-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Payrolls Awaited

EXECUTIVE SUMMARY:

- U.S. NONFARM PAYROLLS MNI DEALER MEDIAN CHANGE = ZERO

- E.U. CAN BUY UP TO 300MN MORE DOSES OF PFIZER VACCINE: VON DER LEYEN

- U.K. IMPOSES MANDATORY COVID TESTS ON ALL INCOMING TRAVELERS

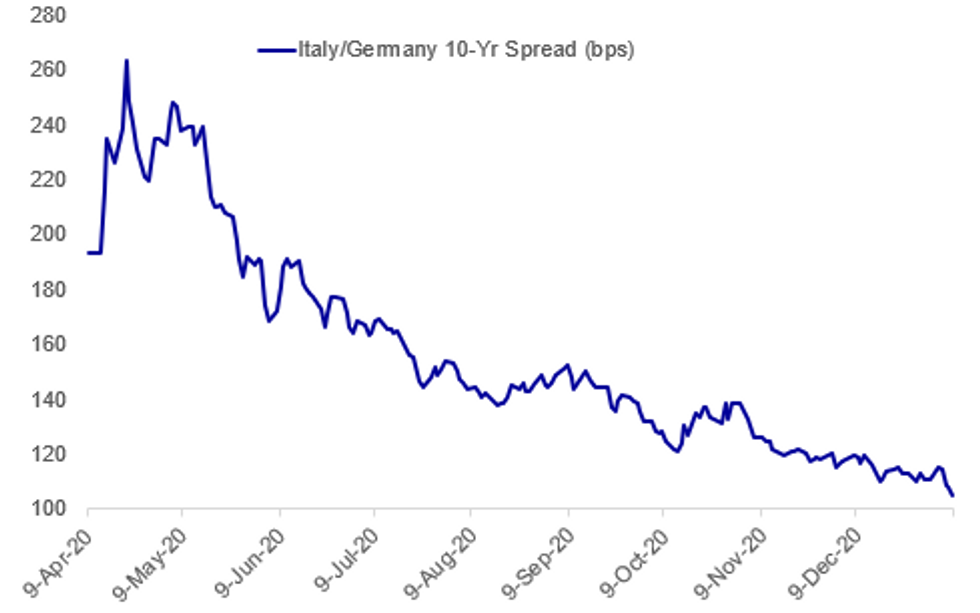

Fig.1: Italy Spreads Continue To Narrow

BBG, MNI

BBG, MNI

NEWS:

EU: Commission President Ursula von der Leyen tweets: "We make sure Europeans have sufficient doses of safe & effective #COVID19 vaccines. We now enable EU countries to buy more doses of the 1st vaccine approved in EU. They can now buy up to 300 million more doses of the #BioNTech/@pfizer vaccine."

- Link to her press conference on vaccines: https://www.pscp.tv/Ursulavonderleyen/1mrGmwzdBknxy

- EU has received criticism for perceived failings in the rollout of the vaccine.

U.K. (BBG): All passengers arriving in the U.K. will be required to prove they do not have coronavirus, showing a negative test result taken within 72 hours of the start of their journey. Under rules announced Friday, anyone failing to produce the evidence of a negative test will be fined 500 pounds ($678). Travelers arriving from countries not on the government's open travel corridor list will be required to isolate at home for 10 days, regardless of their test results.

GERMANY: Production plans in Germany deteriorated in December, with the Ifo production expectations index dropping to 4.5, down from the 5.6 seen in November. The picture is mixed across sectors. Production expectations declined in the pharmaceutical industry as well as in the automotive sector, while manufacturers for leather and related products are more pessimistic. The lowest indicator level is in the clothing industry where production expectations plunged to -40.

UK DATA: UK house prices ended 2020 at a record high average price, up 6.0% on the year at GBP253,374, the Halifax said Friday. Prices rose 0.2% on month in December, slowing from the 1.0% rise seen in the previous months. Helped by government schemes including a time-limited holiday of stamp duty, prices rose steadily from mid-year, the monthly update on house prices noted.

