-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: ECB Set To Hold Fire As PEPP Debate Simmers

EXECUTIVE SUMMARY:

- E.C.B. SET TO HOLD FIRE FOR NOW AS PEPP DEBATE SIMMERS

- FRENCH BUSINESS CLIMATE EASED IN APRIL

- GERMANY WANTS TO BUY UP TO 30MN DOSES OF SPUTNIK VACCINE

- CREDIT SUISSE RAISES $2BN, WARNS ON MORE ARCHEGOS PAIN

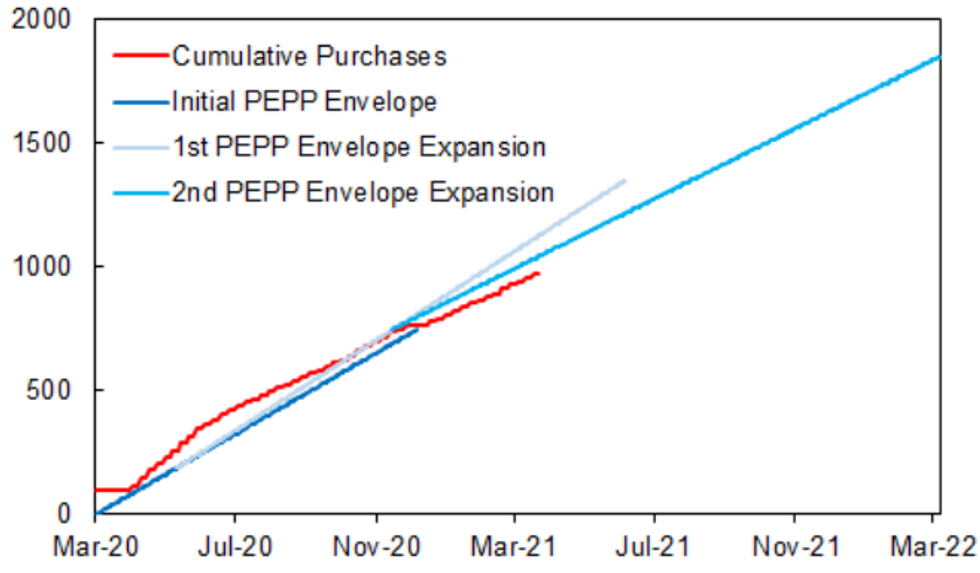

Fig. 1: Cumulative ECB PEPP Purchases, EURbn

ECB, MNI

ECB, MNI

NEWS:

ECB: This week's ECB meeting is widely expected to be a low-risk event. Nonetheless, competing views on the economic trajectory and the lifespan of PEPP are starting to emerge, which could come into sharper focus by the time of the June meeting. No change in policy or the economic outlook expected today, focus will be on commentary around weekly PEPP purchases. Our full preview is here: https://roar-assets-auto.rbl.ms/documents/9624/ECB...

ECB (MNI EXCLUSIVE, PUBLISHED APR 21): A suggestion that the European Central Bank could soon reduce the pace of its Pandemic Emergency Purchase Programme was an early shot in what it is set to become a fierce battle over the future of extraordinary monetary stimulus, with eurosystem sources telling MNI of deep Governing Council differences over the strength of recovery as the eurozone contends with another Covid wave. For full article contact sales@marketnews.com

CREDIT SUISSE/ARCHEGOS (BBG): Credit Suisse Group AG is raising about $2 billion to shore up capital after warning of another financial hit from the Archegos Capital Management collapse, adding to the Swiss bank's woes after two blow-ups within a month left investors nursing losses and questioning its leadership.The bank, which has exited about 97% of its exposure to Archegos, said it expects a related 600 million-franc ($654 million) hit in the second quarter and has tapped investors for about 1.8 billion francs of funding with two notes convertible into 203 million shares. Swiss regulator Finma has now started enforcement proceedings against Credit Suisse and the bank said it plans to cut back the prime brokerage business at the center of the blow up.

EU / PORTUGAL (BBG): European Commission will assess the Portuguese recovery plan, the first one to be officially submitted, within the next two months based on the eleven criteria set out in the regulation and will also assess whether the plan dedicates at least 37% of expenditure to investments and reforms that support climate objectives, and 20% to the digital transition, according to statement.

GERMANY/COVID (RTRS): Germany wants to buy up to a total 30 million doses of Russia's Sputnik V COVID-19 vaccine in June, July and August as long as the European drugs regulator gives the shot the green light, the premier of the state of Saxony, Michael Kretschmer, said on Thursday in Moscow.Health minister Jens Spahn said earlier this month that Germany was negotiating with Russia on an advance purchase agreement of Sputnik V.

