-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

MNI US Open: Equity Bounce Starting To Fade

EXECUTIVE SUMMARY:

- OIL FALLS WITH POSSIBLE RETURN OF IRANIAN SUPPLIES

- CHINA SEEN GROWING AT LEAST 6% IN H2; SPENDING TO RECOVER (MNI)

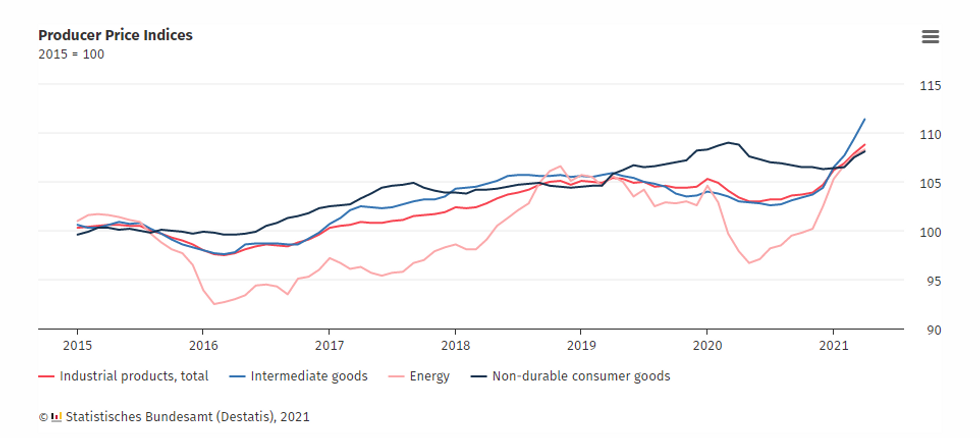

- GERMAN PRODUCER PRICE INFLATION NEAR 10-YEAR HIGH

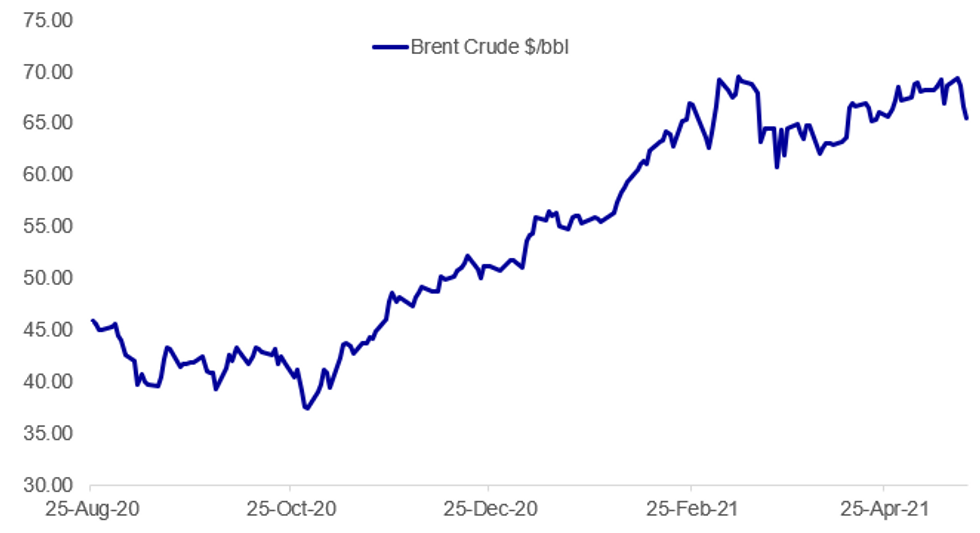

Fig. 1: Oil Weaker Again

BBG, MNI

BBG, MNI

NEWS:

OIL (RTRS): Oil prices were poised for a third day of losses on Thursday after diplomats said progress was made towards a deal to lift sanctions on Iran, which could boost crude supply. European powers, the United States and Iran have made progress in talks over Tehran's nuclear programme that could result in sanctions on Iranian oil being lifted. The EU official leading the talks said on Wednesday he was confident a deal would be reached as the negotiations adjourned.

CHINA: China may grow at least 6% in the second half of this year bringing annual growth to above 8% as consumption recovers to pre-pandemic levels with rising vaccination rates and as real-estate investment stays resilient, Beijing policy advisors told MNI. Although high commodity prices and Beijing's attempts to control debt may reduce some growth momentum, they will be offset by greater demand for Chinese products as the western recovery gathers pace, they said. However, growth may drop below 6% next year as the comparison with Covid-affected 2020 no longer figures in calculations and as global demand softens.

