-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: European Stocks Gain Ahead Of E.C.B. Decision

EXECUTIVE SUMMARY:

- E.C.B. DECISION AWAITED, WITH COMMUNICATIONS IN FOCUS

- B.O.E.'S BROADBENT PUSHES BACK ON U.K. INFLATION PERSISTENCE

- E.U. TO ESCALATE LEGAL ACTION AGAINST U.K. OVER NORTHERN IRELAND (BBG)

- TOKYO NEW CASES HIT HIGHEST SINCE MID-JAN AS FEARS OF DELTA VARIANT GROW

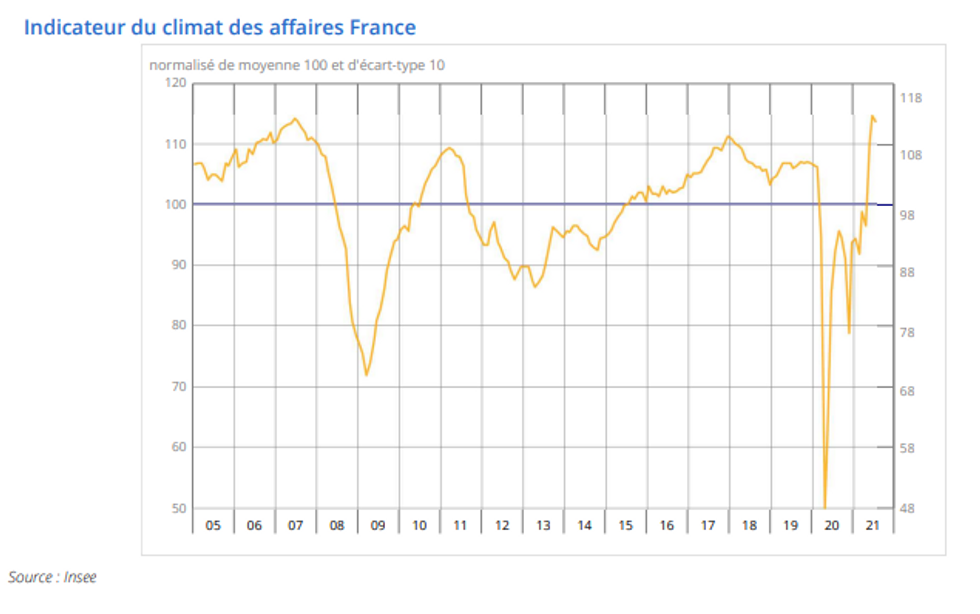

- FRENCH BUSINESS CLIMATE DIPPED SLIGHTLY IN JULY

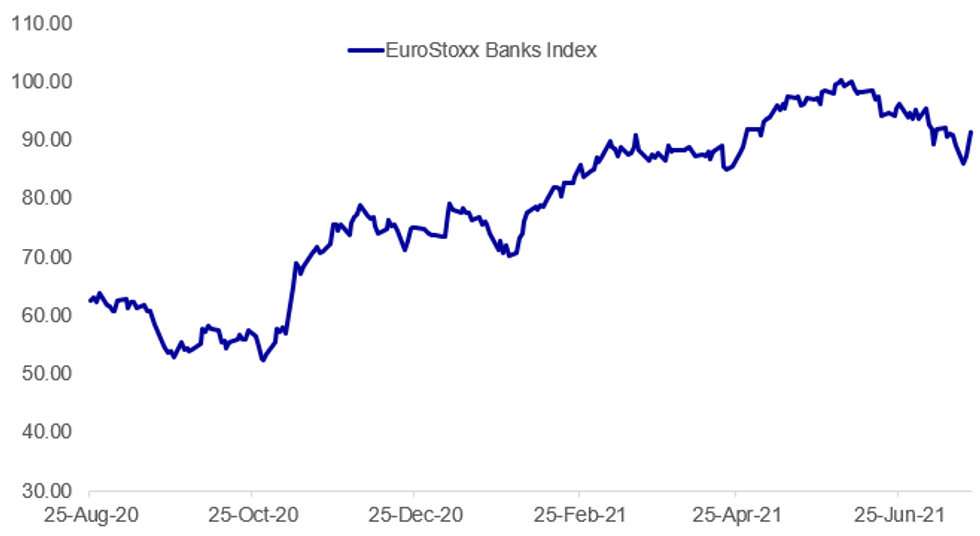

Fig. 1: Financial Equities Outperforming Ahead Of ECB Decision

Source: BBG, MNI

Source: BBG, MNI

NEWS:

E.C.B. (MNI MARKETS PREVIEW): The earlier-than-expected publication of the strategy review has transformed the July GC meeting from a placeholder to a live event. Any material changes in policy are still likely to be on hold for September (or possibly December), but changes to the forward guidance and additional communication around the strategy review implications could be market moving. Clarification of the new buzzwords "forceful" and "persistent", as well as the extent to which inflation deviations from target will be tolerated, are likely to be a focus during the press conference.

B.O.E.: Bank of England Deputy Governor Ben Broadbent pushed back against the view that higher inflation is likely to be persistent, with his remarks tilting the scales away from early tightening by the central bank in August. He noted that much of the rise in imported inflation has been "concentrated overwhelmingly in goods prices" and that as the economy reopens and rebalances, with services demand increasing, the mismatches that have driven prices higher should fade away. He said that he was "not convinced that the current inflation in retail goods prices should in and of itself mean higher inflation 18-24 months ahead."

E.U.-U.K. (BBG): Britain is set to be handed a final warning from the European Union to meet its commitments under the Northern Ireland Protocol as the two sides struggle to work out their post-Brexit relationship.The European Commission, the EU's executive arm, plans to file a so-called reasoned opinion on what it says are the U.K.'s breaches of the protocol by the end of the month, according to two officials with knowledge of the process.

US-CHINA (BBG): An agreement by the U.S. and China for their first face-to-face talks between senior diplomats in months represents the latest effort by both sides to keep a growing list of disputes from spiraling out of control.The nations announced plans Wednesday for Deputy U.S. Secretary of State Wendy Sherman to meet Chinese Foreign Minister Wang Yi next week in the northern port city of Tianjin as part of her current swing through Asia. The trip followed behind-the-scenes wrangling, with the Financial Times reportingearlier that the No. 2 American diplomat had suspended her travel plans after Beijing offered only a meeting with one of Wang's subordinates.

JAPAN / COVID: The Tokyo metropolitan gov't confirmed that it recorded 1,979 new COVID-19 cases in the past 24 hours, the highest daily total since mid-January, raising concerns further about a more widespread outbreak of the virus just as the Tokyo Olympic Games get underway. The hosting of the Games remains controversial in Japan, and if a major wave of infections becomes linked to the event it could lead to a backlash against the gov't of PM Yoshihide Suga. The gov't is already struggling with declining approval ratings ahead of this autumn's general election. The Tokyo authorities and the gov't have frequently stated that a spike in cases ahead of the Games could lead to their suspension, but with just over 24 hours until the opening ceremony is slated to start, this seems unlikely.

GREECE / TRAVEL (BBG): Greece sees international arrivals at over 130% of 2020 and 40% below 2019 so far and what's more interesting is that there is still an upward trajectory, Greek PM's Chief Economic Adviser, Alex Patelis tells Bloomberg TV. I don't know what's going to happen in the future, but Delta variant doesn't seem to be reducing the people's appetite to travel and to have a holiday in Greece, Patelis says.

INDONESIA: Bank Indonesia has left its benchmark 7-day reverse repurchase interest rate unchanged at 3.5% Thursday, saying the rate is in line with maintaining the stability of the rupiah. The central bank also maintained the overnight deposit and lending facility rates at 2.75% and 4.25%, respectively.

