-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI US Open: Dollar Dips With Europe Rate Hikes Reassessed

EXECUTIVE SUMMARY:

- NO REASON FOR E.C.B. TO INCREASE RATES BY END-2022: VILLEROY

- SELL-SIDE ANALYSTS REASSESS BANK OF ENGLAND RATE HIKE VIEWS

- VON DER LEYEN: WITHOLDING RECOVERY FUNDS AN OPTION IN POLAND SPAT

- UK 30Y YIELDS DROP AS GREEN BOND SYNDICATION DELAYED

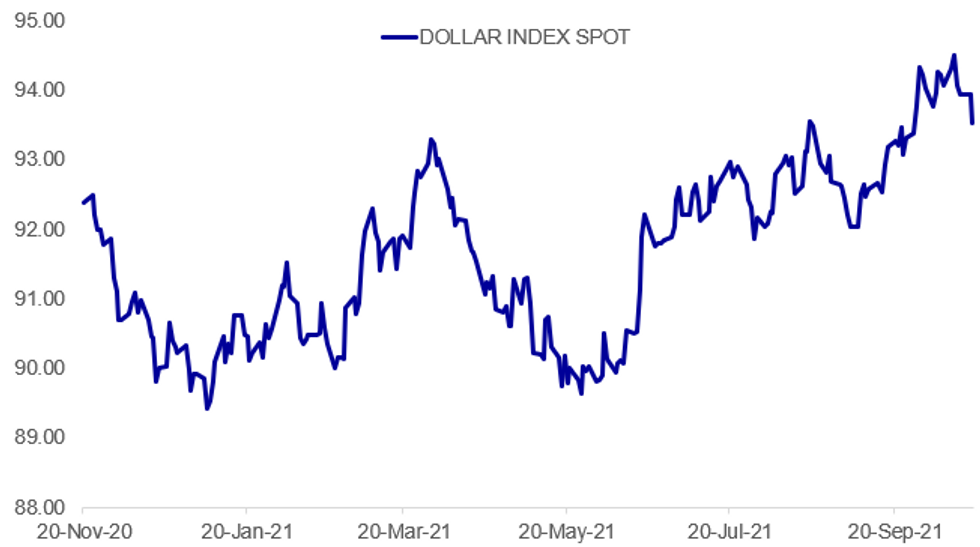

Fig. 1: Dollar Dips

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (RTRS): There is no reason for the European Central Bank to increase rates between now and the end of 2022 as euro zone inflation is expected to fall back below the ECB's 2% target, Bank of France governor Francois Villeroy de Galhau said on Tuesday. He also played down concerns that problems at China Evergrande Group, which faces a liquidity crisis, could have a broader impact, saying: "There will be no contagion outside China. This is a serious problem for Chinese authorities."

BOE VIEW: HSBC has stuck to its call that the first BOE hike will be in February. "Our view of a first 15bp rate rise in February is in line with the consensus of economists, but it is a long way from market pricing. The MPC's lack of pushback is a major risk to this." "A lot has changed over the past three weeks and a lot could change before 4 November. In our view, the economic fundamentals don't seem to have changed sufficiently to warrant the recent market move." "Even if we are wrong on the timing, the speed and extent of tightening now being priced in looks too aggressive given the likely medium-term balance of supply and demand - and this may be more important point than whether tightening begins in November, December, or February."

BOE VIEW: TD Securities now sees a BoE hike this year. "Whether the MPC hikes in Nov or Dec remains a coin toss. The vote for a hike in Nov is likely to be close - likely 5-4 or 4-5. We count 4 probable votes to hold policy unchanged, 3 to hike, and 2 unknowns. Dec could be a more clear-cut vote to hike if the MPC chooses to take a pass in two weeks." "We therefore anticipate a 15bps rate hike at one of the Nov or Dec MPC meetings (with Nov more likely given Bailey's signal), followed by 25bps hikes in Feb and Aug 2022." TD previously looked for the first 15bp hike in Aug22 with a further 25bp in Nov 22.

BOE VIEW: CIBC expect swing-voter Broadbent to vote to keep rates on hold in November. "We anticipate that despite the Bailey warnings the bank will hold rates at 0.1% in November. Expect a split vote, likely 5:4, underlining the knife edge scale of the event."

"We would view BoE deputy Governor Broadbent as being a key swing MPC member. Several members have suggested the need to see evidence of the effects of the ending of the jobs support mechanism (furlough), prior to acting, and thus we would expect Broadbent to be in this grouping."

E.U. / POLAND: EU Commission President Ursula von der Leyen told the European Parliament Tuesday that withholding Recovery Fund money from Poland was one option the EU had in its current battle with Poland over rule of law breaches. "The Polish government has to explain us how it intends to protect European money, given this ruling of their constitutional court," von der Leyen said. Poland has requested a total of EUR23.9 billion in grants under the RRF and EUR12.1 billion in loans under its yet-to-be approved recovery plan. For the moment, the Commission is continuing to "carefully assess" the recent ruling of the Polish constitutional court, she said.

