-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Europe PMIs Show Strong Growth...And Inflation

EXECUTIVE SUMMARY:

- EUROZONE JUNE FLASH COMPOSITE PMI HIGHEST IN 15 YEARS; U.K. SERVICES DISAPPOINT

- EUROPEAN PMIS SHOW SIGNIFICANT PRIVATE SECTOR PRICE PRESSURES

- ECB'S DE GUINDOS SAYS HE EXPECTS "VERY SIGNIFICANT" 2H GROWTH

- MNI BANK OF ENGLAND MEETING PREVIEW: ENCOURAGING DATA; MORE UNCERTAINTY

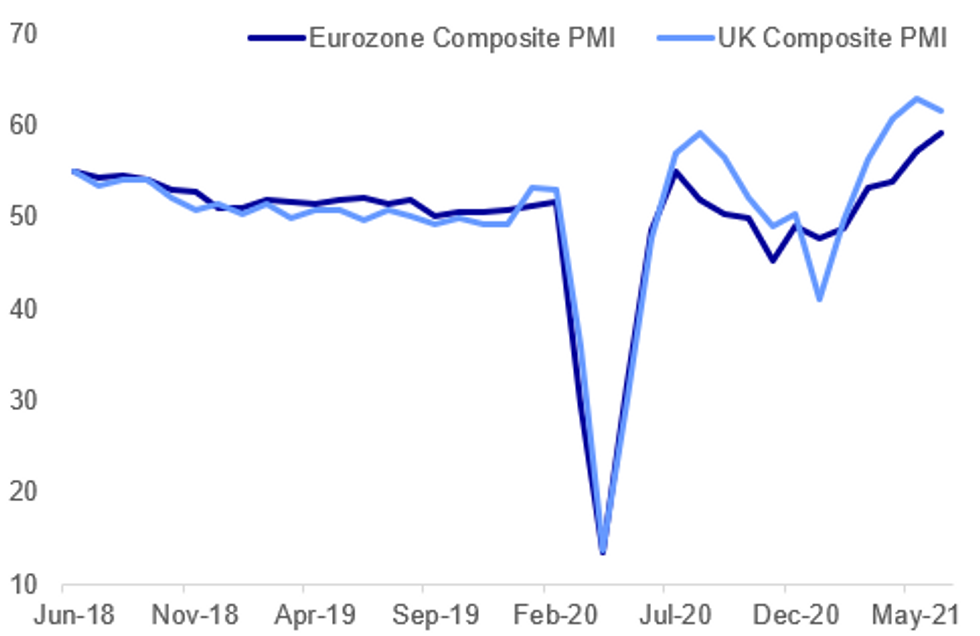

Fig. 1: European PMIs Continue To Rise On Re-Openings

Source: IHS Markit, MNI

Source: IHS Markit, MNI

NEWS:

EUROZONE PMI: Eurozone composite flash PMI came in at 59.2 in June, the highest in 180 months (i.e. 15 years), vs 57.1 prior.

- Services posted a 41-month high of 58.0 (vs 55.2 prior, and in line w expectations), while manufacturing was unchanged at 63.1 (just above 62.3 expected).

- The IHS Markit report notes re-opening dynamics, which include stronger price pressures: "the economy re-opened further from virus-fighting restrictions and vaccine progress boosted confidence. Prices charged for goods and services rose at an unprecedented rate, however, as demand continued to outstrip supply. Despite firms taking on extra staff at the sharpest rate for almost three years, June saw a record rise in backlogs of work, a further near-record lengthening of supply chains and the increasingly widespread depletion of warehouse inventories."

GERMAN PMI: German flash PMIs impressed in June amid re-opening, hitting best levels in a decade. Services came in at 58.1 (vs 55.7 forecast, 52.8 prior), with manufacturing at 64.9 (vs 63.0 forecast, 64.4 prior).

- The IHS Markit report noted strong demand, but additionally mounting price pressures:

- "A further easing of COVID-19 restrictions and release of pent-up demand leading to a sharp and accelerated rise in business activity...However, the recovery in output levels was accompanied by a further increase in price pressures, with rates of inflation in both input costs and output prices accelerating to new record highs."

- New orders (composite) were the strongest since Jan 2011; job creation hit the highest levels in the history of the subcomponent in the survey (to Jan 1998).

UK PMI: From the June UK PMI report: 'Companies responded to rising workloads by taking on extra staff at an unprecedented rate at the end of the second quarter. Also hitting previously unsurpassed levels, however, were rates of inflation of input costs and output prices as supply-chain disruption fuelled price pressures.'

MNI MARKETS B.O.E. PREVIEW: We think it is unlikely, but the most significant event for the market at the June meeting, would be if another MPC member joined Haldane in voting for a reduction to the QE target. For our full preview including summaries of over 20 sell side summaries see here: https://marketnews.com/mni-boe-preview-june-2021-e...

ECB (BBG): "In the second quarter of the year as well as in the second half of the year, we expect very significant growth in the euro-area," European Central Bank Vice President Luis de Guindos says in online event.Services sector is expanding as economies reopen, closing the gap with manufacturingSays higher inflation rates are result of temporary factors.

E.U. (RTRS): The European Commission will take action against Hungary's LGBT draft law, the head of the EU's executive said on Wednesday, calling the bill a shame and violation of fundamental EU values. "The Hungarian bill is a shame," European Commission chief Ursula von der Leyen said, stressing the EU would not compromise on principles such as human dignity, equality and the respect for human rights."I have instructed my responsible commissioners to write to the Hungarian authorities expressing our legal concerns before the bill enters into force."

