-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

PIPELINE: $2.2B Nigeria 2Pt Kicks Off December Issuance

MNI US Open: ECB In Focus

EXECUTIVE SUMMARY:

- ATLANTA FED'S BOSTIC: DOOR REMAINS OPEN TO TAPER THIS YEAR (WSJ)

- CHINA ALLOWS EVERGRANDE TO RESET DEBT TERMS TO EASE CASH CRUNCH

- GERMANY'S SCHOLZ: INFLATION DEVELOPMENTS NEED VERY CLOSE MONITORING

- CHINA SAID TO SUSPEND APPROVAL FOR NEW ONLINE GAMES (SCMP)

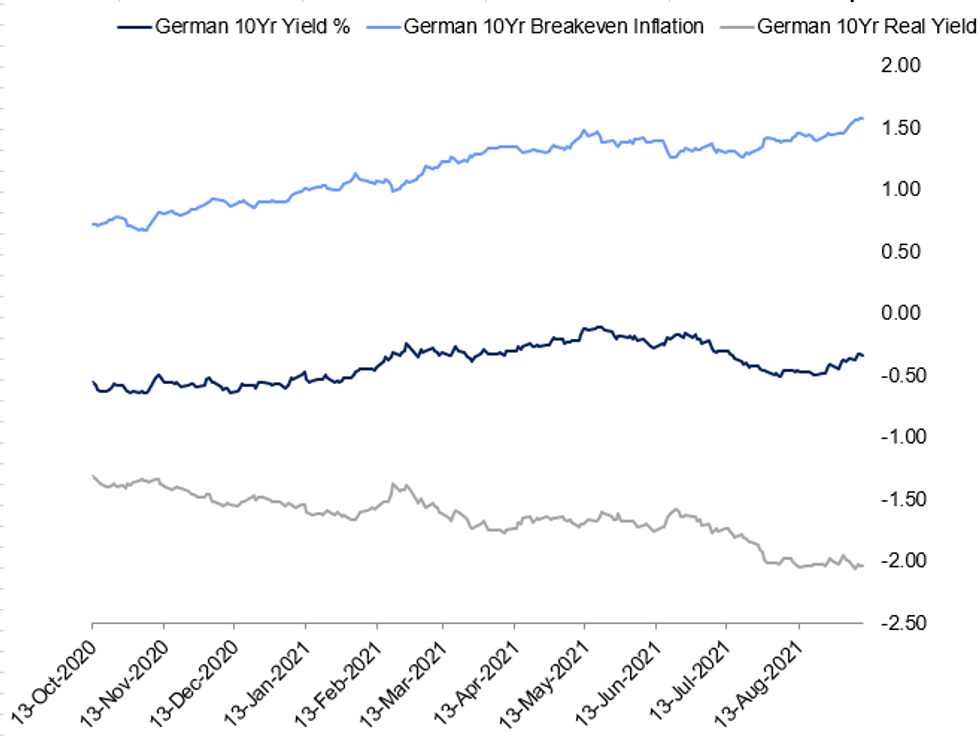

Fig. 1: German Yield Breakdown

Source: BBG, MNI

Source: BBG, MNI

NEWS:

FED (WSJ): Federal Reserve Bank of Atlanta President Raphael Bostic believes the Fed will be able to pull back on its asset buying campaign this year, though he doesn't expect a decision to do so will come at the U.S. central bank's meeting this month. Mr. Bostic, who for most of this year has advocated the Fed pare its $120 billion a month in Treasury and mortgage bond stimulus, said in an interview with The Wall Street Journal that recent data and the resurgence of the coronavirus pandemic call for more time before a decision on reducing stimulus for the economy. Bostic doesn't expect a call to pull back on asset buying to happen at the Sept. 21-22 Federal Open Market Committee meeting. "I wouldn't lean in too heavily to expecting anything on taper at the next meeting," he said.

CHINA / EVERGRANDE (BBG): Regulators in Beijing have signed off on a China Evergrande Group proposal to renegotiate payment deadlines with banks and other creditors, paving the way for a temporary reprieve as the cash-strapped developer struggles to come to grips with more than $300 billion of liabilities. China's Financial Stability and Development Committee, the nation's top financial regulator, gave its blessing to Evergrande's plan last month after the property giant missed interest and principal payments on some loans, a person familiar with the matter said, asking not to be identified discussing private information.

GERMANY (BBG): German Finance Minister Olaf Scholz says gains in consumer prices must be monitored very closely, and cites widespread predictions that faster inflation is a temporary phenomenon. "We have to see if that happens when we have more specific data in the next few months and the next year".