E.U. / POLAND: Polish PM Mateusz Morawiecki responding to Commission President Ursula von der Leyen's speech to the EU parliament plenary session. Morawiecki states that on the EU, 'here we are, here is our place and we arenot going anywhere'.'We cannot remain silent when our country is being attacked in this Chamberin an unfair and biased way. The rules of the game must be the same for everyone. It is unacceptable to expand EU competences...[with] language offinancial blackmail' EU law precedes national law to the level of law and this principle in theareas granted such a principle applies in EU countries [...] but the Constitution remains the supreme law. We have entrusted the EU with many areas, but we have not entrusted everything.'

UK ISSUANCE: The DMO has confirmed that the green gilt syndication will not take place today due to the update on the Carbon Capture, Usage and Storage (CCUS)Cluster Sequencing Process update and the update on Heat and Buildings Strategy (i.e. heat pump grants etc). "The UK DMO is keen to allow market participants the opportunity to review any potentially relevant information. Therefore the 2053 green gilt will not be today's business. We would anticipate the transaction to take place later this week." We now expect a Thursday transaction to avoid tomorrow's auction.

DATA:

MNI BRIEF: Eurozone Construction Sees Biggest Fall Since Feb

Eurozone construction output declined by 1.3% in August, the biggest fall since a 1.8% slide in February, according to data released by Eurostat on Tuesday. That follows a 0.1% increase in July, unrevised from last month's initial report. Building work fell by 1.3%, while civil engineer contracted by 1.9%.

Over the year to August, construction slumped by 1.6%, also the worst performance since February, following a 3.5% rise in July (revised up from an earlier report of +3.3%).

German construction output fell 3.1% between July and August, the worst fall since January, while French construction fell by 1.7% and Spain suffered a 1.5% decline.

FIXED INCOME: Curves steepening as some pressure comes off the 2-year

TY1 futures are higher while gilt and Bund futures are marginally lower on the day. The focus is on partial retracement of 2-year yields with curves steepening across core FI today after yesterday's large moves. The moves in 2-year gilt/UST yields are a bit smaller than those seen in STIR markets.

- There have not been any real big headline drivers this morning. A number of sellside analysts continue to bring forward their expectation of BoE hikes (but still to a lesser extent than the market has priced). While we did see a decent swing in 10s30s gilts this morning as it was announced that the 30-year green gilt syndication would not take place today, but later in the week after some green policy announcements from the government.

