-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI US Open: Pipeline Price Pressures Persist In Europe

EXECUTIVE SUMMARY:

- RBA STAYING THE COURSE DESPITE LOCKDOWNS (MNI STATE OF PLAY)

- EUROZONE PIPELINE INFLATION AT RECORD HIGH

- TENCENT DIVES AFTER CHINA MEDIA CALL GAMES "SPIRITUAL OPIUM"

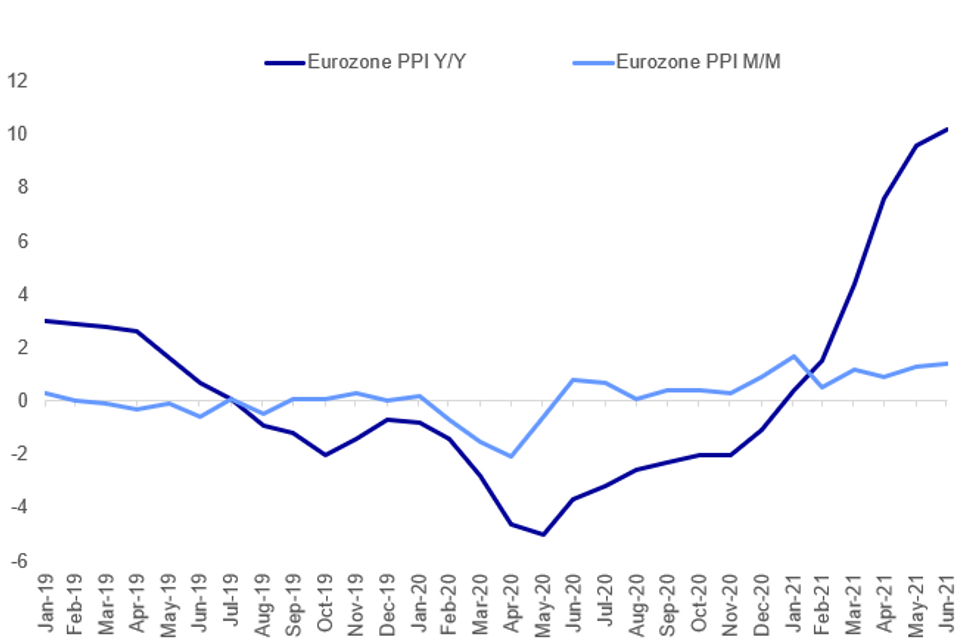

Fig. 1: Eurozone Producer Prices

Source: Eurostat, MNI

Source: Eurostat, MNI

NEWS:

RBA: The Reserve Bank of Australia has held to its policy course despite the recent resurgence of the pandemic and maintained all its policy settings unchanged at Tuesday's board meeting. Interest rates have been held at the record low of 0.10%, the yield target has been maintained on three year government bonds maturing in April 2024 and there has been no change to the program of buying longer dated bonds as expected MNI STATE OF PLAY: RBA Dilemma As Lockdowns Threaten Rebound. That program will continue at AUD5 billion per week until early September, when the current program ends, and then continue at AUD4 billion per week until November when the purchases will be reviewed. The RBA said it had a "flexible approach" to bond purchases, and the program would continue to be reviewed "in light of economic conditions and the pandemic and acknowledged that the outlook for the coming months is uncertain and dependent on the "health situation and containment measures".

EUROZONE DATA: Eurozone producer prices surged to a new record high of 10.2% in Jun, Eurostat said Tuesday, extending the record high seen in May. Just 7 months ago, in December, eurozone PPI stood at -1.1% y/y. Energy prices jumped to 25.4% in Jun and prices for intermediate goods accelerated sharply as well at 10.6%. Survey evidence, such as the EZ manufacturing PMI for July, suggests another increase in input prices at a record rate due to supply-side constraints. Additionally, the report saw an uptick in output prices as well, as companies pass on the higher costs.

CHINA / TECH (BBG): Tencent Holdings Ltd. dived as much as 10% Tuesday after an offshoot of China's official news agency decried the "spiritual opium" and "electronic drugs" of games, stoking fears Beijing will next set its sights on online entertainment.The social media giant joined rivals NetEase Inc. and XD Inc. in an abrupt selloff in early Hong Kong trading after an outlet run by the Xinhua News Agency published a blistering critique of the gaming industry. The Economic Information Daily cited a student as saying some schoolmates played Tencent's Honor of Kings -- one of its most popular titles -- eight hours a day and called for stricter controls over time spent on games. It spooked investors already on edge after Beijing came down hard on online industries from e-commerce to ride-hailing, triggering a global selloff of Chinese shares that at one point surpassed $1 trillion.

