-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Heavy Treasury Issuance To Start The Week

EXECUTIVE SUMMARY:

- GERMAN C.D.U. BACKS LASCHET AS CHANCELLOR CANDIDATE, BUT SOEDER MAY SEEK PARLIAMENTARY SUPPORT

- CHINA LOCAL GOVTS GET MORE CONTROL OF S.O.E. DEBT (MNI EXCLUSIVE)

- E.U., U.K. OFFICIALS WORKING TO RESOLVE N. IRELAND PROTOCOL ISSUES

- ENGLAND'S LOCKDOWN EASES AS SHOPS AND PUB GARDENS OPEN

- FINANCIALS IN FOCUS AS U.S. EARNINGS SEASON KICKS OFF THIS WEEK

Fig. 1: Better Than Expected, But EZ Retail Sales Still Weak

Eurostat, MNI

Eurostat, MNI

NEWS:

GERMANY: Wires and social media reporting that the leadership of the centre-right Christian Democratic Union has backed their own leader, Armin Laschet, to be chancellor candidate for the 'Union parties' in the September federal election.

- Focus now turns to Markus Soeder, head of the CDU's Bavarian sister party, the CSU (see 1005BST bullet).

- CDU supporting Laschet not a major surprise, with observers stating the larger national CDU would not want to be 'humiliated' by selecting the smaller CSU's candidate.

- Soeder could seek to rally support in the Bundestag for his candidacy, but the backing of the CDU for Laschet undoubtedly comes as a blow to his chances.

CHINA (MNI EXCLUSIVE): China is nudging local governments to help state-owned enterprises with short-term liquidity problems and assume more oversight of their debt, policy advisors said, heralding a move that could reduce support for weaker borrowers, avert major defaults and strengthen the bond market by differentiating credit. For full article contact sales@marketnews.com

U.K./E.U. (RTE): EU and UK officials are embarking on a process of technical and political talks which could result in a new joint document on resolving the outstanding issues around the Northern Ireland Protocol, RTÉ News understands. Diplomats have told RTÉ News that technical talks have been inching forward positively and that the process could be given a political boost by the UK's lead minister David Frost and his EU counterpart Maros Sefcovic as early as this week. While the rioting in Northern Ireland has gripped the headlines, there is a technical and political process underway involving London and Brussels.

U.K. (BBG): Non-essential retailers as well as pubs and restaurants with outdoor space will reopen Monday across England after almost 100 days of lockdown, hoping pent-up demand will translate into strong sales. Retailers from luxury department store Harrods to budget fashion chain Primark have been lining up new spring and summer ranges, while bars and restaurants have been buying tents to host outdoor gatherings in a bid to make up for lost time and sales." Today is a major step forward in our roadmap to freedom," Prime Minister Boris Johnson said in a statement. "I'm sure it will be a huge relief to those business owners who have been closed for so long."

U.S. CORPORATE EARNINGS (MNI): Q2 earnings season kicks off this week with the largest US bank names, with reports from Goldman Sachs, JPMorgan Morgan Stanley, Bank of America, Wells Fargo and Citigroup likely to take focus. This keeps the financials sector in focus, with the bulk of the larger reports due on Thursday. Full schedule here: https://roar-assets-auto.rbl.ms/documents/9444/MNI...

GERMANY/COVID (BBG): The head of the German chancellery, Helge Braun, conveyed in a meeting with state leaders that the federal government projects the current situation of high infections will last another six to eight weeks, Tagesspiegel reports, without saying where it got the information.

ARCHEGOS/U.S. BANKS (BBG): Total losses for banks hit by fallout from the Archegos Capital Management crisis will be about $10b, JPMorgan analysts write in a note. The analysts led by Kian Abouhossein earlier estimated the losses could range between $5bn and $10bn. While the presumably high leverage provided by Nomura and Credit Suisse raises questions around operational and credit risk management and potential regulatory fines, the analyst sees no systematic issue.

DATA:

EZ Retail Sales Beat Expectations

EZ FEB RET SALES +3.0% M/M, -2.9% Y/Y; JAN -5.2% M/M

- Monthly EZ retail sales rebounded by 3.0% m/m in Feb, after plunging by 5.2% in Jan (rev. up from -5.9%).

