-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Equities Bouncing To New All-Time Highs

EXECUTIVE SUMMARY:

- V.P. HARRIS BLASTS CHINA, SAYS U.S. WON'T PUSH ASIA TO PICK SIDES

- G7 LEADERS TO DISCUSS AFGHANISTAN

- GERMAN GDP REVISED UP, BUT STILL BELOW PRE-COVID LEVEL

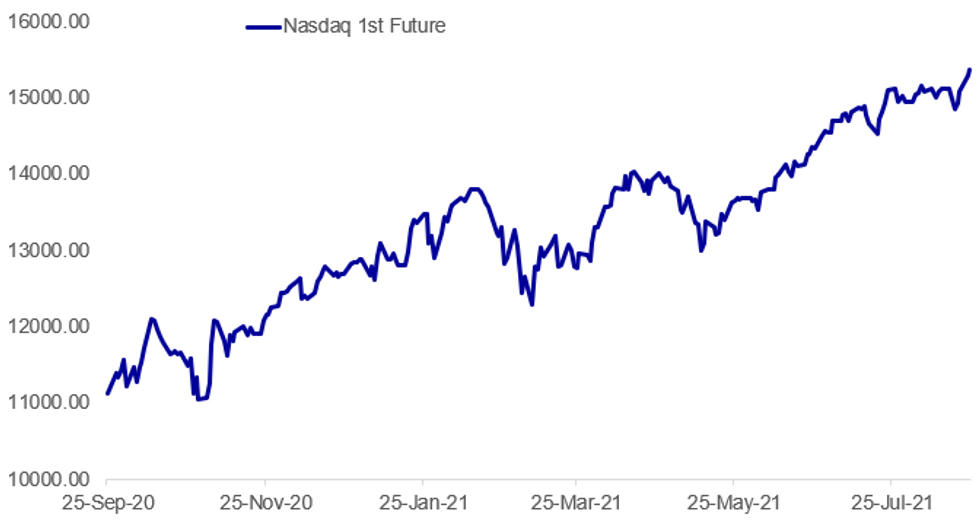

Fig. 1: Fresh All-Time Highs For Nasdaq Futures

Source: BBG, MNI

Source: BBG, MNI

NEWS:

US/CHINA (BBG): Vice President Kamala Harris warned that China poses a threat to countries in Asia, while reassuring nations in the region the U.S. won't force countries to choose between the world's biggest economies. In a speech in Singapore on Tuesday, Harris spoke about the U.S. vision for a region built on rules, human rights, freedom of the seas and unimpeded commerce. She also offered for the U.S. to host the 2023 summit of the 21-member Asia-Pacific Economic Cooperation forum, signifying the administration's commitment to multilateral engagement.

U.S. (BBG): Harris's planned departure from Singapore on Tuesday was delayed for an unknown reason. It was unclear how long Harris will remain in Singapore. She'd been scheduled to depart for Vietnam, the second leg of a trip to Southeast Asia, at 4 p.m. local time. The White House didn't immediately respond to a request for comment on the reason for the delay.

G7/AFGHANISTAN: The G7 leaders videoconference to discuss the situation in Afghanistan takes place at 1430BST (0930ET, 1530CET) [contrary to the Political Risk Week Ahead which stated the call was due at 1330BST].

- European G7 leaders UK PM Boris Johnson, French President Emmanuel Macron and German Chancellor Angela Merkel believed to be the two heads of gov't most keen on extending the deadline for evacuating individuals from Kabul beyond the 31 August date set by the Biden administration in the US.

- However, expectations for an extension of this deadline are low, with UK Defence Secretary Ben Wallace warning that there are "hours, not weeks" to get people out of Kabul, and the Taliban holding firm that they will not allow Western forces to stay unmolested at the airport beyond the end of the month.

- Following the call, President Biden is expected to deliver remarks at 1200ET (1700BST, 1800CET), while European Commission and Council Presidents Ursula von der Leyen and Charles Michel speak beforehand at 1700CET (1100ET, 1600BST).

