-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: European Inflation Pressures

EXECUTIVE SUMMARY:

- ITALIAN AND SPANISH PMIS SHOW STRONG ACTIVITY, BUT BOTTLENECKS BOOST INFLATION

- EUROZONE FLASH INFLATION RISES TO HIGHEST SINCE OCT 2018

- OIL FUTURES CLIMB AS OPEC+ FLAGS TIGHT MARKET

- GERMANY TO CUT COVID RISK LEVEL TO HIGH FROM VERY HIGH

- EYES ON JULY AS R.B.A. LEAVES POLICY UNCHANGED (MNI STATE OF PLAY)

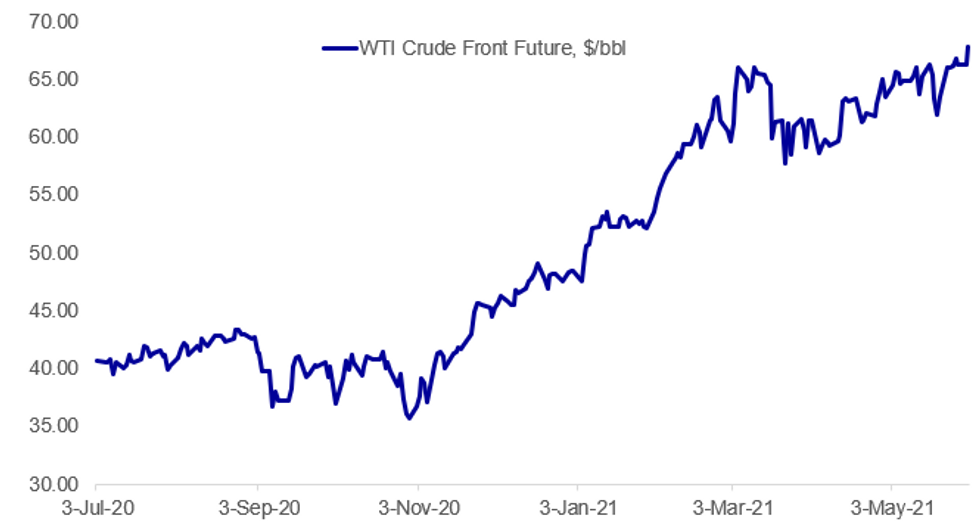

Fig. 1: WTI Hits Highest Since 2018

BBG, MNI

BBG, MNI

NEWS:

OIL/OPEC (BBG): U.S. crude futures hit their highest level in more than two years after the OPEC+ alliance forecast a tightening global market ahead of a production policy meeting. West Texas Intermediate rose as much as 2.6% from Friday's close to $68.04 a barrel. Global benchmark Brent topped $70 earlier Tuesday. The oil glut built up during the pandemic has almost gone and stockpiles will slide rapidly in the second half of the year, according to an assessment of the market from an OPEC+ committee. The coalition is expected to ratify a scheduled output increase for July when it meets later Tuesday.

GERMANY (RTRS): Germany's Robert Koch Institute (RKI) for infectious disease is to reduce the coronavirus risk level for the country to "high" from "very high" as the situation improves, Health Minister Jens Spahn said on Tuesday. "We have grounds for optimism," said Spahn at a news conference with the head of the RKI, Lothar Wieler, who said developments were improving but the pandemic was not yet over.

RBA (MNI STATE OF PLAY): The Reserve Bank of Australia confirmed Tuesday that key decisions on forward guidance and the scale of the the longer-dated bond buying programme will be taken at the July meeting, with stronger growth forecasts but a subdued medium-term inflation outlook muddying the water for policymakers. The June meeting saw the RBA leave all major policy settings unchanged, with the key interest rate remaining at a record low 0.10%, the same level level being targeted on the 3-year government bond and the size of the asset-purchase programme still at AUD200 billion. For full State of Play contact sales@marketnews.com

U.S. (WASHINGTON POST): President Biden plans to unveil a set of policies intended to narrow the wealth gap between Black and White Americans in a speech he's set to deliver Tuesday in Tulsa, commemorating the 100th anniversary of the massacre there that ravaged a once-prosperous Black business district and neighborhood.The president will offer a raft of policies intended to bolster homeownership and help minority small businesses and entrepreneurs, an administration official said.

