-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Bonds Under Renewed Pressure

EXECUTIVE SUMMARY:

- ECB'S DE GUINDOS SAYS CREDIT STILL FAVORABLE AT CURRENT YIELD LEVEL

- U.K. INFLATION RISES SHARPLY IN APRIL

- GAZANS AND ISRAELIS FIGHT ON AMID TALK OF A CEASE-FIRE

- CRYPTO STOCKS PLUMMET AFTER BITCOIN PLUNGES BELOW $40K

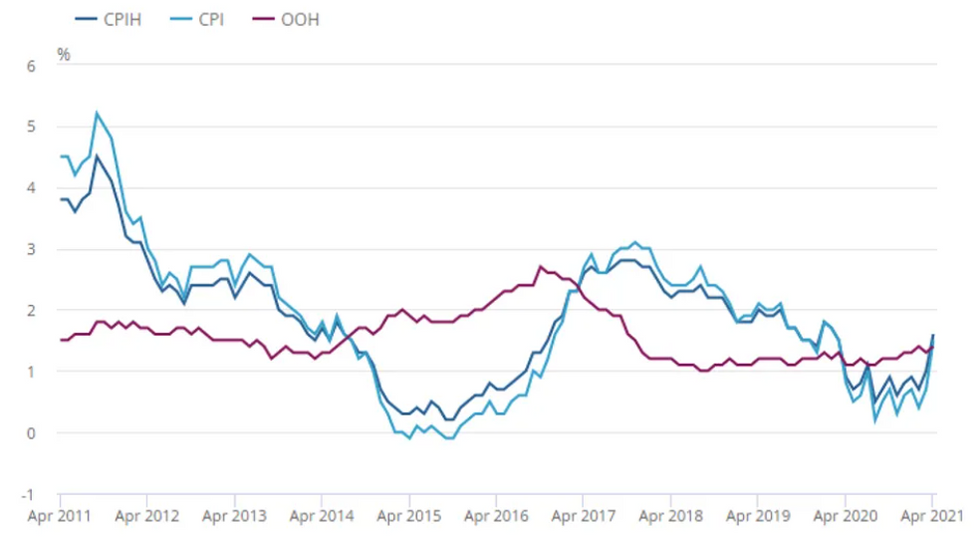

Fig. 1: UK Inflation "Doubles" In April

Source: ONS

Source: ONS

NEWS:

ECB (RTRS): Euro zone governments, households and companies can still borrow cheaply at the current level of bond yields, European Central Bank Vice President Luis de Guindos said on Wednesday after a selloff in fixed-income markets in recent months. "The present level of yields permits that the financing conditions of the governments as well as... for households and corporates are favourable," de Guindos told a news conference.

EQUITIES/CRYPTO (BBG): Cryptocurrency-exposed stocks plunge after Bitcoin sank below $40,000 and other cryptocurrencies followed suit.In U.S. premarket: Coinbase -3.8%, Marathon Digital -7.2%, Riot Blockchain -7.7%, Ebang -5.7%, Silvergate Capital -4.3%Among other crypto-exposed companies, Tesla -1.9% and payments firms Square -1.9% and PayPal -1.5%.

MIDDLE EAST (BBG): Israeli airstrikes battered the Hamas-ruled Gaza Strip early Wednesday and rocket barrages from the isolated enclave thudded into Israel as a frenzy of diplomatic activity sought to end an increasingly deadly conflict.Israeli aircraft struck about 40 underground military targets belonging to Hamas overnight, as well as rocket-launching sites and other military facilities of the Islamic Jihad militant group, the Israeli army said. The strikes sent the Palestinian death toll climbing to 219. Rocket fire pounded Israel, where 12 people have died since the fighting began on May 10.

ECB (BBG): The euro-area faces elevated risks to financial stability as it emerges from the pandemic with high debt burdens and "remarkable exuberance" in markets as bond yields rose, according to the European Central Bank. The language, echoing former Federal Reserve Chairman Alan Greenspan's description of the dot-com bubble in the 1990s as "irrational exuberance," highlights mounting concerns that the flood of fiscal and monetary stimulus needed to fight the crisis is also building up dangerous imbalances. If more upward surprises in U.S. inflation prompts investors bet on earlier monetary tightening, driving up bond yields without an accompanying improvement in economic growth, "spillovers from U.S. equity market repricing could be substantial," the ECB said in its Financial Stability Review on Wednesday.

