-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Focus On Bank Of England QE Vote

EXECUTIVE SUMMARY:

- BANK OF ENGLAND SET TO MAINTAIN POLICY, BUT Q.E. VOTES EYED

- GERMAN IFO BEATS EXPECTATIONS; FRENCH BUSINESS CLIMATE HIGHEST SINCE 2018

- MERKEL CALLS FOR COORDINATED E.U. TRAVEL RULES; DIRECT LINE OF COMMUNICATION W PUTIN

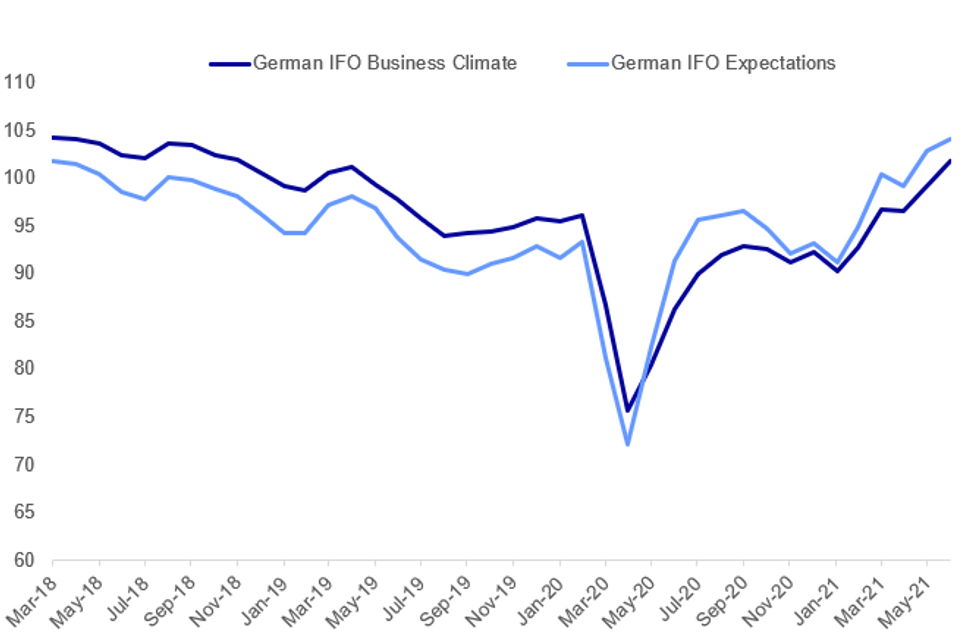

Fig. 1: German IFO Beats Expectations

Source: IFO, MNI

Source: IFO, MNI

NEWS:

BANK OF ENGLAND (MNI MARKETS PREVIEW): We think it is unlikely, but the most significant event for the market at the June meeting, would be if another MPC member joined Haldane in voting for a reduction to the QE target. Economic data has been encouraging: the biggest surprise to the economic datahas been the increase in core CPI in June to 2.0%. The MNI Markets team do think the extra uncertainty will be enough to stop any members of the MPC making any further hawkish moves, however. And then there is the elephant in the room of what happens to the labour market when the furlough scheme begins to wind down. For our full preview including summaries of over 20 sell side summaries click here. https://marketnews.com/mni-boe-preview-june-2021-e...

GERMAN IFO: German business confidence improved significantly again in June, hitting the highest level since November 2018, the Munich-based Ifo Institute said Thursday. The headline index rose to 101.8, up from 99.2, as both the current situation (99.6) and expectations (104.0) posted another monthly gain. "The German economy is shaking off the coronavirus crisis," Ifo said in a statement accompanying the data. Firms in the manufacturing sector were satisfied with their current situation, however they were slightly less optimistic regarding the outlook. The construction sector saw sentiment improve only marginally as firms continue to struggle with material shortages. Sentiment in the service sector surged across all sub-sectors. Especially the logistics sector and IT service providers noted good business conditions, but also the hospitality sector is expecting a strong increase in sales. The data followed the publication of data from France earlier Thursday, showing business sentiment at a 14-year high.

GERMANY-E.U. (BBG): German Chancellor Angela Merkel called on the European Union to coordinate rules for travelers from areas with outbreaks of Covid-19 variants as the risk of a renewed spike in infections remains."We're still treading on thin ice," Merkel said Thursday in a speech to parliament -- likely to be her last major addresses to lawmakers after 16 years as chancellor.While Germany's infection rates have declined steadily for weeks, Merkel has raised concern in recent days about the delta variant. She has called for Germany's quarantine measures to be imposed across the bloc.

