-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Dollar Gains Amid European Lockdowns

EXECUTIVE SUMMARY:

- MERKEL IMPOSES EASTER LOCKDOWN, EXTENDS CURBS IN GERMAN SETBACK

- ASTRAZENECA MAY HAVE GIVEN OUTDATED DETAILS ON COVID VACCINE

- LANE SAYS E.C.B. CAN DECOUPLE EUROZONE BOND MARKET FROM U.S.

- XI-BIDEN MEET LIKELY AT APRIL CLIMATE SUMMIT (MNI EXCLUSIVE)

- EUROPE'S 2021 BOND DEALS HIT HALF TRILLION EUROS IN RECORD TIME

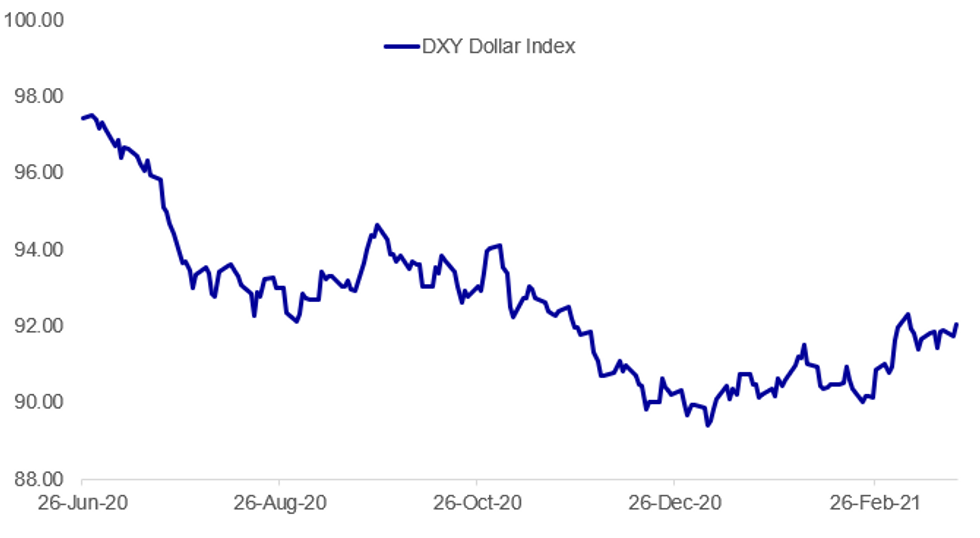

Fig.1: Dollar Moving Higher With Safe Havens In Demand

BBG, MNI

BBG, MNI

NEWS:

GERMANY/COVID (BBG): Chancellor Angela Merkel and regional leaders agreed to put Germany into hard lockdown over Easter to try to defuse a "third wave" of Covid-19 infections fueled by faster-spreading mutations. After more than 11 hours of tense talks that ended early Tuesday, Merkel and state leaders extended existing lockdown measures for four more weeks and postponed plans to reopen Europe's largest economy. But they failed to reach an agreement on tougher measures such as curfews in hard-hit areas and establish rules for domestic travel.

ASTRAZENECA VACCINE (BBG): AstraZeneca Plc may have released outdated information about its Covid-19 vaccine trial, giving an "incomplete" view of the efficacy of the shot, said the leading U.S. agency on infectious diseases. The Data and Safety Monitoring Board, charged with ensuring the safety and accuracy of AstraZeneca's vaccine trial, has expressed concerns to the National Institute for Allergy and Infectious Diseases that the information released about the testing results included outdated information. This "may have provided an incomplete view of the efficacy data," the agency said in a statement early Tuesday, without elaborating.

U.K./E.U./COVID VACCINE (BBG): The European Union and Britain are pursuing talks to break their deadlock over AstraZeneca Plc's coronavirus shots. The goal is to avoid an escalation that could see exports to the U.K. blocked from AstraZeneca's plant in the Netherlands. The EU believes that the drugmaker had double booked its production and that both Brussels and London have valid claims, so European officials have floated the possibility of sharing the facility's output with Britain, according to diplomats familiar with the matter.

E.C.B. (BBG): "The fact that we responded in our March decision by stepping up the pace of purchasing is a reflection that we can decouple if you like the trend in the international bond market with the trend in the euro-area market," ECB chief economist Philip Lane says in interview with CNBC. "It's also the case, as you know, that the increase in yields in recent times in the euro area has not been up to the same scale as in the U.S." ECB's March forecasts "allow for some extension" of lockdown measures into the second quarter.

