-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI US Open: China Risks Prevalent As Fed Week Begins

EXECUTIVE SUMMARY:

- CHINA STOCKS TUMBLE IN "PANIC SELLING" AMID EDUCATION CRACKDOWN

- DEADLINES LOOM FOR BIDEN'S INFRASTRUCTURE BILL

- CHINA UNLOADS GRIEVANCES IN U.S. TALKS, SAYS TIES IN "STALEMATE"

- BUSIEST WEEK OF THE QUARTER FOR CORPORATE EARNINGS

- GERMAN JUL IFO SURVEY DISAPPOINTS

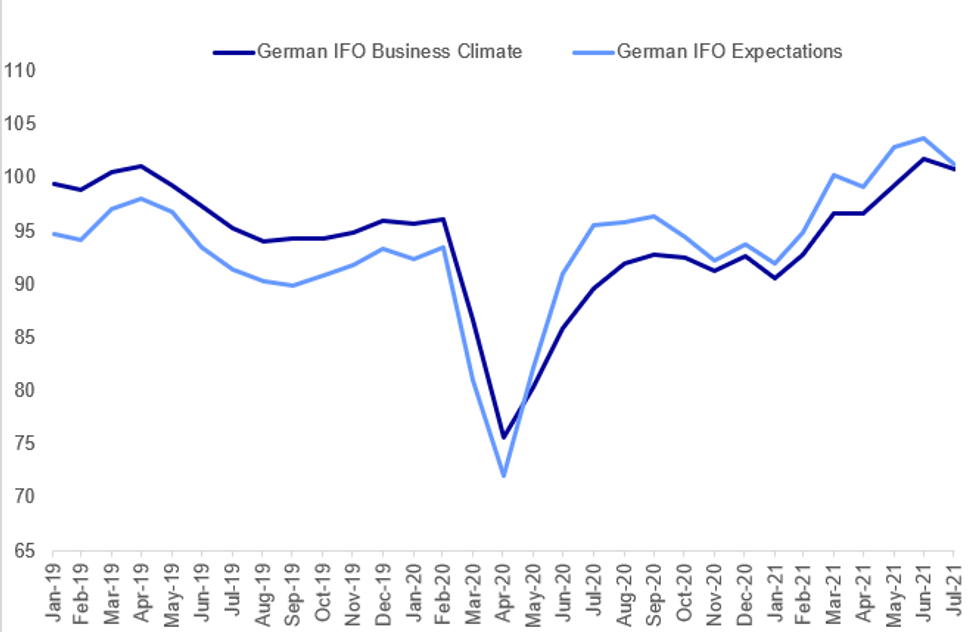

Fig. 1: German IFO

Source: IFO, MNI

Source: IFO, MNI

NEWS:

CHINA / HONG KONG EQUITIES (BBG): A selloff in Chinese private education companies sent shockwaves through the equity market Monday, as investors scrambled to price in the growing risks from an intensifying crackdown by Beijing on some of the nation's industries. Stocks slumped on the mainland and in Hong Kong, with the benchmark CSI 300 Index dropping 3.2% and the Hang Seng Index tumbling 4.1%. Steep losses in education stocks in the wake of a sweeping overhaul that threatens to upend the $100 billion sector, spilled over into other areas.

U.S. INFRASTRUCTURE: On US infrastructure talks, BBG write this morning that Senators are looking to round off negotiations "early this week" as the looming August recesscould knock back any progress significantly. The latest seems to be that both Senators and aides believe a deal is close, but a finish date mentioned by some as early as today could be unrealistic given whether legislative text itself could be completed on time. With August recess looming, lawmakers (particularly democrats) are concerned that if an infrastructure bill isn't completed this week, it will end up chewing into time allotted to deal with the debt ceiling and threat of government shutdown in the Autumn. The outstanding issue appears to be the transit section of the final bill, which takes extra focus given Chuck Schumer's close proximity to transportation.

