-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Eyeing A 7-Figure Payrolls Gain

EXECUTIVE SUMMARY:

- U.S. APR NONFARM PAYROLLS SEEN INCREASING BY 1.1MN

- E.C.B.'S KAZAKS SAYS JUNE DECISION TO SLOW BOND-BUYING POSSIBLE

- U.K. P.M. JOHNSON SECURES FIRST PART OF ELECTORAL "HAT TRICK" AS ELECTION RESULTS COME IN

- SPANISH, FRENCH, GERMAN INDUSTRIAL PRODUCTION PICKS UP IN MARCH

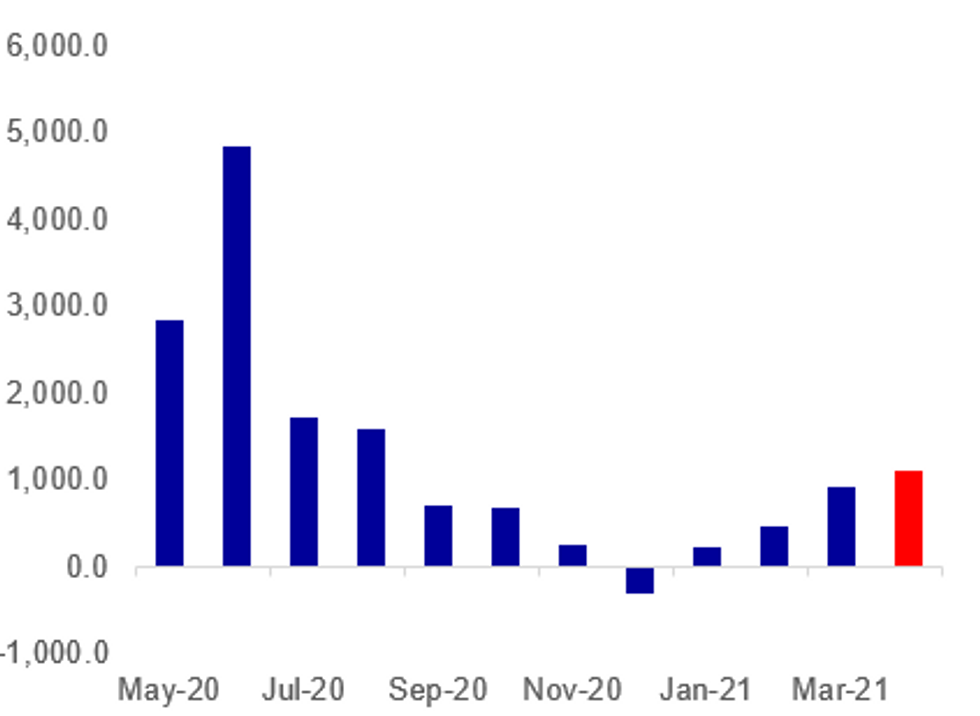

Fig. 1: Apr Payrolls Seen +1.1mn (NFP M/MCHG, '000s)

Source: BLS, BBG Survey, MNI

Source: BLS, BBG Survey, MNI

NEWS:

U.S. NONFARM PAYROLLS (MNI REALITY CHECK): U.S. job growth surged in April as widely available vaccines and stimulus money fueled business confidence, recruiters and industry experts told MNI, though a significant labor shortage threatens to slow the market's recovery. For full article contact sales@marketnews.com

ECB (BBG): The European Central Bank could decide to scale back its emergency bond-buying program as early as next month if the euro-area economy doesn't deteriorate, according to Governing Council member Martins Kazaks. Kazaks, who also heads Latvia's central bank, said the ECB's pledge to keep financing conditions favorable remains key to determining how much support the 19-nation bloc needs to recover. While nominal bond yields have edged higher in recent weeks, those adjusted for inflation have stayed low since officials decided in March to temporarily increase the pace of their pandemic emergency purchase program. "If financial conditions remain favorable, in June we can decide to buy less," Kazaks said in an interview on Thursday. "Flexibility is at the very core of PEPP."

