-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: China Tightening In Focus

EXECUTIVE SUMMARY:

- CHINA TARGETS COMMODITY "SPECULATORS AND HOARDERS"

- P.B.O.C. SEEN TIGHTENING IF CPI RISES OVER 3% (MNI)

- E.U. MULLS RESPONSE TO BELARUS DIVERTING PLANE TO NAB REPORTER

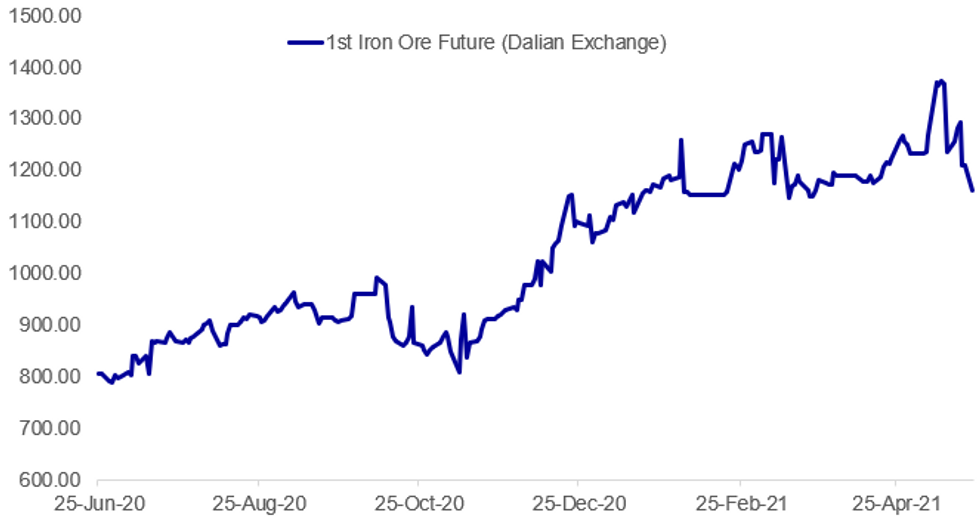

Fig. 1: China To Metals Markets: Curb Your Enthusiasm

BBG, MNI

BBG, MNI

NEWS:

CHINA/COMMODITIES (BBG): China stepped up its fight against soaring commodities prices, summoning top executives to a meeting that threatened severe punishment for violations ranging from excessive speculation to spreading fake news. The government will show "zero tolerance" for monopoly behavior and hoarding, the National Development and Reform Commission said in a statement after leaders of top metals producers were called to a meeting in Beijing with multiple government departments on Sunday. The push to rein in surging metals prices rippled across markets -- with steel dropping more than 5% and iron ore tumbling by close to the daily limit -- before prices steadied later in the session.

P.B.O.C. (MNI): The People's Bank of China is likely to keep liquidity stable unless the consumer price index rises over 3% year-on-year while continuing to restrict further credit expansion in the hot property market, policy advisors told MNI, an approach aimed at supporting growth and curbing major risk. For full article contact sales@marketnews.com

BELARUS/E.U. (AP): Angry European Union leaders were set to consider a joint response Monday to Belarus' diversion of a plane traveling between EU member nations in order to arrest a prominent Belarusian opposition journalist.Raman Pratasevich, who ran a popular messaging app that played a key role in helping organize massive protests against Belarus' authoritarian president, was on board the Ryanair flight from Athens, Greece, to Vilnius, Lithuania, when it was diverted to the Belarusian capital, Minsk while flying over Belarus. Belarusian flight controllers had warned the plane crew of an alleged bomb threat and ordered it to land in Minsk, and a Belarusian fighter jet was scrambled to escort the Ryanair airliner.

BELARUS/E.U. (BBG): Poland will propose concrete new sanctions on Belarus at EU Council meeting on Monday, Deputy Foreign Minister Pawel Jablonski tells reporters in Warsaw. Jablonski declines to specify the type of sanction Poland will seek, saying the government wants to consult with EU partners first.

