-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: BoE: Sequencing Guidance In Focus

EXECUTIVE SUMMARY:

- ANALYSTS SEE VOTE SPLIT ON BANK OF ENGLAND QE

- ISRAEL IS PREPARED TO ATTACK IN IRAN, GANTZ SAYS (YNET)

- BIDEN SETS U.S. GOAL OF 50% CLEAN CARS AS CARMAKERS ASK FOR HELP

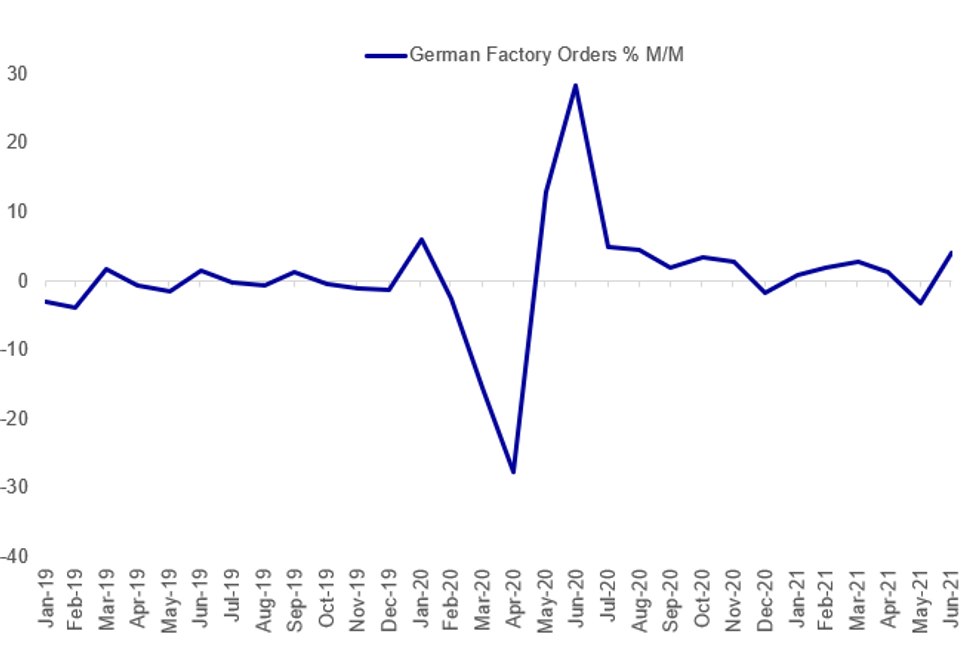

- GERMANY FACTORY ORDERS WERE BETTER THAN EXPECTED IN JUNE

- U.S., FRANCE MULL 3RD BOOSTER VACCINE FOR VULNERABLE

Fig. 1: German Factory Orders Beat Expectations In June

Source: Destatis, MNI

Source: Destatis, MNI

NEWS:

