-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI US Open: Post-CPI Moves Extend

EXECUTIVE SUMMARY:

- LUKASHENKO WARNS HE COULD SHUT DOWN GAS PIPELINE TO EU

- TESLA RISES IN U.S. PREMARKET AFTER MUSK OFFLOADS $5B IN SHARES

- U.K. Q3 GDP UP, BUT BELOW EXPECTATIONS

- E.C. SEES EUROZONE INFLATION BELOW ECB TARGET IN 2023

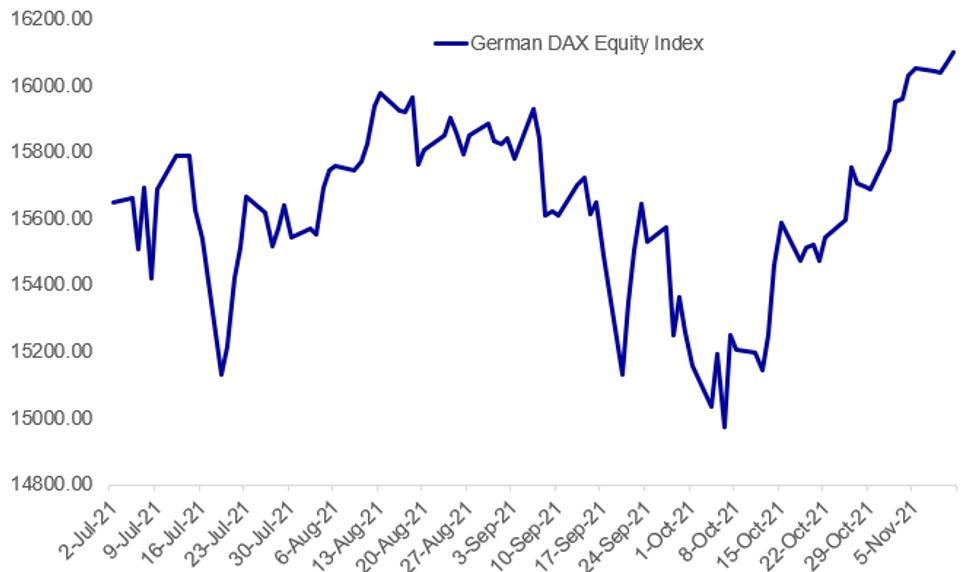

Fig. 1: German DAX Hits All-Time High

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BELARUS / E.U. / ENERGY (BBG): Belarus President Alexander Lukashenko says he might consider shutting down the Yamal-Europe gas pipeline that passes through Belarus territory in response to further EU sanctions, Belta reports. Also said he had asked Russian Defense Ministry to help patrol the EU border, according to Tass.

TESLA (BBG): Tesla shares rise 2.4% in U.S. premarket trading following filings that showed CEO Elon Musk has offloaded $5b in the EV maker's stock this week.Musk has so far sold more than 4.5m shares, according to regulatory filings on Wednesday, his first sales in more than five years

E.C./E.C.B.: The European Commission forecasts average eurozone inflation to peak at 2.4% in 2021 (headline currently at 4.1%p, the year's low was 0.9% in January), accelerating from the 1.9% forecast back in the summer. For 2022, the EC sees inflation dipping to 2.2%, before falling back to 1.4% in 2023, well below the ECB's new symmetric 2% price target. In the summer, the Commission forecast average EZ inflation at 1.9% in 2021 and 1.4% in 2022. However, Brussels warned that "inflation may turn out higher than forecast if supply constraints are more persistent and above productivity wage increases are passed on to consumer prices."

GERMANY: Finance Minister Olaf Scholz has stated that Chancellor Angela Merkel will hold a meeting with state minister-presidents next week in order to discuss the spike in COVID-19 cases in Germany. Comes as Scholz tells the Bundestag that efforts must be made to vaccinate every eligible person, an effort that he says would be aided by reopening vaccination centres. Scholz also emphasised the importance of booster shots for the elderly and vulnerable in containing the virus. Scholz's comments on the pandemic will be viewed with great interest, given the strong likelihood that he becomes Germany's next chancellor once his Social Democrats, the Greens, and the Free Democrats reach a coalition agreement.