CHINA/U.S./COVID (BBG): China accused the U.S. of promoting theories that the coronavirus escaped from a high-security lab in Wuhan, as a fresh report about sick workers at the facility prompted Beijing to reaffirm denials."The report that you mentioned about three people getting sick, that is not true," Foreign Ministry spokesman Zhao Lijian told a regular briefing Monday in Beijing. Zhao was responding to a Wall Street Journal report that a trio of researchers from the Wuhan Institute of Virology -- a lab in the city where the first Covid-19 outbreak was identified -- had fallen ill and sought hospital care in November 2019.

INDONESIA (MNI STATE OF PLAY): Bank Indonesia is expected to leave the benchmark seven-day reverse repo rate unchanged at the record low of 3.5% despite economic weakness, with the volatile rupiah continuing to be a major factor in policy. For full article contact sales@marketnews.com

DATA:

No key data in the European morning (much of Europe is observing a public holiday).

FIXED INCOME: Focus on CB speakers later

The European morning session had been fairly lackluster with most of continental Europe out of the office for the Whit Monday holiday before a short, sharp move stronger for the USD also saw core fixed income hit the lows of the day (although much of the move has since been reversed in FX core fixed income still generally sits a bit lower).

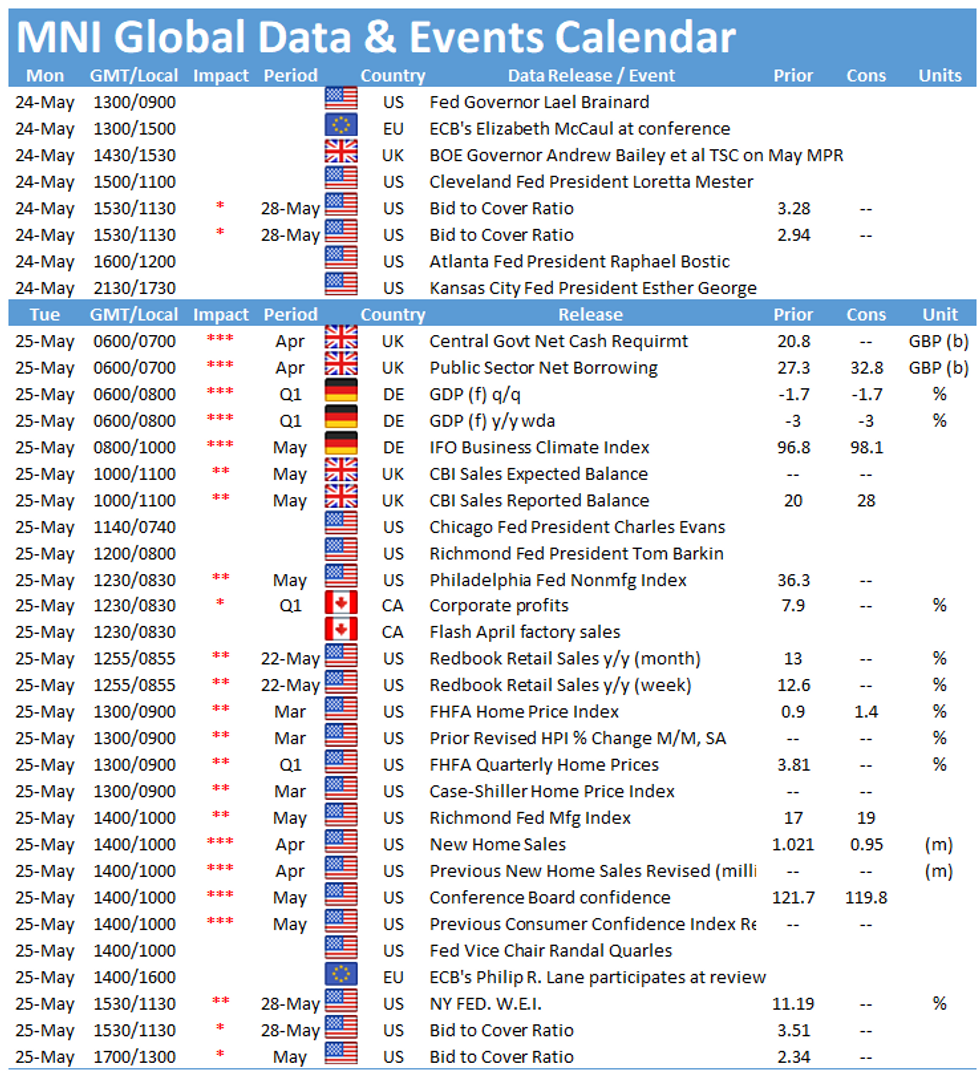

- With little on the data calendar, today's focus will be on central bank speakers. In the UK, MPC members Bailey, Cunliffe, Haldane and Saunders will testify before the Treasury Select Committee at 15:30BST/10:30ET. While across the pond, the Fed's Mester, Bostic and George will all speak.

- Looking ahead in the week, the highlights on the data calendar will be US durable goods and the second print of Q1 GDP Thursday, the German IFO tomorrow, French HICP Friday while the UK gilt calendar for Jul-Sep announced on Friday morning.

- TY1 futures are up 0-1+ today at 132-15+ with 10y UST yields unch at 1.622% and 2y yields up 0.2bp at 0.156%.

- Bund futures are down -0.04 today at 169.10 with 10y Bund yields up 0.4bp at -0.127% and Schatz yields up 0.2bp at -0.659%.

