing house LCH Ltd. said it successfully switched a notional $120 trillion of financial contracts to a new rate that will determine their value over a transition known as the big bang.The firm facilitated payment of at least tens of billions of dollars worth of basis swaps to clients in order to compensate for risk. Clients were then able to auction off unwanted basis swaps totaling $24 billion "at close to zero liquidation cost," the company said.

E.U. (BBG): The European Union plans to remove Canada, Tunisia and Georgia from its list of countries whose residents should be allowed to visit the bloc amid the coronavirus pandemic, according to EU officials familiar with the matter.The EU intends at the same time to reopen its doors to travelers from Singapore as a result of improved virus trends there, the officials said on the condition of anonymity because the deliberations on Tuesday in Brussels are confidential. The U.S. will remain blacklisted along with most other countries in the world.

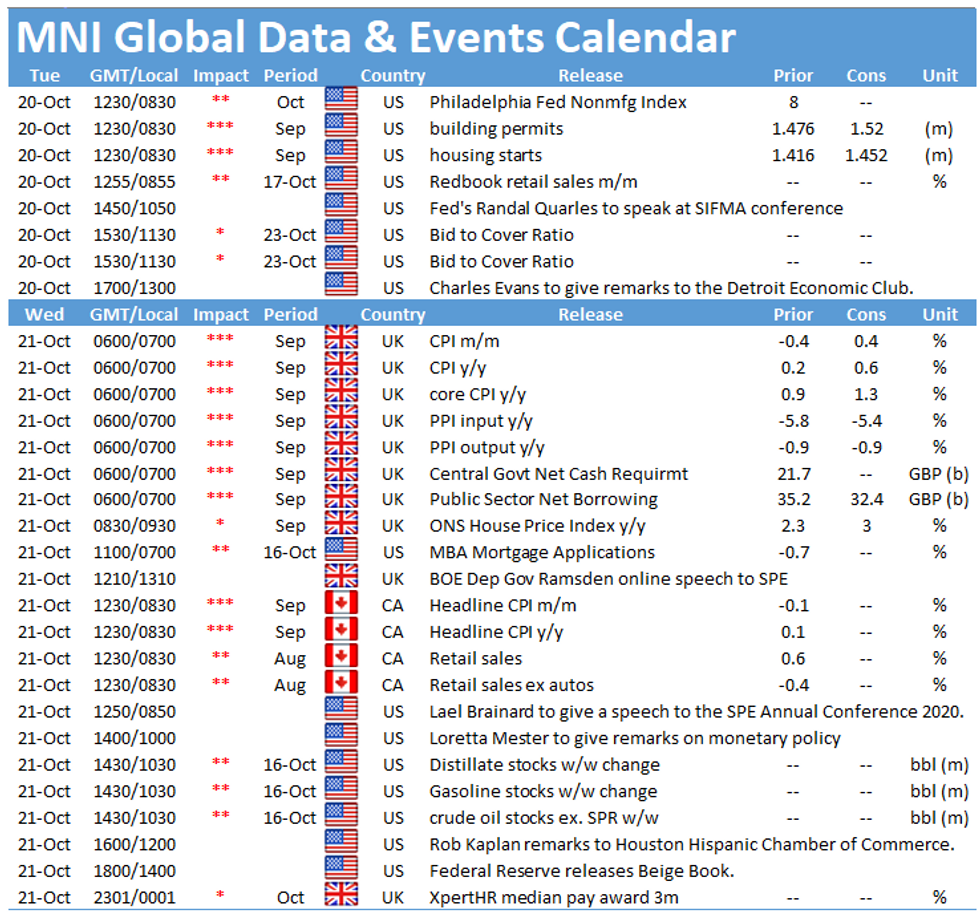

DATA:

FIXED INCOME: EU SURE Syndication and BOE's Vlieghe the key events of the morning

A slightly risk-on tone in the European morning session has seen equities a little higher and cored fixed income lower, although peripheral spreads have barely moved.

- There hasn't been too much in the way of headline developments so far this morning with the focus remaining on Covid-19, Brexit talks and potential US fiscal stimulus (despite the lack of real new news on the topics).

- This morning has seen the syndication of the new EU SURE bonds get underway. Books are in excess of EUR233bln with issue sizes set at EUR10bln (10-year) and EUR7bln (20-year).

- BOE's Vlieghe is due to speak at 10:30BST/5:30ET on the "Health of the Economy". This has the potential to be one of the key events of the week for the UK, along with Ramsden's speech tomorrow on "UK Monetary Policy: Issues and Outlook" (and of course any developments on Brexit).

- Later today we will also have a number of Fed speakers including Quarles, Evans, Singh, Brainard and Bostic.

- TY1 futures are down -0-5 today at 138-24+ with 10y UST yields up 1.1bp at 0.782% and 2y yields down -0.2bp at 0.146%.

- Bund futures are down -0.07 today at 176.04 with 10y Bund yields up 0.8bp at -0.621% and Schatz yields up 0.1bp at -0.790%.

- Gilt futures are down -0.11 today at 136.56 with 10y yields up 1.4bp at 0.182% and 2y yields up 1.3bp at -0.64%.

FOREX: AUD Offered as RBA Sees Room for Further Rate Compression

AUD underperforms, with a speech from RBA Assistant Governor Kent providing some near-term weight. He stated that there is still room for the central bank to "compress" short-term rates, raising the risk of further cuts to the RBA cash rate. AUD/USD slipped on decent volume to fall through 0.7050 support and hit new multi-week lows of $0.7031. Selling pressure in the AUD bled into the NZD, with both currencies at the bottom of the G10 pile this morning.

USD's bouncing slightly off the Monday lows, but there's been no meaningful recovery in the greenback. GBP and the EUR are benefiting moderately, but both currencies are yet to top yesterday's highs vs. the USD.

US housing starts are the data highlight Tuesday, with the speaker schedule likely to prove more interesting. ECB's de Cos, Fed's Evans, Quarles, Brainard & Bostic are all due to speak.

EQUITIES: Clawing Back Monday Losses

Global equities have largely edged higher so far Tuesday, clawing back late Monday losses to some extent.

- Asian stocks closed mixed, with Japan's NIKKEI down 104.09 pts or -0.44% at 23567.04 and the TOPIX down 12.24 pts or -0.75% at 1625.74. China's SHANGHAI closed up 15.436 pts or +0.47% at 3328.103 and the HANG SENG ended 27.28 pts higher or +0.11% at 24569.54

- European stocks are largely mixed, with the German Dax down 13.65 pts or -0.11% at 12839.82, FTSE 100 up 16.91 pts or +0.29% at 5901.64, CAC 40 up 31.48 pts or +0.64% at 4960.78 and Euro Stoxx 50 up 5.36 pts or +0.17% at 3248.09.

- U.S. futures are higher, with the Dow Jones mini up 134 pts or +0.48% at 28233, S&P 500 mini up 20 pts or +0.58% at 3442.5, NASDAQ mini up 79.25 pts or +0.68% at 11728.75.

COMMODITIES: Mixed In Early Trade

Commodities are trading mixed, with Copper and Silver outperforming.

- WTI Crude down $0.15 or -0.37% at $40.68

- Natural Gas up $0.05 or +1.9% at $2.848

- Gold spot down $1 or -0.05% at $1903.1

- Copper up $1.25 or +0.41% at $309.9

- Silver up $0.08 or +0.33% at $24.4667

- Platinum down $2.33 or -0.27% at $857.78

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.