ECB: Employee pay should rebound strongly in the second quarter of 2021 following a dramatic drop in growth in the second quarter of 2020 as a result of the Covid crisis, according to the European Central Bank's latest Economic Bulletin, with upward base effects strongest in those high-contact service sector jobs hit hardest by lockdown restrictions.

GERMANY: The German car industry saw July business conditions improve to the highest level in three years, as the business situation index rose 11.9pt to 56.8, data published Tuesday by the Ifo institute showed. Expectations ticked up 2.7pt to 6.3 in July. "Demand in Asia and the US continues to be very strong, and pre-crisis levels are within reach. In Europe, however, we've still got quite a way to go," said Oliver Falck, Director of the ifo Center for Industrial Organization and New Technologies.

JAPAN/COVID: Gearoid Reidy at Bloomberg tweets the latest COVID-19 stats from the Japanese capital, Tokyo: "Tokyo coronavirus case count for today is 3,709. Previous two Tuesdays: 2,848, 1,387. 7-day average: 3,337.4.. Serious cases -2 to 112. Cases in over-65s: 115 (3.1%)"

EU: National and EU-level fiscal interventions to support non-financial corporations have largely succeeded in insulating the sector from major disruptions, although significant explicit and implicit risks to government balance sheets have built up as a result, a study published in the latest European Central Bank Economic Bulletin concludes. More targeted approaches will be needed as the pandemic evolves, economists Celestino Girón and Marta Rodríguez Vives argue, though a rush to privatise public corporations should be resisted, and action should be taken to prevent spillovers from non-performing loans undermining banks and reinforcing possible negative sovereign-financial loops.

HONG KONG (BBG): Hong Kong will allow vaccinated tourists from all but 10 places in the world to enter the city starting on Aug. 9, a significant easing of some of the tightest border curbs in the world.Vaccinated visitors from countries now considered "medium-risk" -- which includes the U.S. and Canada -- will be able to enter the city for the first time since the pandemic started. Meanwhile, Hong Kong residents from previously banned places like the U.K. and India can now return home.