DATA:

US PREVIEW: Primary Dealer NFP Estimates

| Primary Dealer | Estimate | Primary Dealer | Estimate |

|---|---|---|---|

| Societe Generale | +150K | Citi | +120K |

| HSBC | +100K | Mizuho | +100K |

| Morgan Stanley | +100K | RBC | +100K |

| Scotiabank | +75K | Bank of America | +50K |

| Deutsche Bank | +50K | BMO | 0 |

| BNP Paribas | 0 | J.P.Morgan | -25K |

| NatWest | -25K | UBS | -35K |

| Barclays | -50K | Credit Suisse | -50K |

| Goldman Sachs | -50K | TD Securities | -50K |

| Wells Fargo | -50K | Jefferies | -110K |

| Nomura | -150K | ||

| Dealer Median | 0 | BBG Whisper | +63K |

MNI: GERMANY NOV IND PROD +0.9% M/M, -2.6% Y/Y; OCT +3.4% M/M

MNI: GERMANY NOV SA TRADE BALANCE +EUR16.4BN

MNI: FRANCE NOV IP -0.9% M/M, -4.6% Y/Y; OCT +1.9% M/M

MNI: FRANCE NOV SA TRADE BALANCE -EUR3.6 BN; OCT -EUR4.6 BN

MNI: FRANCE NOV CONSUMER SPENDING -18.9% M/M, -17.1% Y/Y

FIXED INCOME: Eurozone peripherals outperform, led by BTPs

Core bonds are performing well this morning with Bunds leading the moves higher.

- Core bond markets remain within yesterday's ranges but have been on the front foot since the European open this morning. The real movers, however, have been Eurozone peripherals. 10-year BTP-Bund spreads are 3.0bp tighter on the day and Portuguese spreads 2.2bp tighter. 10-year BTP yields are approaching the record lows seen in mid-December.

- Economic data on the whole has been better than expeted with French and German IP, German trade and Eurozone unemployment all better than expected.

- The newsflow this morning has largely focused on whether President Trump will remain in office to see out his full term, a study by the University of Texas that shows the Pfizer vaccine has given promising results against the UK and South African Covid-19 variants. The latter story is helping equities and risk in general rally.

- TY1 futures are down -0-1+ today at 136-29 with 10y UST yields down -0.4bp at 1.077% and 2y yields down -0.2bp at 0.138%.

- Bund futures are up 0.22 today at 177.47 with 10y Bund yields down -0.6bp at -0.531% and Schatz yields down -0.4bp at -0.714%.

- Gilt futures are up 0.22 today at 134.57 with 10y yields down -0.9bp at 0.274% and 2y yields unch at -0.143%.

FOREX: Jobs Data in Focus, USD Bounce Stutters

In typical pre-NFP trade, markets have been rangebound and largely muted early Friday. The USD made early gains in Asia-Pac hours, but these have been swiftly reversed thanks to a modest uptick in GBP, AUD and NZD. The single currency trades also trades soft, although EUR/USD has recovered off overnight lows of 1.2213.

Scandi FX trades poorly, with NOK and SEK the poorest performers so far, albeit on light newsflow, although industrial production data from both Sweden and Norway continues to look weak.

The US jobs report crosses later today, with the US expected to have added 50,000 jobs over the month of December - the lowest since the outbreak of the COVID crisis early last year. The whisper number is inline with consensus, with the unemployment rate expected to tick higher to 6.8%. The equivalent Canadian data is also on the docket. The speaker slate is quiet, with just Fed's Clarida due.

EQUITIES: Continuing To Push Higher

- Asian stocks closed higher, with Japan's NIKKEI up 648.9 pts or +2.36% at 28139.03 and the TOPIX up 28.64 pts or +1.57% at 1854.94. China's SHANGHAI closed down 6.097 pts or -0.17% at 3570.108 and the HANG SENG ended 329.7 pts higher or +1.2% at 27878.22.

- European futures are mostly higher, with the German Dax up 98.08 pts or +0.7% at 13968.24, FTSE 100 down 3.33 pts or -0.05% at 6856.96, CAC 40 up 18.81 pts or +0.33% at 5669.85 and Euro Stoxx 50 up 20.35 pts or +0.56% at 3622.42.

- U.S. futures continue to gain, with the Dow Jones mini up 87 pts or +0.28% at 31029, S&P 500 mini up 10.25 pts or +0.27% at 3805.75, NASDAQ mini up 50.5 pts or +0.39% at 12978.5.

COMMODITIES: Gold And Silver Drop On USD Buying

Precious metals have dropped sharply early Friday, gold falling suddenly with little clear catalyst.

- WTI Crude up $0.31 or +0.61% at $51.21

- Natural Gas down $0.07 or -2.46% at $2.67

- Gold spot down $22.54 or -1.18% at $1907.79

- Copper up $0.15 or +0.04% at $370.4

- Silver down $0.62 or -2.29% at $26.494

- Platinum down $12.55 or -1.12% at $1107.32

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.