-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Europe PMIs Highlight Price Pressures

EXECUTIVE SUMMARY:

- EUROPE PMIS SHOW CONTINUED INFLATION SURGE

- UK RETAIL SALES FALL FOR 5TH STRAIGHT MONTH

- BOE'S PILL THE FIRST HAWK TO TALK DOWN MARKET RATE EXPECTATIONS

- BIDEN COMMITS TO TAIWAN DEFENSE, BEIJING PUSHES BACK

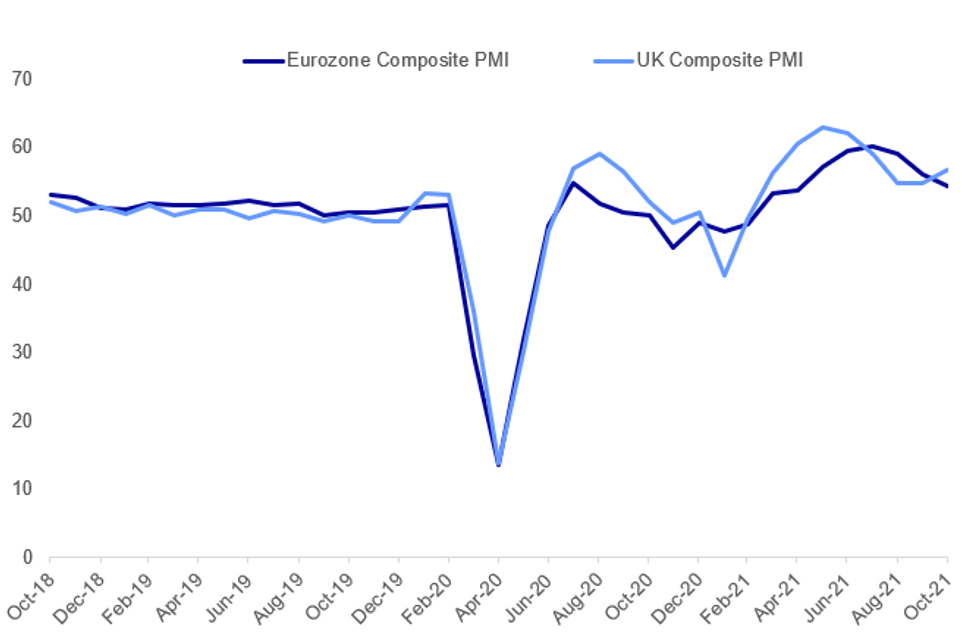

Fig. 1: Europe PMIs Come In Mixed Vs Expectations, With Prices Surging

Source: IHS Markit, MNI

Source: IHS Markit, MNI

NEWS:

BOE (MNI MARKETS): Huw Pill is widely regarded as one of the members who will be voting for a Bank Rate hike relatively soon. Indeed, his the following comment from the FT seems to suggest he will vote for a hike relatively soon (he does not specifywhen). "The big picture is, I think, there are reasons that we don't need the emergency settings of policy that we saw after the intensification of the pandemic.. The settings [of monetary policy] that we now have are supportive settings. The need for support has diminished, as this [policy] bridge [to the other side of the pandemic] has been built and largely traversed." However, perhaps more importantly he said that "maybe there's a bit too much excitement in the focus on rates right now." This is the first time one of the more hawkish members of the MPC has made any attempt at talking markets down.

U.S. / CHINA: In a town hall event overnight, US President Joe Biden, in answer to a question regarding the potential US defence of Taiwan in the event of a Chinese invasion, responded "Yes, we have a commitment to do that." Later, the White House appeared to try to walk back Biden's comment, stating that the administration was "not announcing any change in our policy and there is no change in our policy". * Nevertheless, the comments have understandably gained traction in Beijing. The Chinese Foreign Ministry has stated that China has 'no room for concessions in its core interests' and that the United States should 'avoidsending wrong signals' to Taiwanese independence forces.

SWEDEN / RIKSBANK (BBG): While economic activity has continued to strengthen for major Swedish companies since the spring, parts of the manufacturing sector have periodically been forced to limit output due to logistics problems and component shortages, the Riksbank says in a survey based on interviews with 51 companies and trade associations. Manufacturing-sector supply shocks are now being reported as "more comprehensive than at the start of the pandemic and they are also expected to persist next year," according to the Riksbank Business Survey.

CREDIT RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- Fitch on Austria (current rating: AA+; Outlook Stable), Finland (current rating: AA+; Outlook Stable) & the Netherlands (current rating: AAA; Outlook Stable).