GERMANY-E.U.-RUSSIA (BBG): Merkel said the European Union must forge a direct line of communication with President Vladimir Putin in order to address Russia's "many provocations" against the bloc and its interests in eastern Europe."It's not enough for the American President Joe Biden to speak with the Russian president -- which I very much welcome -- but the European Union must also establish a format for talks," Merkel told Germany's lower house of parliament in what may be one of her last major policy speeches as German leader.

CHINA-HONG KONG - UK (BBG): U.K. Foreign Secretary Dominic Raab on Thursday called on China to respect the basic freedoms of the people of Hong Kong following the arrest of journalists there and the closure of the Apple Daily newspaper."We certainly view what's been happening with the closure of the Apple Daily and the arrest of journalists very, very seriously," he said during a virtual press conference from Singapore. "It is part of the ongoing failure to comply with the joint declaration by China -- a series of commitments to respect their freedoms and the people of Hong Kong. That's reflected in the basic law and we call on China to respect the terms that it freely signed up to."

CHINA (BBG): Exercises by People's Liberation Army aircraft in the Taiwan Strait are "necessary" response to regional security situation, Chinese Defense Ministry says Thursday, without elaborating. Defense Ministry spokesman Senior Colonel Ren Guoqiang speaks during monthly briefing in Beijing. Opposed to U.S. using Taiwan to deal with China: Ren.

HONG KONG-U.K. (BBG): Hong Kong plans to raise the Covid risk level of the U.K. to "very high" from "high", indicating arrivals will not be able to qualify to have their quarantine reduced even if they are fully vaccinated, South China Morning Post reports, citing unidentified people.The move may come into effect next week.

CHINA-AUSTRALIA (BBG): China files complaint to WTO over Australia's anti-dumping and anti-subsidy measures targeting Chinese products including wind towers and stainless steel sinks, Commerce Ministry says in a statement.NOTE: Move follows Australia's decision to appeal to the World Trade Organization regarding China's imposition of anti-dumping duties on Australian wine

JAPAN: Japan's government has left its main economic assessment unchanged from the previous month but upgraded its assessment on housing investment for the first time since January, the Cabinet Office said Thursday. Overall, Japan's economy is still seeing signs of weakness in some areas, although there are signs of recovery from the pandemic, the government said. The Cabinet Office also slightly tweaked its assessment of corporate goods price index, saying that "CGPI is rising" in the wake of the recent rise in petroleum and coal products caused by strong global demand. The previous view was CGP is rising moderately.

BOJ: Japan's regional financial institutions must strengthen the foundations for businesses to help smooth the intermediation role, BOJ Governor Haruhiko Kuroda said Thursday. "Looking ahead, the economy continues recovering, and the focus of support from financial institutions will shift from financial aid to supporting main businesses," Kuroda said at the National Shinkin Bank Association meeting.

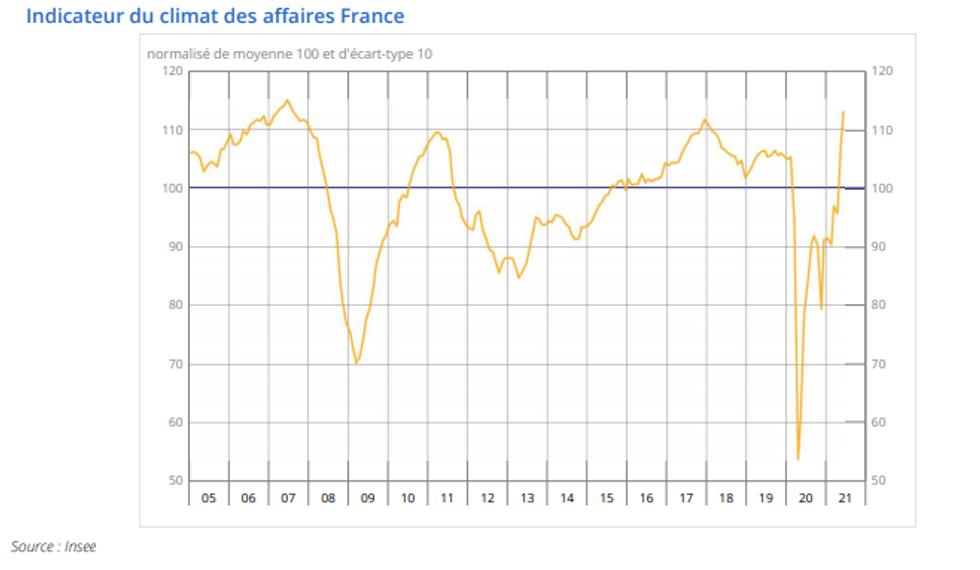

FR Business Climate At Highest Since Apr 2018

JUN BUS CLIM INDICATOR 113; MAY 108

JUN MFG SENTIMENT 107; MAY 107

JUN SERVICES SENTIMENT 113; MAY 107

- The French business climate indicator jumped to the highest level since Aug 2007, rising 5pt to 113 and surpassing market expectations (BBG: 110)