CHINA-U.S. (BBG): China lashed out at U.S. policies in a tense start to high-level talks in Tianjin, handing the Americans lists of demands and declaring the relationship between the world's two largest economies in a "stalemate." Vice Foreign Minister Xie Feng told visiting Deputy Secretary of State Wendy Sherman that some Americans seek to portray China as an "imagined enemy," according to accounts released by the Foreign Ministry as talks got underway. Still, Xie said Beijing was willing to seek common ground and deal with the U.S. on an equal footing. The Chinese diplomats presented Sherman with two lists of demands, according to the official Xinhua News Agency. One was "U.S. wrongdoings that must stop" and the other was a list of "key individual cases that China has concerns with," Xinhua said, citing a briefing by Xie. "The China-U.S. relationship is now in a stalemate and faces serious difficulties," Xie said, according to the ministry.

U.S. EARNINGS: As for earnings, it's easily the biggest week of the quarter for the S&P500, with 49% of the index's total market cap due to report. Of the reports so far, 86% of names have beaten EPS forecasts, and 83% have beaten on sales. Highlights for the week are:

- MON: Tesla, Lockheed Martin

- TUES: Apple, Alphabet, Microsoft, Visa

- WEDS: Facebook, Pfizer, PayPal, Ford

- THURS: Amazon, Mastercard

- FRI: Caterpillar, ExxonMobil, Chevron, P&G

Full schedule with timings, EPS & sales expectations here: https://roar-assets-auto.rbl.ms/documents/11286/MN...

DATA:

GERMANY DATA: Business Climate Dropped in July

German business confidence declined in July after rising for several months, the Munich-based Ifo Institute said Monday, with the headline index slipping to 100.8, down from 101.7 seen in June, driven by a decrease of expectations to a 3-month low of 101.2. Current conditions on the other hand rose to 100.4.

"Supply bottlenecks and concerns over newly rising infection numbers are weighing on the German economy," the report noted. Expectations in the manufacturing sector fell in July as firms noted concerns about scarcity of intermediate products and a lack of skilled workers. Similarly, expectations in the service and trade sector declined as well as supply bottlenecks create a problem.

FIXED INCOME: Core Sovereigns Bid

Safe haven demand is underpinning the bid in government bonds this morning, with USTs and Gilts leading the charge.

- Sovereign curves are bull flattening amid broad weakness in European equities, which follows on the heels of a poor session for Asian stocks in the wake of China's clampdown on education tech stocks.

- Treasury cash yields are 1-4bp lower across the curve with the long-end outperforming. TYU1 trades at 134-14, near the top end of the day's range (L: 134-04+ / 134-19).

- Gilts have similarly caught a bid with yields 2bp lower in the belly/long-end of the curve.

- Bunds are slightly underperforming USTs and Gilts. Yields are broadly 1bp lower with the curve close to flat overall.

- BTPs trade a touch weaker, albeit with price action relatively contained thus far.

- The German IFO update for July was a touch weaker than expected with the Expectations component reading 101.2 vs 103.6 consensus.

- European supply today comes from Germany (Bubills), France (BTFs) and Belgium (OLOs).

FOREX: China Stock Slide Prompts Risk-Off Start to Week

- A sharp drawback in China and Hong Kong equities has gotten risk sentiment off to a poor start Monday, with core European indices and US futures all in negative territory. This has helped underpin have currencies, with JPY, USD and EUR among the strongest in G10.

- AUD, NZD and other commodity-tied currencies are on the backfoot, with a soft start for oil benchmarks and industrial metals undermining recent progress. AUD/USD trades in closer proximity to the key support at the Jul 21 low of 0.7290.

- GBP trades well, with local press highlighting the recent downtick in case growth despite economic re-opening. Showing the effectiveness of vaccines, case growth has slowed before any catch-up in hospitalisation or fatality statistics, helping GBP/USD rise further above the 200-dma at 1.3719.

- It's a quieter data slate, with just US new home sales on the docket. This will likely keep focus on the earnings schedule this week, which kicks off today with reports from Tesla and Lockheed Martin among others.

EQUITIES: Asian Markets Lead Global Stocks Lower

- Asian stock markets closed mixed, China and Hong Kong sharply lower - with Japan's NIKKEI up 285.29 pts or +1.04% at 27833.29 and the TOPIX up 21.21 pts or +1.11% at 1925.62 (in returns from a 4-day weekend). China's SHANGHAI closed down 82.955 pts or -2.34% at 3467.441 and the HANG SENG ended 1129.66 pts lower or -4.13% at 26192.32.

