-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: EUR Rises Ahead Of E.C.B. 'Recalibration'

EXECUTIVE SUMMARY:

- SUNDAY "POINT OF FINALITY" FOR BREXIT TALKS BUT "NEVER SAY NEVER": U.K.'S RAAB

- E.C.B. SET TO DELIVER FURTHER MONETARY STIMULUS TODAY

- HUNGARY OFFICIAL: CHANCE OF E.U. BUDGET DEAL BEING REACHED TODAY

- U.K. OCT GDP SLOWS AS HOSPITALITY SECTOR SLUMPS

- CHINA TO SANCTION U.S. LAWMAKERS, REQUIRE VISAS FOR DIPLOMATS

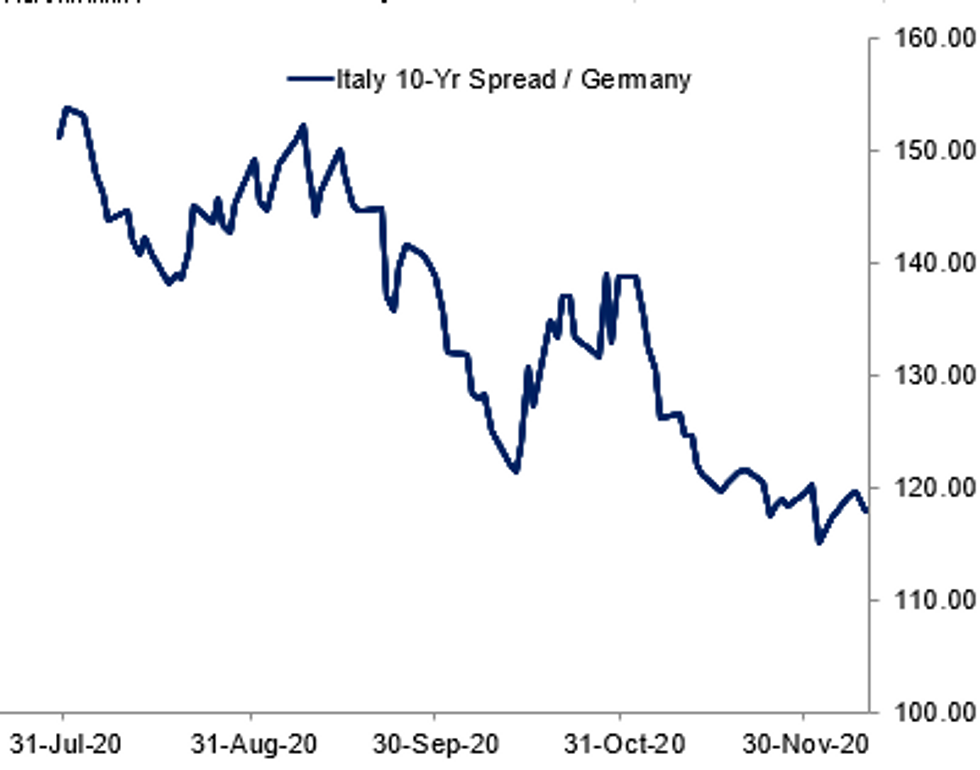

Fig.1: Further E.C.B. Action Anticipated

BBG, MNI

BBG, MNI

NEWS:

U.K.-E.U.: UK Foreign Secretary Dominic Raab has stated that the EU must change its position in relation to fisheries and the level playing field if talks about an FTA are to continue beyond Sunday. Of course, this is not the first time an official/minister on either side has issued such an ultimatum and seen the deadline pass by. Raab: "UK sees Sunday as a point of finality", but "never say never".

U.K.-E.U.: The European Commission has issued a press release on its no-deal Brexit contingency measures. Below are the four main contingency measures direct from the Commission's statement:- Basic air connectivity: A proposal for a Regulation to ensure the provision of certain air services between the UK and the EU for 6 months, provided the UK ensures the same.

- Aviation safety: A proposal for a Regulation ensuring that various safety certificates for products can continue to be used in EU aircraft without disruption, thereby avoiding the grounding of EU aircraft.

- Basic road connectivity: A proposal for a Regulation covering basic connectivity with regard to both road freight, and road passenger transport for 6 months, provided the UK assures the same to EU hauliers.

- Fisheries: A proposal for a Regulation to create the appropriate legal framework until 31 December 2021, or until a fisheries agreement with the UK has been concluded - whichever date is earlier - for continued reciprocal access by EU and UK vessels to each other's waters after 31 December 2020. In order to guarantee the sustainability of fisheries and in light of the importance of fisheries for the economic livelihood of many communities, it is necessary to facilitate the procedures of authorisation of fishing vessels.

