-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI US Open: PBOC Eases

EXECUTIVE SUMMARY:

- P.B.O.C. CUTS RESERVE REQUIREMENT RATIO BY 0.5PP

- WEIDMANN SAYS E.C.B. WON'T DELIBERATELY SEEK INFLATION OVERSHOOTS

- REHN: MUST PREPARE FOR RECOVERY TO SLOW DUE TO DELTA VARIANT

- FED'S DALY WARNS DELTA VARIANT POSES THREAT TO GLOBAL RECOVERY (FT)

- UK GDP UP IN MAY, BUT WEAKER THAN EXPECTED

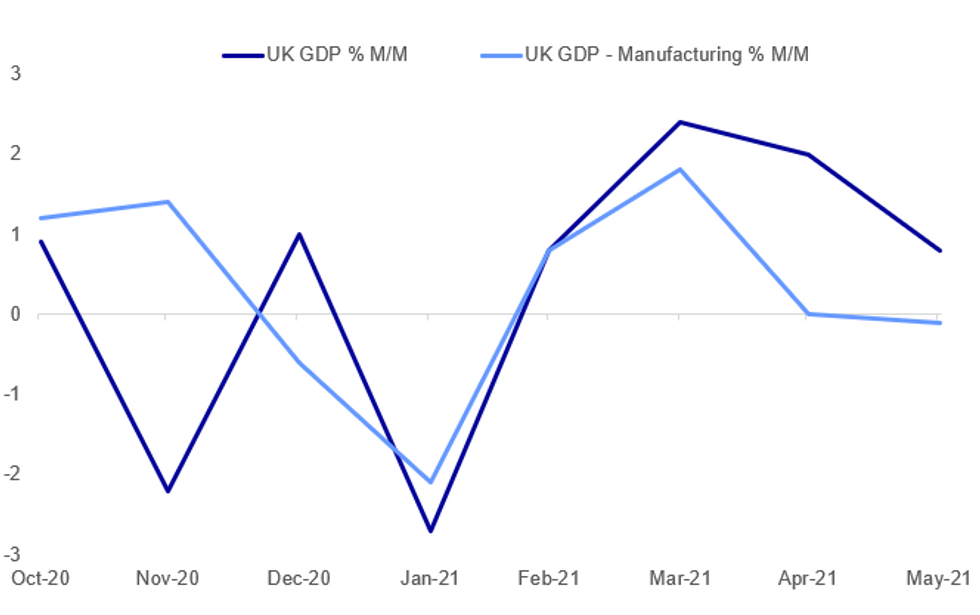

Fig. 1: UK May GDP Disappoints As Manufacturing Slips Back Into Contraction

Source: ONS, MNI

Source: ONS, MNI

NEWS:

P.B.O.C.: The PBOC has cut banks' reserve requirement ratio by 50bp, effective July 15, wires report citing a PBOC statement. The weighted avg RRR for all financial institutions will be 8.9% after the new cut, and around CNY1T of liquidity will be released into the market. USD/CNH inches to the best levels of the session on that headline, but no huge move in global risk assets, as this adjustment was largely telegraphed by the China State Council statement earlier in the week.

E.C.B. (BBG): Bundesbank President Jens Weidmann said the European Central Bank won't deliberately seek higher inflation rates to make up for previous undershoots, a day after it settled on a new strategy that implies price growth can exceed its target.The ECB raised its inflation goal to 2% on Thursday after an 18-month debate and acknowledged that temporary overshoots might occur when interest rates are near their lower limit, as now. In the run-up to the announcement, economists and investors speculated over whether the central bank would emulate the Federal Reserve in embracing average inflation targeting, which would mean automatic overshooting after periods of weakness."We are not striving for either lower or higher rates," Weidmann said, in one of the first reactions from within the Governing Council to the outcome of the ECB's strategy review. "That was important to me."