GERMANY (BBG): Chancellor Angela Merkel's cabinet approved plans to increase borrowing by 99.7 billion euros ($119 billion) next year to help finance Germany's response to the coronavirus pandemic.The projected net debt would take the total for this year and next to more than 340 billion euros. Merkel's ruling coalition of her conservatives and Finance Minister Olaf Scholz's Social Democrats have spent freely to offset lingering damage to Europe's biggest economy.

BANK OF THAILAND (BBG): Thailand's central bank kept its benchmark interest rate unchanged and lowered its economic growth forecast for this year and next as the country grapples with its biggest wave of Covid cases yet.The Bank of Thailand held the policy rate at a record low of 0.5% Wednesday for a ninth straight meeting in a unanimous decision, as expected by all 25 economists in a Bloomberg survey.

HONG KONG: Hong Kong's pro-democracy tabloid Apple Daily said it will print its last edition on Thursday, after a tumultuous year in which it was raided by police and its tycoon owner and other staff were arrested under a new national security law. The end of the popular 26-year-old tabloid, which mixes pro-democracy discourse with racy celebrity gossip and investigations of those in power, has escalated alarm over media freedom and other rights in the Chinese-ruled city. The paper's newsroom was raided by 200 police in August last year when owner and staunch Beijing critic Jimmy Lai was arrested on suspicion of colluding with foreign forces, and again by 500 police last week when five other executives were detained.

IRAN (RTRS): PTV, a breaking news Twitter account linked to Iran's English language Press TV, said on Wednesday a sabotage attempt on a building of the Iranian atomic energy organization had been foiled.The was no confirmation of the report from the Iranian authorities.Iran has accused Israel of several attacks on facilities linked to its nuclear program and killing its nuclear scientists over the past years. Israel has neither denied nor confirmed the allegations.

DATA:

FRANCE FLASH JUN MFG PMI 58.6; MAY 59.4

GERMANY FLASH JUN MFG PMI 64.9; MAY 64.4

EZ FLASH JUN MFG PMI 63.1; MAY 63.1

UK FLASH JUN MFG PMI 64.2; MAY 65.6

FIXED INCOME: Some core FI divergence

There has been some divergence in core fixed income markets this morning with Bunds a bit higher, Treasuries lower and gilt largely unchanged. This can largely be equated to a fairly steady Treasuries curve but a bull steepening of European curves.

- The main event of the morning has been European PMIs which saw French data disappoint a little but German, Eurozone and UK data marginally better than expected.

- European peripheral spreads are generally tighter on the day.

- Yellen is due to testify before the Senate Appropriations committee today at 14:00ET which is worth watching, but unlikely to yield market moves. Later today we will also hear from the Fed's Bowman and ECB's Lagarde.

- TY1 futures are down -0-1 today at 132-10+ with 10y UST yields up 1.1bp at 1.476% and 2y yields up 0.6bp at 0.249%.

- Bund futures are up 0.07 today at 172.02 with 10y Bund yields down -0.5bp at -0.170% and Schatz yields down -0.2bp at -0.655%.

- Gilt futures are down -0.03 today at 127.41 with 10y yields up 0.6bp at 0.785% and 2y yields down -1.2bp at 0.092%.

FOREX: USD/JPY Narrows In On Year's High

- The recovery from the post-Fed low in global equity markets remains the pervasive driver of asset prices, with the e-mini S&P now 120 points above the Jun21 low. This has filtered solidly into currencies, resulting in USD/JPY narrowing the gap with the 2021 highs of 110.97. A break and close above here would be a solidly bullish development, opening initially the 1.0% 10-dma envelope of 111.19 and the Mar 26 2020 high of 111.30.

- PMI numbers across Europe have been mixed, with more solid German activity numbers countered by a weaker than expected French turnout. EUR has edged lower throughout the morning, softening against all others in G10.

- Further strength in crude prices is working in favour of CAD and NOK, with USD/CAD now eyeing first key support at the 1.2224 50-dma.

- Focus turns to Canadian retail sales, prelim June US PMI numbers and the new home sales release for May. Speakers due Wednesday include ECB's Lagarde and Fed's Bowman, Bostic & Rosengren.

EQUITIES: Energy Stocks Outperforming Again

- Asian stocks closed mixed, with Japan's NIKKEI down 9.24 pts or -0.03% at 28874.89 and the TOPIX down 10.39 pts or -0.53% at 1949.14. China's SHANGHAI closed up 8.808 pts or +0.25% at 3566.22 and the HANG SENG ended 507.31 pts higher or +1.79% at 28817.07.

- European equities are mostly lower, with the German Dax down 70.34 pts or -0.45% at 15573.55, FTSE 100 up 15.9 pts or +0.22% at 7103.87, CAC 40 down 18.49 pts or -0.28% at 6589.96 and Euro Stoxx 50 down 16.34 pts or -0.4% at 4109.22.

- U.S. futures have edged slightly higher, with the Dow Jones mini up 58 pts or +0.17% at 33894, S&P 500 mini up 3 pts or +0.07% at 4239.25, NASDAQ mini up 8 pts or +0.06% at 14266.25.

COMMODITIES: Copper Rebound Continues

- WTI Crude up $0.55 or +0.76% at $73.42

- Natural Gas flat at $3.259

- Gold spot up $4.62 or +0.26% at $1783.24

- Copper up $3.65 or +0.87% at $425.45

- Silver up $0.2 or +0.79% at $25.9867

- Platinum up $8.2 or +0.76% at $1086.6

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.