GERMANY/COVID (BBG/BILD): Germany may be in a position to lift vaccination prioritization from the end of May, a step that would open access to all adults, Bild-Zeitung reports, citing internal discussions between the government and federal states. Current high delivery volumes of vaccine behind government optimism priority groups will have been treated by then. Chancellery Chief of Staff Helge Braun confirms to Bild that prioritization may be lifted at the end of May or early June, topic will be discussed at next meeting between federal government and states on April 26.

EU/UK: RTE's Tony Connelly tweets: "BREAKING: the European Parliament will vote next Tuesday to ratify the EU UK trade agreement (TCA) - source". Since the start of 2021 the Trade and Cooperation Agreement has been applied provisionally, waiting for its ratification by the European Parliament and member state parliaments.

JAPAN: Japanese life insurance firms are planning to boost holdings of both longer-dated domestic bonds and unhedged foreign bonds, two industry leading firms, Dai-Ichi Life and Sumitomo Life, said Thursday. Dai-Ichi, Japan's second biggest lifer by assets, will increase its unhedged holdings of foreign bonds -- mainly corporate and agency -- if it doesn't see increased signs of a sharp yen rise, according to Akifumi Kai, general manager of the investment planning department. Sumitomo life plans to increase longer-end JGB holdings by several hundred billion yen this fiscal year, Toshio Fujimura, general manager of Investment Planning Department at Sumitomo Life, told reporters, while unhedged foreign bond holdings will increase by about JPY100 billion. The plan reflects that the company doesn't expect the yen to appreciate against the U.S. dollar, he said.

DATA:

FR Business Climate Eased in April

APR BUS CLIM INDICATOR 95; MAR 97

APR MFG SENTIMENT 104; MAR 99

APR SERVICES SENTIMENT 91; MAR 94

- French business climate edged down to 95 in Apr, falling 2pt from 97 recorded in Mar and coming in stronger than markets expected (BBG: 94).

- Insee noted that the tightening of restrictions at the end of Mar weighed on the forward-looking components of the services and retail trade sentiment indices.

- While services confidence dropped 3pt to 91 in Apr, retail trade sentiment declined 5pt to 90, both recording a two-month low.

- Business climate in the manufacturing sector rose 5pt to 104 in Apr, surpassing expectations looking for a 1pt uptick and shifting the index back above the long-term average.

- The report showed the assessment of order books, personal perspectives of production and past production improved in Apr.

- Employment climate was stable in Apr, remaining at Mar's level of 92.

FIXED INCOME: Awaiting The ECB

Sovereign bonds are broadly trading a touch firmer heading into today's ECB meeting. Although no changes to monetary policy or the economic outlook are expected, markets will be focused on any commentary around the weekly PEPP purchases.

- USTs initially rallied in the European morning, but quickly gave back gains to trade near yesterday's close. TYM1 trades at 132.18, near the bottom end of the day's range (L: 132-17 / H: 132-24+).

- The gilt curve has flattened with the 2s30s spread 2bp narrower on the day. Short sterling futures are broadly flat/1.0 ticks higher in whites through blues.

- Bunds have similarly inched higher with the curve 1bp flatter.

- BTPs opened strongly but soon retraced with cash yields now within 1bp of the last close.

- French manufacturing confidence data for April came in slightly better than expected.

FOREX SUMMARY

USD started the European early session on the back foot, in the red against most G10s, but the Greenback has now pared losses and trend in the Green.

- Turnovers in G10s are running circa 20%-30% of the 5 day averages, with most desk on the sideline ahead of the ECB.

- As our Preview noted: This week's ECB meeting is widely expected to be a low-risk event.

- Nonetheless, competing views on the economic trajectory and the lifespan of PEPP are starting to emerge, which could come into sharper focus by the time of the June meeting.

- The Kiwi and the Pound are the worst performers against the Dollar, down 0.51% and 0.21% respectively.

- Cable led the way lower, with a quick 22 pip drop as we broke the early morning tight range.

- Cable is near yesterday's low, hovering around the 1.3900 figure (1.3886 was yesterday's low).

- The Kiwi is down against all majors, initially led by some AUDNZD buying interest overnight, but picked up further downside momentum versus the NOK this morning, down 0.62% versus the latter.

- Looking ahead, focus turns to the ECB and presser, EC Consumer Confidence is the last EU data left on the calendar.

- On the other side of the pond, US IJC is the most notable data

EQUITIES: Europe Stocks Bid Pre-ECB

- Asian markets closed mostly higher, with Japan's NIKKEI up 679.62 pts or +2.38% at 29188.17 and the TOPIX up 34.32 pts or +1.82% at 1922.5. China's SHANGHAI closed down 7.816 pts or -0.23% at 3465.114 and the HANG SENG ended 133.42 pts higher or +0.47% at 28755.34

- European equities are stronger, with the German Dax up 70.09 pts or +0.46% at 15265.01, FTSE 100 up 19.21 pts or +0.28% at 6906.25, CAC 40 up 49.24 pts or +0.79% at 6243.37 and Euro Stoxx 50 up 26.93 pts or +0.68% at 4003.81.

