-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: COVID Infiltrates G7 Meetings

EXECUTIVE SUMMARY:

- INDIAN FOREIGN MINISTER QUARANTINES AFTER POSSIBLE COVID EXPOSURE AT LONDON G7 MEETING

- U.S. HAS NO REASON TO BELIEVE G7 DELEGATION AT RISK OF COVID

- BLOW TO SPANISH PRIME MINISTER AS CONSERVATIVES WIN MADRID ELECTION

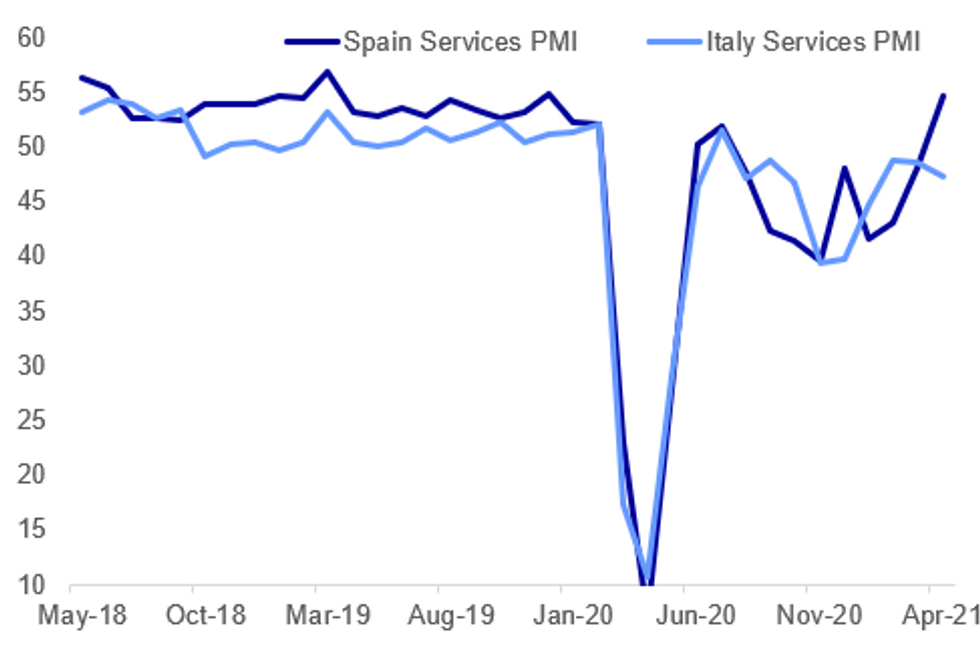

- APRIL SERVICES PMI: ITALY WEAKER THAN EXPECTED; SPAIN BEATS

Fig. 1: Italian Service Sector Unexpectedly Contracts In April

IHS Markit, MNI

IHS Markit, MNI

NEWS:

G-7/INDIA/COVID: India's Foreign Minister S. Jaishankar has tweeted that he and others in the Indian delegation to the London G7 foreign ministers' summit are self-isolating as it emerged some of the diplomats in attendance had tested positive for COVID-19. A senior UK diplomat stated that it was 'very unfortunate' that the Indian FMcould not attend, but that "This is exactly why we have put in place strict Covid protocols and daily testing." Yesterday Jaishankar met UK Home Secretary Priti Patel, although due to COVID-19 protocols being observed she is not being asked to self-isolate.

G-7/US/COVID: The U.S. was advised that its "stringent masking, social distancing, and daily testing protocols" would permit its delegation to continue with G7 activities, State Department spokesman Ned Price says. Price was responding to a question about possible Covid exposure in the Indian delegation. "We will continue to follow the guidance of public health professionals going forward and abide by the same strict Covid-19 protocols."

SPANISH POLITICS: The minority gov't of Spanish Prime Minister Pedro Sanchez was dealt a significant blow last night when the conservative People's Party (PP) doubled its vote share to emerge as the largest single party in elections for Madrid's regional assembly.

- The PP of regional president, Isabel Diaz Ayuso, more than doubled its seat total to 65. This is just short of the 69 seats required for an outright majority. The right-wing nationalist Vox, up one seat to 13 in total, has already pledged its support to Ayuso, likely meaning Spain will have its first outright right-wing regional gov't coming to power.

