-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Oil Keeps Rising

EXECUTIVE SUMMARY:

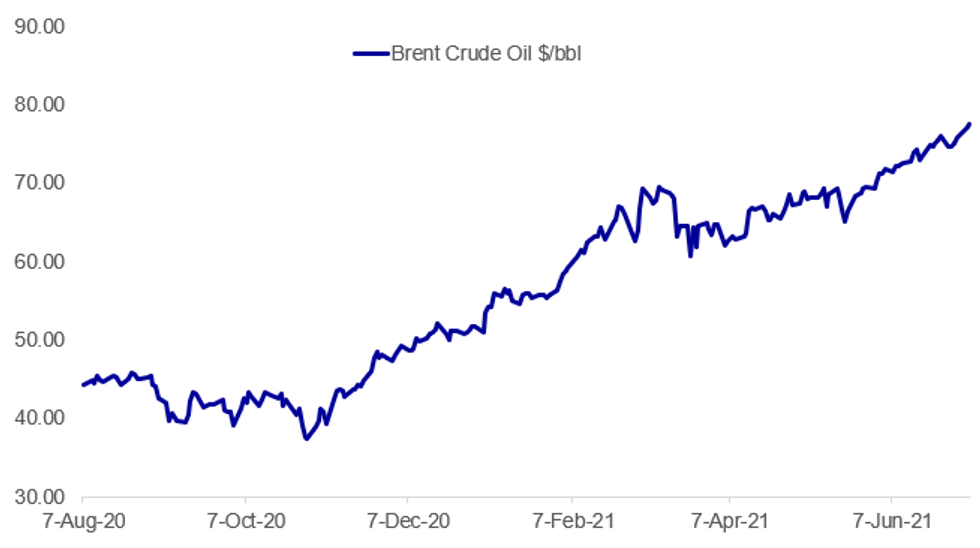

- OIL SURGES TO MULTI-YEAR HIGHS AS OPEC+ IN CRISIS MODE

- GERMAN FACTORY ORDERS UNEXPECTEDLY DROP AS CAR SALES SLUMP

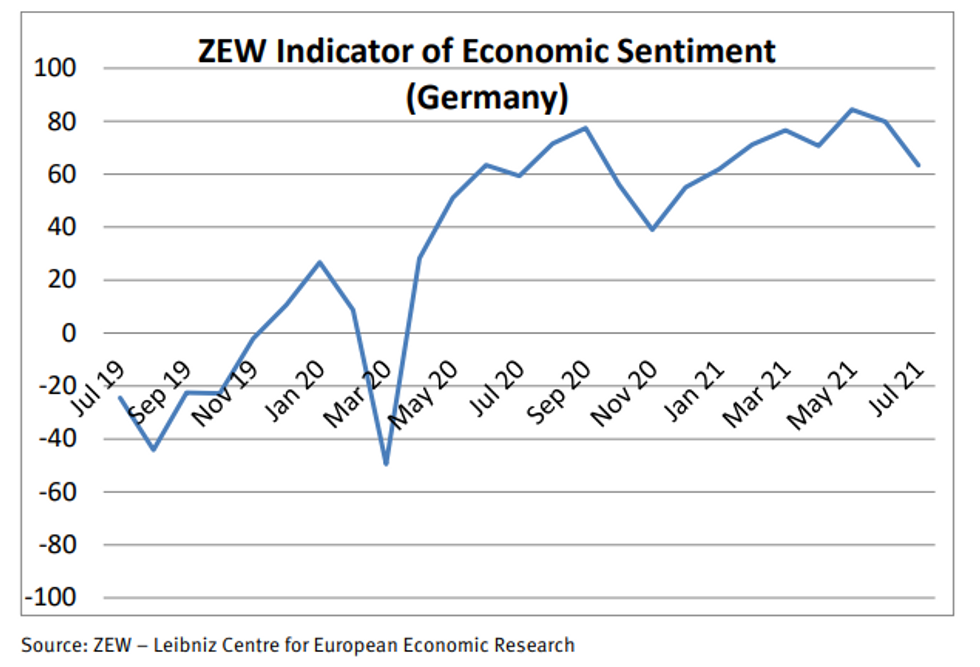

- ...AND ZEW SENTIMENT WELL BELOW CONSENSUS, BUT CURRENT CONDITIONS SURGE

Fig. 1: Brent At Highest Price Since 2018; WTI Since 2014

Source: BBG, MNI

Source: BBG, MNI

NEWS:

OIL (BBG): Oil jumped to the highest in more than six years after a bitter fight between Saudi Arabia and the United Arab Emirates plunged OPEC+ into crisis and blocked a supply increase. West Texas Intermediate crude advanced to $76.98 a barrel, the highest since November 2014, as the breakdown in cartel talks left the market without the extra supplies for next month it had been counting on. What happens next will determine whether the standoff could escalate into a conflict as destructive as last year's price war.