- S&P on the European Financial Stability Facility (current rating: AA; Outlook Stable), Greece (current rating: BB; Outlook Positive), Italy (current rating: BBB; Outlook Stable), Turkey (current rating: B+; Outlook Stable) & the United Kingdom (current rating: AA; Outlook Stable).

- DBRS Morningstar on Cyprus (current rating: BBB (low), Stable Trend).

DATA:

GERMANY FLASH OCT MFG PMI 58.2; SEP 58.4

GERMAN PMI: "Unprecedented" rise in output prices

- Upside surprise to manufacturing but downside surprise to services. More important, however is the rate of inflation which the press release describes as "unprecedented" for output prices. Highlights from the press release:

- The "latest data pointed to an uptick in inflationary pressures across the German private sector, with October seeing faster increases in both input costs and output charges."

- "The rate at which firms' input costs rose was the second-quickest in the survey history, just behind that seen in June... The rate of inflation in average charges for goods and services was the quickest since this series began in September 2002. Both monitored sectors saw unprecedented increases in output prices in October."

- "Firms also reported hiring in the hope of greater activity in the coming months. Business expectations towards future activity showed a slight improvement in October and were above the historical average, although they were still the second-lowest in the year-to-date."

- "The uptick in confidence was driven by the service sector. The degree of optimism among manufacturers, by contrast, continued to wane, dropping to the lowest since July last year."

FRANCE PMI: Inflationary pressures "grew stronger"

- Supply-side issues continue to weigh on manufacturing but services came in higher than expected. Inflation pressures continued to rise, but output prices picked up a little less than in September. From the press release:

- "positive demand-side factors were confined to the service sector as a considerable drag on order books came from the manufacturing sector in October. Surveyed goods producers mentioned that severe delays on input deliveries had caused customers to cancel or postpone their orders. There were also mentions of a slowdown in the automotive sector."

- "Inflationary pressures grew stronger in October, particularly for goods producers. The overall rate of input cost inflation hit a 17-year high, with many firms attributing this to higher material prices. Greater costs for fuel and staff were also reported. Increased expenses were passed on to clients in many cases, with output charges rising for an eighth successive month, albeit at a slightly slower rate when compared to September."

- "Output expectations strengthened during October to reach their most optimistic in four months. Increased positive sentiment reflected bullish projections towards demand, investment and company expansions plans, as well as expectations of supply-side and pandemic-related constraints easing. "

EZ FLASH OCT MFG PMI 58.5; SEP 58.6

EUROZONE PMI: "Survey-record price increases"

- Focus on inflation continues as the Eurozone PMI notes that "survey-record price increases were meanwhile reported as firms sought to pass an unprecedented rise in costs on to customers." Other highlights from the press release:

- "Shortages were meanwhile once again seen as the key driver of higher prices for many goods and services in October, leading to a survey record increase in firms' input costs. An unprecedented input cost increase was recorded in manufacturing while service sector costs rose at the sharpest rate since September 2000."

- "Selling price inflation likewise accelerated as firms passed higher costs on to customers, reaching the fastest in almost two decades of comparable survey history both in manufacturing and services."

- "Future sentiment moderated for a fourth consecutive month to the lowest since February. Although the outlook brightened slightly in services, optimism in manufacturing hit the lowest for a year."

UK FLASH OCT MFG PMI 57.7; SEP 57.1

UK PMI: More focus on inflation

- Highest input costs rise on record. And interesting that higher wages are among the reasons cited - that will be a concern for the BOE. Services output growth looks very encouraging (particularly after stalling over the summer) while manufacturing is suffering with the high costs and supply disruptions.

- All in all, this looks like a report that will favour the hawks' views on the MPC.

- From the press release: "Higher wages and worsening supply shortages resulted in a rapid pace of input cost inflation during October. The latest increase in average cost burdens was the fastest since the index began in January 1998. Survey respondents often cited rising fuel, transport and energy bills, alongside steep price increases for items in short supply around the world (especially semiconductors and other electronics components). Output charges at UK private sector firms increased in response to escalating input costs, with the latest rise the steepest since the index began more than two decades ago."

- "Service sector activity (index at 58.0) outpaced manufacturing production (50.6) by the widest margin since February 2009. The latter saw its weakest output performance for eight months... Measured overall, new business volumes increased at a strong pace in October and the rate of expansion was the fastest for three months"

MNI: UK SEP RETAIL SALES -0.2% M/M, -1.3% Y/Y (AUG 0.0% Y/Y)

MNI BRIEF: UK Retail Sales Fall For 5th Straight Month

UK retail sales fell by 0.2% in September, the fifth straight decline, the longest losing streak since the series began in 1996. The outcome was far below City expectations, but confirmed the warnings of retail industry insiders highlighted in MNI's latest Reality Check.