UK: MNI interviews the former head of the NIESR on UK demographics and the outlook for growth - On MNI Policy MainWire now, for more details please contact sales@marketnews.com

UK DATA (BBG): U.K. house prices rose in March at their fastest annual pace since the financial crisis as tax incentives and a brightening economic outlook injected renewed vigor into the property market.Values surged 10.2% from a year earlier, the largest increase since August 2007, the Office for National Statistics said Wednesday, citing Land Registry data. Prices surged 1.8% in March alone, more than in any month since April 2014. The average value now stands at a record 256,405 pounds ($363,609).

OIL (BBG): Oil fell for a second day amid a spate of weakness in wider markets and as traders tracked talks between world powers on a revival of the Iran nuclear deal.West Texas Intermediate for June delivery tumbled 1.4%, while global benchmark Brent -- which topped $70 a barrel briefly in early Tuesday trade -- also declined. Stock markets fell on inflation fears, while the dollar climbed, hampering prices. There was also an increase in U.S. crude stockpiles last week, the American Petroleum Institute reported.

IRELAND (BBG): Reports of Irish patient data posted online after a cyberattack on Ireland's health service appear to be accurate, a government minister said, as the fallout from the hack continues. A Financial Times report that some patient data has appeared on the so-called dark web "seems very credible and accurate," communications minister Eamon Ryan told RTE Radio on Wednesday.

FED/US: MNI is hosting a webcast event with Mark L. J. Wright, Senior Vice President & Director of Research, Federal Reserve Bank of Minneapolis. To register please go to: MNI Webcast Registration

Topic of discussion: 'Outlook on the US Economy and Fed Policy'. Time: 10am-11:30am New York time, 3pm-4:30pm London time. Date: Wednesday 19th May. This event is on the record

DATA:

UK Inflation Doubles in April

APR CPI +0.6% M/M, +1.5% Y/Y VS +0.7% Y/Y MAR

APR CORE CPI +0.3% M/M, +1.3% Y/Y VS +1.1% Y/Y MAR

APR OUTPUT PPI +0.4% M/M; +3.9% Y/Y VS +1.9% Y/Y MAR

APR INPUT PPI +1.2% M/M; +9.9% Y/Y VS +5.9% Y/Y MAR

- Y/Y CPI jumped to 1.5% in Apr, registering in line with markets forecasts (BBG: 1.5%). This marks the second successive increase, but Apr's rate shows the 21st straight reading below the BOE's 2.0% target.

- Core inflation edged higher to 1.3%, following Mar's uptick to 1.1% and confirming expectations (BBG: 1.3%).

- The largest upward contribution came from housing and HH services such as gas and electricity prices, adding 0.38pp to price growth. Gas prices rose 9.8% between Mar and Apr, while electricity prices were up 9.1%.

- The second largest positive contribution stemmed from clothing and footwear, adding 0.28pp to CPI growth.

- The ONS noted that inflation mainly rose due to base effects as prices rose this year compared to a fall at the same time a year ago.

- Recreation and culture recorded the biggest downward contribution, shaving off 0.26pp from CPI growth and led by games, toys and hobbies.

- Output inflation rose by 3.9% in Apr, marking the fourth consecutive increase and it was largely driven by transport equipment.

- Input inflation surged by 9.9% in Apr, the highest level since Feb 2017 and the fifth positive reading in a row after 10 successive months of decline. Metals and non-metallic minerals led the increase of input PPI.

MNI DATA BRIEF: UK Factory Gate Inflation Surges In April

UK pipeline inflation soared in April, far outpacing expectations, providing fodder for some of the more hawkish members of the Bank of England's Monetary Policy Committee ahead of June's MPC meeting -- the last for inflation-wary departing chief economist Andy Haldane.

Input PPI jumped to an annual rate of 9.9% last month from 6.4% in March, the Office for National Statistics said, with much of the upward pressure coming from the import of precious metals. Core input PPI (excluding food, beverages and petroleum) surged by 7.6%, the highest rate since January of 2009. Output PPI raced to 3.9%, the highest since October of 2019, from 2.3% in March. Core output prices rose by 2.5%, the highest since February 2019, from 2.0% in April.