- U.S. futures are flat/down, with the Dow Jones mini down 24 pts or -0.07% at 33992, S&P 500 mini down 4 pts or -0.1% at 4160.75, NASDAQ mini down 3 pts or -0.02% at 13916.25.

COMMODITIES: Weaker Across The Board As Dollar Gains

- WTI Crude down $0.47 or -0.77% at $60.95

- Natural Gas down $0.02 or -0.71% at $2.681

- Gold spot down $3.75 or -0.21% at $1791.53

- Copper down $0.8 or -0.19% at $428.25

- Silver down $0.17 or -0.65% at $26.4724

- Platinum down $10.93 or -0.9% at $1212.13

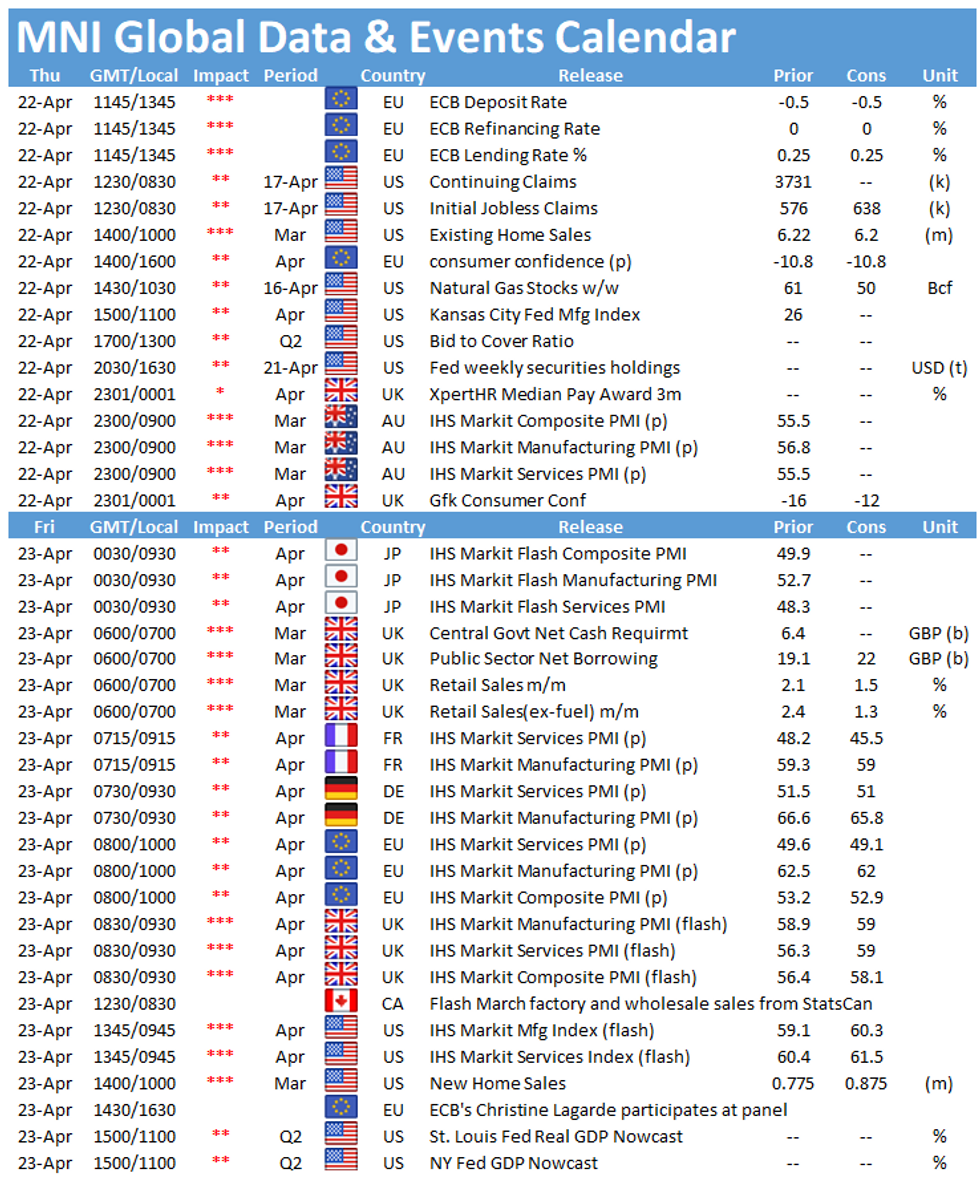

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.