U.K. POLITICS: Prime Minister Boris Johnson and his Conservative Party have secured the first part of their sought-after electoral 'hat trick' by winning the Hartlepool by-election with a comfortable majority.

- Hartlepool, parliamentary by-election result: Conservative: 51.9% (+23.0), Labour: 28.7% (-9.0), Independent: 9.7% (+7.5), ReformUK: 1.2% (-24.6), Green: 1.2% (+1.2), Liberal Democrat: 1.2% (-3.0), Oth: 6.1% (+4.9). Con GAIN from Lab.

- The 23% increase in the Conservative vote share is the largest increase in support for a sitting government party in a by-election since the end of the Second World War (previous largest was 12% gain for Labour in Bournemouth in 1945).

- The two other closely watched contests in England - the Tees Valley and West Midlands mayoralties - are not expected to declare until this evening UK time and Saturday afternoon UK time respectively. For full details of expected declaration times for the Scottish and Welsh parliament and English local and mayoral elections please follow this link.

GERMANY: German manufacturing expectations improved further in April, hitting the highest levels in 30 years, led by the automotive and electrical sectors, a senior Ifo Institute analysts said Friday, noting that "order books are filling up, and there is still some catching up to do in the wake of the crisis last year." According to the Business Survey published Friday, the expectations index jumped to 33.1 in April, from 30.2 in March, the highest level since 1991 and the uptick was mainly driven by car producers and the electrical industry.

DATA:

US PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| Jefferies | +2.1mn | Goldman Sachs | +1.3mn |

| Nomura | +1.3mn | Scotiabank | +1.3mn |

| Deutsche Bank | +1.275mn | Morgan Stanley | +1.25mn |

| NatWest | +1.25mn | BNP Paribas | +1.15mn |

| Citi | +1.15mn | BMO | +1.1mn |

| Credit Suisse | +1.1mn | RBC | +1.1mn |

| Wells Fargo | +1.1mn | UBS | +1.02mn |

| Daiwa | +1.0mn | J.P.Morgan | +1.0mn |

| Amherst Pierpoint | +965K | Barclays | +950K |

| Bank of America | +950K | HSBC | +900K |

| Mizuho | +900K | Societe Generale | +900K |

| TD Securities | +875K | -- | -- |

| Dealer Median | +1.1mn | BBG Whisper | +1.105mn |

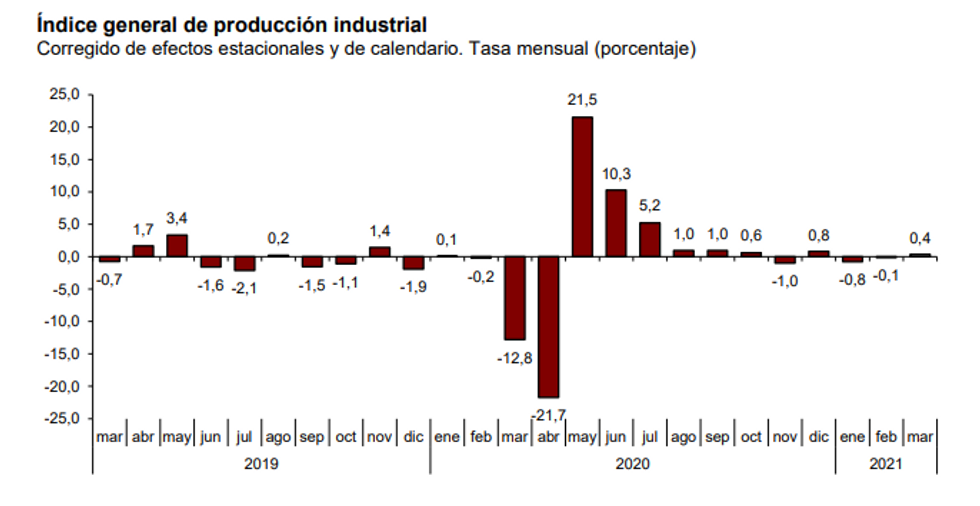

Spanish IP Edged Higher in Mar

SPAIN MAR IND PRD +0.4% M/M, +12.4% Y/Y; FEB -0.1% M/M

- Spanish IP rebounded to 0.4%, slightly short of market expectations of a 0.5% uptick.

