-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Growth And Taper Fears

EXECUTIVE SUMMARY:

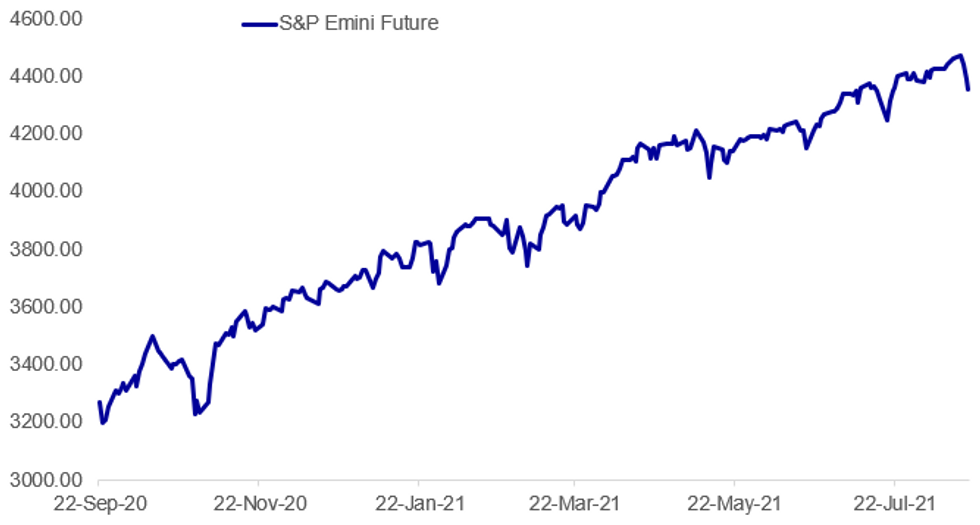

- S&P FUTURES CONTINUE LOWER WITH DOLLAR INDEX AT YEAR'S HIGH

- NORGES BANK REITERATES THAT RATE HIKE LIKELY NEXT MONTH

- IRON ORE SELLOFF ACCELERATES AS CHINA SEEKS TO CUT STEEL OUTPUT

- TOYOTA PLUNGES ON REPORT CHIP SHORTAGE TO FORCE 40% OUTPUT CUT

- RATE GUIDANCE FIRST STEP IN ECB POLICY SHIFT: LANE

Fig. 1: S&P Futures Extend Late Weds Decline

Source: BBG, MNI

Source: BBG, MNI

NEWS:

NORGES BANK: Norges Bank keep the key policy rate unchanged at 0.00%, as widely expected. The bank also retain the key messaging from the June policy decision: "In the Committee's current assessment of the outlook and balance of risks, the policy rate will most likely be raised in September". USD/NOK extends week's minor uptrend, trading just shy of last week's highsof 8.9804.

IRON ORE / CHINA (BBG): Iron ore's rout accelerated as China pushes forward with a pledge to curb steel production. Futures in Singapore tumbled 10% and are trading at the lowest in eight months on expectations that Chinese steel output and consumption will weaken over the rest of the year. Prices are now down more than 40% from the record reached in mid-May. China has repeatedly urged steel mills all year to reduce output to cut back on pollution, with a drop in July's production signaling that measures are starting to take effect.

AUTOS /TOYOTA (BBG): Toyota Motor Corp. slumped as much as 4.7% after a report the worsening chip shortage will force the world's No. 1 automaker to cut global production for September by 40% from initial plans. Toyota had intended to build about 900,000 cars next month, based on a forecast drawn up in July, but that number has been reduced to about 500,000 units due to chip supply issues, the Nikkei reportedwithout attribution Thursday. A growing outbreak linked to the delta variant of Covid-19 across Southeast Asia has also impacted upon the Japanese company's procurement of auto parts, the newspaper said.

ECB: July's revision of interest rate forward guidance is just the first step taken by the ECB in implementing its new monetary policy strategy, chief economist Philip Lane wrote in a blog post Thursday, as he highlighted the role asset purchases and longer-term refinancing operations will continue to play when nominal interest rates are close to the lower bound. The requirements that inflation should be seen to converge towards the new 2% target well ahead of the ECB's projection horizon implies that it should by "sufficiently advanced and mature at the time of policy rate lift off," Lane explained, while the condition that it should do so "well ahead of the end of the projection horizon" helps to hedge against the risk of reacting to forecast errors.

BOJ (MNI INSIGHT): Bank of Japan officials remain vigilant on the outlook for automobile exports and production due to parts shortages in Southeast Asia but await data later this month after gains in real exports in July, MNI understands. For full article contact sales@marketnews.com