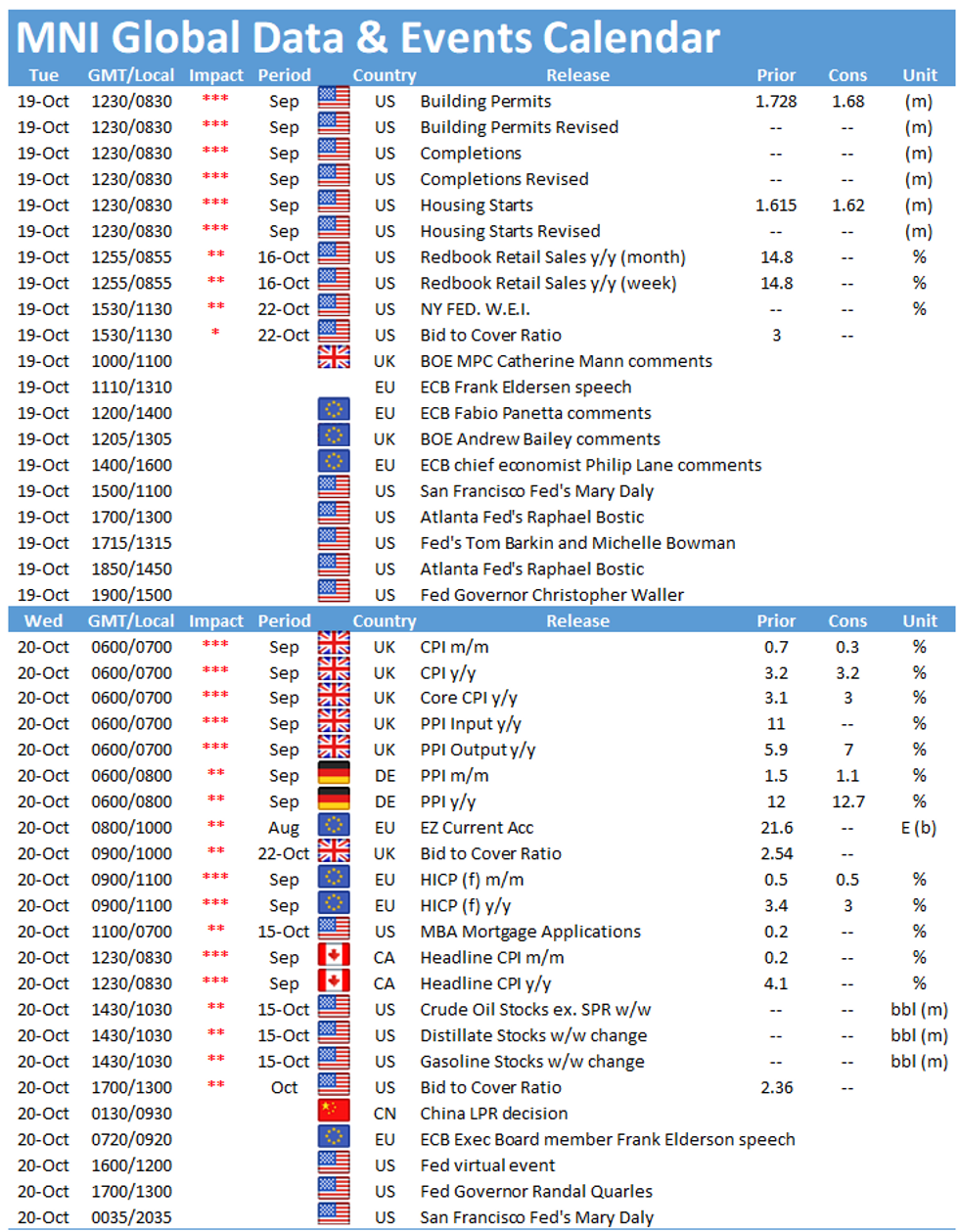

- We have a number of central bank speakers due today including the BoE's Bailey and Mann, the ECB's Lane and Panetta as well as the Fed's Daly, Barkin, Bostic and Waller.

- The only notable data due is US housing starts.

- TY1 futures are up 0-2 today at 130-26+ with 10y UST yields down -1.7bp at 1.585% and 2y yields down -3.4bp at 0.392%.

- Bund futures are down -0.06 today at 169.05 with 10y Bund yields up 0.1bp at -0.148% and Schatz yields down -1.7bp at -0.674%.

- Gilt futures are down -0.12 today at 124.19 with 10y yields up 0.4bp at 1.139% and 2y yields down -1.2bp at 0.700%.

FOREX: Greenback Ebbs to Monthly Low

- The USD pullback this morning has drawn some market focus at these levels, with the USD Index edging to new October lows of 93.592 to narrow the gap with the 50-dma support of 93.2378. This puts the USD as the weakest performing currency so far Tuesday.

- The greenback move coincides with a softer US yield curve, with 10y yields off as much as 3bps while the front-end also sees a decent correction lower.

- EUR, GBP both printing new October highs vs. USD, but the move is perhaps most notable in CNH, with USD/CNH falling through 6.40 for the first time since mid-June, exposing the YTD lows of 6.3525.

- GBP/USD is testing resistance at 1.3795 at typing, the level marks the 76.4% retracement of the Sep 14 -29 downleg. Break through here opens the mid-September highs of 1.3854, which sit just above the 100-dma of 1.3811.

- US housing starts and building permits data crosses later today, but the central bank speaker will likely draw more focus. Speeches from ECB's Elderson, Rehn, Lane and Panetta, Fed's Daly, Barkin, Bostic and BoE's Bailey are all due.

EQUITIES: Modest Gains, Energy Stocks Leading

- Asian stocks closed higher, with Japan's NIKKEI up 190.06 pts or +0.65% at 29215.52 and the TOPIX up 7.34 pts or +0.36% at 2026.57. China's SHANGHAI closed up 25.015 pts or +0.7% at 3593.153 and the HANG SENG ended 377.46 pts higher or +1.49% at 25787.21.

- European equities are mixed, with the German Dax up 1.53 pts or +0.01% at 15475.88, FTSE 100 up 2.98 pts or +0.04% at 7204.02, CAC 40 down 0.7 pts or -0.01% at 6673.66 and Euro Stoxx 50 up 7.31 pts or +0.18% at 4159.21.

- U.S. futures are a little higher, with the Dow Jones mini up 76 pts or +0.22% at 35209, S&P 500 mini up 13 pts or +0.29% at 4490.5, NASDAQ mini up 35.5 pts or +0.23% at 15326.

COMMODITIES: Metals Gain As Dollar Slips

- WTI Crude up $0.91 or +1.1% at $83.25

- Natural Gas up $0.02 or +0.4% at $5

- Gold spot up $16.17 or +0.92% at $1781.96

- Copper up $6.2 or +1.31% at $478.3

- Silver up $0.56 or +2.43% at $23.7883

- Platinum up $14.97 or +1.44% at $1056.06

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.