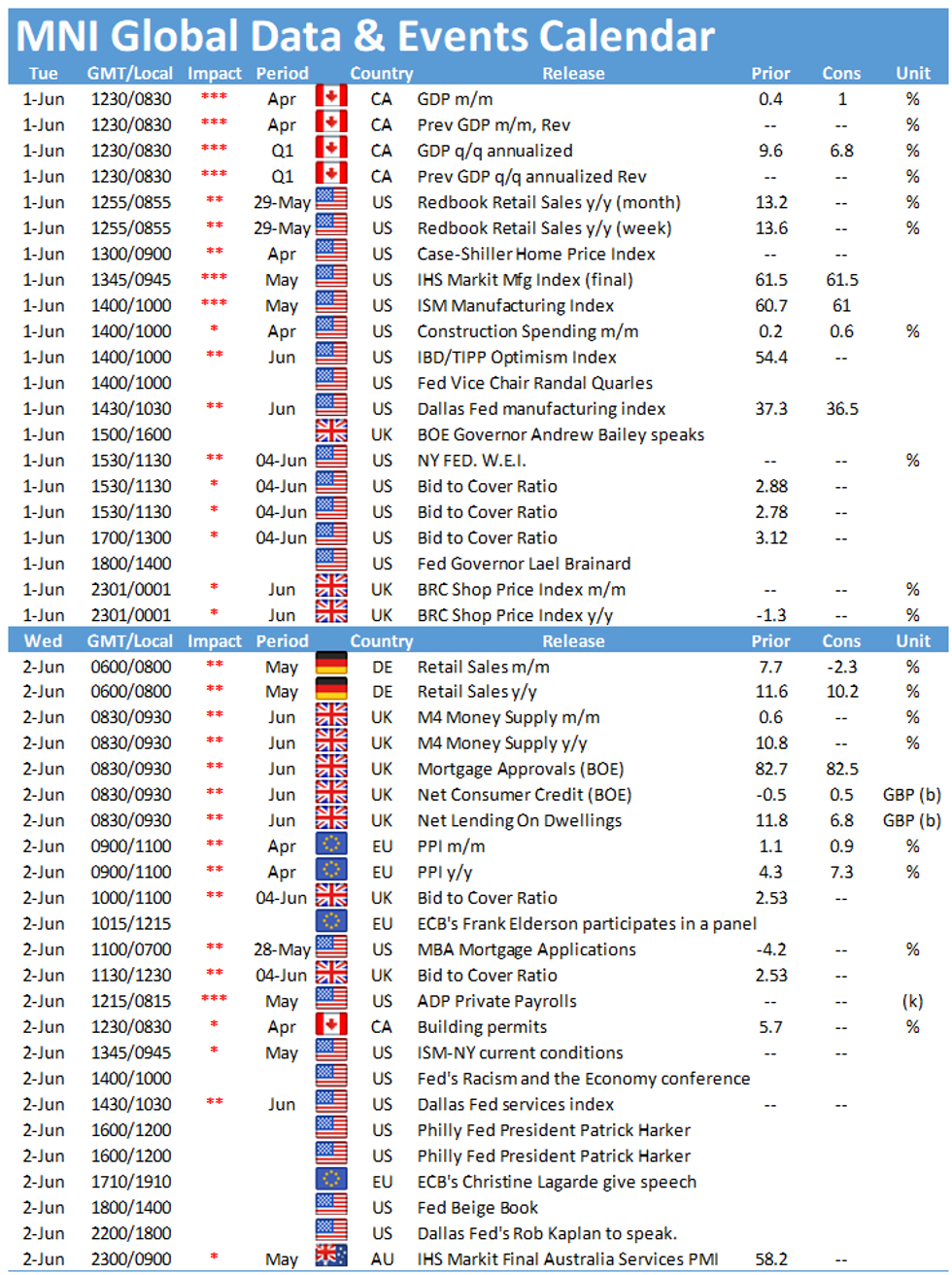

DATA:

