-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, July 12

MNI US OPEN - Harris Overtakes Biden in Democratic Nomination Betting Odds

MNI US Open: Fixed income under pressure

EXECUTIVE SUMMARY:

- FRANCE PM SAYS FRANCE NO LONGER TO EVACUATE PEOPLE FROM ARGHANISTAN AFTER FRIDAY

- MOFCOM SAYS US-CHINA ECONOMIC AND TRADE TEAMS MAINTAIN NORMAL COMMUNICATIONS

- FIXED INCOME UNDER PRESSURE WITH BUND FUTURES AT LOWEST LEVEL FOR A MONTH

Fig 1. Bund Futures at Lowest Level in a Month

Source: MNI, Bloomberg

NEWS:

US-CHINA (MNI): The China-U.S. economic and trade teams maintain normal communications, said Gao Feng, spokesman of the Ministry of Commerce at a briefing on Thursday, when asked to confirm media reports about possible meeting in China between the U.S. Treasury Secretary and Chinese Vice Premier Liu He.

EQUITIES (BBG): Net purchases of Chinese technology shares in New York by retail investors in the past five trading sessions topped the $400 million mark, according to Vanda Research.

JAPAN (MNI): Japan's government kept its main economic assessment unchanged for a 4th straight month in August, but upgraded its view on corporate profits, the Cabinet Office said Thursday, again saying the country is recovering from the pandemic, despite some areas of weakness.

JAPAN POLITICS (Kyodo News): Former Foreign Minister Fumio Kishida said Thursday he will run in the leadership race of Japan's governing Liberal Democratic Party, pitting him against Prime Minister Yoshihide Suga.

GEOPOLITICS (France 24): France will no longer be able to evacuate people from Afghanistan after Friday evening, French Prime Minister Jean Castex told RTL radio.

UK (ONS): The estimated 7% of businesses' workforce reported to be on full or partial furlough leave in early August 2021 suggests that approximately 1.6 to 2 million people were furloughed within the industries surveyed in BICS.

