-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Energy Leads Equity Gains On Higher Oil

EXECUTIVE SUMMARY:

- BIDEN ADMINISTRATION UNVEILS WINTER COVID STRATEGY

- MERKEL TO ENFORCE "LOCKDOWN FOR UNVACCINATED" WITH COVID SURGING

- PFIZER EXECUTIVE EXPECTS VACCINE TO HOLD UP TO OMICRON

- EUROZONE FACTORY GATE INFLATION SEES OCTOBER SURGE

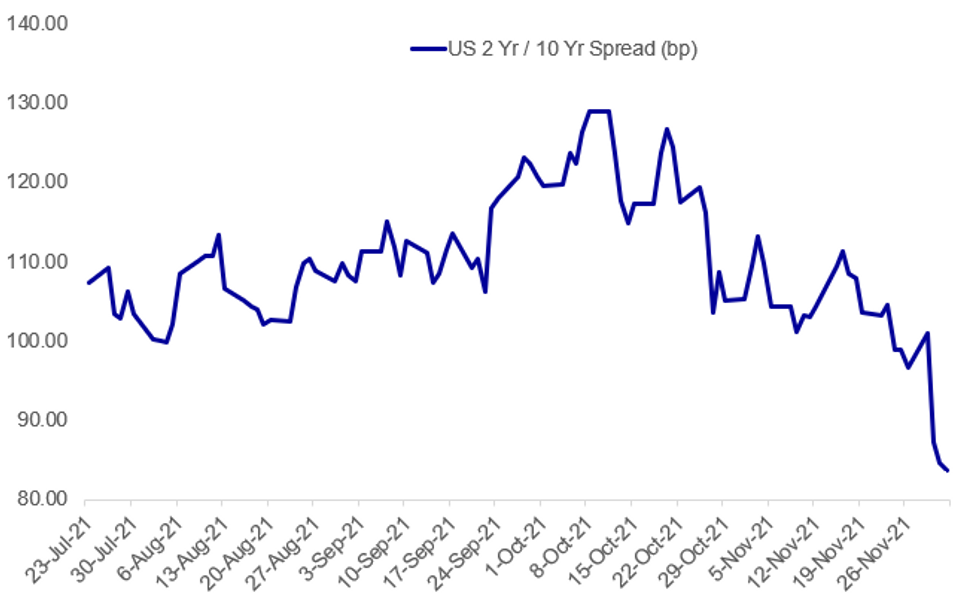

Fig. 1: US Curve Flattening Continues

Source: BBG, MNI

Source: BBG, MNI

NEWS:

US / COVID (DJ): President Biden plans to tighten up Covid-19 testing timelines for travelers entering the U.S. and extend a mask mandate on airplanes and other public transportation as part of a broad administration effort to combat the Omicron variant.International travelers coming to the U.S. will have to test within a day of departure, regardless of vaccination status, rather than the 72 hours currently required for vaccinated travelers, under new protocols early next week, senior administration officials said. The new testing rules will apply both to U.S. citizens and foreign nationals entering the country. The administration will also require travelers to wear masks through mid-March on planes, buses and trains, and at domestic transportation hubs such as airports and indoor bus terminals, rather than allowing the requirement to expire on Jan. 18 as planned. Fines will continue to be double their initial levels, with a minimum fine of $500 for noncompliance and up to $3,000 for repeat offenses.

US / COVID (DJ): Other measures include expanding access to at-home, over-the-counter Covid-19 tests and ensuring they are covered by private insurance or offered free at health centers; launching family-vaccination clinics; and issuing checklists for schools to promote vaccination. The administration is also ramping up its push around booster shots, and Mr. Biden on Thursday is expected to announce a public-education campaign that will target seniors and a program with pharmacies to reach out to Americans who are eligible for a booster.

GERMANY / COVID (BBG): Germany is poised to clamp down on people who aren’t vaccinated against Covid-19 and drastically curtail social contacts to ease pressure on increasingly stretched hospitals. In one of her final acts as chancellor, Angela Merkel will hold talks with Germany’s 16 regional premiers later on Thursday at which they’re expected to agree on new curbs including allowing only people who are vaccinated or recovered into restaurants, theaters and non-essential stores.

COVID / PFIZER (BBG): Pfizer Inc. expects its Covid-19 vaccine to hold up against the omicron variant, an executive said, and data on how well it protects should be available within two to three weeks. “We don’t expect that there will be a significant drop in effectiveness,” Ralf Rene Reinert, vice president of vaccines for international developed markets, said in an interview with Bloomberg Television. “But again, this is speculation. We will check this. We will have the data in the next couple of weeks.”

OIL / OPEC+: Reuters reporting that OPEC+ will likely discuss pausing oil output hike for January among its options, according to an unnamed OPEC+ source. The Joint Ministerial Monitoring Committee (JMMC) and OPEC+ meetings takeplace today following a short postponement to allow the body to assess the potential impact of the spread of the Omicron COVID-19 variant on oil markets.