E.C.B. (BBG): The European Central Bank and the Federal Reserve would react similarly to economic shocks even though their goals aren't identical, Finland's Governing Council member Olli Rehn tells reporters. "The monetary policy reaction functions on both sides of the Atlantic would not be that far apart" because both central banks now have a symmetrical target, he said. Incomplete inoculation programs and spreading of Delta variant "one more reason" to ensure favorable financing conditions are retained. "We must prepare for the economic recovery to hit an adversity".

E.C.B. (BBG): European Central Bank officials have seen that the risk of too low inflation is at least as significant as the risk of it being too high, Bank of France Governor Francois Villeroy de Galhau says in Boursorama interview. Inflation objective is symmetric, not a ceiling. Can surpass the 2% target temporarily; "the 'temporarily' needs to be analyzed"

FED (FT): "A top Federal Reserve official has warned the spread of the Delta coronavirus variant and low vaccination rates in some parts of the world poses a threat to the global recovery as she urged caution in removing monetary support for the US economy. "I think one of the biggest risks to our global growth going forward is that we prematurely declare victory on Covid," Mary Daly, the president of the Federal Reserve Bank of San Francisco, said in an interview with the Financial Times. "We are not through the pandemic, we are getting through the pandemic."

FRANCE/G20/CARBON PRICING (BBG): France is proposing a global floor for carbon pricing as it's politically impossible to settle on a set price at present, Finance Minister Bruno Le Maire says.Le Maire speaks at Group of 20 meeting of finance ministers in Venice, Italy"A carbon price should be global and it would prevent the risk of carbon leakage, but we all know the political difficulties to have a set global carbon price everywhere in the world so let's forget about that for the time being."

U.K./COVID (BBG/FT): The U.K. government will tell English companies next week that employees can stop wearing face masks, while companies can stop enforcing social distancing and other virus-related measures, the Financial Times reports, citing unidentified people familiar with the plans. Documents issued by the government will be "heavily condensed" and republished as revised guidance, the people told the FT.

GLOBAL / DIGITAL CURRENCIES: The Bank for International Settlements has stepped up its campaign for central banks to press ahead with work on digital currencies, making the case in its latest report for developing versions that can be used for cross-border payments. A BIS survey found that while 25% of central banks are considering allowing non-residents to use CBDC's only 8% are considering allowing their own CBDC to be used in other jurisdictions from the outset. The BIS makes the case that CBDCs could facilitate cross-border payments and it calls on banks to explore the option, with the BIS taking the view that CBDC's are pretty much an inevitability that should be made as beneficial as possible.

DATA:

UK GDP Up in May; But Lower Than Expected

MAY GDP +0.8% M/M (PREV +2.0%), +24.6% Y/Y (PREV +27.4%)

MAY INDEX OF SERVICES +0.9% M/M; +23.4% Y/Y; PRV +2.8% M/M, MED +1.6%

MAY IND PRODUCTION +0.8% M/M, PRV -1.0%, MED +1.5%

MAY MANUFACTURING -0.1% M/M, PRV 0.0%, MEDIAN +1.0%

MAY CONSTRUCTION -0.8% M/M, PRV -0.7%, MEDIAN +1.0%

- M/M GDP ticked up 0.8% in May, showing the fourth consecutive gain but coming in weaker than expected (BBG: 1.5%). In May, GDP was still 3.1% below the pre-pandemic level.

- Y/Y GDP was up 24.6% in May, reflecting base effects as the economy was largely closed in May 2020.

- The service sector recorded the largest upward contribution to GDP growth, rising by 0.9% in May and adding 0.76pp to growth.

- Within services, accommodation and food services saw the largest gain, up 37.1%, as restaurants and pubs were able to open indoors. Food services rose by 34.0% in May, while accommodation services were up 39.3%. The ONS noted that also hotels saw a marked recovery as restrictions lifted.

- Industrial output rebounded to 0.8% in May, mainly due to adverse weather conditions leading to higher output of electricity, gas and air supply.