NEW ZEALAND: The New Zealand Government will boost spending on social benefits, health and infrastructure as it forecasts net Government debt to hit 43.6% of GDP by 2025, around double the pre-COVID-19 level. Finance Minister Grant Roberson said the 2021 budget was based on a faster NZ recovery than expected, with GDP growth forecast to average 3.4% over the next four years, rising from 2.9% this year to 4.4% in 2023 before plateauing -- significantly higher than previous estimates.

EU/COVID VACCINES: European Commission tweets: "Today we signed a third contract with BioNTech-Pfizer for an additional 1.8 billion doses between end 2021 and 2023. This is good news for our long-term fight to protect European citizens against the virus and its variants."

- Link to statement: https://ec.europa.eu/commission/presscorner/detail...

- Since the rancour that surrounded the reduced delivery of AstraZeneca doses in February this year and the subsequent, largely unfounded, fears surrounding blood clots the EU has put significant focus on securing more Pfizer/BioNTech doses.

- The prime reason behind this is that it is largely produced within the EU, and as such member states would not be reliant on shipment of doses from outside the bloc.

DATA:

German PPI Hits Near 10-Year High in April

GERMANY APR PPI +0.8% M/M, +5.2% Y/Y; MAR +3.7% Y/Y

- Annual PPI surged to 5.2% in Apr, while monthly PPI edged up 0.8%, both in line with market expectations (BBG: 5.2%)

- This marks the fifth consecutive positive reading and the highest since Aug 2011 (

- April's gain was driven by a sharp increase in energy price inflation, rising by 10.6%, and intermediate goods prices which were up 8.2% and recorded the highest increase since Feb 2011.

- Excluding energy, PPI ticked up 3.6% in Apr.

- Energy inflation was led by higher electricity prices as well as prices for mineral oil products, which were driven by base effects as oil prices fell sharply in Apr 2020.

- Intermediate goods inflation was led by secondary raw materials (+62.7%) , such as wood and metals, but also steel prices were up sharply due to raw material shortages.

- Meanwhile, consumer goods inflation rose by 1.6% and capital goods prices were up 1.0% in Apr.

Source: Destatis

EZ MAR CONS OUTPUT +2.7% M/M, +18.3% Y/Y; FEB -2.0% M/M

MNI: EZ MAR CURRENT ACCOUNT +EUR18 BN; FEB +EUR26 BN

FIXED INCOME: Some divergence

- It has been a more mixed session for core fixed income this morning with Treasuries higher on the day but Bunds and gilts now largely unchanged after weak starts to the day.