APPLE/ U.S. EQUITIES: Apple Inc. shares fell after the iPhone maker was said to tell suppliers that demand for its flagship product has slowed. Wall Street analysts, however, remained bullish. The stock dropped as much as 1.8% in U.S. premarket trading to $161.86. Shares in iPhone suppliers also fell in Asia and Europe after the Bloomberg report, which said that Cupertino-based Apple told component makers that demand for its iPhone 13 lineup has weakened.

CHINA / COVID: China will continue to closely monitor changes in the global pandemic situation, study the impact on the country's foreign trade and supply chain in a timely manner, said Shu Jueting, spokeswoman of the Ministry of Commerce at a briefing on Thursday. China will study policy measures to deal with possible problems faced by exporters and importers, said Shu, when asked if the new Covid-19 variant Omicron would challenge the global supply chain and affect China's trade.

AUSTRIA (BBG): Interior Minister Karl Nehammer may assume chancellor role after taking over as head of People’s Party from Sebastian Kurz, Kurier newspaper says without citing anyone.

DATA:

MNI: EZ OCT PPI +5.4% M/M, +21.9% Y/Y; SEP +16.0% Y/Y

EUROZONE DATA: Factory gate inflation sees October surge

Eurozone factory gate inflation skyrocketed by 5.4% between October and November, bringing the annual rate of increase to a record-smashing 21.9%, according to data released by Eurostat on Thursday.

- Shortages in European gas supplies, accounted for much of the increase, rising by 16.8% between October and November, taking the annual rise to 62.5%.

- Excluding energy, PPI rose by 0.8% over the month and by still-historically-high 8.9% over October of 2020.

- The producer price data suggest the consumer price inflation could continue to accelerate from the euro-era-high of 4.9% in November.

- EZ PPI now far exceeds the elevated rate in the UK, where output prices rose by 8.0% over October of 2021, while input prices jumped by 13.0%.

MNI: EZ OCT UNEMPLOYMENT RATE 7.3%; SEP 7.4%

FIXED INCOME: Core FI divergence as CB reactions to Omicron seem to diverge

There has been clear divergence between Treasuries and gilts/Bund this morning. Treasuries continue to underperform after Mester's comments last night that a faster tapering pace was still on the table to give the Fed optionality to raise rates to combat inflation if needed. This follows up Powell's comments a couple of days ago and seems to suggest that the Fed is seeing the Omricon as more a future risk rather than an increase in uncertainty that should delay any policy actions. This seems to contrast with comments from the BOE and ECB recently.

- Looking ahead the highlight of today's CB-speak are likely to come from Daly and Barkin at the Peterson Institute. We also have weekly claims data.

- TY1 futures are down -0-5 today at 130-24+ with 10y UST yields up 3.2bp at 1.437% and 2y yields up 4.4bp at 0.598%.

- Bund futures are up 0.35 today at 172.42 with 10y Bund yields down -0.8bp at -0.354% and Schatz yields down -0.6bp at -0.778%.

- Gilt futures are up 0.23 today at 126.43 with 10y yields down -0.5bp at 0.814% and 2y yields down -0.4bp at 0.513%.

FOREX: GBP Stronger, But Rallies Contained For Now

- GBP is furtively the best performer across G10, putting GBP/USD back above the 1.33 handle and EUR/GBP either side of 0.8500. CAD and EUR similarly trade well, but market moves are shallow in the wake of recent market volatility.

- NOK is the notable underperformer, with USD/NOK making headway above the 9.00 handle to close in on the cycle best printed earlier in the week at 9.1299.

- The USD Index trades on the backfoot, running off the week's Powell-inspired highs, but the index remains comfortably north of the week's lows. The potency of the newly discovered Omicron variant remains top of mind for markets, with markets still awaiting data on the ability of the strain to evade vaccine-acquired immunity.

- The data slate is quieter Thursday, but markets may pay some heed to the weekly jobless claims numbers ahead of Friday labour market report. There are a number of Fed speakers to digest, with Fed's Bostic, Quarles, Daly and Barkin all on the docket. ECB's Panetta also makes an appearance.

EQUITIES: Energy Leads, Tech Lags

- Asian markets closed mostly lower: Japan's NIKKEI closed down 182.25 pts or -0.65% at 27753.37 and the TOPIX ended 10.37 pts lower or -0.54% at 1926.37. China's SHANGHAI closed down 3.049 pts or -0.09% at 3573.836 and the HANG SENG ended 130.01 pts higher or +0.55% at 23788.93.