- Before the call, the chairs of the various G7 member state parliamentary foreign affairs committees have called on the leaders to avoid unilateral talks with the Taliban, instead waiting until all members have agreed to discussions with the group.

- Participants favoured a 10-12Y initial Green issuance in September, with a 20-30Y maturity Green follow-up in October - in line with our expectations.

- Some advocated a launch of a new 2032 maturity Gilt to become the next 10Y benchmark. As we noted in our Deep Dive, we favour a Jul-32 maturity.

- Some favoured a new ultra-long linker (2071-74 maturity), others a re-opening of the 2051 linker, and some investors wanted a new 40Y maturity linker. MNI looks for a long-dated linker syndication to be held on 23 November.

- The issuance calendar for the Oct-Dec period will be published at 7:30BST on 31 August.

GERMANY Q2 FINAL GDP +1.6% Q/Q SA; +9.4% Y/Y WDA

Germany's economy recovered strongly in the second quarter, data released Tuesday confirmed, although the economy still remains around 4% below the pre-pandemic levels of Q4 2019. GDP growth was 1.6% quarter-on-quarter, revised up 0.1% from the preliminary reading, Destatis, the national statistics agency said.

Growth was revised higher to 9.4% y/y, up from the preliminary reading of 9.2%.

Private consumption came in below expectations, up 3.2% q/q against a 5.4% decline in Q1. Government spending was ahead of forecasts, rising 1.8% q/q vs a rise of just 0.2% in Q1.

FIXED INCOME: Core FI Off Session Lows, USTs Underperforming

Global core FI has bounced from intraday lows in London trade, with most instruments now well above Monday's worst levels.

- Some modest flattening in the UK and German curves, with the US underperforming / bear steepening slightly. Notably, US equities outperforming, with the dollar a little stronger.

