-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Focus On American Consumers

EXECUTIVE SUMMARY:

- US RETAIL SPENDING SEEN STRONG THROUGH MAY (MNI REALITY CHECK)

- UK JOBLESS RATE LOWER AGAIN IN APRIL; PAY GROWTH UP SHARPLY

- E.U.-U.S. REACH DEAL TO END BOEING-AIRBUS TRADE DISPUTE

- E.U. SET TO LIFT TRAVEL CURBS FOR U.S. RESIDENTS THIS WEEK

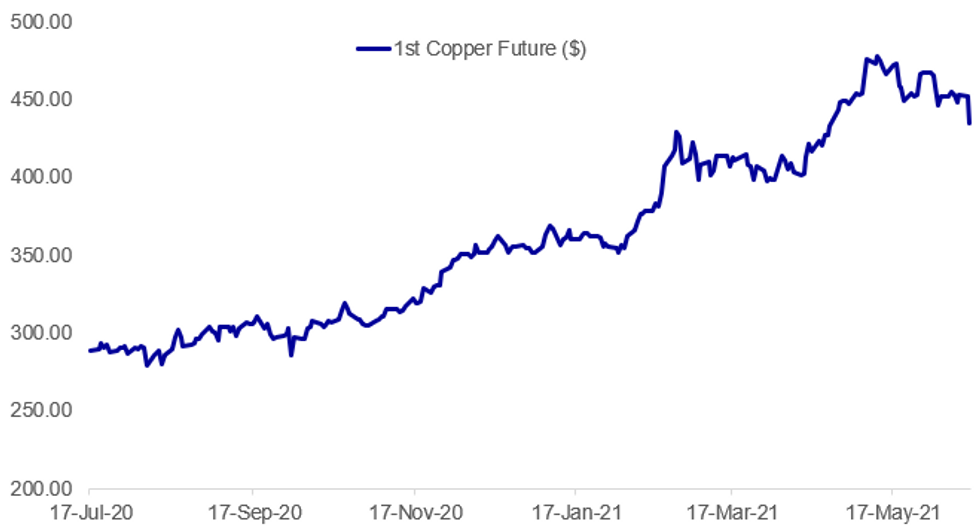

Fig. 1: Copper Hits 7-Week Lows As China Seen Curbing Prices

Source: BBG, MNI

Source: BBG, MNI

NEWS:

US DATA (MNI REALITY CHECK): Retail sales likely strengthened in May as mobility increased and consumers were mostly undeterred by higher prices, industry experts told MNI, painting a rosier picture than most forecasts suggest. For full article contact sales@marketnews.com

UK DATA: Regular pay rose by an annual rate of 5.6% in the three months to April (up from 4.3% in Q1), the biggest increase on record, with earnings flattered by easy 2020 comparisons, when the effects of the pandemic first wreaked havoc with the economy. Total earnings also increased by 5.6% (boosted by an 8.4% surge in the month of April), the biggest rise since March 2007, the Office for National Statistics said. Bonuses increased by 9.0% in the latest three months, and by 32.1% in April, amid reports of signing-on incentives in certain areas of the economy. Real regular earnings increased by a record high of 4.4% from 3.3% in Q1, while real nominal earnings increased by 4.4%, the biggest rise since April of 2001. Approximately 1.5% of earnings growth is due to the compositional effect of earnings, with job growth over the spring concentrated in higher-paid roles.

E.U.-U.S. (BBG): The U.S. and the European Union agreed to end their 17-year dispute over aircraft subsidies to Airbus SE and Boeing Co. that saw the allies impose tariffs on $11.5 billion of each other's exports.The European Commission spent Monday night discussing the accord with member states to get the deal over the line before an EU-U.S. summit in Brussels with President Joe Biden, according to officials familiar with the deliberations. A formal announcement is expected later Tuesday.