- European equities are weaker, with the German Dax down 132.23 pts or -0.85% at 15330.34, FTSE 100 down 51.63 pts or -0.72% at 7124.67, CAC 40 down 62.96 pts or -0.91% at 6825.56 and Euro Stoxx 50 down 44.06 pts or -1.05% at 4131.37.

- U.S. futures are bouncing a little (though tech lags), with the Dow Jones mini up 324 pts or +0.95% at 34326, S&P 500 mini up 34.5 pts or +0.77% at 4543, NASDAQ mini up 77 pts or +0.49% at 15946.75.

COMMODITIES: Oil Gains As OPEC+ Mulls Options

- WTI Crude up $1.39 or +2.12% at $67.08

- Natural Gas up $0.05 or +1.08% at $4.31

- Gold spot down $9.57 or -0.54% at $1771.11

- Copper up $1.7 or +0.4% at $426.15

- Silver up $0.04 or +0.18% at $22.3445

- Platinum up $7.39 or +0.79% at $943.74

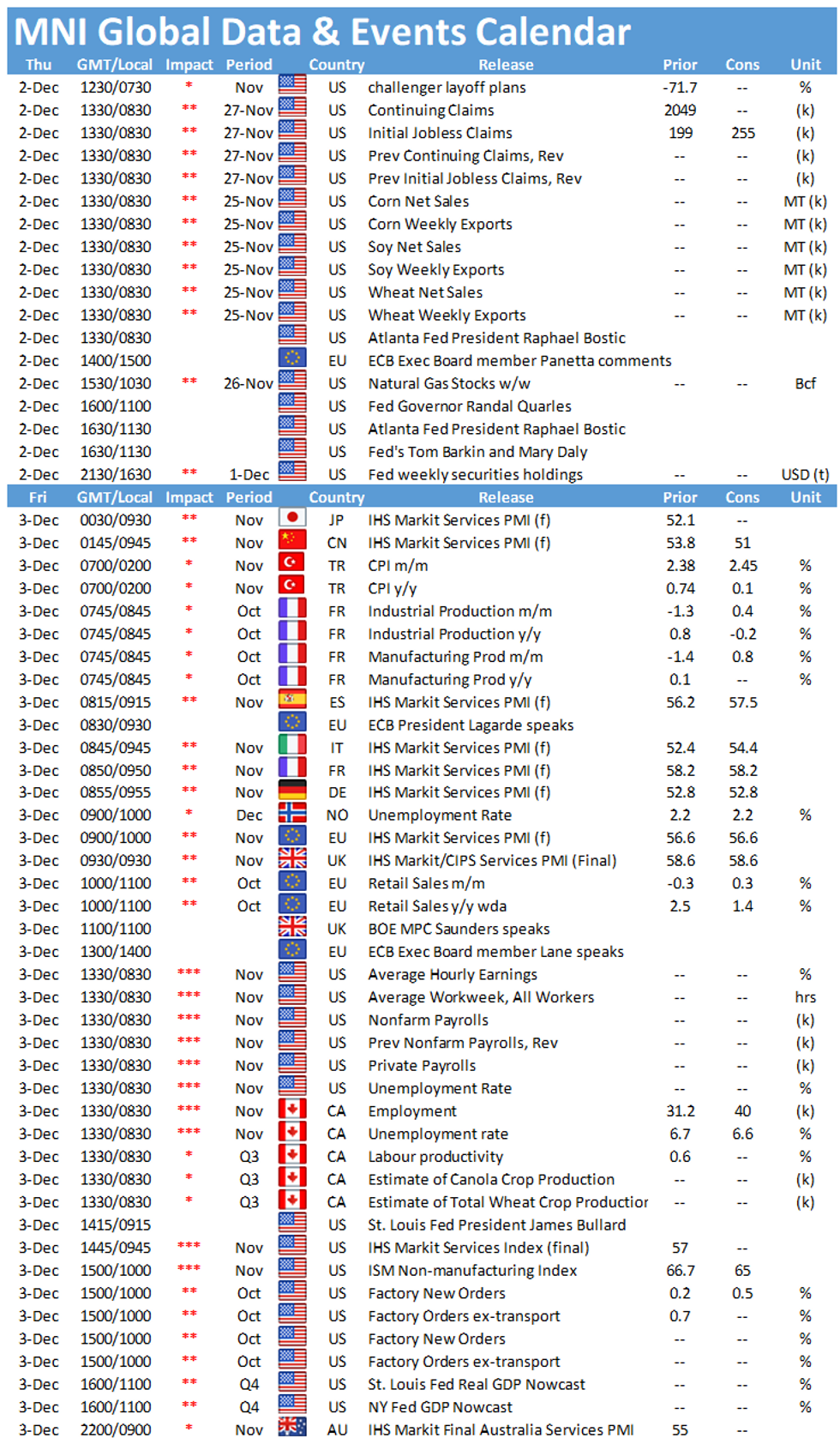

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.