- Jun's uptick was driven by a marked improvement in the service sector and the index is now stands significantly above the long-term average and the pre-crisis level.

- Business climate in the service and retail trade sector surged 6pt and 8pt to 113 and 115, respectively.

- Service sector sentiment rose to the highest level since Jul 2007, while retail trade confidence increased to a 40-month high.

- Manufacturing business climate remained at May's level of 107 in Jun, following several months of growh.

- Insee noted that firm's assessment of the outlook in all the sectors is increasing.

- Employment climate rose significantly as well, up 5pt to 104 and recording the highest level since the start of the pandemic. The increase was led by the service sector according to Insee.

Source: Insee

EQUITIES: U.S. Futures Pushing To All-Time Highs

- Asian stocks closed fairly flat/mixed, with Japan's NIKKEI up 0.34 pts or +0% at 28875.23 and the TOPIX down 2.04 pts or -0.1% at 1947.1. China's SHANGHAI closed up 0.434 pts or +0.01% at 3566.654 and the HANG SENG ended 65.39 pts higher or +0.23% at 28882.46.

- European stocks are higher, with the German Dax up 129.24 pts or +0.84% at 15456.39, FTSE 100 up 9.16 pts or +0.13% at 7074.06, CAC 40 up 56.3 pts or +0.86% at 6551.07 and Euro Stoxx 50 up 40.43 pts or +0.99% at 4075.94.

- U.S. futures are at/testing all-time highs (S&P emini ATH = 4,258.25), with the Dow Jones mini up 181 pts or +0.54% at 33937, S&P 500 mini up 22 pts or +0.52% at 4253, NASDAQ mini up 91.75 pts or +0.64% at 14354.25.

COMMODITIES: Copper Gives Back Some Of Wednesday's Big Gains

- WTI Crude up $0.39 or +0.53% at $73.41

- Natural Gas down $0.01 or -0.27% at $3.329

- Gold spot up $2.2 or +0.12% at $1777.43

- Copper down $4.95 or -1.14% at $427.15

- Silver up $0.11 or +0.42% at $25.9273

- Platinum down $7.09 or -0.65% at $1079.21

FIXED INCOME: BoE, US Data and speakers in Focus

EGBs trade mainly in the red this morning albeit within past ranges.

- Bunds are down 14 ticks at the time of typing with the curve leaning steeper.

- Peripherals have traded inline with the German 10yr and as such trade flat to a touch tighter.

- Italy leads by just 0.3bp.

- Gilts have traded range bound (127.36-127.55), as investors await for the BoE statement.

- Main focus will be on the vote count and whether another MPC member joins Haldane in calling for a reduction in the QE target.

- US Treasuries are trading in tandem with EGBs, with the long end strip in the red,

- Tnotes are down 3 ticks and within the overnight ranges.

- Price action in the US has been limited as we await for US data and speakers.