- The result of the Madrilenian election is such a blow to the federal gov't due to the amount of political capital spent by both parties in the federal gov't in trying to boost their respective parties' vote share.

- PM Pedro Sanchez from the centre-left Spanish Socialist Workers' Party (PSOE) campaigned strongly in the region, while Ayuso ran the campaign as an explicit rejection of the federal gov'ts COVID-19 restrictions with the slogan 'freedom or communism'.

GERMAN POLITICS: The latest opinion poll from outlet Forsa shows the centre-left Greens as Germany's most popular political party, leading the centre-right CDU-CDU by 28% to 23%.

- Germany, Forsa poll: Green-G/EFA: 28%, CDU/CSU-EPP: 23% (+1), SPD-S&D: 14% (+1), FDP-RE: 12%, AfD-ID: 10% (-1), LINKE-LEFT: 6% (-1). +/- vs. 20-26 April 2021. Fieldwork: 27 April - 3 May 2021. Sample size: 2,508

- This is the second Forsa poll in a row showing the Greens leading the CDU. Of the last 7 full polls carried out in Germany since the selection of Annalena Baerbock as the Green chancellor candidate and Armin Laschet as the candidate for the CDU, the Greens have lead in five.

DATA:

Italy PMI: Lockdown Setback For Services

The Italian services sector unexpectedly contracted in April, with the PMI reading falling to 47.3 (50.0 exp., 48.6 prior), and dragging down the composite figure (51.2, vs 53.0 exp., 51.9 prior) amid Italian COVID lockdown measures. The IHS Markit release reports that business activity, new orders, exports, and employment all declined.

- Activity: April saw the 9th consecutive monthly contraction in services output, and the sharpest drop in 3 months, with new orders falling and exports subdued.

- Backlogs: Outstanding business "rose very slightly" after 13 consecutive contractions, as pandemic restrictions and business closures "weighed on firms' ability to complete incoming new work".

- Employment: The fall in the employment reading was the biggest in 3 months, "with firms often mentioning voluntary resignations and retirements".

- Prices: Input costs rose again (fuel/raw materials inflation noted), though the rate was softest since Jan, and below long-run averages. Output charges "fell marginally as respondents noted efforts to encourage sales prompted discounting strategies".

- Outlook: Services firms remained "widely optimistic" for the year ahead, citing "the passing of COVID-19 and positive vaccination efforts".

Spain PMI: Stronger Than Expected As Demand And Hiring Picks Up

Spanish PMI came in well above expectations in April, with a services reading of 54.6 (50.0 exp., 48.1 prior) and composite of 55.2 (52.2 exp., 50.1 prior). This was the strongest services expansion since the end of 2019, and came as "encouraging demand developments and positive projections for activity helped to support growth" per the IHS Markit release

- Activity: Sales volumes rose by the most since Aug 2019, but new business "predominantly driven by the domestic market", and new export business continued to decline.

- Employment: Firms took on additional staff for the first time since Feb 2020 - growth also linked to planned re-openings and the return of furloughed staff.

- Prices: Higher staffing levels led to rising labor costs, while "suppliers generally increasing their charges amid widespread product shortages, plus rising costs for transportation, overall operating expenses" rose the most since Aug 2008. Output charges rose for the first time for over a year (albeit only modestly).

- Outlook: "Confidence about the future hit its highest level since early 2004" amid vaccinations / economic reopening.

MNI: FRANCE FINAL APR SERVICES PMI 50.3; FLASH 50.4; MAR 48.2

MNI: FRANCE FINAL APR COMPOSITE PMI 51.6; FLASH 51.7; MAR 50.0

MNI: GERMANY FINAL APR SERVICES PMI 49.9; FLASH 50.1; MAR 51.5

MNI: GERMANY FINAL APR COMPOSITE PMI 55.8; FLASH 56.0; MAR 57.3

MNI: EZ FINAL APR SERVICES PMI 50.5; FLASH 50.3; MAR 49.6

MNI: EZ FINAL APR COMPOSITE PMI 53.8; FLASH 53.7; MAR 53.2

EZ Factory Gate Inflation At Highest Since 2018

EZ MAR PPI +1.1% M/M, +4.3% Y/Y; FEB +1.5% Y/Y

- Annual producer price inflation jumped to 4.3% in Mar, slightly stronger than markets expected (Median: 4.2%)

- This marks the third positive reading after 17 consecutive month of negative rates and the highest level since Oct 2018.