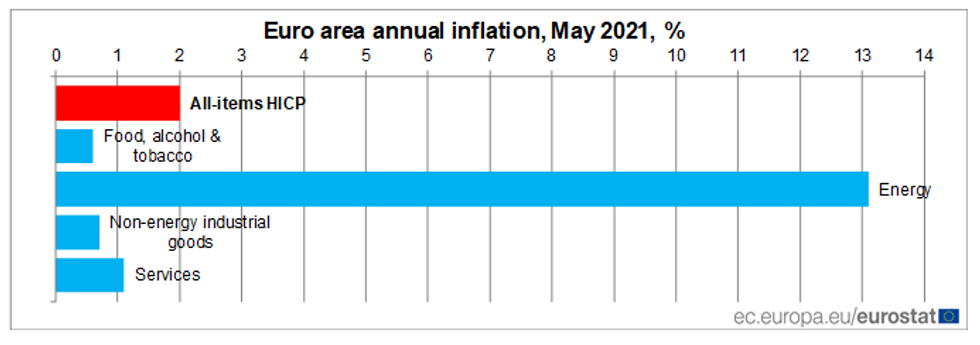

EZ Flash Inflation Rose to 2.0% in May

EZ MAY FLASH HICP +0.3% M/M; +2.0% Y/Y; APR +1.6% Y/Y

EZ MAY FLASH CORE HICP +0.2% M/M; +0.9% Y/Y; APR +0.7% Y/Y

- EZ inflation rose further to 2.0% in May, coming in slightly above expectations (BBG: +1.9%).

- Annual HICP rose to the highest level since Oct 2018, above the ECB's target for the first time since then.

- Core inflation ticked up to 0.9% in May, confirming market forecasts and showing a two-month high.

- May's uptick was driven by another sharp gain of energy inflation, rising by 13.1% after increasing 10.4% in Apr.

- This marks the third successive positive rate, as energy prices are compared to the unusually low levels seen in 2020 at the beginning of the pandemic.

- While non-energy industrial goods prices ticked up to 0.7% and service prices accelerated to 1.1%, food inflation remained unchanged at 0.6%.

- Among the member states, Luxembourg (4.0%), Lithuania (3.5%) and Estonia (3.1%) recorded the largest rates, while Greece (-1.1%) was the only country to post a decline of consumer prices.

Source: Eurostat

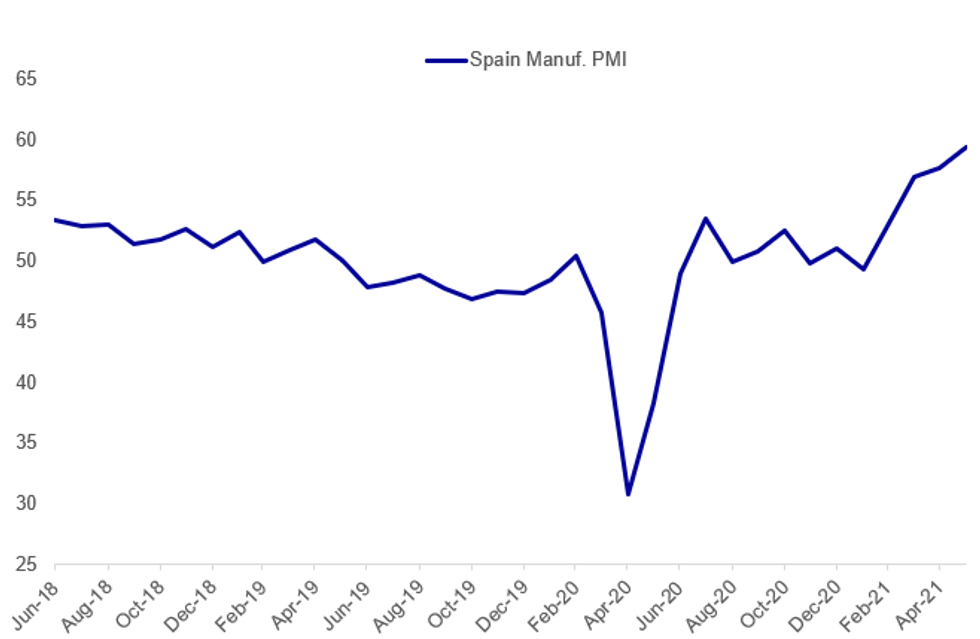

MNI: SPAIN MAY MFG PMI 59.4; APR 57.7

Spain Manuf PMI: 23-Year High Despite Supply Constraints

Spanish Manufacturing PMI came in slightly better than expected at 59.4 (59.3 survey, 57.7 prior), which was a 23-year high - but part of the story is that supply-side constraints held that figure back from being even higher.