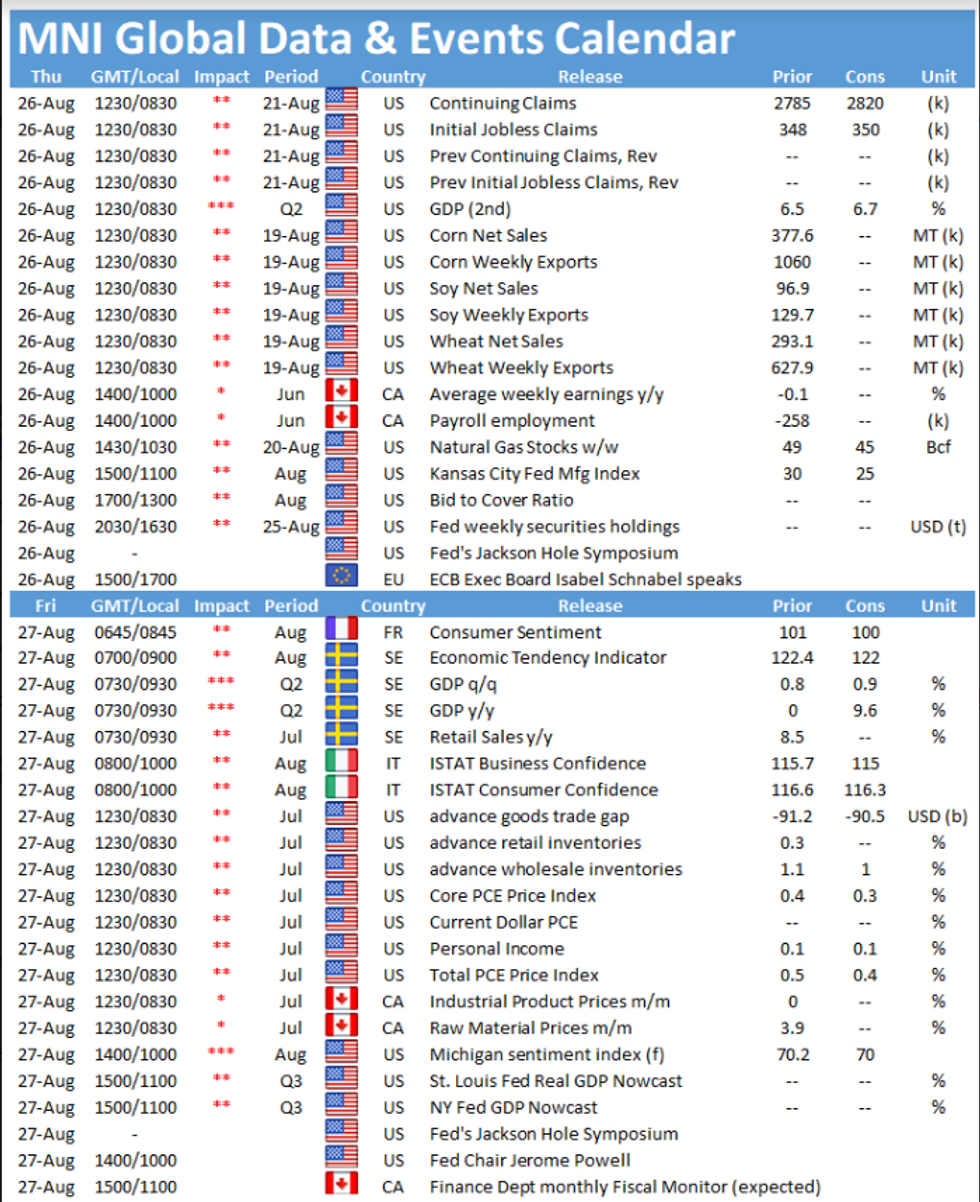

DATA:

FIXED INCOME: Bear Steepening Continues

Sovereign bonds have traded weaker this morning and mark a continuation of yesterday's bear steepening theme. Equities have traded lower while the dollar has made broad gains against G10 FX.

- UST cash yields have drifted higher and are broadly 1bp higher across much of the curve. TYU1 trades at 133-17+, near the bottom end of the day's range (L: 133-15 / H: 133-22).

- The gilt curve has steepened as a result of the short end firming slightly and longer end yields inching higher. The 2s30s spread is 2bp wider on the day.

- The bund curve has bear steepened with 2s30s up 1bp.

- OATs trade in line with bunds, with the longer end similarly underperforming.

- The European data slate has been light this morning, with the market instead focused on US claims data and the second estimate of US Q2 GDP, which will be published later today.

USD bid on rising US yields

Still fairly subdued session for FX so far this morning.

- USD has extended small gains and is in the green versus all majors, but ranges have been limited, with most of the early action happening in Govies, as yield rises.

- This has helped keep the USD underpinned, and the Greenback leads versus the Kiwi, up 0.36%.

- Ranges are tight, EURUSD 18 pips (1.1757/1.1775), while other crosses trade in circa 30 pips range.

- The pound is mixed in G10, down 0.21% against the USD, and up 0.15% versus the Kiwi.

- There's a notable large Option expiry in EURGBP, with 1.16bn at 0.8600, although the pair is still a little far, now at 0.8562 at the time of typing.

- The EUR is faring better on the margin, up versus most G10s, albeit small down with the USD and NOK.

- Looking ahead, US, sees GDP and Core PCE, but these are second readings, so unlikely to move the needle.

- Plenty of speakers are scheduled, ECB Rhen, Villeroy and Schnabel. ECB also publish their minutes from the 21-22 July meeting.

- And few Fed speakers appear on Network TV, 0730ET KC's George (Bloomberg), 0800ET Bullard (CNBC), 1030ET Dallas' Kaplan (CNBC).

- 2000ET Full Jackson Hole Agenda Released

EQUITIES: European equity futures lower

- Japan's NIKKEI up 17.49 pts or +0.06% at 27742.29 and the TOPIX down 0.31 pts or -0.02% at 1935.35

- China's SHANGHAI closed down 38.72 pts or -1.09% at 3501.664 and the HANG SENG ended 278.26 pts lower or -1.08% at 25415.69.

- German Dax down 112.87 pts or -0.71% at 15748.74, FTSE 100 down 28.06 pts or -0.39% at 7121.45, CAC 40 down 17.66 pts or -0.26% at 6658.97 and Euro Stoxx 50 down 29.14 pts or -0.7% at 4152.19.

- Dow Jones mini down 2 pts or -0.01% at 35359, S&P 500 mini down 7.5 pts or -0.17% at 4486, NASDAQ mini down 45.25 pts or -0.29% at 15320.

COMMODITIES: LEVELS UPDATE: Lower with the exception of natgas

- WTI Crude down $0.77 or -1.13% at $67.54

- Natural Gas up $0.01 or +0.21% at $3.905

- Gold spot down $5.25 or -0.29% at $1785.35

- Copper down $1.5 or -0.35% at $426.05

- Silver down $0.16 or -0.67% at $23.6756

- Platinum down $7.27 or -0.73% at $991.8

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.