-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Oil And Gold Drop Sharply

EXECUTIVE SUMMARY:

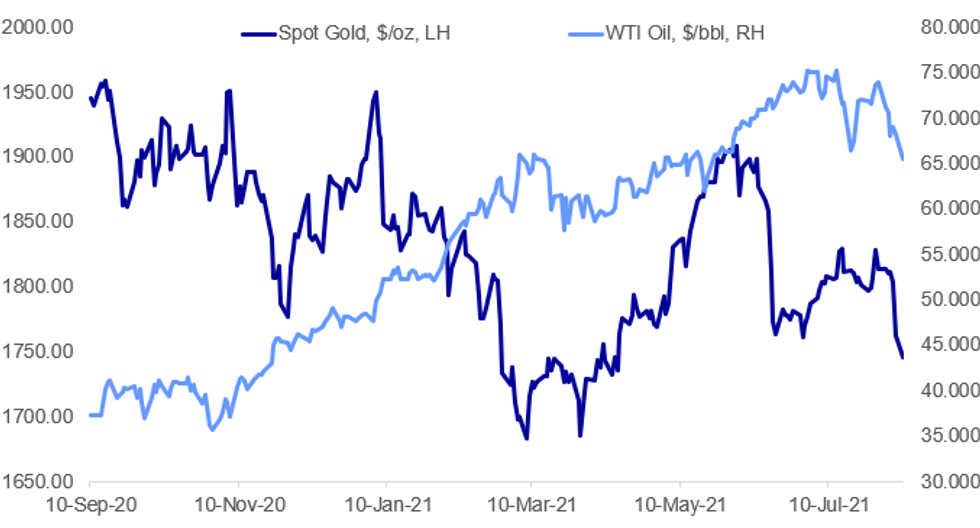

- OIL, GOLD PRICES DROP SHARPLY OVERNIGHT

- ECB'S WEIDMANN WARNS INFLATION MAY PICK UP FASTER THAN EXPECTED

- U.S. SENATE RESUMES INFRASTRUCTURE BILL PROCESS AT NOON E.T.

Fig. 1: Gold And Oil Drop Sharply

Source: BBG, MNI

Source: BBG, MNI

NEWS:

ECB (BBG): European Central Bank Governing Council member Jens Weidmann warned that inflation in the euro area could pick up faster than expected, and urged not to drag out the institution's pandemic bond-buying program. Weidmann, who is also the president of Germany's Bundesbank, will "urge to also keep a close eye on the risk of an inflation rate that is too high and not just look at the risk of an inflation rate that is too low," he told German newspaper Welt am Sonntag in an interview published on Sunday. "Higher inflation rates cannot be ruled out."

OIL (BBG): Oil extended losses after the worst week since October as a Covid-19 comeback raised concerns about the short-term demand outlook. Futures in New York fell below $67 a barrel after sliding almost 8% last week. The resurgence has led Goldman Sachs Group Inc. to downgrade its economic growth forecast for China, which recently completed a mass testing program in Wuhan -- the original epicenter of the pandemic -- following new confirmed cases. Infections have also climbed in the U.S. and Thailand.

GOLD: Fragile and illiquid conditions in precious metals markets saw gold prices spiral lower in early Asia-Pac trade, with markets taking out all nearby support levels to print multi-month lows of $1690.6. There was no obvious headline action on which to pin the move, stop-loss selling may have been in play, with broader activity limited by public holidays in Japan and Singapore.

CHINA STOCKS (BBG): China's microchip industry is feeling the heat of Beijing's regulatory scrutiny. A warning in state media Friday that regulators will show no tolerance in cracking down on speculators in the chip market sent related stocks lower on Monday. China's biggest chip foundry Semiconductor Manufacturing International Corp. dropped 5% in Hong Kong, while Hua Hong Semiconductor Ltd. tumbled 5.7% in its worst drop in nearly three months. Shanghai-listed Will Semiconductor Co. fell 5.7%, while Hubei Tech Semiconductors Co. was down 3.3%.