CHINA / GAMING (SCMP): The Chinese government has temporarily suspended approval for all new online games in the country, dealing a fresh blow to the video gaming businesses of industry giants Tencent Holdings and NetEase, as Beijing steps up measures to tackle gaming addiction among young people, according to people with knowledge of the matter.That decision was revealed during a meeting on Wednesday called by Chinese authorities, led by the publicity department of the Chinese Communist Party and gaming watchdog the National Press and Publication Administration (NPPA), to discuss with representatives from Tencent and NetEase how they will implement Beijing's new restrictions on video gaming for minors, according to a person briefed on the matter, but declined to be named because the information is private.The authorities' move means "everything is on hold", the person said.

GERMANY: Income tax reforms proposed by Germany's major political parties will have a positive effect on employment, with those of the FDP creating 330,000 jobs, according to an ifo study (in German). Die Linke's (The Left) plans would create 229,000 new jobs, compared with 100,000 under the CDU/CSU, the SPD's 66,000 and the Greens' 24,000. However, no party's tax reforms would be sufficient to offset government budget shortfalls caused by their spending plans. Each set of plans would have differing effects on income inequality, the same study found, with CDU/CSU/FDP plans decreasing the tax burden on wealthier earners, while those of the Greens and Die Linke would have the opposite effect.

MNI / FED: MNI is hosting a webcast event with Anna Paulson, Executive Vice President and Director of Research at the Federal Reserve Bank of Chicago. Topic of discussion: 'US Economy and Fed Policy'. To register please go to: MNI Webcast Registration

- Time: 10am-11:15am New York time; 3pm-4:15pm London time

- Date: Wednesday 6th October

- This event is on the record

NORTHERN IRELAND: Leader of Northern Ireland's Democratic Unionist Party (DUP) Sir Jeffrey Donaldson delivering a speech as European Commission VP Maros Sefcovic arrives in Northern Ireland for talks on the Northern Ireland Protocol, which remains the major sticking point of EU-UK relations at present. The threat to bring down the Northern Ireland executive, and the Stormont Assembly, could significantly increase political tensions in Northern Ireland, scuppering any prospect of a deal between the UK and EU that is supported by all sides.

DATA:

No key data in the European morning session.FIXED INCOME: ECB Comes Into Focus

Government bonds are broadly bid this morning alongside renewed selling in equities ahead of today's GC meeting.

- The UST curve has bull flattened with the 2s30s spread 2bp narrower. TYZ1 trades at 133-10 and holds within a relatively narrow intraday range (L: 133-06+ / H: 133-12+).

- The gilt curve has flattened on the back of the short-end selling off and long-end yields pushing lower. The 2s30s spread is now down 4bp on the day.

- Bunds have firmed with cash yields 1bp below yesterday's close.

- BTPs have slightly outperformed core EGBs.