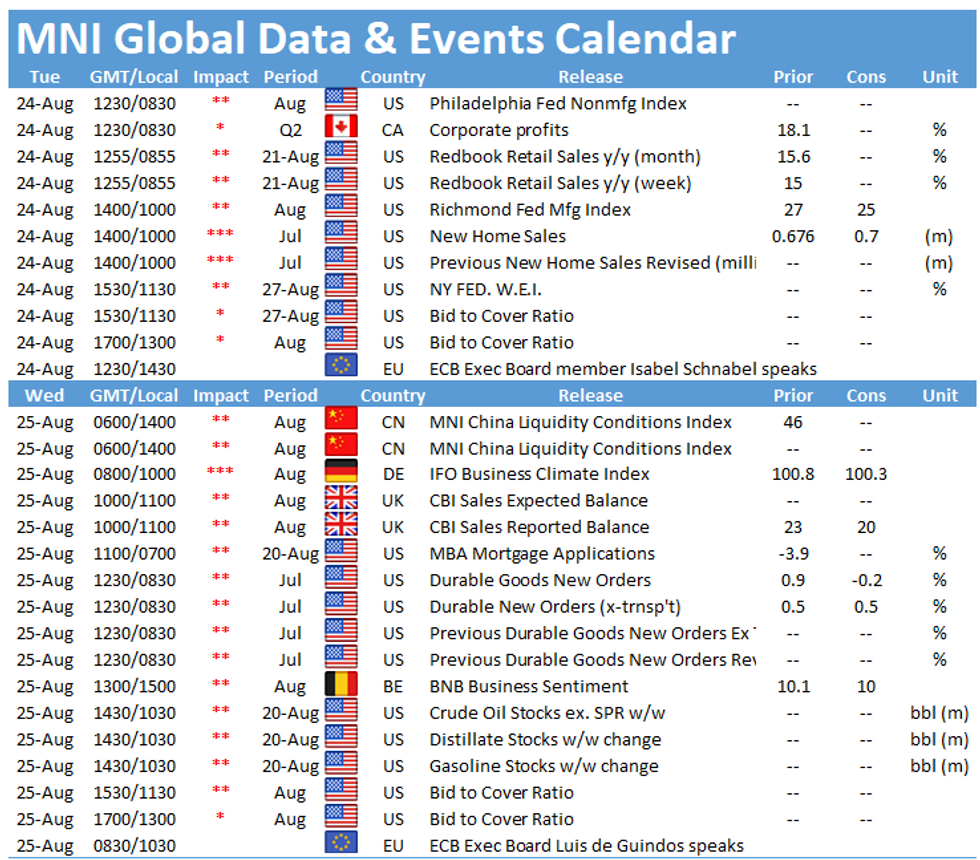

- With a quiet calendar on both the data (German GDP was revised higher in the final reading; US sees Richmond Fed and new home sales later) and speaker (ECB's Schnabel the only one scheduled) front, supply is the focus.

- In Europe we had GBP3bln 5Y auction (which was weak), with Finland 5Y E3bln syndication underway and German 4bln 7Y Bund sale coming up. $60B of US 2Y Note on sale later.

- Rolls are the theme in UK and US futures, running between 10-20% complete.

Latest levels:

- Sep US 10-Yr futures (TY) down 1.5/32 at 134-05.5 (L: 134-01 / H: 134-07.5)

- Sep Bund futures (RX) up 8 ticks at 176.97 (L: 176.66 / H: 177.01)

- Sep Gilt futures (G) up 5 ticks at 130.18 (L: 129.93 / H: 130.25)

- Italy / German 10-Yr spread 1.2bps tighter at 105bps

FOREX: USD fades some of its weakness

- USD has pared some of its overnight and early morning losses, as Equities loses upside momentum.

- It is still worth noting that the Mini S&P printed another record high, trading just short of the next psychological target at 4500, printed 4492 high.

- The Dollar is now more mixed in G10, up 0.14% versus the EUR, and down 0.55% against the NZD.

- The Kiwi has been the standout currency during our morning European session.

- A weaker Dollar and overnight Retail Sales Ex inflation QoQ beat, has keep the currency underpinned.

- The Kiwi is up across the board in the majors, beside the KRW, just flat on the session.

- AUDNZD is through the August double bottom (1.0420) and the December low (1.0418), now lowest level since 13th April 2020.

- Next support in the pair is now at 1.0392.

- Looking ahead, we have very little in terms of market moving data.

- At 14.30BST/09.30ET The US President meets virtually with G7 leaders to discuss Afghanistan policy.

- And at 16.00BST/11.00ET: President of the European Commission Ursula von der Leyen and President of the European Council Charles Michel give joint press conference following the G7 leaders' meeting.

EQUITIES: NASDAQ Futures At Fresh Record Highs

- Asian stocks closed higher, with Japan's NIKKEI up 237.86 pts or +0.87% at 27732.1 and the TOPIX up 19.06 pts or +1% at 1934.2. China's SHANGHAI closed up 37.339 pts or +1.07% at 3514.471 and the HANG SENG ended 618.33 pts higher or +2.46% at 25727.92.

- European equities are mixed, with the German Dax up 53.75 pts or +0.34% at 15852.79, FTSE 100 down 0.41 pts or -0.01% at 7109.02, CAC 40 down 4.99 pts or -0.07% at 6683.1 and Euro Stoxx 50 up 8.32 pts or +0.2% at 4176.42.

- U.S. futures are higher, led by tech, with the Dow Jones mini up 49 pts or +0.14% at 35330, S&P 500 mini up 9.25 pts or +0.21% at 4484.75, NASDAQ mini up 68.25 pts or +0.45% at 15372.75.

COMMODITIES: Oil Continues To Bounce

- WTI Crude up $0.66 or +1.01% at $66.02

- Natural Gas down $0.01 or -0.35% at $3.933

- Gold spot down $3.55 or -0.2% at $1803.95

- Copper up $1.1 or +0.26% at $419.85

- Silver down $0.01 or -0.06% at $23.621

- Platinum down $1.74 or -0.17% at $1015.37

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.