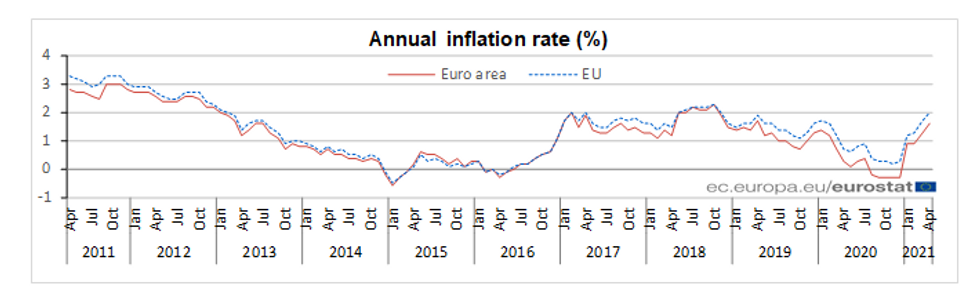

EZ Inflation At Highest Since Apr 2019

APR FINAL HICP +0.6% M/M, +1.6% Y/Y; MAR +1.3% Y/Y

APR FINAL CORE HICP +0.5% M/M; +0.7% Y/Y; MAR +0.9% Y/Y

- Headline EZ inflation rose further in Apr by 0.3pp to 1.6%, confirming the flash estimate and coming in line with market expectations.

- This marks the highest level since Apr 2019 where inflation registered at 1.7%.

- Core inflation eased to 0.7% in Apr, down from 0.9% seen in Mar and showing the lowest level since Dec 2020.

- Energy prices showed the largest upward contribution to price growth in Apr, as energy inflation surged by 10.3% and added 0.96pp to CPI growth.

- Price growth for food, alcohol and tobacco slowed to 0.6% in Apr, while service inflation decelerated to 0.9%.

- Prices for non-energy industrial goods edged higher to 0.4% in Apr, after dropping to 0.3% in Mar.

- Among the member states, the highest annual rates have been recorded in Luxembourg (3.3%), Lithuania (2.4%) and Slovenia (2.2%), while Greece (-1.1%), Portugal (-0.1%) and Malta (0.1%) saw the lowest inflation rates.

Source: Eurostat

FIXED INCOME: Bunds break through major support level

Core fixed income has been under pressure once again this morning while peripheral spreads have widened.

- Despite the move on the day in Bunds being a little smaller than the moves in Treasuries and gilts, it is Bunds that have broken through key technical levels. Our technical analyst noted 168.59 as the key support level (the May 13 low) and we have broken through this level already today. This opens up a move towards 168.09.