DATA:

FRANCE DATA: Business Climate Dipped Slightly in July

JUL BUS CLIM INDICATOR 113; JUN 114r

JUL MFG SENTIMENT 110; JUN 108r

JUL SERVICES SENTIMENT 112; JUN 112

- French business climate slipped 1pt to 113 in Jul, following an upward revised Jun reading of 114 and confirming expectations (BBG: 113)

- Despite the downtick, business climate remains at a very high level, well above the long-term average and above the pre-crisis level.

- Jul's small drop was led by a decline recorded in the retail trade sector, while the manufacturing sector posted a monthly gain.

- Business climate in the service sector remained unchanged at Jun's very high level of 112, following Jun's downward revision by 1pt to 112.

- Retail trade business climate eased 1pt to 115 in Jul, which was due to a fall in sales opinion on general business prospects, Insee noted.

- Manufacturing sentiment rose 2pt in Jul, showing the highest level since Apr 2018.

- Employment climate rose 3pt to 108, its the highest level since Mar 2019, mainly on the back of service sector employment in the past months.

Source: Insee

FIXED INCOME: Attention turns to the ECB

A calmer start for market when you compare to the very busy start of the week.

- This is not too surprising given investors and market participants turning their attention towards the ECB meeting and Presser.

- It could be an interesting one, with new opening statement format, Strategy review, forward guidance, inflation target.

- Bund is flat on the session and so is the curve.

- Peripheral spreads are mostly tighter, with Spain, Italy and Portugal leading by 0.7bp.

- Gilts were mostly better offered ahead of Broadbent (neutral) speech titled ``Mismatch'.

- There was nothing new to get excited about, noted that inflation was likely transitory, and had to watch data closely.

- With the lack of anything hawkish, Gilts are back in positive territory, up 5 ticks at the time of typing.

- US Treasuries have been better offered this morning on the risk on tone.

- Tnotes tested through yesterday's low, but found some demand at 133.30, and now trades at 134.02.

- Looking ahead, ECB rate and presser, US data include IJC, the most notable one.

FOREX: GBP Edges Off Early Gains

- GBP was bid from the European open, with GBP/USD benefiting on the way up to 1.3758 as markets eyed recent signs that UK COVID case growth could have topped out, and awaited comments from BoE's Broadbent. The MPC member flagged near-term upside risks to the inflation outlook, but posited that this would subside in time. GBP is off the best levels of the session but remains one of the firmest currencies in G10.

- NZD, USD and CAD are among the poorest performers so far Thursday, slightly reversing the price action over the past few sessions.

- The ECB rate decision takes focus going forward, with no changes in policy expected today, but markets are likely to laser in on the explanation and justification behind the ECB's strategy review that resulted in a symmetric inflation target. The decision is due at 1245BST/0745ET with the press conference following 45 minutes later.

- In the first real data releases of the week, US weekly jobless claims, existing home sales and the Chicago National Activity Index all cross later today. Eurozone consumer confidence is also due.

EQUITIES: Rebound Continues, With Financials Leading Europe Gains

- Asian markets closed higher (Japan was closed for holidays). China's SHANGHAI closed up 12.073 pts or +0.34% at 3574.734 and the HANG SENG ended 499.26 pts higher or +1.83% at 27723.84

- European equities are higher, with the German Dax up 129.61 pts or +0.84% at 15422.5, FTSE 100 up 11.34 pts or +0.16% at 6998.28, CAC 40 up 42.74 pts or +0.66% at 6464.48 and Euro Stoxx 50 up 39.06 pts or +0.97% at 4026.68.

- U.S. futures are gaining, with the Dow Jones mini up 67 pts or +0.19% at 34756, S&P 500 mini up 6.75 pts or +0.16% at 4357.25, NASDAQ mini up 20.75 pts or +0.14% at 14848.5.

COMMODITIES: Copper Leads Gains

- WTI Crude up $0.54 or +0.77% at $70.22

- Natural Gas down $0.03 or -0.81% at $3.927

- Gold spot down $6.88 or -0.38% at $1801.93

- Copper up $5.25 or +1.23% at $432.1

- Silver down $0.16 or -0.63% at $25.2318

- Platinum down $2.07 or -0.19% at $1083.36

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.