- Gilt futures are up 0.05 today at 127.87 with 10y yields down -0.1bp at 0.828% and 2y yields up 0.3bp at 0.039%.

FOREX: USD Perky Pre-NY Hours

- After a sanguine start to the session, the greenback has bumped higher pre-NY hours, with the likes of GBP/USD and AUD/USD plumbing new session lows on relatively little newsflow. The somewhat erratic move higher in the greenback saw markets scrambling for a news driver, but the more likely catalyst is a thin market (much of Europe out for Whit Monday, although not a full bank holiday) and still fragile market sentiment.

- Equities are rangebound, but still holding above support, but that's provided little support for AUD, and NZD, which are among the session's weakest performers. NOK trades well given the still supported oil price, with EUR/NOK rolling off last week's highs as WTI crude futures narrow the gap with $65/bbl.

- There's little on the data slate to snatch attention Monday, with the speaker schedule likely to hold more focus, as Fed's Brainard, Mester, Bostic and George as well as BoE's Bailey, Cunliffe, Haldane and Saunders all on the docket.

EQUITIES: Broadly Constructive Start To The Week

- Asian stocks closed mostly higher, with Japan's NIKKEI up 46.78 pts or +0.17% at 28364.61 and the TOPIX up 8.35 pts or +0.44% at 1913.04. China's SHANGHAI closed up 10.725 pts or +0.31% at 3497.282 and the HANG SENG ended 46.18 pts lower or -0.16% at 28412.26.

- European equities are slightly higher (amid a holiday for the DAX), with the FTSE 100 up 14.14 pts or +0.2% at 7031.8, CAC 40 up 2.99 pts or +0.05% at 6396.17 and Euro Stoxx 50 up 0.34 pts or +0.01% at 4031.17.

- U.S. futures are higher, with the Dow Jones mini up 128 pts or +0.37% at 34281, S&P 500 mini up 16.75 pts or +0.4% at 4168.5, NASDAQ mini up 60.75 pts or +0.45% at 13465.75.

COMMODITIES: Oil Recovering Some Of Last Week's Losses

- WTI Crude up $1.12 or +1.76% at $64.33

- Natural Gas down $0.05 or -1.79% at $2.858

- Gold spot down $3.33 or -0.18% at $1882.74

- Copper up $0.5 or +0.11% at $448.7

- Silver up $0 or +0.01% at $27.7295

- Platinum down $4.93 or -0.42% at $1171.88

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.