- Feb sales came in stronger than markets expected (BBG: 1.3%) and rose to the highest level since Aug 2020.

- Feb's uptick was driven by a sharp rebound of non-food product sales, up 6.8% after falling by 9.9%.

- Automotive fuel sales rose markedly as well by 3.7% following Jan's 0.9%-drop.

- Food sales declined in Feb by 1.1% after two consecutive months of gains.

- Annual sales improved to -2.9% in Feb, but they remain in negative territory for the second successive month.

- Among the member states, the largest gains were recorded in Austria (+28.2%), Slovenia (+16.4%) and Italy (+8.4%), while the biggest declines were seen in Malta (-1.5%), France (-1.2%) and Portugal (-0.7%)

FIXED INCOME: Core fixed income moves higher ahead of 3/10y UST auctions

Core fixed income has been on the front foot, with equities in the red this morning but little in the way of new news driving the moves.

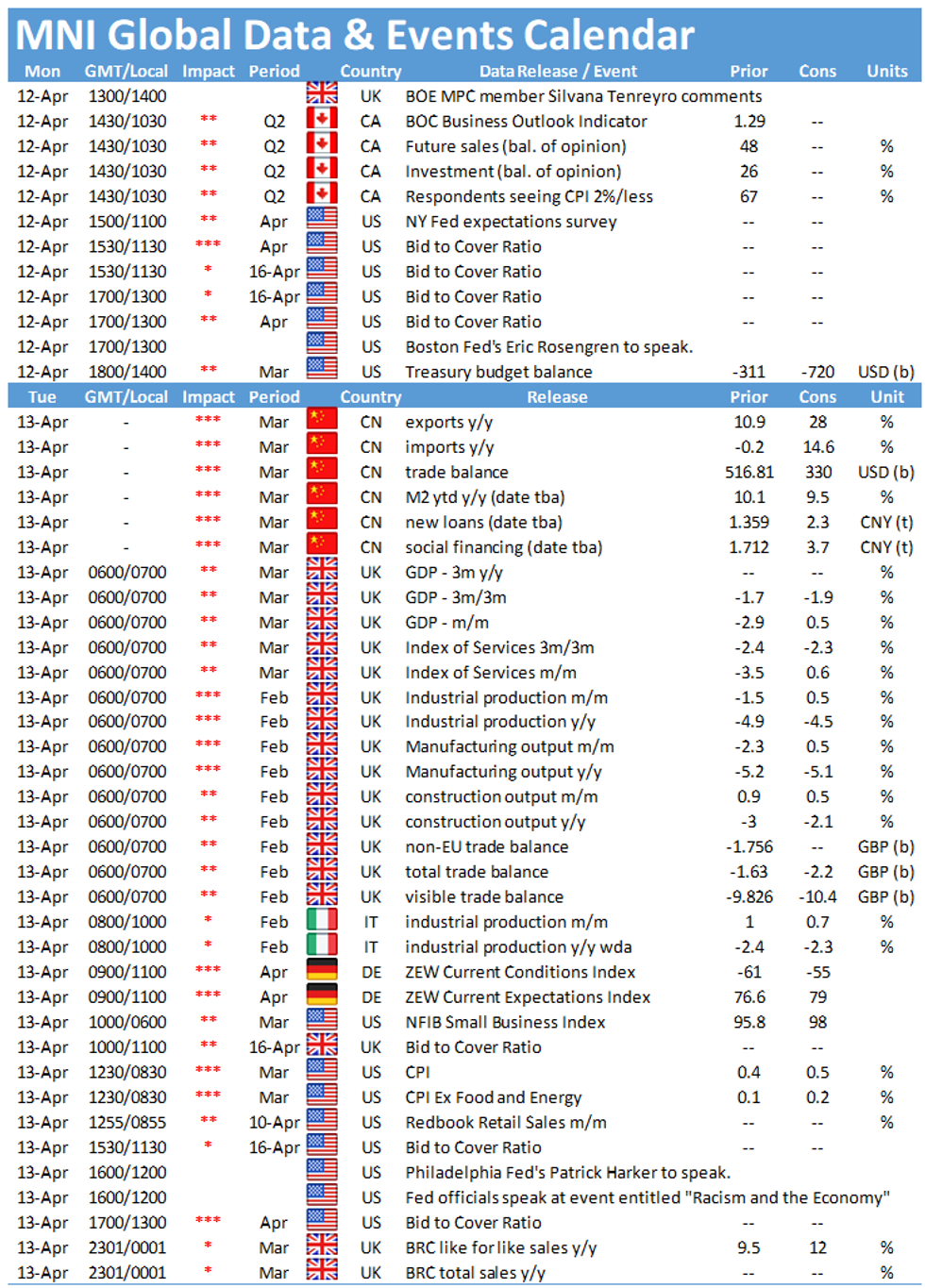

- Today sees a light data calendar with Eurozone retail sales alongside a few ECB/BOE speakers. Most notable in the day ahead will be a speech from the Fed's Rosengren (at 18:00BST/13:00ET) and the weekly ECB asset purchase release (at 14:45BST/09:45ET).

- In terms of supply the UST 3-year ($58bln) and UST 10-year ($38bln) auctions will be the highlights while the EFSF are holding a syndication for E4bln of a new long 5-year.

- TY1 futures are up 0-2+ today at 131-26 with 10y UST yields down -0.5bp at 1.655% and 2y yields unch at 0.156%.

- Bund futures are up 0.37 today at 171.74 with 10y Bund yields down -1.8bp at -0.322% and Schatz yields down -0.7bp at -0.714%.

- Gilt futures are up 0.08 today at 128.32 with 10y yields unch at 0.772% and 2y yields up 1.0bp at 0.050%.

FOREX: GBP Bouncing, USD Creeping Lower