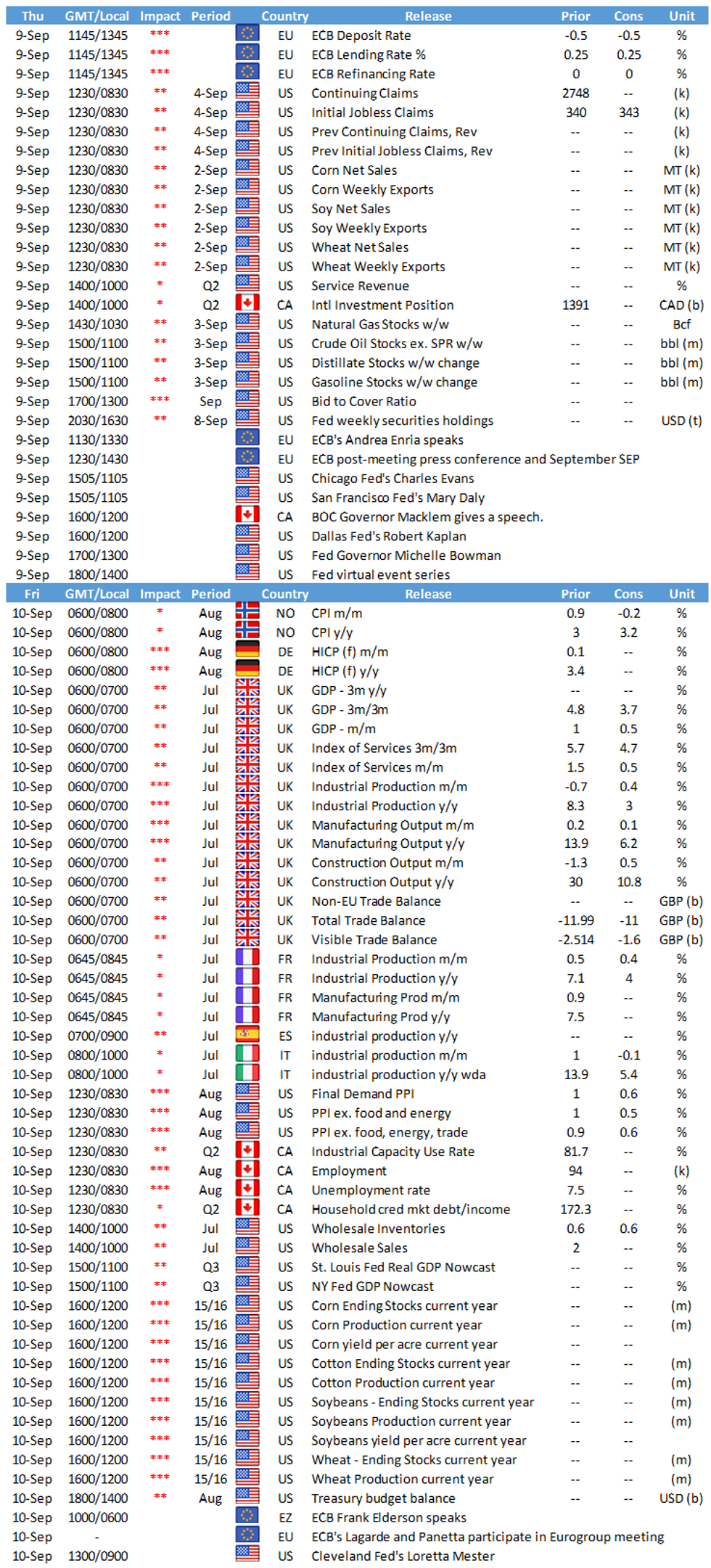

- Focus today will be on the ECB meeting where the GC is widely expected to reduce the PEPP purchase pace alongside an upgrade to staff macroeconomic projections for growth and inflation.

- The European data slate has been light with the only release of note being German trade data for July, which showed an improvement in the trade surplus since June.

- European supply has come from Italy (BOTs, EUR7b) and Ireland (IGB, EUR1.25bn).

FOREX: A good session for the British Pound

- The Greenback remains better offered during our European morning trading session, and that's despite the risk off tone.

- Best performers in G10 versus the Dollar have been the safe haven currencies, JPY and CHF.

- The British Pound has also had a strong performance today, with the currency up against all the majors, following Andrew Bailey's hawkish comment yesterday.

- The USD is down against all G10s, beside the CAD, and trades flat versus the NOK.

- Most G10 crossed trade mostly within ranges, as market participants await on the ECB and Lagarde's presser.

- Looking ahead, US IJC is the only notable data.

- Plenty of speakers are scheduled, including Fed Daly, Evans, Bowman and Williams.

EQUITIES: European Stocks Weaker Ahead Of ECB Decision

- Asian stocks closed mixed, with Japan's NIKKEI down 173.02 pts or -0.57% at 30008.19 and the TOPIX down 14.68 pts or -0.71% at 2064.93. China's SHANGHAI closed up 17.943 pts or +0.49% at 3693.13 and the HANG SENG ended 604.93 pts lower or -2.3% at 25716.

- European equities are lower, with the German Dax down 66.99 pts or -0.43% at 15610.28, FTSE 100 down 81.42 pts or -1.15% at 7095.53, CAC 40 down 25.81 pts or -0.39% at 6668.89 and Euro Stoxx 50 down 26.46 pts or -0.63% at 4177.15.

- U.S. futures are weaker, with the Dow Jones mini down 94 pts or -0.27% at 34918, S&P 500 mini down 13.75 pts or -0.3% at 4498.75, NASDAQ mini down 44.25 pts or -0.28% at 15575.75.

COMMODITIES: Industrial Metals Outperforming

- WTI Crude down $0.23 or -0.33% at $69.42

- Natural Gas down $0 or -0.02% at $4.92

- Gold spot up $5.44 or +0.3% at $1788.24

- Copper up $5.2 or +1.23% at $428.4

- Silver up $0.16 or +0.65% at $23.8688

- Platinum up $1.28 or +0.13% at $978.69

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.