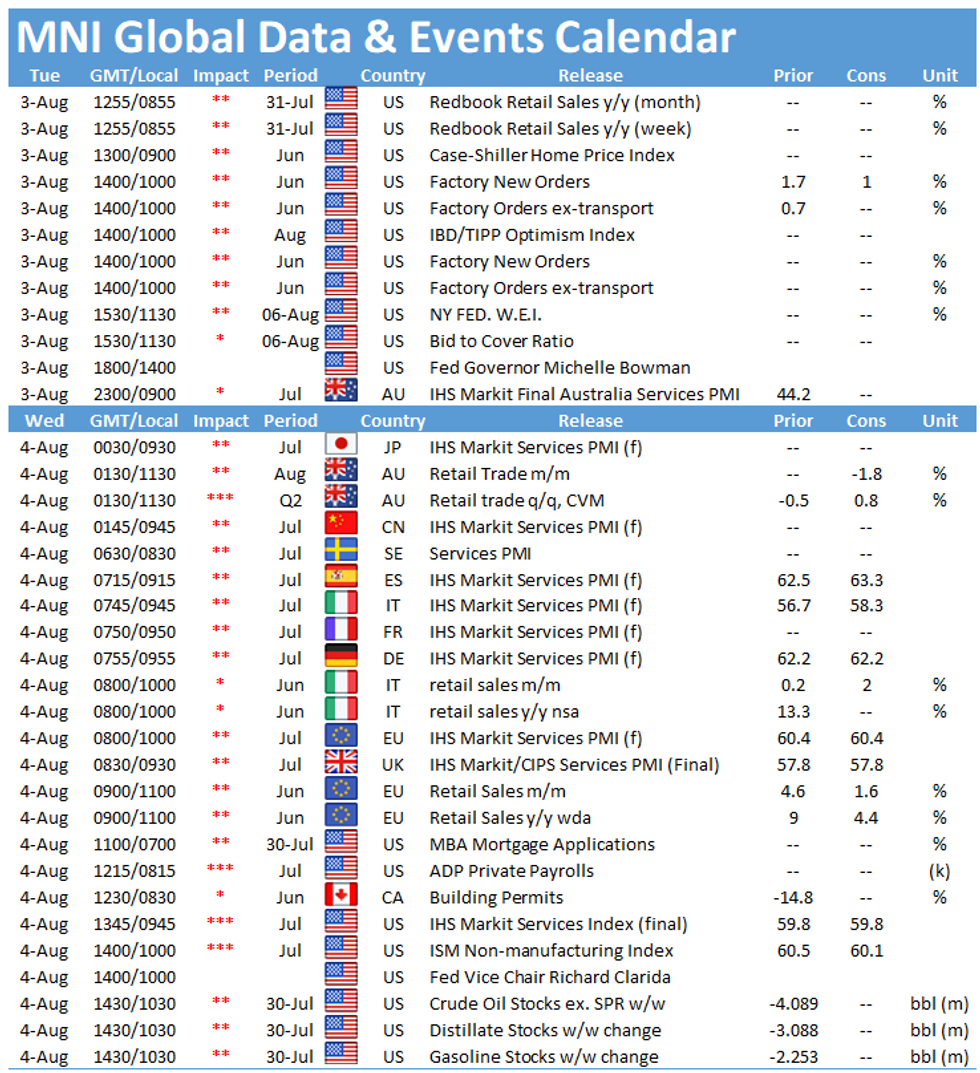

DATA:

FIXED INCOME: Divergence at the short-end

10-year UST, Bund and gilt yields are all up 2.0-2.1bp this morning but there are more differences at the short-end.

- 2-year UST and Schatz yields are both up around 0.8-0.9bp, with the curve bear steepening while 2-year gilt yields are up 2.6bp with the curve bear flattening.

- The moves in 2-year gilts are not wholly consistent with those seen in short sterling markets, with Greens and Blues only really down 0.5 ticks. The Eurodollar curve has seen bigger moves with Greens down 2.0-2.5 ticks and Reds down 2.5-3.5 ticks on the day.

- There is no real explanation for the divergence, although it could be a product of positioning ahead of the BOE MPC meeting which is scheduled for Thursday.

- Today's calendar is relatively light with Bowman the only scheduled Fed speaker and the final print of US durable goods / US factory orders the only notable data.

- TY1 futures are down -0-6 today at 134-26 with 10y UST yields up 2.0bp at 1.198% and 2y yields up 0.8bp at 0.181%.

- Bund futures are down -0.12 today at 176.70 with 10y Bund yields up 2.1bp at -0.467% and Schatz yields up 0.9bp at -0.770%.

- Gilt futures are down -0.01 today at 130.03 with 10y yields up 2.1bp at 0.541% and 2y yields up 2.6bp at 0.053%.

FOREX: AUD On The Up as RBA Double Down on Taper Plan

- AUD outperforms, with the currency seeing some support from the RBA rate decision, which ran against market expectations. The Bank chose to stick with its tapering plan, going against market consensus, pledging to continue to wind down purchases from A$5bln per week to A$4bln in early September. AUD/USD is just below the week's highs of 0.7408, with resistance seen at 0.7429, the high from Jul 19.

- The greenback is weaker inside a range, with the USD Index soft but still just above the Monday lows of 91.912 and last week's multi-month lows of 91.782.

- NOK is the strongest currency in G10, with the currency benefiting from a stabilisation in oil prices after Monday's downtick. USD/NOK eyes the formation of a golden cross in DMA space, with the 50-dma likely to top the 200-dma at some point this week.

- US factory orders and final durable goods orders numbers are the highlight on the data slate, with the speaker schedule also light. Fed's Bowman is due to give welcoming remarks at a Fed conference focused on low income and marginalized workers.

EQUITIES: Edging Higher From Overnight Lows

- Asian markets closed weaker, with Japan's NIKKEI down 139.19 pts or -0.5% at 27641.83 and the TOPIX down 8.91 pts or -0.46% at 1931.14. China's SHANGHAI closed down 16.294 pts or -0.47% at 3447.991 and the HANG SENG ended 40.98 pts lower or -0.16% at 26194.82

- European stocks are a little higher, with the German Dax up 10.36 pts or +0.07% at 15575.98, FTSE 100 up 19.69 pts or +0.28% at 7092.45, CAC 40 up 50.01 pts or +0.75% at 6716.25 and Euro Stoxx 50 up 2.02 pts or +0.05% at 4119.97.

- U.S. futures are higher, with the Dow Jones mini up 138 pts or +0.4% at 34860, S&P 500 mini up 14.25 pts or +0.33% at 4394, NASDAQ mini up 25.25 pts or +0.17% at 14978.

COMMODITIES: Copper Weaker As China Slowdown Fears Persist

- WTI Crude up $0.57 or +0.8% at $71.39

- Natural Gas up $0.04 or +0.97% at $3.978

- Gold spot down $3.33 or -0.18% at $1809.72

- Copper down $4.65 or -1.05% at $440.95

- Silver unchanged at $25.3183

- Platinum down $4.84 or -0.46% at $1054.93

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.