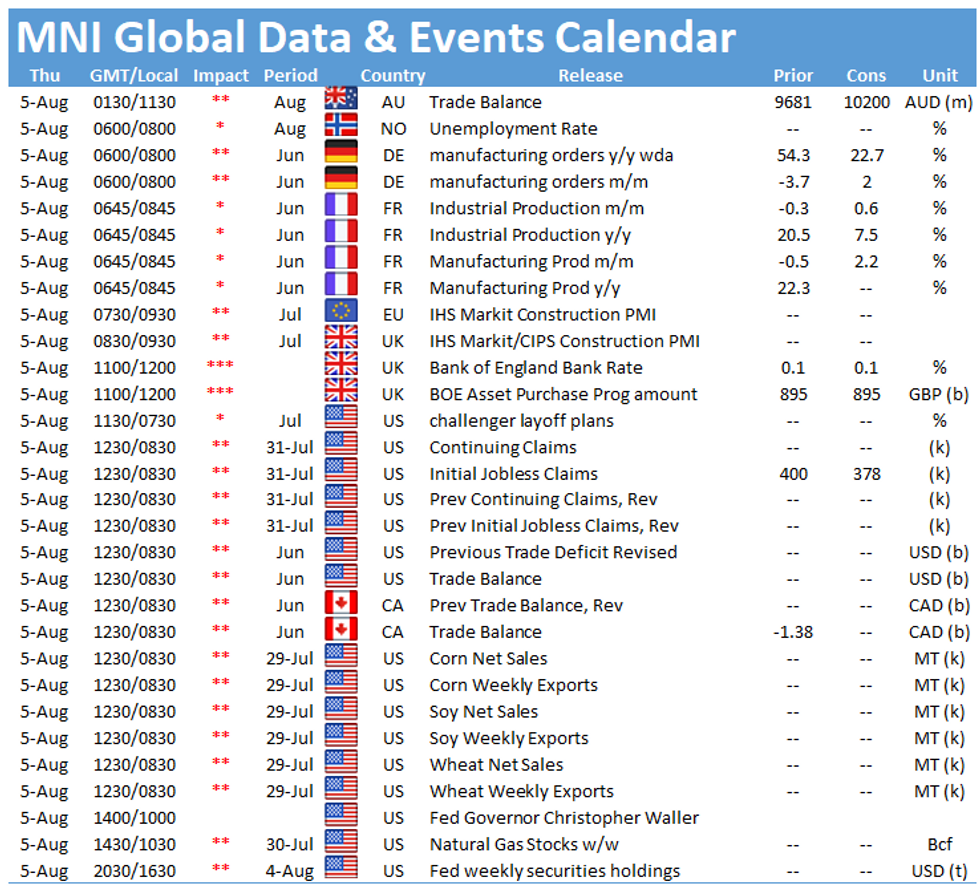

BANK OF ENGLAND (From MNI's BoE Preview): The BoE MPC meeting has the potential to be a key event for the market. Voting dynamics surrounding the Bank's asset purchase facility will be eyed. However, the sequencing review will potentially be much more significant. The MNI Markets team thinks the most likely change to the sequencing guidance will be to remove the Bank Rate threshold altogether, and leave maximum flexibility to the MPC.A split vote on whether to complete the current QE programme is expected today by 16/17 of the analysts who explicitly stated their voting expectations. 4 analysts see 6-2 as their base case, 2 analysts are on the fence between 6-2 and 7-1 while 9 analysts look for 7-1 and one analyst is on the fence between 7-1 and 8-0. There is also not a clear conviction that the sequencing review will be published as part of the August meeting. 5 analysts explicitly look for August, 2 look for November but most note that it could be August or November. The decision will be released at 0700ET/1200BST, with press conference at 0800ET/1300BST.

ISRAEL/IRAN (BBG): Israel is prepared to attack in Iran, Defense Minister Benny Gantz said on Thursday, in answer to a question during an interview broadcast on a local news website. Asked whether Israel is prepared for an attack in Iran, Gantz gave a one-word answer: "'Yes." Asked whether the country's military is also ready for a multifront conflict, that might include Iran, Gantz answered in the affirmative, but added that Israel must continue to develop its capabilities.

U.S. (BBG): President Joe Biden plans to call for half of all vehicles sold in the U.S. to be emission free by the end of the decade, an ambitious goal that automakers say can only be achieved with a bigger government investment in charging stations and other infrastructure. Biden will be joined at the White House Thursday by representatives of the major Detroit automakers and the United Automobile Workers union as he unveils an executive order establishing the the goal for half of all the cars sold to be battery electric, plug-in hybrid electric or fuel cell electric by 2030, according to senior administration officials and a White House fact sheet.

U.S. / COVID (AXIOS): The Biden administration is actively working toward making a recommendation that certain immunocompromised people receive an additional dose of coronavirus vaccine, two sources familiar with the discussions tell Axios. Two shots of Pfizer and Moderna's mRNA vaccines don't generate strong levels of protection in some immunocompromised people. But data suggests a third shot could significantly boost their response. What we're watching: A recommendation is likely to come "very soon," according to a source familiar with internal discussions. A senior Biden official agreed that the recommendation is likely to be issued soon, but said there's no firm timeline.

FRANCE / COVID: As part of an Instagram Q&A session, French President Emmanuel Macron stated that a third COVID-19 vaccine booster shot may only be required for the elderly and vulnerable. There has been rising speculation in many heavily-vaccinated developed nations that a third shot may be required to boost immunity levels going into the autumn and winter.