- GBP trades well, with the currency recouping recent losses to climb to the top of the G10 leaderboard early Monday. The UK enters the second stage of the lifting of lockdown restrictions Monday, with non-essential retail and outdoor hospitality opening for the first time in months. EUR/GBP eyes the 50-dma as next support at 0.8637, but a break below would extend the reversal of last week's rally.

- Oil-tied currencies are at the bottom-end of the table, with NOK and CAD softer, but within ranges, while WTI and Brent crude futures hold below first resistance.

- The USD trades at the day's lows ahead of the NY crossover, edging lower while equities bounce off the overnight lows. The e-mini S&P is in minor negative territory, although well within range of the all time highs posted last week.

- There are no tier 1 data releases due Monday, with focus remaining on scheduled speeches from Fed's Rosengren, BoE's Tenreyro and ECB's de Cos. The beginning of earnings season remains in view, with large-cap US bank names kicking off reporting tomorrow.

EQUITIES: A Little Softer, With U.S. Earnings In Sight

- Asian stock markets closed lower, with Japan's NIKKEI down 229.33 pts or -0.77% at 29538.73 and the TOPIX down 4.88 pts or -0.25% at 1954.59. China's SHANGHAI closed down 37.729 pts or -1.09% at 3412.948 and the HANG SENG ended 245.52 pts lower or -0.86% at 28453.28.

- European equities are flat/lower, with the German Dax up 0.09 pts or +0% at 15225.54, FTSE 100 down 37.07 pts or -0.54% at 6903.77, CAC 40 down 6.18 pts or -0.1% at 6172.35 and Euro Stoxx 50 down 7.6 pts or -0.19% at 3974.23.

- U.S. equities are a little weaker as well, Dow Jones mini down 88 pts or -0.26% at 33594, S&P 500 mini down 8.75 pts or -0.21% at 4110.75, NASDAQ mini down 26 pts or -0.19% at 13803.5.

COMMODITIES: Oil Outperforming, Metals Weaker

- WTI Crude up $0.28 or +0.47% at $58.84

- Natural Gas up $0.04 or +1.43% at $2.553

- Gold spot down $4.59 or -0.26% at $1738.87

- Copper down $2.1 or -0.52% at $399.35

- Silver down $0.12 or -0.47% at $25.0869

- Platinum down $15.71 or -1.3% at $1189.53

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.