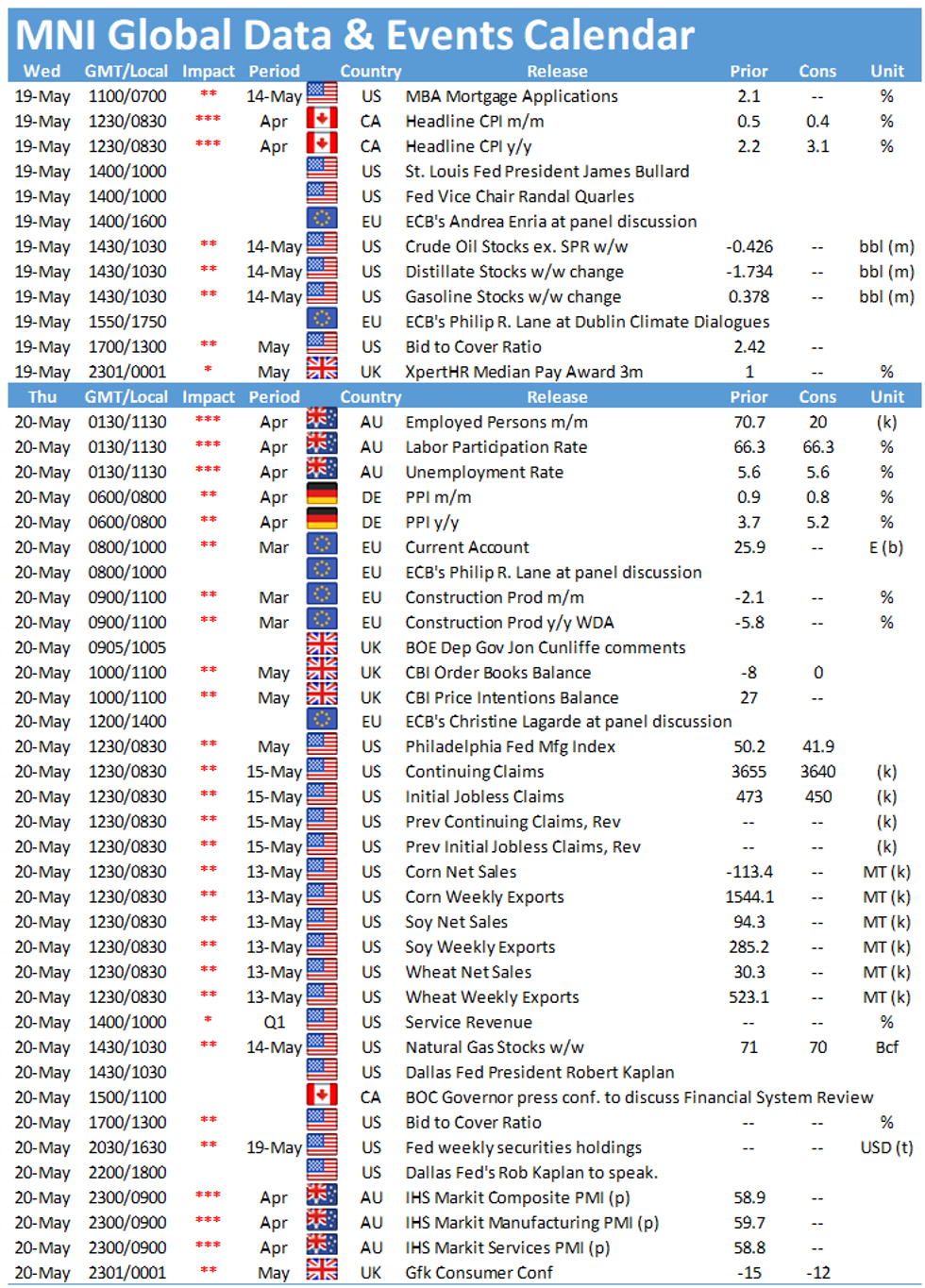

- The focus later today will be on the FOMC Minutes. Although a number of analysts are expecting the details to be dated given the data and market moves seen since, the market will be looking for any hints of the magnitude of economic growth or inflation needed for tapering to be on the table.

- In addition to the Minutes, there will be speeches from the ECB's de Cos and Lane, Fed's Bullard, Quarles and Bostic.

- There will also be focus on today's 20-year Treasury auction. In Europe, Finland holds a syndication while the UK, Germany and the EFSF are all holding auctions.

- TY1 futures are down -0-5+ today at 132-07 with 10y UST yields up 2.3bp at 1.662% and 2y yields up 0.1bp at 0.152%.

- Bund futures are down -0.32 today at 168.50 with 10y Bund yields up 1.6bp at -0.88% and Schatz yields up 0.1bp at -0.652%.

- Gilt futures are down -0.27 today at 127.22 with 10y yields up 2.3bp at 0.890% and 2y yields up 0.5bp at 0.088%.

FOREX: USD Mixed But DXY Touching Session Highs

A more steady session in FX, with most of the action seen in Govies and Equities.

- USD was mostly mixed in G10 in early trading, but we soon reversed after Bund fell lower dragging other Bond lower and in turn pushing yield higher.

- EURUSD tested key initial resistance at 1.2243 High Feb 25 (printed 1.2245 high today).

- But the pair has since faded from best levels as yields drifts a touch lower.

- USD is now moving into green territory in G10s,

- DXY hover at session high.

- The Dollar leads versus the Kiwi, now up 0.61%, and testing next small initial support in NZDUSD at 0.7203 (did print 0.7199 low).

- Looking ahead, notable data will be the Canadian CPI, while we still have plenty of speakers for the rest of the day.

- ECB de Cos, Lane, and Fed Bullard, Quarles, Bostic.

- FOMC minutes will be the last event for the session, but likely to be a non event, with focus already turning towards Fed, ECB and BoE June meetings

EQUITIES: NASDAQ Futures Off More Than 1%

- Asian markets closed weaker, with Japan's NIKKEI down 362.39 pts or -1.28% at 28044.45 and the TOPIX down 12.5 pts or -0.66% at 1895.24. China's SHANGHAI closed down 18.049 pts or -0.51% at 3510.965.

- European stocks are offered, with the German Dax down 206.77 pts or -1.34% at 15204.58, FTSE 100 down 96.45 pts or -1.37% at 6984.09, CAC 40 down 81.48 pts or -1.28% at 6301.84 and Euro Stoxx 50 down 49.97 pts or -1.25% at 3956.48.

- U.S. futures are weakening (tech led gains Tuesday, but lead losses Wednesday), with the Dow Jones mini down 180 pts or -0.53% at 33816, S&P 500 mini down 28 pts or -0.68% at 4095, NASDAQ mini down 145.75 pts or -1.1% at 13065.75.

COMMODITIES: Oil And Copper Lead Declines

- WTI Crude down $1.13 or -1.73% at $64.35

- Natural Gas down $0.03 or -0.86% at $2.986

- Gold spot down $5.15 or -0.28% at $1867.87

- Copper down $10.3 or -2.18% at $462.2

- Silver down $0.39 or -1.39% at $27.7889

- Platinum down $4.95 or -0.4% at $1217.78

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.