- Manufacturing output eased by 0.1% as transport equipment production fell by 16.5%, the largest drop since Apr 2020. The decline was driven by the shortage of microchips which disrupted car production.

- Construction output fell by 0.8%, but remains above the pre-crisis level.

- Looking ahead, if GDP was flat in June, economic growth in Q2 would grow by 4.5%. This would be the largest growth rate since Q3 2020 and the second highest since 1973.

ITALY DATA: Industrial Output Dropped in May

- May SA ind. output -1.5% m/m (Apr revised dn + 1.5% m/m), WDA +21.1% y/y; falling short of expectations looking for an uptick of 0.5%.

- May'21 m/m SA industrial output fell for the first time since Nov'20--Istat says

- ITALY ISTAT: 21 working days in May 2021 vs. 20 in May 2020

- May SA m/m consumer goods, intermed., capital gds, energy fell—Istat says

- May WDA y/y consumer, intermed., capital gds., energy rose--Istat says

FIXED INCOME: Yields regaining some ground

Core fixed income yields have continued to drift off of yesterday's lows this morning but over the past hour or so seem to have lost some momentum.

- At the time of writing:

- 10-year UST yields are around 8bp above their lows (down around 9.5bp on the week).

- 10-year gilts around 8.5bp higher than the lows (down around 7.0bp on the week).

- 10-year Bunds 3.3bp higher than yesterday's low (down around 7.5bp on the week).

- It is interesting that despite some of the divergences between core fixed income markets seen over the past couple of days, the overall moves on the week so far are pretty correlated.