GERMAN DATA (BBG): German factory orders rose in June, bolstering the recovery in Europe's largest economy as an easing of pandemic restrictions supported business activity across sectors. Demand increased 4.1%, beating the median estimate in a Bloomberg survey. The gain was driven by domestic orders, with investment goods up 14.8%.

DATA:

MNI: EZ JULY CONSTRUCTION PMI 49.8; JUNE 50.3

MNI: UK JULY CONSTRUCTION PMI 58.7; JUNE 66.3

FIXED INCOME: Short-End Gilts A Little Weaker Pre-BoE

Futures are broadly higher but within limited ranges early Thursday, with Treasuries slightly underperforming. Fairly light volumes overall ahead of the Bank of England decision.

- The UK short end is notably weaker (2-Yr yield is up 1.4bps at 0.077%) in a bear flattening move on the UK curve ahead of the BoE decision.

- Spain sold E4.7bln of Bono/Obli - SPGBs are leading EGB periphery tightening, with large screen buying in 10s (about a half hour before the auction). Meanwhile France sold E7.5bln of LT OAT.

- The calendar for the rest of the session includes the BoE decision (0700ET/1200BST) and press conference an hour later; as well as appearances by Fed's Waller and Kashkari.

- US initial jobless claims are the data highlight (earlier, German factory orders beat expectations).

Latest levels:

- Sep Bund futures (RX) up 35 ticks at 177.29 (L: 177.05 / H: 177.31)

- Sep Gilt futures (G) up 17 ticks at 130.31 (L: 130.21 / H: 130.39)

- Sep BTP futures (IK) up 46 ticks at 155.43 (L: 154.98 / H: 155.46)

- Sep 10-Yr US futures (TY) down 2.5/32 at 134-24 (L: 134-21.5 / H: 134-27.5)

FOREX: EUR/CHF Shows at New 2021 Low

- Modest downside pressure on EUR/CHF has persisted this morning, with the cross showing at new 2021 lows of 1.0721, the lowest level since November last year. While persistent CHF strength may normally suggest a bout of risk-off, equity markets are trading solidly, with uniform gains across European cash markets as well as US index futures.

- JPY is the poorest performer so far Thursday, helping USD/JPY hold above the 109.50 level and retain the recovery off the week's lows. This keeps US weekly jobless claims and and trade balance data in focus as markets gear up for Friday's payrolls release.

- AUD and NZD remain firm, with antipodean currencies remaining strong after the Kiwi jobs data earlier in the week suggested August's RBNZ decision could see rate hikes in play.

- The Bank of England rate decision takes focus going forward, with markets focusing on the vote split for the asset purchase target as well as any conclusions drawn from the Bank's assessment of the sequencing for the unwinding of the bank balance sheet at a later date.

EQUITIES: Edging Higher In Early Trade

- Asian markets closed mixed, with Japan's NIKKEI up 144.04 pts or +0.52% at 27728.12 and the TOPIX up 7.55 pts or +0.39% at 1928.98. China's SHANGHAI closed down 10.67 pts or -0.31% at 3466.549 and the HANG SENG ended 221.86 pts lower or -0.84% at 26204.69.

- European equities are slightly higher, with the German Dax up 35.11 pts or +0.22% at 15699.14, FTSE 100 up 6.32 pts or +0.09% at 7118.09, CAC 40 up 37.34 pts or +0.55% at 6775.02 and Euro Stoxx 50 up 19.2 pts or +0.46% at 4155.52.

- U.S. futures are edging higher as well, with the Dow Jones mini up 60 pts or +0.17% at 34750, S&P 500 mini up 9 pts or +0.2% at 4403.75, NASDAQ mini up 20.75 pts or +0.14% at 15094.25.

COMMODITIES: Oil Reverses Losses As MidEast Tensions Simmer

- WTI Crude up $0.23 or +0.34% at $68.03

- Natural Gas down $0.03 or -0.67% at $4.136

- Gold spot down $1.57 or -0.09% at $1812.01

- Copper down $0.8 or -0.18% at $432.25

- Silver up $0.01 or +0.02% at $25.4034

- Platinum down $6.03 or -0.59% at $1021.97

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.