Sales volumes slumped by 3.9% between July and September, leaving retail poised to shave 0.2% from gross domestic product in the third quarter, the ONS said Friday. Total sales declined by 1.3% over September of 2020, but remain 4.2% above pre-pandemic levels.

Despite widespread reports of petrol shortages last month, motoring fuel sales rose by 2.9% in September, as consumers filled their tanks when they could. The leaves fuel sales 1.8% above pre-pandemic levels.

FIXED INCOME: Driven by two Ps: Pill and PMIs

- There have been two Ps driving fixed income markets this morning: Pill and PMIs.

- BOE Chief Economist said in an FT interview published late last night UK time that a November rate discussion would be "live" but also said that markets were getting a bit overexcited. Short sterling has seen a small move higher this morning, particularly at the very front end with two rate hikes in 2021 no longer quite fully priced (but still almost fully priced). Since then, we have seen the UK PMI point to record price pressures and also a pick up in service sector growth - both elements that will probably make MPC members more comfortable about raising rates. Despite this, Pill's warning about overexcitement is stopping markets get too carried away here, particularly with so much already priced in. The gilt curve has steepened, and dragged the Treasury curve with it.

- The European PMIs also focused on price pressures, but pace of output continues to decline. The German curve has steepened with higher inflation expectations rather than a policy response driving the response.

- Looking ahead, Powell and Daly are due to speak while the US PMI is due for release.

- TY1 futures are down -0-3+ today at 130-02+ with 10y UST yields down -1.7bp at 1.686% and 2y yields unch at 0.456%.

- Bund futures are down -0.17 today at 168.08 with 10y Bund yields up 2.0bp at -0.83% and Schatz yields unch at -0.672%.

- Gilt futures are up 0.14 today at 123.68 with 10y yields down -0.6bp at 1.194% and 2y yields down -1.7bp at 0.685%.

FOREX: EUR Off Overnight Lows on Better Manufacturing Data

- Following an unimpressive open for the EUR, the single currency picked up some steam on the release of better-than-expected Eurozone PMI data, with strong activity seen across manufacturing in particular. This prompted a minor spell in strength for the currency up toward 1.1650 before fading.

- UK data has been more mixed, with stronger PMI numbers countered by a poor set of retail sales data, which is keeping GBP toward the bottom-end of the G10 table.

- The greenback trades poorly with the USD index now just above the week's lows of 93.496. Weakness through here would open losses back toward the 50-dma at 93.2894.

- Antipodean currencies are resuming the strength seen earlier in the week, with AUD, NZD trading well alongside commodities. This keeps AUD/USD within range of key resistance at the 0.7564 200-dma.

- Canada's August retail sales release takes focus going forward, with prelim October US PMI data also due. Fed's Daly is due to speak later today, as well as the Fed Chair Powell who appears alongside the SARB governor Kganyago on a BIS panel.

EQUITIES: Nasdaq Underperforming, S&P Futs Off Record Highs

- Asian markets closed mostly higher, with Japan's NIKKEI up 96.27 pts or +0.34% at 28804.85 and the TOPIX up 1.42 pts or +0.07% at 2002.23. China's SHANGHAI closed down 12.179 pts or -0.34% at 3582.604 and the HANG SENG ended 109.4 pts higher or +0.42% at 26126.93.

- European equities are gaining, with the German Dax up 95.84 pts or +0.62% at 15564.16, FTSE 100 up 29.76 pts or +0.41% at 7220.26, CAC 40 up 71.83 pts or +1.07% at 6759.97 and Euro Stoxx 50 up 42.61 pts or +1.03% at 4197.15.

- U. S. futures are flat/lower, with tech underperforming (though off lows) following disappointing after-hours earnings reports Thursday: Dow Jones mini up 19 pts or +0.05% at 35499, S&P 500 mini down 2.25 pts or -0.05% at 4539.5, NASDAQ mini down 50.75 pts or -0.33% at 15428.

COMMODITIES: Energy Gaining

- WTI Crude up $0.29 or +0.35% at $82.75

- Natural Gas up $0.08 or +1.54% at $5.188

- Gold spot up $9.44 or +0.53% at $1791.83

- Copper up $1.2 or +0.26% at $457.6

- Silver up $0.17 or +0.71% at $24.3211

- Platinum up $8.64 or +0.82% at $1060.78

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.