E.U.-U.S. (BBG): The European Union is set to lift travel restrictions for U.S. residents as soon as this week, in the latest step toward a return to normal despite concerns over the spread of potentially dangerous coronavirus variants.Portugal, which holds the rotating presidency of the EU, proposed adding the U.S., Albania, Hong Kong, Lebanon, Macau, the Republic of Northern Macedonia, Saudi Arabia, Serbia, and Taiwan to a so-called "white list" of countries from which non-essential travel to the bloc is allowed, according to a diplomat familiar with the matter. Assuming no objections, EU government envoys in Brussels will approve the expanded white list on Wednesday, the diplomat said, asking not to be named, in line with policy.

ECB (BBG): European Central Bank Governing Council member Olli Rehn says "accommodative financing conditions are a key element in supporting the recovery of the euro-area economy. "Emergency purchases of assets amid the pandemic "will be conducted in a flexible manner to help counteract the disinflationary effects of the pandemic and support growth". Finnish central bank, which Rehn heads, says recent faster inflation in the euro area is due to "one-off and temporary factors"

UK/AUSTRALIA: Following a dinner last night between UK PM Boris Johnson and his Australian counterpart Scott Morrison, the UK and Australia have officially concluded a full free trade agreement, the first brand new bilateral deal (as opposed to a rollover of an EU deal) achieved by the UK since it left the European Union. While the deal is not expected to add a significant amount to headline GDP (0.02% over 15 years), but benefits are likely to be felt in areas on both sides currently subject to significant tariffs. There is also the prospect of soft power benefits accruing from a more relaxed work visa regime for young Britons seeking work in Australia and vice versa.The heads of the devolved national gov'ts of the UK have demanded scrutiny of the deal not only in Westminster, but also in their national parliaments.A significant area of concern for the first ministers of Scotland and Wales in particular - given their outsized agricultural sectors in comparison to England - will be what protection is offered to farmers in the deal. The brief released announcing the deal says that farmers will be "protected by a cap on tariff-free imports for 15 years, using tariff rate quotas and other safeguards", but it remains to be seen what this will offer in practice.

BOFA FUND MANAGER SURVEY: 51% of survey respondents expecting the bull market in equities to continue until next year (up from 36% last month)

- The proportion believing that equities will peak in H2 this year has declined from 47% to 38%

- 41% of respondents see reducing equity exposure too early as the biggest risk, while only 10% worry about not having enough defensive hedges

- A net 41% of global investors say they are overweight European equities, the highest since February 2018

- 75% of investors expecting global growth to improve over the coming twelve months, down from 91% in March

- Tech remains the largest consensus overweight among European investors, while travel & leisure is now the largest consensus underweight.

UK DATA: Jobless Rate Lower Again in Apr; Pay Growth Up Sharply

FEB-APR LFS JOBLESS RATE 4.7% VS 4.8%

FEB-APR AVG TOTAL EARNINGS +5.6% VS +4.3% PRIOR

FEB-APR AVG EARNINGS EX-BONUS +5.6% VS +4.6% PRIOR

MAY CLAIMANT COUNT DOWN 92,600 to 2,495,700

- The UK jobless rate ticked down again to 4.7 in Apr, in line with markets looking for a small downtick to 4.7%.

- While the employment rate edged slightly up to 75.2% in Apr, the inactivity rate was unchanged at 21.0%.

- More up-to-date PAYE data showed a m/m increase of 197,000 in the number of payrolled employees in May, the largest uptick since records began in Jul 2014. However, compared to Feb 2020, there were still 553,000 fewer people in payrolled employment, and the largest falls have been recorded in the accommodation and hospitality sector and among those under 25 and living in London.

- There were 758,000 vacancies in Mar 2021 to May 2021, 146,600 more than in the previous quarter and only 27k less than before the crisis. Jobs growth was particularly strong in the hospitality sector.

- Redundancies were back at pre-crisis levels in Apr and the number of furloughed employees continued to fall.