U.S.-CHINA (MNI EXCLUSIVE): A virtual meeting between Joe Biden and Xi Jinping looks likely to take place on the sidelines of the Global Leaders' Climate Summit Apr. 22 despite last week's rancorous China-U.S. meeting in Alaska, Beijing policy advisors told MNI. For full article contact sales@marketnews.com

E.U. FIXED INCOME (BBG): Europe's bond market has cemented its status as a global funding force with 500 billion-euros ($595 billion) of sales in the fastest time ever. A two-part minimum 1 billion euros social bond from the European Union on Tuesday helped push issuance past the landmark, putting sales so far this year at least 14% ahead of the same period in 2020, according to data compiled by Bloomberg. The milestone wasn't reached until March 31 last year.

E.U. BANKS (BBG): European Central Bank Supervisory Board Chair Andrea Enriasays that lenders should provide the regulator with their suitability assessments before appointing new executives. ECB expects to be informed even if banks "are currently subject to national regulation that allows for ex post assessments only," Enria tells EU Parliament hearing Tuesday.

JAPAN: Japan's government left its main economic assessment unchanged on the previous month, the Cabinet Office released its monthly economic report. "The Japanese economy shows weakness in some components, although it is still picking up" but remains a severe situation due to the Novel Coronavirus." the report said. The government lowered its assessment on exports, noting they are increasing "at a slower pace recently" as overseas demand for autos slows. The downward revision is the first since May 2020.

DATA:

UK Jobless Rate Down in Jan

NOV-JAN LFS JOBLESS RATE 5.0% VS 5.1%

NOV-JAN AVG TOTAL EARNINGS +4.8% VS +4.7% PRIOR

NOV-JAN AVG EARNINGS EX-BONUS +4.2% VS +4.1% PRIOR

FEB CLAIMANT COUNT DOWN 86,600 to 2,682,800

The UK's jobless rate edged slightly lower in Jan, falling to 5.0% from Dec's 5.1%, coming in below expectations of a rise to 5.2%. The employment rate ticked down to 75.0%, while the inactivity rate was 21.0% in Jan. More up-to-date PAYE data showed a 68,000 increase in payrolled employees in Feb compared to Jan, marking a third successive gain. Since Feb 2020 there are 693,000 fewer people in payrolled employment in Feb 2021 and the ONS noted around two-thirds of this decline have been those under under 25, while 328,000 of the decrease was recorded in the hospitality sector. The redundancy rate stood at 11.0 people per 1000 employees in Jan. Vacancy growth slowed in recent months - there were 601,000 vacancies in the three month to Feb, which is 220,000 fewer than a year ago. Actual weekly hours worked eased slightly in Jan to 29.9, following six consecutive months of growth. Total and regular pay both accelerated in Jan to 4.8% and 4.2%, respectively, albeit skewed by composition effects.

FIXED INCOME: Core fixed income in demand

Core fixed income has been in demand this morning, moving higher shortly after 7:30GMT on a safehaven bid which also saw demand for the Swiss franc. There were no significant headlines out at the time, although there is continued talk of the extended lockdowns across the Eurozone. Despite the moves, Eurozone peripheral spreads are only a little wide on the day.

- There are a number of central bank speakers scheduled today and also a hefty chunk of supply led by the EU SURE syndication where E8bln of the 5-year and E5bln of the 25-year tranches are being sold.

- TY1 futures are up 0-7 today at 131-24+ with 10y UST yields down -4.1bp at 1.655% and 2y yields down -0.3bp at 0.146%.

- Bund futures are up 0.31 today at 171.80 with 10y Bund yields down -2.1bp at -0.333% and Schatz yields down -0.7bp at -0.714%.

- Gilt futures are up 0.25 today at 128.00 with 10y yields down -1.7bp at 0.795% and 2y yields unch at 0.067%.

FOREX: Markets in Risk-Off Mode as Lockdown Extensions, Vaccine Ire Weigh

- JPY and USD are among the strongest currencies in G10 so far Tuesday, with growth proxies and antipodeans lagging. AUD and NZD are among the morning's worst performers.

- EUR/USD saw a sharp spell of weakness alongside the European open, with markets moving in a risk averse fashion as traders digested the extension of the German lockdown restrictions in the face of stubbornly high news cases.

- Over-arching USD strength has weighed in most major pairs, with GBP/USD breaking below 1.38 to open next support at 1.3779. Further ire over the UK's vaccine supply continues to take focus, with a decision set to be made by the European Union later in the week.