- From the IHS Markit release: "Difficulties in sourcing inputs meant firms sought to satisfy rising production and order book requirements through the greater utilisation of their inventories of inputs and finished goods. For the latter, the decline was the sharpest since last August."

- On overall activity: "Driving the PMI higher were faster gains in both output and new orders. For sales, the net rise was the sharpest recorded by the survey since December 2006 amid reports of surging demand, both from at home and abroad. New export business increased to the strongest degree for three-and-a half years amid markedly higher demand from neighbouring European countries. Production meanwhile increased to the strongest degree for over 14 years as firms ramped up output in response to increased sales."

- On inflation, note also that both input and output price series recorded all-time highs, with "sharply rising demand for inputs [leading to] considerable inflationary pressures".

IHS Markit, MNI

IHS Markit, MNI

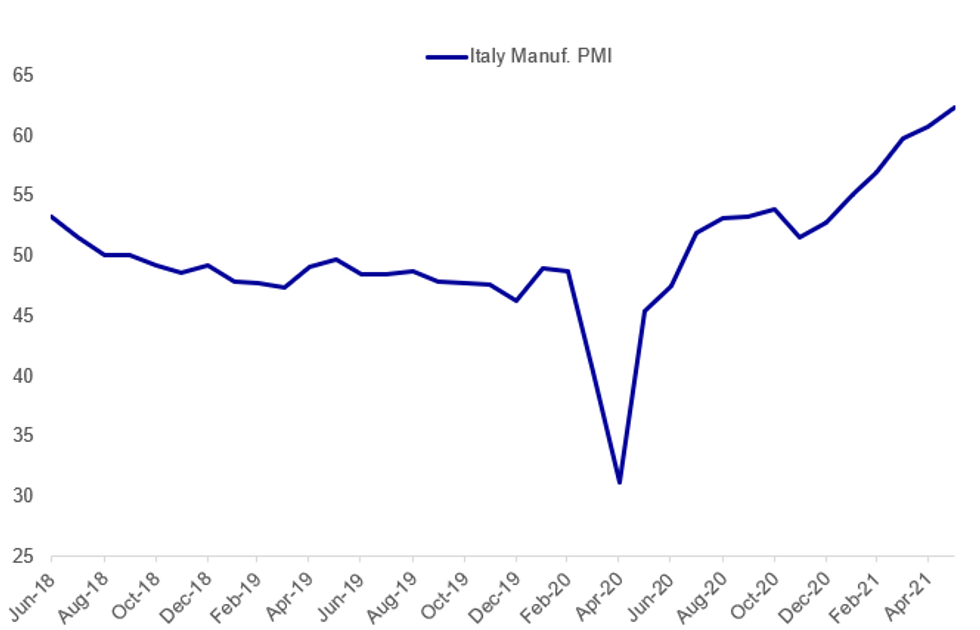

MNI: ITALY MAY MFG PMI 62.3; APR 60.7

Italy Manuf PMI: Record Jobs, "Surging" Sales...And Infl Concerns

A variety of factors contributed to Italy's better-than-expected 62.3 reading for May Manufacturing PMI (vs 61.1 exp., 60.7 prior), from "surging" sales and strong output growth, and the strongest job creation data since the series began in 1997.

- From the IHS Markit release, on activity: "A strong boost to the headline figure in May came from the seasonally adjusted New Orders Index, which reached a series record peak and pointed to a rapid increase in order book volumes overall. According to panellists, more favourable economic conditions had led to improved client demand. Improved sales also came from foreign markets during May, as new export orders expanded at one of the steepest rates in the series history, with the upturn attributed by panellists to improved demand, particularly in the US and China."

- On the price front: "Inflationary pressures remained the principal concern in May, with input costs continuing to surge and firms raising their average charges to a series record degree as a result. Greater costs stemmed mostly from shortages and transport delays, with suppliers' delivery times again lengthening to a broadly unprecedented extent."