CHINA BONDS (BBG): China's benchmark sovereign bond yield jumped the most in a year, as quickening inflation sowed doubts about whether the nation's notes can maintain their world-beating advance. The 10-year government bond yield climbed as much as six basis points to 2.87% on Monday, its biggest rise since July 2020, after eight straight weeks of declines. That's after China's July factory-gate inflation unexpectedly returned to a 13-month high of 9% touched in May. A rise in short-term interbank rates also weighed on government debt.

U.S. SENATE / INFRASTRUCTURE (FOX'S CHAD PERGRAM ON TWITTER): Senate meets at noon et. Is burning post-cloture time on bipartisan infrastructure bill. If there is no deal to speed things up, passage of the bill likely comes between 3/4 am et Tuesday. Some GOPers, notably GOP TN Sen Bill Hagerty, requiring Senate to burn time in protest. The delay puts off Senate Dems from beginning work on budget framework for $3.5 trillion infrastructure bill the Dems are pushing. Dems using special budget reconciliation process to avoid a filibuster

DATA:

FIXED INCOME: Looking ahead to US CPI on Wednesday

After a delayed cash open for USTs (with much of Asia closed for holidays), the European morning session has seen Bunds and gilts drifted higher, but smaller moves for Treasuries.

- German trade data has been the only notable data so far this morning. Export data was stronger than expected (as was import data to a lesser extent). Looking ahead the only other data today is US JOLTs while the Fed's Bostic and Barkin are both due to speak.

- Looking ahead the biggest event of the week will be the US CPI print on Wednesday where the majority of analysts in the Bloomberg survey are looking for a slight dip in the Y/Y print from 5.4%Y/Y to 5.3%. There will also be focus on UK GDP and activity data for June/Q2 on Thursday.

- TY1 futures are up 0-1 today at 134-01 with 10y UST yields down -1.1bp at 1.288% and 2y yields down -0.4bp at 0.206%.

- Bund futures are up 0.22 today at 176.72 with 10y Bund yields down -1.0bp at -0.467% and Schatz yields down -0.7bp at -0.768%.

- Gilt futures are up 0.32 today at 129.58 with 10y yields down -2.4bp at 0.586% and 2y yields down -0.9bp at 0.123%.

FOREX: Commodity-Tied Currencies Shake Off Gold Volatility

- Commodity-tied currencies have been in focus with AUD, ZAR and others seeing early weakness after gold suffered an abrupt and sharp intraday sell-off. The bounce off the lows in gold has helped these currencies claw back initial losses, with the picture far more stable headed into the NY crossover.

- Stock markets sit just below recent highs, with markets generally working against the post-payrolls moves seen Friday. JPY is slightly stronger, with USD/JPY edging off last week's highs, but holding comfortably above 110.00.

- NOK is the poorest performer so far, with USD/NOK inching back toward the 9.00 handle as oil benchmarks extend recent losses.

- The data slate is relatively light Monday, with JOLTS job openings numbers the only real highlight. The central bank speaker schedule should be of more interest, with both Fed's Bostic and Barkin both on the docket.

EQUITIES: Tech Holding Ground In Mixed Trade

- With Japanese markets closed for holidays, Asian equities elsewhere closed higher. China's SHANGHAI closed up 36.407 pts or +1.05% at 3494.635 and the HANG SENG ended 104 pts higher or +0.4% at 26283.4

- European stocks are mixed, with the German Dax down 19.19 pts or -0.12% at 15772.16, FTSE 100 down 16.74 pts or -0.24% at 7122.95, CAC 40 up 1.04 pts or +0.02% at 6816.96 and Euro Stoxx 50 up 3.76 pts or +0.09% at 4180.75.

- Tech is holding ground amid slightly weaker US equities as a whole, with the Dow Jones mini down 101 pts or -0.29% at 34990, S&P 500 mini down 8 pts or -0.18% at 4421.5, NASDAQ mini up 4.25 pts or +0.03% at 15099.75.

COMMODITIES: Oil And Precious Metals Drop Sharply In Overnight Trade

- WTI Crude down $2.75 or -4.03% at $66.35

- Natural Gas up $0.01 or +0.29% at $4.166

- Gold spot down $16.01 or -0.91% at $1746.17

- Copper down $5.4 or -1.24% at $432

- Silver down $0.45 or -1.87% at $23.944

- Platinum down $9.13 or -0.93% at $976.18

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.