-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Focus On The Fed

MNI US Open: Focus On The Fed

EXECUTIVE SUMMARY:

- Focus today is on the FOMC meeting.

- Global coronavirus cases pass 100mn

- France urges faster disbursement of EU recovery funds.

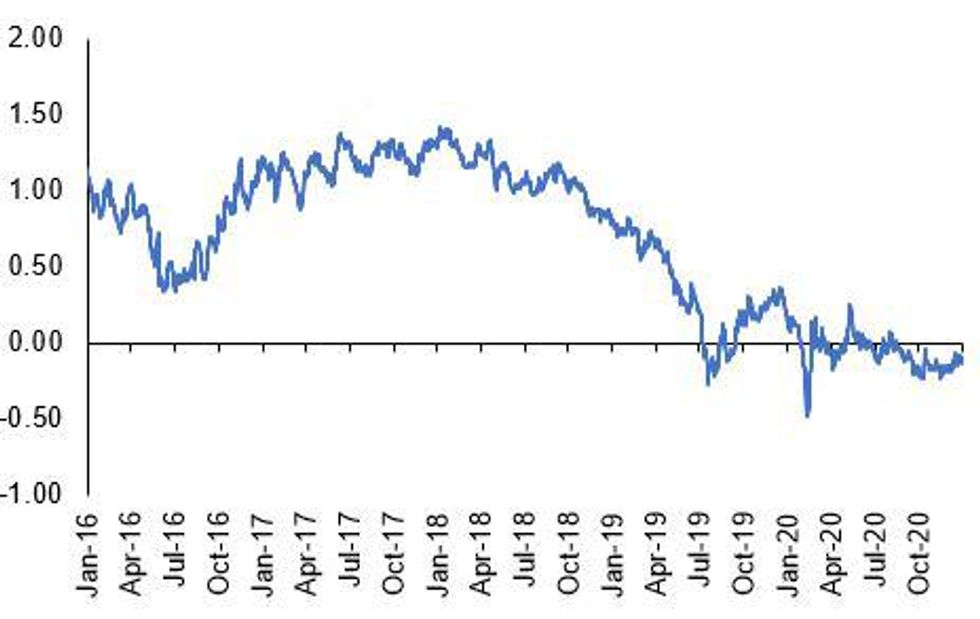

Fig 1. German 30-Year Government Bond Yield, %

NEWS:

CORONAVIRUS (REUTERS): Global coronavirus cases surpassed 100 million on Wednesday, according to a Reuters tally, as countries around the world struggle with new virus variants and vaccine shortfalls. Almost 1.3% of the world's population has now been infected with COVID-19, the disease caused by the novel coronavirus, and more than 2.1 million people have died. One person has been infected every 7.7 seconds, on average, since the start of the year. Around 668,250 cases have been reported each day over the same period, and the global fatality rate stands at 2.15%. The worst-affected countries – the United States, India, Brazil, Russia and the United Kingdom – make up more than half all reported COVID-19 cases but represent 28% of the global population, according to a Reuters analysis.

US (WSJ): Most Republican senators questioned the Senate's authority to hold an impeachment trial for a former president, dealing a blow to Democrats' chances of convicting Donald Trump of inciting an attack on the Capitol. Forty-five Republicans, including Senate Minority Leader Mitch McConnell (R., Ky.), sided with Sen. Rand Paul (R., Ky.) on his point of order arguing that the planned trial of a now-private citizen violates the Constitution. Some cautioned, however, that their vote Tuesday didn't necessarily dictate how they would vote at the end of trial. The proposal was tabled, or killed, in a 55-45 vote that clears the way for the trial to move forward in two weeks. All 50 lawmakers in the Democratic caucus joined GOP Sens. Mitt Romney of Utah, Ben Sasse of Nebraska, Susan Collins of Maine, Lisa Murkowski of Alaska and Pat Toomey of Pennsylvania.

FRANCE/EU (FT): France has called on the EU to overcome "blockages" to ensure faster disbursement of its €750bn recovery fund to member states, and said the coronavirus pandemic will require re-evaluating eurozone fiscal constraints. "I see there are blockages and that all this is too slow, that we need to accelerate and that if we want to emerge from the economic crisis in the best conditions, the European money must arrive as quickly as possible," Bruno Le Maire, French finance minister, told the Financial Times in an interview on Tuesday.