GERMAN DATA (BBG): German manufacturers unexpectedly saw demand decline in May, suggesting an uneven start to the country's economic recovery. Orders fell 3.7%, worse than all estimates in a Bloomberg survey. The Economy Ministry said the slump was driven by weak export demand for cars following a steep rise the previous month. Domestic orders rose 0.9%.

R.B.A.: (Earlier overnight): The Reserve Bank of Australia has maintained its yield target program on government bonds maturing in April 2024 at Tuesday's Board meeting, deciding against extending the target out to November 2024. The central bank has left official rates unchanged at a record low of 0.10%, and will continue with its bond buying program for longer dated bonds at the rate of AUD$4 billion per week "until at least mid-November."

SPAIN DATA (DJ): Spain's industrial production increased in May for the third consecutive month, data from national statistics office INE showed Tuesday. Industrial output rose by 4.3% in May compared with the previous month in calendar and seasonally-adjusted terms, after a 1.2% on-month rise in April. This is the highest rate since July 2020 when output rose by 5.2%.

ITALY (BBG): Some smaller commercial banks are fragile and struggling to adapt to external changes, says Bank of Italy governor Ignazio Visco at Italian Banking Association annual meeting. Impact of recession adds to banks' structural problems and can lead some of them to face crises, Visco says..

U.K. (BBG): Office for Budget Responsibility cites pandemic, climate change and debt in its Fiscal Risks Report published Tuesday: The pandemic could leave the Government facing around 10 billion pounds of unfunded pressures on departmental spending on average over the next three years, from legacy effects across health, education and transport": fiscal watchdog. Planned transition to net zero carbon emissions could add 21% of gross domestic product to U.K. debt over 30 years

SWEDEN (BBG): The core of Sweden's payment system that handles transactions between banks went down for an unknown reason on Tuesday, the central bank said. The Riksbank's payment system, RIX, "is currently encountering operational disruptions. These disruptions mean that no payments can be made in the system," the Riksbank said on its website on Tuesday.

DIDI / CHINA / EQUITIES (BBG) :Didi Global Inc. plunged in premarket trading after a Chinese regulator ordered the removal of the company's platform from app stores, days after a $4.4 billion initial public offering in the U.S.Shares of the China-based tech firm fell as much as 30% to $10.90, taking them below the $14 IPO price. They traded at $11.90 as of 4:19 a.m. in New York after the Cyberspace Administration of China barred new users, citing security risks and tightening its grip on sensitive online data. Didi, whose American Depository Receipts have only traded in New York since June 30, said the move may have an "adverse impact" on its revenue in China.

DATA:

MNI: GERMANY MAY IND ORD -3.7% M/M, +54.3% Y/Y; APR +1.2% M/M

MNI: SPAIN MAY IND PRD +4.3% M/M, +26.0% Y/Y; APR +1.2% M/M

MNI: EZ JUN CONSTRUCTION PMI 50.3; MAY 50.3

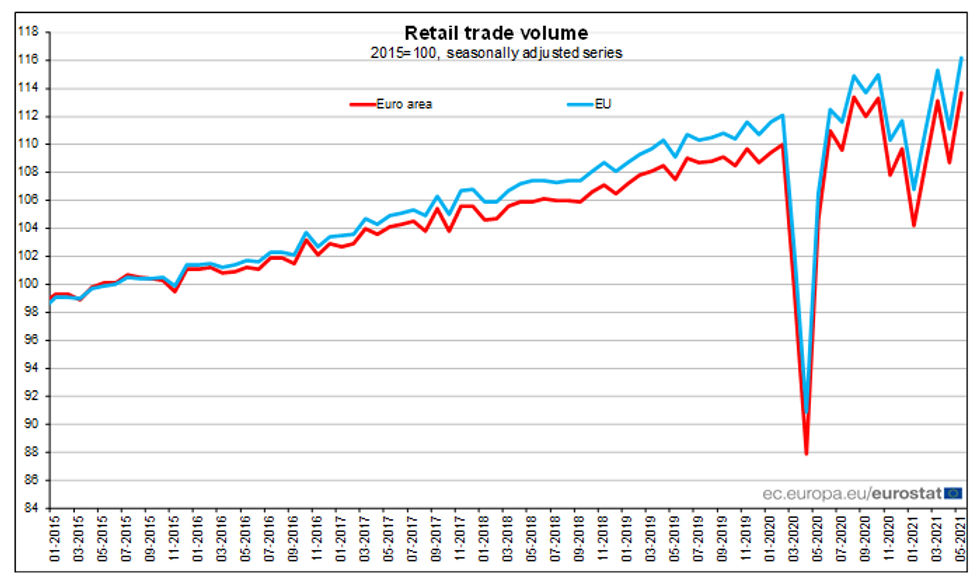

EZ Retail Sales Rebounded in May

EZ MAY RET SALES +4.6% M/M, +9.0% Y/Y; APR -3.9% M/M

- EZ retail retail sales rose by 4.6% in May after falling by 3.9% in Apr, hitting the highest level since Jun 2020.

- Monthly sales came in stronger than markets anticipated (BBG: +4.0%).

- Food sales declined at a slower pace of 0.2% in May, while sales of non-food products increased sharply by 8.8%, after decreasing 6.1%.

- Fuel sales rebounded as well, surging to 8.1% following two consecutive months of decline.

- Annual sales slowed to 9.0% in May, after jumping to 23.3% in April due to base effects.

- Among the member states, France (+9.9%), the Netherlands (+9.3%) and Estonia (+8.1%) recorded the largest m/m gains, while Latvia (‑3.9%), Finland (‑3.3%) and Luxembourg (‑0.7%) saw the biggest declines.

Source: Eurostat

ZEW Current Conditions Surged in Jul

GERMANY JUL ZEW ECONOMIC SENTIMENT +63.3; JUN +79.8

GERMANY JUL CURRENT CONDITIONS 21.9; JUN -9.1

- ZEW Expectations dropped 16.5pt to 63.3 in Jul, coming in weaker than expected (BBG: 75.0), although remaining at a very high historical level, according to the report.

- The ZEW Current Conditions jumped 31.0pt to 21.9 in Jul, outpacing market forecasts (BBG: +5) and showing the first positive reading in two years.

- "The economic development continues to normalise. In the meantime, the situation indicator for Germany has clearly overcome the coronavirus-related decline", said s ZEW President Professor Achim Wambach.

- "The financial market experts therefore expect the overall economic situation to be extraordinarily positive in the coming six months.", he added.

- EZ economic sentiment dropped 20.1pt to 61.2 in Jul, while current conditions surged 30.4pt to 6.0.

- Inflation expectations for the EZ declined 10pt, although 75% of experts still expect prices to rise in the next 6 months.

FIXED INCOME: Core FI higher after a weak gilt open

Core fixed income is higher on the day after some weakness around the gilt open (which saw gilt futures touch yesterday's lows briefly).

- Economic data has been mixed today with German factory orders weak (showing weak orders from outside of the euro area) while the ZEW expectations index was also weak but Spanish industrial production data was stronger than expected. Eurozone retail sales data was in line with expectations.