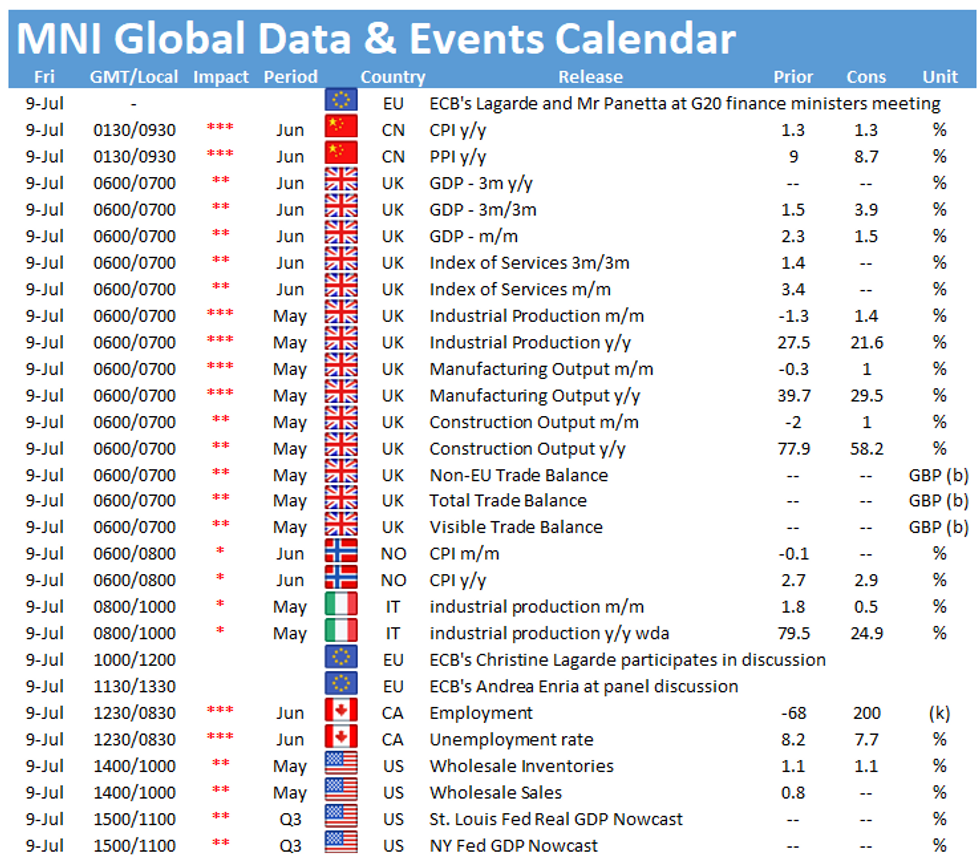

- Data this morning has largely been disappointing with UK monthly GDP and its components for May posting a slower than expected pace of growth while Italian industrial production unexpectedly saw its first month-on-month fall since November. Looking ahead, the data calendar is light with UK trade due at 12:00BST (7:00ET) in a delayed release, and US wholesale inventories.

- One of the highlights will be the Accounts of the June ECB meeting, although this may be looked at in a slightly different light following the outcome of yesterday's Strategy Review.

- TY1 futures are down -0-10+ today at 133-18 with 10y UST yields up 3.7bp at 1.331% and 2y yields up 1.1bp at 0.206%.

- Bund futures are down -0.10 today at 174.24 with 10y Bund yields down -0.3bp at -0.311% and Schatz yields down -0.1bp at -0.688%.

- Gilt futures are down -0.37 today at 129.05 with 10y yields up 2.0bp at 0.631% and 2y yields up 0.4bp at 0.077%.

FOREX: Havens Softer, Growth Proxies Firmer as Markets Stabilise

- Haven currencies are unwinding slightly this morning, with the JPY reversing recent outperformance on likely profit-taking after an extended spell of strength. This puts USD/JPY back above the Y110 handle, but USD/JPY bulls need to take the pair through 110.34 Fib retracement before any recovery solidifies.

- Oil-tied and growth-beta FX are the strongest this morning, helping AUD, NZD and NOK rally off the week's worst levels. A decent bounce in US equity futures is helping, with the e-mini S&P comfortably back above 4,300.

- CNH saw a modest downtick as the Chinese central bank cut the Reserve Requirement Ratio by 50bps, boosting USD/CNH to 6.50 before quickly retracing. The move was largely telegraphed earlier in the week, as the China State Council noted they would "use timely reserve requirement ratio cuts in order to support the real economy and to use RRR cuts to lower financing costs."

- Focus turns to the Canadian jobs report, expected to show a gain of 175k in the net change in employment headline. ECB's Lagarde is due to speak, as well as the publication of the ECB minutes from their early June meeting.

EQUITIES: Cyclicals Lead Gains Early Friday

- Asian stocks closed mixed, with Japan's NIKKEI down 177.61 pts or -0.63% at 27940.42 and the TOPIX down 7.94 pts or -0.41% at 1912.38. China's SHANGHAI closed down 1.416 pts or -0.04% at 3524.088 and the HANG SENG ended 191.41 pts higher or +0.7% at 27344.54.

- European equities are higher, with with the German Dax up 156.98 pts or +1.02% at 15567.77, FTSE 100 up 57.97 pts or +0.82% at 7085.99, CAC 40 up 116.2 pts or +1.82% at 6501.19 and Euro Stoxx 50 up 61.92 pts or +1.55% at 4047.89.

- U.S. futures are gaining, with the Dow Jones mini up 189 pts or +0.55% at 34483, S&P 500 mini up 17.5 pts or +0.41% at 4330.5, NASDAQ mini up 21.5 pts or +0.15% at 14734.

COMMODITIES: Oil Continues To Regain Lost Ground

- WTI Crude up $0.72 or +0.99% at $73.71

- Natural Gas down $0.01 or -0.3% at $3.676

- Gold spot down $0.18 or -0.01% at $1802.67

- Copper up $1 or +0.23% at $427.35

- Silver down $0 or 0% at $25.942

- Platinum up $6.87 or +0.64% at $1086.16

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.