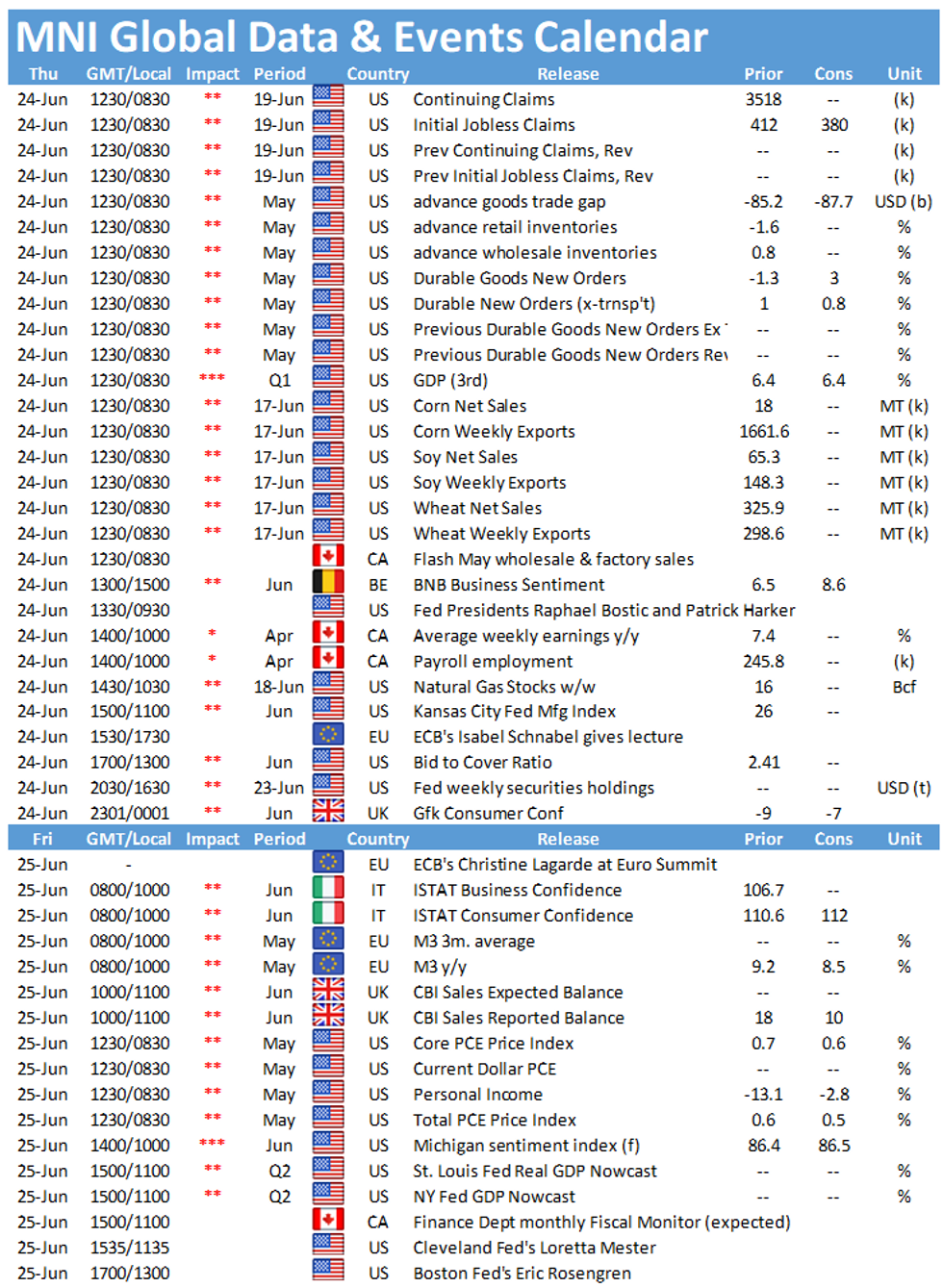

- Looking ahead, a busier day on the data front, with the notable US data being, GDP (3rd reading), Core PCE, IJC, Wholesale Inventory and Durable goods.

- Fed will also release their Bank stress test results.

- In Europe, European Council, 24-25 June 2021, no set time for the presser as of yet.

- Plenty of speakers are scheduled, which today include ECB Panetta, Schnabel, Fed Barkin, Harker, Williams, Bullard, Kaplan,

- Early attention will be on the UK BoE

FOREX: USD/JPY Inches to New 2021 Highs Overnight

- The greenback trades slightly softer as markets resume their overall bullish poise. Stock futures are extending their recovery, with the e-mini S&P within 15 points of the alltime highs.

- USD/JPY inched higher to touch a fresh 2021 high of Y110.21 in Asia-Pac hours, before prices faded into minor negative territory ahead of the NY crossover.

- NOK is stronger for a fourth session, with USD/NOK trading either side of the 8.50 level as a solid oil price performance underpins the currency. EUR/NOK eyes support at the 10.1276 100-dma, and a break below here would open the 10.09 50-dma and the 2021 lows of 9.8998.

- Focus turns to the Bank of England rate decision, with markets on watch for any signs of other MPC members joining outgoing Chief Economist Andy Haldane in voting for a slowdown in QE purchases. Data includes weekly US jobless claims, prelim durable goods orders and the tertiary reading for Q1 GDP.

- Speakers due Thursday include ECB's Panetta & Schnabel as well as Fed's Barkin, Bostic, Harker, Williams, Bullard and Kaplan.

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.