- European equities are slipping, with the German Dax down 99.64 pts or -0.64% at 15595.56, FTSE 100 down 25.2 pts or -0.36% at 7027.58, CAC 40 down 35.28 pts or -0.54% at 6568.82 and Euro Stoxx 50 down 29.09 pts or -0.71% at 4090.47.

- U.S. futures are a little lower, with the Dow Jones mini down 215 pts or -0.62% at 34736, S&P 500 mini down 19 pts or -0.43% at 4384, NASDAQ mini down 34.75 pts or -0.23% at 15063.25.

COMMODITIES: Oil Retreats Amid Continued Demand Concerns

- WTI Crude down $0.97 or -1.35% at $71.2

- Natural Gas up $0.01 or +0.15% at $4.07

- Gold spot up $6.55 or +0.36% at $1806.85

- Copper up $4.85 or +1.1% at $447

- Silver up $0.2 or +0.79% at $25.375

- Platinum down $1.31 or -0.12% at $1067.45

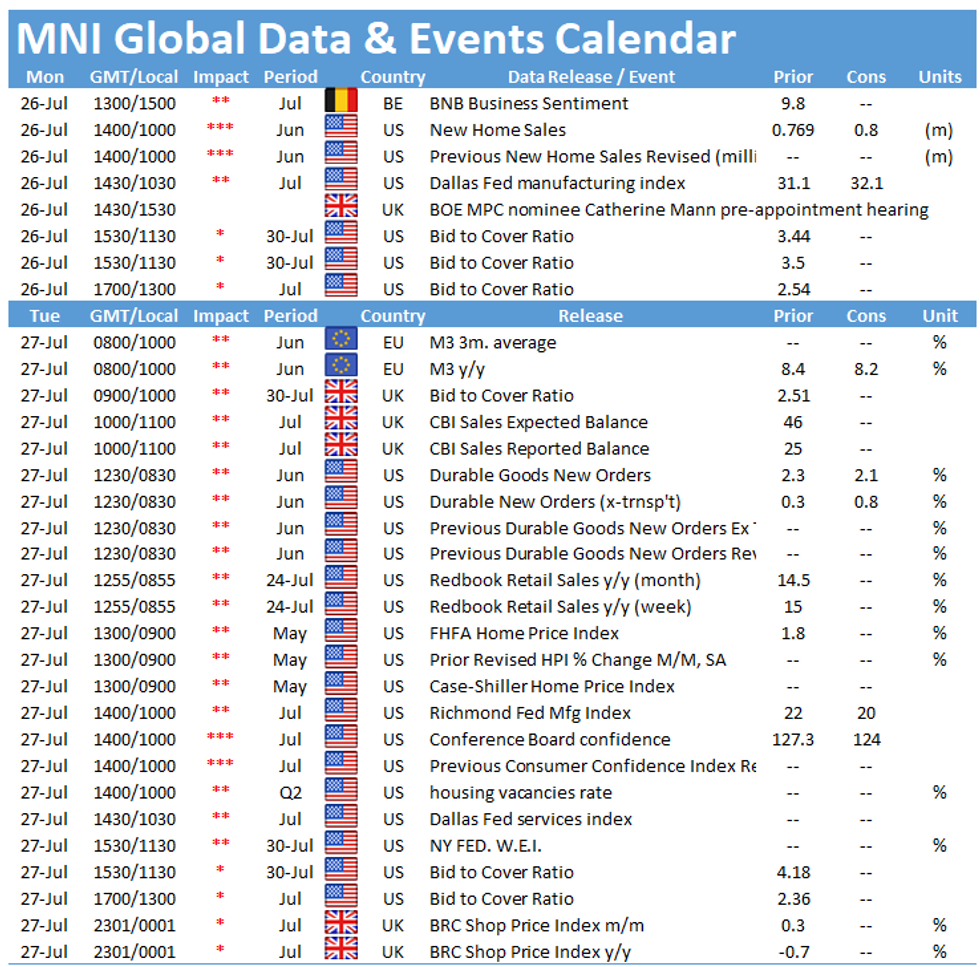

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.