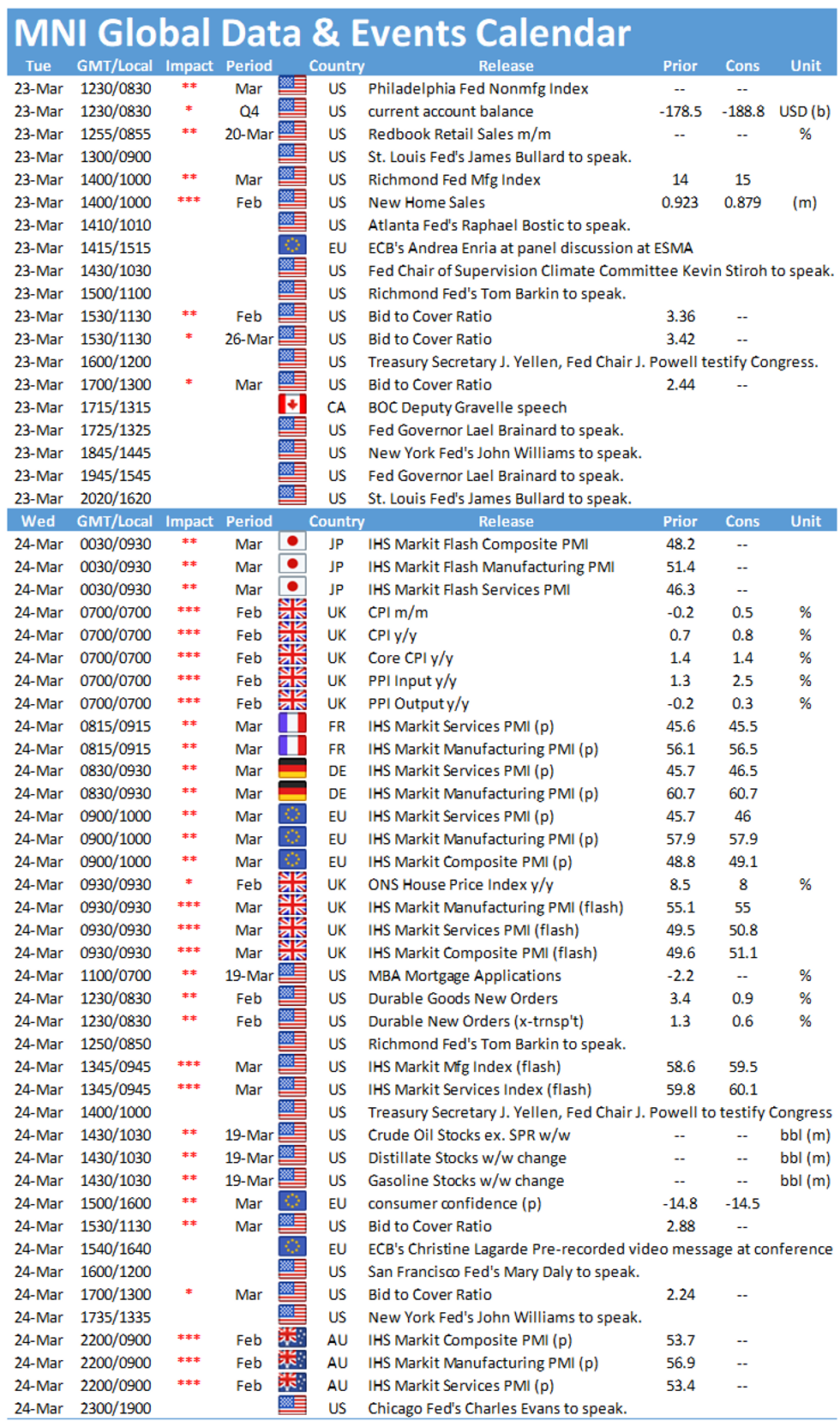

- Focus turns to February new home sales from the US and a busy central bank speaker slate. BoE's Bailey, Haldane & Cunliffe are due as well as ECB's Villeroy. The Fed docket is busier, with 8 speeches scheduled from Fed members - most notably Fed's Powell, who appears alongside Treasury Secretary Yellen in front of the House Financial Services Committee.

EQUITIES: Edging Lower In Early Trade

- Asian stocks closed lower, with Japan's NIKKEI down 178.23 pts or -0.61% at 28995.92 and the TOPIX down 18.7 pts or -0.94% at 1971.48. China's SHANGHAI closed down 31.93 pts or -0.93% at 3411.509 and the HANG SENG ended 387.96 pts lower or -1.34% at 28497.38.

- European equities are weaker too, with the German Dax down 57.25 pts or -0.39% at 14530.26, FTSE 100 down 12.34 pts or -0.18% at 6726.1, CAC 40 down 23.34 pts or -0.39% at 5968.48 and Euro Stoxx 50 down 11.48 pts or -0.3% at 3807.04.

- U.S. futures are off slightly, with the Dow Jones mini down 100 pts or -0.31% at 32519, S&P 500 mini down 11.25 pts or -0.29% at 3918.75, NASDAQ mini down 20.25 pts or -0.15% at 13051.5.

COMMODITIES: Oil Underperforms On Demand Concerns

- WTI Crude down $0.93 or -1.51% at $60.62

- Natural Gas down $0.02 or -0.85% at $2.555

- Gold spot down $0.27 or -0.02% at $1736.97

- Copper down $2.45 or -0.59% at $412.3

- Silver down $0.2 or -0.77% at $25.5726

- Platinum down $10.47 or -0.88% at $1177.77

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.