- Mar's uptick was driven by a sharp increase in energy prices to the highest level since Nov 2018, up 10.3% in Mar after rising by 2.3% in Feb.

- Intermediate goods prices rose 4.4%, its highest level since Nov 2011 and the third successive increase.

- While capital goods prices accelerated to 1.1%, durable consumer goods inflation rose by 1.4% in Mar.

- Prices for non-durable consumer goods rebounded to 0.4%, after falling by 0.4% in Feb.

- Monthly PPI increased by 1.1% in Mar, following Feb's growth rate of 0.5%

- Among the member states, the highest annual rates were recorded in Ireland (+21.2%), Belgium (+9.3%) and Estonia and the Netherlands (both at +7.5%), while the only decreased were seen in Cyprus (-3.0%) and Slovakia (-0.6%).

FIXED INCOME: A calmer start

A calmer start for Bonds, as Equities reverse some of yesterday's big sell off.

- This has in turn kept the lid on Govies, and curves bear steeper, but well within yesterday's ranges.

- EU services PMIs were the early focus, but the data miss had little impact, with German Bobl supplies weighing.

- Peripherals trade close to flat against the German 10yr, although Greece is the stand out, albeit at just 2.8bps tighter.

- Gilts have traded inline with Bunds, also weighted going into UK 2031 and 2046 auctions.

- UK curve sits bear steeper, while the contract trades in a tight 20 ticks range (127.88-128.08).

- US Treasuries are also better offered with volumes picking up slightly during the European session, after a very quiet overnight session, with Japan and China on holiday.

- The long Treasury strip trades in the red after Equity, like the Nasdaq and mini S&P recovers most of their losses

- Looking ahead, US services PMI, but final reading here.

- Speakers include ECB Vasle, Lane, and Fed Evans, Rosengren, Mester

FOREX: NZD On Top as Unemployment Rate Unexpectedly Slips

- Antipodean currencies are bouncing early Wednesday, with NZD the strongest in G10 after a solid jobs data release overnight which saw the unemployment rate unexpectedly shed 0.2 ppts. This sees NZD/USD bounce back above the 50-dma at $0.7141, with the week's highs of $0.7212 the next target.

- The USD is firmer after an eventful week, with the USD Index showing above Tuesday's best levels to near the 50-dma resistance at 91.7426.

- The weakest currencies so far Wednesday are CHF, EUR and SEK, while NZD, AUD and CAD outperform.

- Today's ADP Employment Change and ISM Services Index numbers will be carefully watched for any further clues ahead of Friday's Nonfarm Payrolls update. Monday's Manufacturing ISM number may have tempered expectations, but markets still expect further resilience in today's ADP number (Exp. +850k, Prev. +517k). Central bank speakers include ECB's Vasle and Lane, with Fed's Evans, Rosengren and Mester also due.

EQUITIES: European Stocks Bouncing

- Several Asian markets are closed for holiday. The HANG SENG ended 139.16 pts lower or -0.49% at 28417.98.

- European stocks are bouncing, with the German Dax up 198.87 pts or +1.34% at 15058.79, FTSE 100 up 81.34 pts or +1.17% at 6987.51, CAC 40 up 62.03 pts or +0.99% at 6309.1 and Euro Stoxx 50 up 50.9 pts or +1.3% at 3976.41.

- U.S. futures are higher, with the Dow Jones mini up 96 pts or +0.28% at 34115, S&P 500 mini up 14.25 pts or +0.34% at 4172.5, NASDAQ mini up 58 pts or +0.43% at 13594.5.