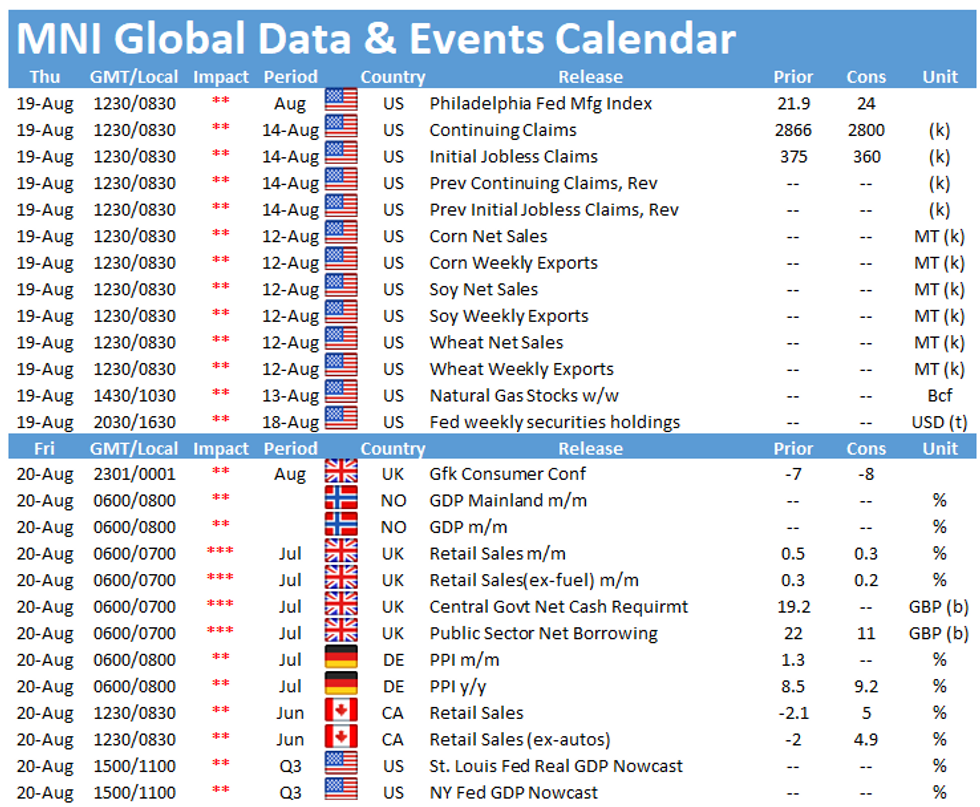

DATA:

FIXED INCOME: Higher, but still below Tuesday's highs

Given the moves lower in European equity indices this morning it is perhaps surprising that futures of Treasuries, Bunds and gilts all remain lower than their Tuesday highs

- There has been an underlying risk-off tone to markets this morning, but there have not been any real new triggers - more resumption of Afghan and Covid-19 concerns. Curves have bull flattened.

- There has been no tier 1 data this morning with the most notable data later today US Philadelphia Fed Business Outlook Survey and US weekly jobless claims data.

- In terms of supply today have have already seen France sell E7bln of MT OATs with E0.5-1.0bln of French linkers due while there is a reopening of the 30-year UST Bond later today for USD8bln.

- TY1 futures are up 0-12 today at 134-16+ with 10y UST yields down -3.8bp at 1.222% and 2y yields down -1.4bp at 0.202%.

- Bund futures are up 0.30 today at 177.22 with 10y Bund yields down -1.6bp at -0.499% and Schatz yields down -0.4bp at -0.752%.

- Gilt futures are up 0.40 today at 130.22 with 10y yields down -3.7bp at 0.528% and 2y yields down -2.8bp at 0.107%.

FOREX: Pervasive Risk-Off Puts AUD on the Ropes

- The risk-off feel that's bubbled through markets since the Monday open crystallized further Thursday, with a sharp drop in commodities prices the bleeding through equities, fixed income and foreign exchange this morning.

- Iron ore took focus in the late Asia session, with prices falling as much as 12% from the week's high as markets eye reports on China's intentions to 'aggressively' reduce steel production (thereby trimming demand for iron ore, a key input). This has undermined materials and energy stocks from the open, pressing core European markets lower by over 2% and, in turn, hurting risk sentiment.

- The slip in commodities prices has worked against materials-tied FX, putting AUD, NZD and CAD at the bottom of the G10 pile.

- The USD is firmer following the Fed minutes late yesterday, helping the USD Index trade at fresh cycle highs. The minutes proved hawkish, but were infitting with recent public FOMC speeches, preparing markets for a taper to asset purchases before the end of 2021.

- Focus turns to weekly US jobless claims data, and a particularly frenetic option expiry schedule, with sizeable strikes in EUR/USD, NZD/USD and USD/JPY worth watching.

EQUITIES: European Stocks Down 2+%

- Asian markets closed weaker, with Japan's NIKKEI down 304.74 pts or -1.1% at 27281.17 and the TOPIX down 26.78 pts or -1.39% at 1897.19. China's SHANGHAI closed down 19.731 pts or -0.57% at 3465.555 and the HANG SENG ended 550.68 pts lower or -2.13% at 25316.33

- European markets are sharply lower, with the German Dax down 294.34 pts or -1.84% at 15965.97, FTSE 100 down 160.03 pts or -2.23% at 7169.32, CAC 40 down 196.98 pts or -2.91% at 6770.11 and Euro Stoxx 50 down 93.05 pts or -2.22% at 4125.71.

- Next support for Eurostoxx 50 is at 4096.00.

- U.S. futures are continuing to fall, with the Dow Jones mini down 341 pts or -0.98% at 34546, S&P 500 mini down 40.25 pts or -0.92% at 4354.25, NASDAQ mini down 117 pts or -0.79% at 14732.5.

- Next support for S&P eminis is 50-day EMA coming in at 4341.36.

COMMODITIES: Oil Plunges As Risk-Off Move Hits Industrial Commodities

- WTI Crude down $2.16 or -3.3% at $64.08 (note next support at $63.17)

- Natural Gas down $0.06 or -1.48% at $3.797

- Gold spot down $2.74 or -0.15% at $1781.22

- Copper down $10.35 or -2.51% at $408.1

- Silver down $0.19 or -0.81% at $23.3024

- Platinum down $23.99 or -2.4% at $984.98

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.