CHINA (BBG): President Xi Jinping has delivered the first doctrine on Communist Party history by a Chinese leader in 40 years, giving him the mandate to potentially rule for life as a major summit wraps in Beijing. The landmark document that could change the course of China was announced in a communique Thursday, the official Xinhua News Agency said, as the four-day summit at a military hotel in Beijing closed. Only Mao Zedong and Deng Xiaoping have authored a so-called historical resolution, and both used their works to dominate party politics until they died.

FED (MNI EXCLUSIVE - REPEAT FROM WEDNESDAY): The Federal Reserve's December "dot plot" interest rate forecasts will likely show most officials seeing at least one hike next year and perhaps several others preferring two or three increases, ex-Fed staff economists told MNI. For full article contact sales@marketnews.com

UBER (BBG): Uber Technologies Inc. is raising its base fares in London by 10% in a bid to attract more drivers to the platform.Customers had complained on social media in recent months of longer waiting times and higher fares during peak hours after demand spiked as more workers opted to avoid public transit during the Covid-19 pandemic. Uber needs about 20,000 more drivers to help return service levels to normal.

DATA:

MNI: UK Q3 GDP +1.3 % Q/Q (MEDIAN +1.5%, Q2 +5.5%)

MNI: UK SEP INDEX OF SERVICES +0.7% M/M (MEDIAN +0.5%, AUG 0.3%)

MNI BRIEF: UK Q3 GDP Up, But Below Expectations

UK GDP expanded by 1.3% in the third quarter, falling short of analyst expectations, leaving output 2.1% below the level of Q4 2019, the Office for National Statistics said Thursday

The outcome was also below the Bank of England's latest forecast that saw growth at 1.5% in the 3 months to September.

Output expanded by a higher-than-expected 0.6% in September, but the outturn for previous months was revised downward. GDP contracted by 0.2% in July (compared the the initially-reported 0.1% decline), while August output rose by 0.2% (versus the first estimate of +0.4%)

FIXED INCOME: Pressure on the Euribor strip

- The biggest moves of the day have been in the Euribor strip which has moved down up to 7 ticks this morning (more than the moves seen in EGBs, although there has been some curve steepening in Europe).

- With UST cash closed today, moves in TY1 futures have been relatively subdued, while gilt and Bund futures remain within yesterday's ranges.

- It's a fairly light calendar today with a few speeches (BOE's Mann, ECB's Lane, Schnabel, de Cos).

- TY1 futures are down -0-2 today at 130-21+ with UST cash closed.

- Bund futures are down -0.14 today at 170.55 with 10y Bund yields up 1.0bp at -0.240% and Schatz yields down -0.9bp at -0.782%.

- Gilt futures are up 0.07 today at 126.32 with 10y yields down -0.6bp at 0.916% and 2y yields down -0.4bp at 0.560%.

FOREX: Greenback Holds Post-CPI Strength

- The greenback remains the firmest currency in G10 Thursday, extending the strength built on the back of the surge in inflation evident in Wednesday's CPI. This puts EUR/USD at a fresh 2021 low and the lowest levels since July 2020, opening losses toward 1.1423, the Jul 21 2020 low as well as the 1.1375 1.382 projection, drawn from the Jan 6 - Mar 31 - May 25 price swing.

- Growth proxies and high beta currencies are following suit, with NZD, AUD and CAD among the session's worst performers, reinforcing the market's renewed concern that hot inflation will force the Fed to bring forward possible rate hikes or accelerate the pace of the asset purchase taper. NZD/USD plumbs a fresh November low at 0.7013, breaking below the 100-dma at 0.7027 in the process.