HONG KONG (FT): Fund managers and bankers leaving Hong Kong for alternative financial centres have been asked to explain their decision to a range of government agencies amid concerns that Beijing's national security law could cause departures from the Asia finance hub to multiply. Government agencies including the Securities and Futures Commission of Hong Kong, the Hong Kong Monetary Authority, the Hong Kong Financial Services and the Treasury Bureau and the Financial Services Development Council have phoned banking and asset management executives who have relocated to rival cities including Singapore and Tokyo, according to three people with direct knowledge of the calls. The calls, which hedge fund managers described as new and unusual, asked for a full picture of the decision-making process behind the moves and the significance of the timing.

FIXED INCOME: Heavy European supply on Fed day

As is often the case on FOMC decision day, it has been a fairly quiet start to the European morning session with core bonds generally a bit lower, led by gilts. Peripheral spreads are lacking direction.

- Issuance has again been a talking point in European markets with the UK and Germany holding auctions while Austria, Greece and Slovenia all launch new issues via syndication.

- Some attention has been paid to comments from ECB's Knot, although more in FX space as he is reported as saying that the ECB has the tools to counter euro appreciation.

- As we note in the MNI Fed Preview (see here), The FOMC is likely to use the January meeting to reflect on developments over the previous six weeks and assess how they may impact the medium-term economic and monetary policy outlook. But there is little reason to expect the Fed to signal a change of course at this meeting, particularly when it comes to slowing the pace of its asset purchases - as Chair Powell put it earlier this month, "now is not the time to be talking about exit".

- TY1 futures are down -0-1 today at 137-11 with 10y UST yields up 0.6bp at 1.042% and 2y yields unch at 0.122%.

- Bund futures are up 0.05 today at 177.57 with 10y Bund yields down -0.1bp at -0.536% and Schatz yields down -0.4bp at -0.732%.

- Gilt futures are down -0.11 today at 134.53 with 10y yields up 1.5bp at 0.279% and 2y yields up 1.1bp at -0.134%.

FOREX: Greenback on the Front Foot Pre-Fed

The USD is mildly stronger against the rest of G10 so far Wednesday, with EUR/USD plumbing new intraday lows just ahead of the NY open. Yesterday's reports that the ECB are studying the exchange rate with respect to Fed and ECB stimulus packages is clearly continuing to weigh, helping EUR/USD test yesterday's lows of 1.2108.

GBP generally trades well, with new multi-year highs of 1.3759 printed this morning in GBP/USD - although macro queues are relatively few and far between. Focus remains on the UK's vaccine rollout, with figures yesterday reinforcing the programme's importance after the UK hit the grisly milestone of 100,000 COVID-19 deaths.

Focus turns to the upcoming FOMC rate decision. The Fed are expected to make no material change to policy, but markets are on watch for any clues that the FOMC could decide to withdraw accommodative policy or taper their asset purchases as the US begins to emerge from the pandemic. Prelim durable goods orders also cross.

EQUITIES: Asian stocks were mixed but European stocks and US futures lower

- Japan's NIKKEI up 89.03 pts or +0.31% at 28635.21 and the TOPIX up 12.07 pts or +0.65% at 1860.07

- China's SHANGHAI closed up 3.912 pts or +0.11% at 3573.341 and the HANG SENG ended 93.73 pts lower or -0.32% at 29297.53

- The German Dax down 73.27 pts or -0.53% at 13798.57, FTSE 100 down 12.92 pts or -0.19% at 6644.09, CAC 40 down 0.36 pts or -0.01% at 5526.42 and Euro Stoxx 50 down 19.89 pts or -0.55% at 3573.03.

- Dow Jones mini down 100 pts or -0.32% at 30747, S&P 500 mini down 8 pts or -0.21% at 3834.5, NASDAQ mini up 56.5 pts or +0.42% at 13538.

COMMODITIES: Trading Mixed

- WTI Crude up $0.24 or +0.46% at $52.86

- Natural Gas up $0.05 or +2.03% at $2.71

- Gold spot down $4.19 or -0.23% at $1846.95

- Copper down $1.80 or -0.5% at $360.1

- Silver down $0.09 or -0.35% at $25.3923

- Platinum down $13.95 or -1.27% at $1088.85

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.