- Wages grew strongly in the 3 months to Apr with total nominal pay rising by 5.6%, the highest level since Mar 2007. However, the ONS noted that pay growth is affected by compositional effects and base effects and the underlying picture suggests a more modest pay rise.

ITALY MAY FINAL HICP -0.1% M/M, +1.2% Y/Y; APR +1.2% Y/Y

MNI: FRANCE MAY FINAL HICP +0.3% M/M, +1.8% Y/Y; APR +1.6% YY

GERMANY MAY FINAL HICP +0.3% M/M, +2.4% Y/Y; APR +2.1% YY

FIXED INCOME: NGEU and US PPI the highlights today

Core fixed income has moved higher this morning, reversing some of its losses yesterday. Treasuries are slightly outperforming gilts and Bunds.

- Focus this morning has been on the inaugural NGEU transaction with books of over E107bln when the final spread was set. We continue to look for a transaction size of E10-12bln but note that three is a legal limit of E20bln to syndication sizes.

- Looking further ahead we note that there will be focus on US PPI ahead of tomorrow's FOMC meeting. The Bloomberg median looks for 0.5% M/M, but the mode looks for 0.6%.

- TY1 futures are up 0-4 today at 132-20+ with 10y UST yields down -1.3bp at 1.483% and 2y yields down -0.1bp at 0.158%.

- Bund futures are up 0.13 today at 172.77 with 10y Bund yields down -1.0bp at -0.262% and Schatz yields down -0.3bp at -0.681%.

- Gilt futures are up 0.03 today at 127.95 with 10y yields down -1.0bp at 0.730% and 2y yields down -0.2bp at 0.065%.

FOREX: GBP/USD Nearing Key Support and Monthly Lows

- The greenback is modestly stronger headed into NY hours, but price action is thin and recent ranges are largely being respected. EUR/USD ran up higher in early Europe, boosting EUR/USD to 1.2147 before the rate faded back to flat at the crossover.

- GBP is softer for a second session, with the currency on the back foot after the UK delayed its economic reopening by four weeks to July 19th. Yesterday's lows at 1.4071 mark first support and a break through here opens the 50-day EMA at 1.4041 initially ahead of 1.4010 and the lowest level since mid-May.

- AUD, CAD are the poorest performers in G10, while the USD and SEK are firmer.

- US retail sales are the highlight Tuesday, with the advance reading seen dropping 0.7% against last month's flat figure. PPI data also crosses - both of which will be in focus ahead of tomorrow's Fed decision. There are plentiful ECB speakers, with de Cos, Lane, Panetta and Holzmann all due. Bailey of the BoE is also on the docket.

EQUITIES: Strong Start, With S&P Testing New Highs

- Asian stocks closed mixed, with Japan's NIKKEI up 279.5 pts or +0.96% at 29441.3 and the TOPIX up 15.73 pts or +0.8% at 1975.48. In a return from holidays, China's SHANGHAI closed down 33.189 pts or -0.92% at 3556.559 and the HANG SENG ended 203.6 pts lower or -0.71% at 28638.53

- European equities are pushing higher yet, with the German Dax up 104.05 pts or +0.66% at 15782.12, FTSE 100 up 18.94 pts or +0.27% at 7179.49, CAC 40 up 31.16 pts or +0.47% at 6645.68 and Euro Stoxx 50 up 20.94 pts or +0.51% at 4157.27.

- U.S. futures are up (S&P futs touching fresh all-time highs earlier), with the Dow Jones mini up 27 pts or +0.08% at 34408, S&P 500 mini up 6.25 pts or +0.15% at 4261, NASDAQ mini up 21.25 pts or +0.15% at 14146.25.