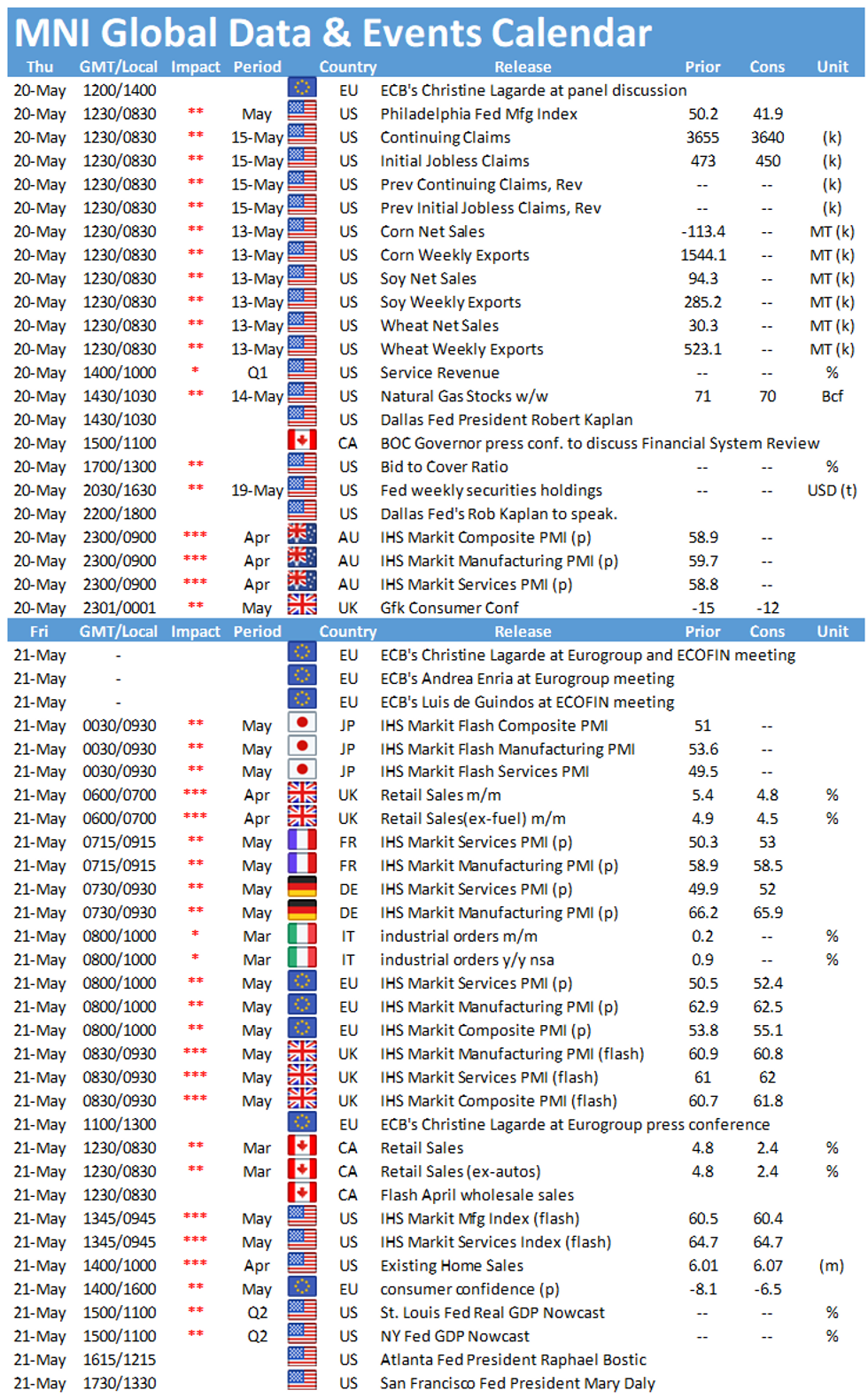

- Data this morning has seen German PPI largely in line with expectations with Philadelphia Fed and jobless claims data among the highlights for later today. The market is also looking towards tomorrow's UK retail sales data and European/UK flash PMI data.

- TY1 futures are up 0-7+ today at 132-08+ with 10y UST yields down -2.1bp at 1.653% and 2y yields down -0.6bp at 0.152%.

- Bund futures are down -0.19 today at 168.71 with 10y Bund yields up 1.0bp at -0.101% and Schatz yields up 0.6bp at -0.650%.

- Gilt futures are down -0.13 today at 127.61 with 10y yields up 0.6bp at 0.853% and 2y yields down -0.3bp at 0.068%.

FOREX: Dollar Mixed, Safe Havens In The Green

A mixed session for the Dollar in early trade.

- Early flow, price action saw some rounds of USD selling as we started the European session.

- USD was already underperforming against G10s overnight, but some small continuation early on.

- USD broke out of the tight ranges to fades yesterday's price action, but nonetheless still within ranges.

- The USD tested session low against EUR, GBP, AUD, CAD, and JPY.

- The small resistance in EURUSD which moved down To 1.2202 held for now, printing a 1.2205 high.

- Above the latter would open to double top at 1.2245 (April and May's high)

- GBP came under pressure, but no clear driver on the latest leg lower, besides some dip lower in yields, as well as some reversal in USD.

- Safe haven FX are in the green with risk better offered and lower yields. CHF and JPY are up 0.25% and 0.22% respectively.

- Looking ahead, US IJC is the notable release.

- Speakers include ECB Lane, Lagarde, Holzmann,,Fed Kaplan.

- BUT all attention is turning to Global prelim PMI releases tomorrow

EQUITIES: Wednesday's Rebound Beginning To Fade

- Asian markets closed mixed, with Japan's NIKKEI up 53.8 pts or +0.19% at 28098.25 and the TOPIX up 0.68 pts or +0.04% at 1895.92. China's SHANGHAI closed down 4.021 pts or -0.11% at 3506.944 and the HANG SENG ended 143.52 pts lower or -0.5% at 28450.29.

- European bourses have edged higher, with the German Dax up 24.58 pts or +0.16% at 15210.91, FTSE 100 up 5.38 pts or +0.08% at 6950.2, CAC 40 up 22.63 pts or +0.36% at 6262.55 and Euro Stoxx 50 up 8.84 pts or +0.22% at 3961.17.

- U.S. futures are fading Wednesday's bounce, with the Dow Jones mini down 181 pts or -0.54% at 33650, S&P 500 mini down 19.75 pts or -0.48% at 4091.75, NASDAQ mini down 52.75 pts or -0.4% at 13180.75.

COMMODITIES: Oil Continues To Slide

- WTI Crude down $0.78 or -1.23% at $63.84

- Natural Gas up $0.01 or +0.17% at $2.965

- Gold spot up $1.68 or +0.09% at $1872.56

- Copper up $0.2 or +0.04% at $460.85

- Silver down $0.13 or -0.47% at $27.816

- Platinum up $10.7 or +0.89% at $1210.45

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.