- Volume and market activity will likely drop off as the session continues, with the Veteran's Day holiday keeping fixed income markets closed for the duration. As a result, there are no key data releases Thursday, however a number of ECB speakers are due - with ECB's Lane, Schnabel and de Cos all on the docket.

EQUITIES: German DAX Touches All-Time Highs

- Asian markets closed stronger, with Japan's NIKKEI up 171.08 pts or +0.59% at 29277.86 and the TOPIX up 6.34 pts or +0.32% at 2014.3. China's SHANGHAI closed up 40.324 pts or +1.15% at 3532.786 and the HANG SENG ended 251.85 pts higher or +1.01% at 25247.99

- European equities are gaining, with the German Dax up 28.11 pts or +0.17% at 16047.31, FTSE 100 up 23.03 pts or +0.31% at 7363.16, CAC 40 up 17.88 pts or +0.25% at 7051.59 and Euro Stoxx 50 up 3.77 pts or +0.09% at 4341.74.

- U.S. futures are up too, led by the Nasdaq, with the Dow Jones mini up 52 pts or +0.14% at 36044, S&P 500 mini up 17.25 pts or +0.37% at 4659.25, NASDAQ mini up 105 pts or +0.66% at 16085.5.

COMMODITIES: Precious Metals Resume Post-CPI Climb

- WTI Crude up $0.73 or +0.9% at $82.05

- Natural Gas up $0.09 or +1.74% at $4.962

- Gold spot up $11.43 or +0.62% at $1863.58

- Copper up $5.85 or +1.35% at $438.15

- Silver up $0.34 or +1.37% at $24.9763

- Platinum up $13.93 or +1.3% at $1084.51

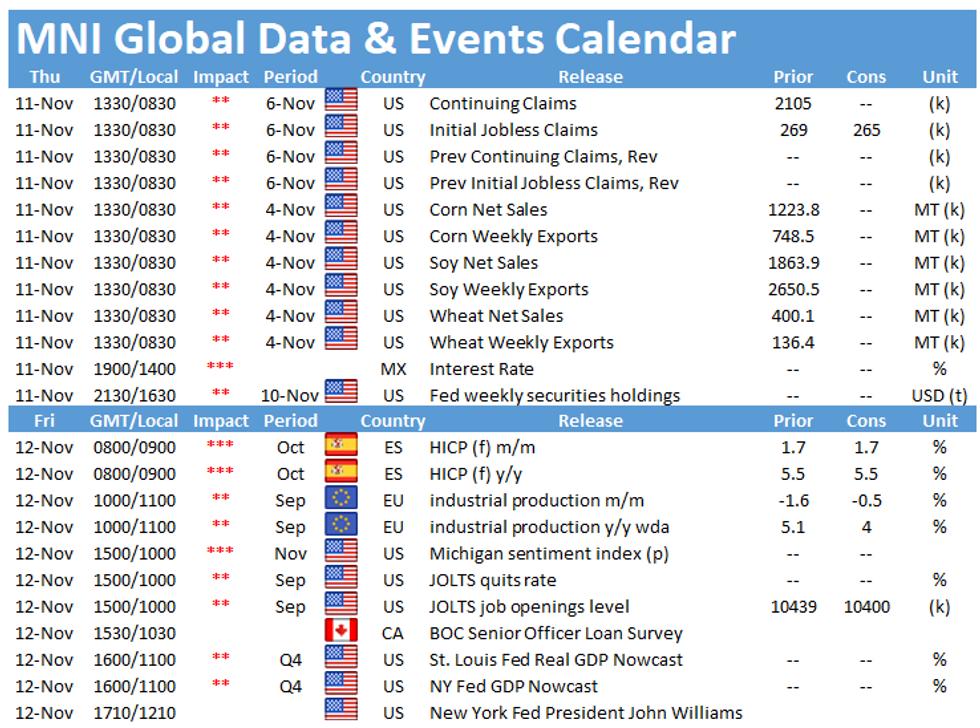

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.