IHS Markit, MNI

IHS Markit, MNI

MNI: FRANCE FINAL MAY MFG PMI 59.4; FLASH 59.2; APR 58.9

MNI: GERMANY FINAL MAY MFG PMI 64.4; FLASH 64.0; APR 66.2

MNI: EZ FINAL MAY MFG PMI 63.1; FLASH 62.8; APR 62.9

Italy Final GDP Revised Up

- Final adjusted 1Q GDP +0.1% q/q (up from prel. data -0.4%)

- Final adjusted 1Q GDP -0.8% y/y (up from prel. data -1.4%)

- 4Q 2020 real SA WDA GDP -1.8% q/q (rev'd up), -6.5% y/y (rev'd up)

- Net exports fell -0.1% q/q, imports up +2.3% Q/Q

- Final net domestic demand subtracted 0.1 pts from GDP

- Inventory changes contributed 0.8 pts to GDP

FIXED INCOME: Eyeing ISM later

We have seen similar price action to yesterday's session with Bunds (and gilts) falling around the European open, but both have made up much of the losses with Bunds close to flat on the day but gilts still a bit lower. Treasuries are off their lows of the days but still lower on the day.

- The morning session has seen the first release of PMI manufacturing data from both Spain and Italy and final release data for France, Germany, the Eurozone and UK. PMI data across the board was generally in line with expectations. This morning has also seen flash Eurozone inflation for May, which has come in one tenth above expectations while Italian Q1 GDP data was revised higher.

- Looking ahead ISM manufacturing will be the highlight of the day.

- TY1 futures are down -0-5+ today at 131-24+ with 10y UST yields up 1.7bp at 1.613% and 2y yields up 0.5bp at 0.148%.

- Bund futures are up 0.08 today at 170.02 with 10y Bund yields unch at -0.188% and Schatz yields up 0.4bp at -0.665%.

- Gilt futures are down -0.12 today at 127.13 with 10y yields up 1.0bp at 0.804% and 2y yields down -0.2bp at 0.055%.

FOREX: China Softer For Second Session

- GBP is the poorest performing currency in G10 so far Tuesday, with GBP/USD pressure below 1.42 as markets unwind the gains seen late Monday on month-end and fix-related buying. Eurozone inflation numbers came in just ahead of expectations, although core CPI was inline at 0.9% Y/Y.

- China FX is softer for a second session, snapping the extended winning streak that pressured USD/CNY to its lowest levels since 2018. Markets continue to react to the PBoC's policy tweak on Monday, in which they raised the FX RRR to 7% from 5%.

- NOKSEK trades either side of parity with the cross looking to have bottomed for now. NOK is the firmest currency in G10, while GBP and NZD are among the weakest.

- US ISM Manufacturing numbers take focus going forward, with markets watching closely for any clues ahead of Friday's payrolls release. Canadian GDP also crosses as well as speeches from BoE's Bailey, Fed's Brainard & Quarles.

EQUITIES: Strong Return From Long Weekend For US And UK

- Asian markets closed mixed though largely higher, with Japan's NIKKEI down 45.74 pts or -0.16% at 28814.34 and the TOPIX up 3.2 pts or +0.17% at 1926.18. China's SHANGHAI closed up 9.237 pts or +0.26% at 3624.714 and the HANG SENG ended 316.2 pts higher or +1.08% at 29468.

- European stocks are higher, with the German Dax up 208.8 pts or +1.35% at 15582.6, FTSE 100 up 80.46 pts or +1.15% at 7047.28, CAC 40 up 43.49 pts or +0.67% at 6467.07 and Euro Stoxx 50 up 42.07 pts or +1.04% at 4070.99.

- U.S. futures are gaining, with the Dow Jones mini up 171 pts or +0.5% at 34685, S&P 500 mini up 16.5 pts or +0.39% at 4219.25, NASDAQ mini up 47.5 pts or +0.35% at 13734.75.

COMMODITIES: WTI Up 3% With OPEC+ Meeting Awaited

- WTI Crude up $1.96 or +2.96% at $67.83

- Natural Gas up $0.1 or +3.48% at $3.078

- Gold spot up $4.34 or +0.23% at $1913.74

- Copper down $0.35 or -0.07% at $468.15

- Silver up $0.25 or +0.91% at $28.3459

- Platinum down $1.53 or -0.13% at $1193.13

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.