UK DATA: UK GDP expanded by its slowest pace since the economy bottomed in April, but still managed to exceed expectations, courtesy of a buoyant manufacturing sector, data released on Thursday by the Office for National Statistics showed. GDP rose by 0.4% in October over the previous month, the slowest pace since the economy returned to growth in May. However, the outturn exceeded analysts' expectations for October. Output remains 7.9% below pre-pandemic levels in February, and fell by 8.2% over the same month of 2019. GDP expanded by 10.2% on a rolling three-month basis, below the 15.5% pace recorded in September.

FRANCE DATA: French IP increased for the sixth successive month in Oct, rising by 1.6% m/mand coming in stronger than markets expected (BBG: 0.4%). Sep monthly IP was revised up to 1.6% from 1.4% reported previously.

CHINA-U.S. (BBG): China will sanction U.S. individuals including Congress members, non-profit organization personnel and their families, Foreign Ministry spokeswoman Hua Chunying tells regular news briefing Thursday in Beijing. Hua responds to question about countermeasures in response to U.S. sanctions on National People's Congress officials over Hong Kong policies. China to also revoke visa-free entry to Hong Kong, Macau for U.S. diplomatic passport holders, Hua says.

CHINA: China will work with fellow WTO members to revive the Appellate Body as soon as possible to help uphold free trade and a rule-based multilateral trading system, Ministry of Commerce spokesman Gao Feng, said Thursday.