- Feb's reading was revised down to -0.1% from 0.0% reported previously.

- Annual production surged to 12.4% in Mar, reflecting base effects due to the sharp decline at the beginning of the crisis.

- Mar's uptick was led by a 1.1% increase in consumer non-durable goods output, followed by durable consumer goods output rising by 0.7% on a monthly basis.

- Intermediate goods output edged up 0.4% in Mar, while energy output was flat.

- Capital goods production saw the only decline among the main categories, falling by 0.4% in Mar.

- The clothing and textile industries saw the largest monthly gains, rising by 19.9% and 13.6%, respectively.

- On the other hand, tobacco production recorded the larges drop, down 11.7% m/m.

Source: Ine

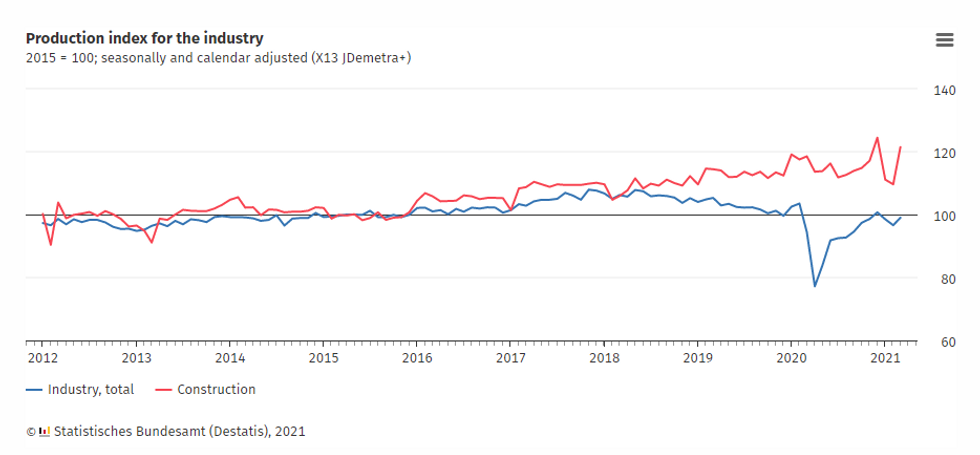

German IP Rebounded in March

GERMANY MAR IND PROD +2.5% M/M, +5.1% Y/Y; FEB -1.9% M/M

- German industrial production rose by 2.5% in Mar, stronger than market expectations (BBG: +2.1%).

- This marked the first increase after two successive declines and the highest level since Oct 2020.

- Feb's reading was revised down to -1.9% from -1.6% previously reported.

- Annual production rebounded to 5.1%, after falling by 6.8% in Feb.

- Despite the recent uptick, Mar's output was still 4.3% compared to Feb 2020, the month before the start of the pandemic.

- While the production of consumer and intermediate goods increased by 2.9% and 1.2%, respectively, capital goods output declined by 0.4%.

- Energy output increased by 2.4%, while construction output surged 10.8%.

- Mar's increase was in line with the truck toll mileage index, which rebounded in Mar and is closely connected to IP.

- However, the index declined by 1.6% in April, which bodes ill with future gains of industrial production.

Source: Destatis

French IP Rebounded Strongly in March

FRANCE MAR IP +0.8% M/M, +13.7% Y/Y; FEB -4.8% M/M

FRANCE MAR Manuf. Output +0.4% M/M, +15.7% Y/Y; FEB -4.8% M/M

- M/M French IP rebounded to 0.8% in Mar, following Feb's decline, but falling short of markets looking for a larger increase of 2.0%.

- Compared to Feb 2020, production remains 5.9% lower in Mar.

- Annual output surged by 13.7% in Mar, reflecting base effects as output fell sharply at the beginning of the pandemic in early 2020.

- Monthly mfg output ticked up as well by 0.4% in Mar, after dropping by 4.8% in the previous month, while annual mfg production rose markedly by 15.7%

- Energy output recorded the largest m/m increase in Mar, up 3.2% after falling by 4.5% in Feb.