COMMODITIES: Falling US Stockpiles Help Boost Crude

- WTI Crude up $0.82 or +1.25% at $66.42

- Natural Gas up $0.01 or +0.44% at $2.976

- Gold spot down $4.24 or -0.24% at $1778.42

- Copper up $4.25 or +0.94% at $453.55

- Silver down $0.17 or -0.64% at $26.4329

- Platinum down $10.26 or -0.83% at $1229.17

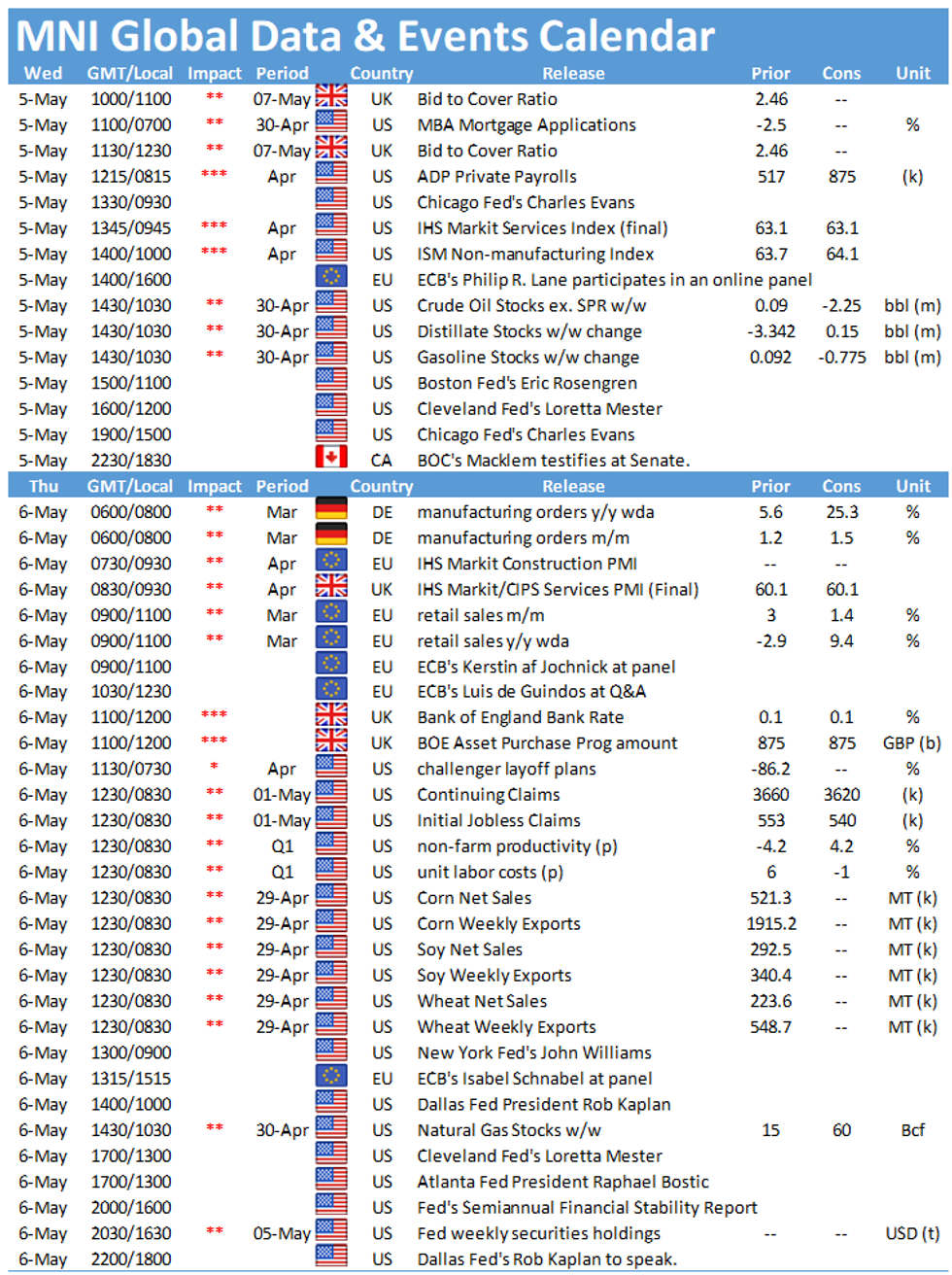

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.