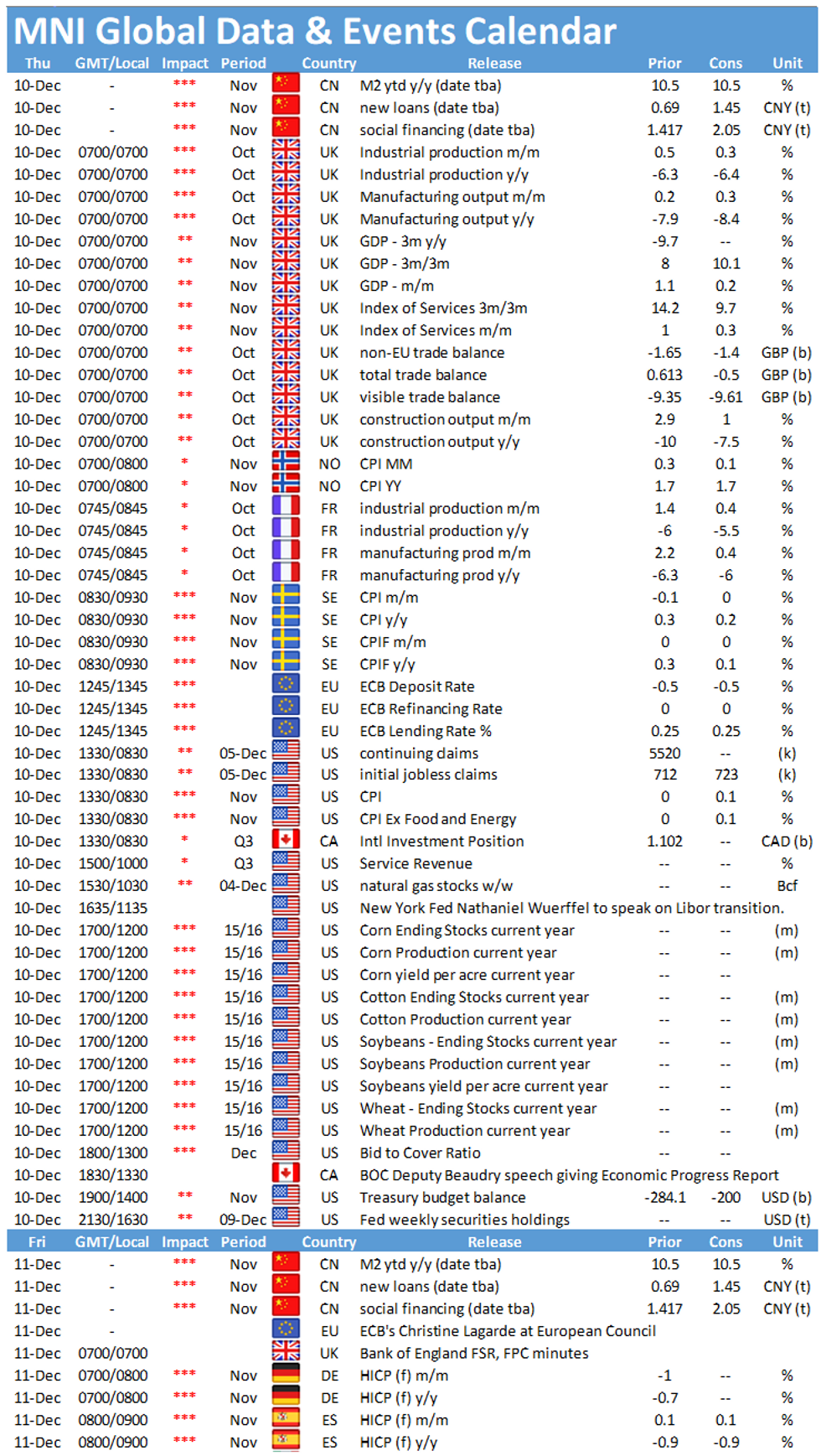

DATA:

FIXED INCOME: Gilts outperform on EU-UK trade deal negativity

- Gilts are the clear outperformers today after little progress seemed to be made on the EU-UK trade deal at the dinner between Boris Johnson and Ursula von der Leyen last night. Negotiations will continue until Sunday but optimism that a deal will be reached is fading quickly with gilts rallying and sterling selling off.

- The other big event of the day will be the ECB policy announcement and press conference. As we note in our ECB preview: "A EUR500bn expansion to the PEPP envelope and extension of net purchases by six-months to end-2021, additional TLTROs and an extension of the most preferential funding rate are the baseline scenario. Further deposit rate cuts are off the cards, but an adjustment to the tiering multiplier is possible".

- Elsewhere we will also receive US CPI data but there are no other central bank speakers scheduled from the BoE or Fed as both are in their blackout period ahead of next week's monetary policy meetings.

- TY1 futures are up 0-3+ today at 137-23+ with 10y UST yields down -1.4bp at 0.923% and 2y yields down -0.5bp at 0.146%.

- Bund futures are up 0.22 today at 178.41 with 10y Bund yields down -1.5bp at -0.621% and Schatz yields down -1.0bp at -0.789%.

- Gilt futures are up 0.46 today at 135.26 with 10y yields down -4.4bp at 0.216% and 2y yields down -2.7bp at -0.113%.

FOREX: Sterling Sags as Yet Another Deadline Looms

Following the lack of any material breakthrough over last night's dinner between the UK PM & EU's von der Leyen, GBP is the poorest performing currency in G10 as the market re-focuses on the next deadline of Sunday evening, at which time leaders on both sides will have to reach a decision over whether trade talks will continue or not, leaving a No Deal end to the transition period a very real prospect.

While GBP is weaker, it still trades north of the Monday lows of 1.3225, which should provide solid support going forward.

Antipodean currencies outperform, with AUD, NZD higher against most others. JPY, USD trade on the backfoot after a solid Tuesday showing.

Focus turns to the ECB rate decision, at which the central bank are seen recalibrating their policy toolkit.

EQUITIES: Tech Underperforming Again As Equities Rise From Lows

Equities are off European morning lows, but very much within Wednesday's ranges, as we await the European Central Bank decision. Once again, tech underperforming.

- Asian markets closed mixed, with Japan's NIKKEI down 61.7 pts or -0.23% at 26756.24 and the TOPIX down 3.21 pts or -0.18% at 1776.21. China's SHANGHAI closed up 1.312 pts or +0.04% at 3373.276 and the HANG SENG ended 92.25 pts lower or -0.35% at 26410.59

- European stocks are higher, with the German Dax up 15.33 pts or +0.11% at 13349.65, FTSE 100 up 30.64 pts or +0.47% at 6599.57, CAC 40 up 16.58 pts or +0.3% at 5562.15 and Euro Stoxx 50 up 9.99 pts or +0.28% at 3537.94.

- U.S. futures are mixed, with the Dow Jones mini up 55 pts or +0.18% at 30118, S&P 500 mini up 5.5 pts or +0.15% at 3678, NASDAQ mini down 2.5 pts or -0.02% at 12364.5.

COMMODITIES: Gold, Silver Fade

Gold and Silver are lower, with a slightly stronger dollar, and some sell-side analysts overnight becoming less positive on gold overnight (HSBC, Morgan Stanley).

- WTI Crude up $0.4 or +0.88% at $45.82

- Natural Gas up $0 or +0.12% at $2.425

- Gold spot down $6.41 or -0.35% at $1836.38

- Copper up $0.25 or +0.07% at $351.8

- Silver down $0.08 or -0.35% at $23.8617

- Platinum up $7.25 or +0.72% at $1010.39

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.