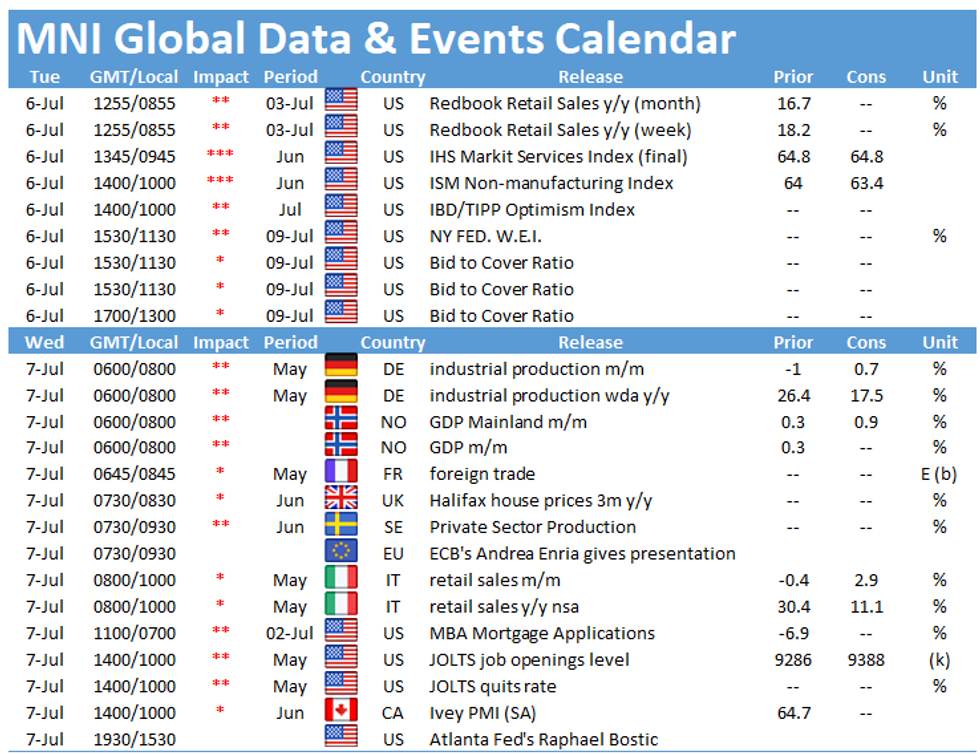

- The US will return to their desks today after the long July 4th weekend which should help liquidity later today.

- Across Europe it has been a fairly heavy day for supply with a French 30-year E5bln syndication while Austria, Germany and the UK are all holding bond auctions.

- The highlight of the afternoon session will be the ISM non-manufacturing, particularly the inflation and labour sub-components.

- TY1 futures are up 0-2 today at 132-23+ with 10y UST yields unch at 1.426% and 2y yields up 0.4bp at 0.239%.

- Bund futures are up 0.25 today at 172.95 with 10y Bund yields down -1.6bp at -0.228% and Schatz yields down -0.6bp at -0.672%.

- Gilt futures are up 0.11 today at 128.29 with 10y yields down -1.0bp at 0.703% and 2y yields unch at 0.052%.

FOREX: AUD Follows RBA Signpost: Easy Policy Not Forever

- AUD is among the session's best performers following the overnight RBA rate decision, in which the bank declined to roll their 3-year yield target from the Apr-24 line. The move was seen as a tacit admission that the Bank are taking their first step toward withdrawing extraordinary stimulus. As a result, AUD is better bid, with the AUD/USD now north of the 200-dma at $0.7576.

- Other majors are less directional, with the USD and EUR mixed. The NOK has been ebbing throughout the morning, reversing some of the week's strength on the back of buoyant oil prices.

- EUR/USD saw some early strength just ahead of the European open, touching $1.1895 before fading and returning to negative territory ahead of the NY crossover. This retains the bearish focus, with the Jul 2 1.1808 low the first target.

- Focus turns to the ISM Services Index, which is expected to slow slightly from last month's record high of 64.0. There are no central bank speakers of note.

EQUITIES: U.S. Futures Slightly Offered After Hitting Fresh Highs

- Asian stocks closed mixed, with Japan's NIKKEI up 45.02 pts or +0.16% at 28643.21 and the TOPIX up 5.51 pts or +0.28% at 1954.5. China's SHANGHAI closed down 4.063 pts or -0.12% at 3530.259 and the HANG SENG ended 70.64 pts lower or -0.25% at 28072.86.

- European equities are weaker, with the German Dax down 76.35 pts or -0.49% at 15661.97, FTSE 100 down 15.61 pts or -0.22% at 7164.91, CAC 40 down 26.24 pts or -0.4% at 6567.54 and Euro Stoxx 50 down 15.78 pts or -0.39% at 4087.37.

- U.S. futures are off slightly, with the Dow Jones mini down 20 pts or -0.06% at 34657, S&P 500 mini down 4 pts or -0.09% at 4338.75, NASDAQ mini down 16 pts or -0.11% at 14697.75.

COMMODITIES: WTI Hits Highest Since 2014 Amid Broader Rally

- WTI Crude up $1.24 or +1.65% at $76.4

- Natural Gas up $0.08 or +2.16% at $3.78

- Gold spot up $12.94 or +0.72% at $1805.94

- Copper up $10.85 or +2.54% at $438.45

- Silver up $0.13 or +0.48% at $26.6067

- Platinum up $10.21 or +0.93% at $1110.78

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.