- Capital and consumer non-durable goods production rebounded to 0.8% and 0.6% in Mar, following declines for both indicators in Feb.

- While intermediate goods production fell at a slower pace of 0.1% in Mar, consumer durables output deteriorated to -4.1%.

- Survey evidence continues to signal expansion in the mfg sector with the manufacturing PMI remaining well above the 50-mark and Insee's business climate indicator for the mfg sector shifting above the long-term average.

MNI: FRANCE MAR SA TRADE BALANCE -EUR6.1 BN; FEB -EUR5.1 BN

FIXED INCOME: Awaiting US employment data

Market awaits US employment data.

- EGBs have traded heavy this morning with curves bear steepening.

- Equity bid and comments from ECB Kazak "decision to slow Bond buying possible in June", have kept the lid on Govies.

- BTP, fell with Bunds, and 10yr yield now eye the May high at 0.944%, also highest yield level since 21/09.

- BTP support noted at 146.70 Low May 3, has so far held, with the contract printing 146.79 low.

- Peripherals are trending a touch wider, Italy at 1.3bp.

- Gilts have ticked lower inline with EGBs, and also following the UK local election headline, that UK Conservatives won Hartlepool, in what was a massive blow for the Labour party.

- US treasuries are trading within overnight ranges and sits in red territory at the time of typing.

- US curve also leans bear steeper, on limited volume and market flow ahead of the US NFP.

- Looking ahead sees US and Canadian employment data.

- US President Biden delivers remarks on the April jobs report

- More speakers are scheduled, including ECB Lagarde, BoE Broadbent and Haldane, Fed Barkin.

- After markets, rating from Fitch on Austria and France, and Moody on Italy

FOREX: EUR Boosted as Market Eyes Kazaks Comments

- EUR/USD saw support all the way higher to 1.2090 early Friday as markets watched comments from ECB's Kazaks, who stated that a decision could be made slow the ECB's bond-buying programme as soon as June, adding that the ECB may not spend the entirety of their pandemic program envelope.

- These comments underpinned early EUR gains, although SEK and NOK remain firmer on the day.

- Separately, GBP trades well, with GBP/USD nearing 1.3930 following regional and by-election results in the UK that showed the Conservative Party firming their lead on the opposition.

- Today's jobs report takes focus going forward, with markets expecting gains of 1mln jobs across April, pressing the unemployment rate lower by 0.2 ppts to new post-pandemic lows of 5.8%.

- The Canadian jobs report also crosses, with CAD continue to pressure new cycle highs. April is expected to have seen job losses in Canada, boosting the unemployment rate up to 8.0%.

EQUITIES: US Futs Edging Higher Pre-Payrolls

- Asian stocks closed mixed, with Japan's NIKKEI up 26.45 pts or +0.09% at 29357.82 and the TOPIX up 5.65 pts or +0.29% at 1933.05. China's SHANGHAI closed down 22.409 pts or -0.65% at 3418.874 and the HANG SENG ended 26.81 pts lower or -0.09% at 28610.65

- European equities are stronger, with the German Dax up 153.09 pts or +1.01% at 15309.57, FTSE 100 up 29.64 pts or +0.42% at 7098.64, CAC 40 up 0.07 pts or +0% at 6359.65 and Euro Stoxx 50 up 14.83 pts or +0.37% at 4007.98.

- U.S. futures are edging higher, with the Dow Jones mini up 30 pts or +0.09% at 34472, S&P 500 mini up 4.25 pts or +0.1% at 4198.5, NASDAQ mini up 18.75 pts or +0.14% at 13616.5.

COMMODITIES: Copper Continues To Soar

- WTI Crude down $0.07 or -0.11% at $64.64

- Natural Gas up $0.01 or +0.31% at $2.937

- Gold spot up $5.17 or +0.28% at $1819.1

- Copper up $7.15 or +1.55% at $467.45

- Silver down $0.02 or -0.06% at $27.3003

- Platinum down $5.3 or -0.42% at $1249.95

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.