COMMODITIES: Copper Hits 7-Week Lows As China Seen Curbing Prices

- WTI Crude up $0.18 or +0.25% at $71.09

- Natural Gas down $0 or -0.06% at $3.351

- Gold spot down $2.57 or -0.14% at $1867.23

- Copper down $16.4 or -3.62% at $440.85

- Silver down $0.24 or -0.85% at $27.7325

- Platinum down $9.42 or -0.81% at $1165.55

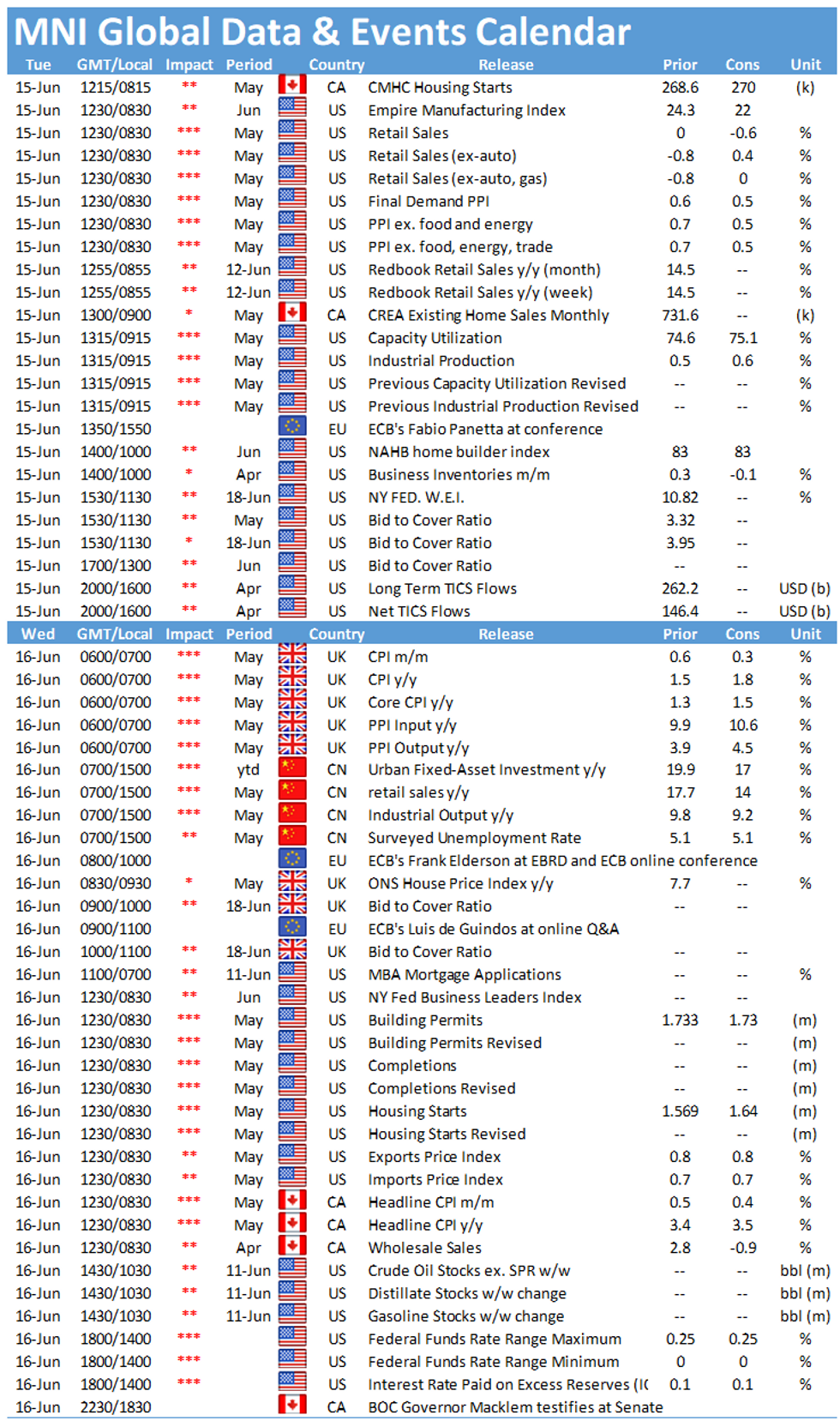

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.