-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI US Open: Rate Hike And Inflation Uncertainty

EXECUTIVE SUMMARY:

- BOE'S PILL: UNCERTAINTY ON THE IMPACT OF RATE HIKES

- GERMAN PPI SURGES TO 70-YEAR HIGH; IFO MISSES EXPECTATIONS

- TURKISH LIRA WEAKENS PAST 17.00 TO USD; RUSSIA HIKES RATES 100BP

- UK RETAIL SALES SOAR IN NOV

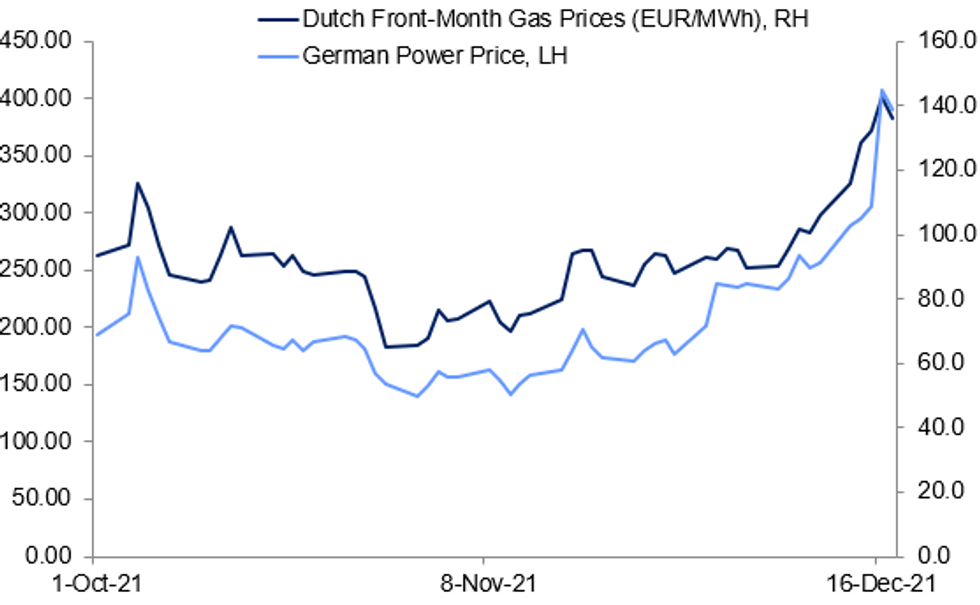

- EUROPEAN ENERGY, POWER PRICES FALL

Fig. 1:

Source: BBG, MNI

Source: BBG, MNI

NEWS:

BOE: BoE's Pill in a CNBC interview this morning: "This is not the first time we have seen changes in behaviour due to the pandemic. There is some evidence of slowdown in consumer, hospitality sectors etc. Need to monitor closely. Experience has shown it shows pattern of consumer spending as well as overall spending - substitution of spending inhospitality to household durable goods which are vulnerable to global supply chains that have been disrupted by Covid. Need to be cautious that just because Omicron weighs on confidence, that it might not have a negative effect on inflation in the medium-term. There is genuine 2-sideduncertainty." Pill asked on gilt yields. Says won't comment on govt financing. Areconcerned about how the transmission into the economy works. Haven't used interest rates as an instrument for some time - so need to monitor the impacts.Pill asked on gilt yields. Says won't comment on govt financing. Are concerned about how the transmission into the economy works. Haven't used interest rates as an instrument for some time - so need to monitor the impacts.

EUROPE / ENERGY (BBG): European natural gas prices plunged from a record close after Russia topped up fuel to the region at the last minute.Dutch next-month futures fell as much as 16%, with the move from Russia easing supply fears already alleviated by expectations of more liquefied natural gas cargoes reaching the continent. Weather forecasts are also indicating that a cold snap from next week won’t last as long as previously expected. The market is still headed for its longest run of weekly gains since July as storage levels are at their lowest ever for this time of year, promising a tough winter with plenty of more volatility to come. Traders remain unsure of what Russia’s supply strategy will be given increasing political tensions with the west over Ukraine.

EUROPE / POWER (BBG): Power prices retreated from record-highs following a series of unplanned outages impacting 10% of France’s nuclear fleet -- a key source of electricity supply for Europe.Volatility is extremely high, with huge price swings from one day to the next. German January power dropped more than 16% on Friday, while year-ahead deliveries slid as much as 9% on EEX. The equivalent French month-ahead contract slumped as much as 10% to 575 euros ($650) a megawatt-hour.EU / UK: European Commission VP Maros Sefcovic and Health Commissioner Stella Kyriakides are set to hold a press conference later today to announce the Commission's proposals for ensuring supply of medicines into Northern Ireland amidst ongoing talks between Brussels and Westminster over the NI protocol.

ECB (RTRS): Inflation in the euro zone may come in higher than the European Central Bank expects while growth may disappoint because of lasting supply snags and higher energy costs, ECB policymaker Gediminas Simkus said on Friday. "Inflationary risks are on upside," Simkus, the Lithuanian central bank governor, told reporters in Vilnius. "The risk balance is tilted towards higher inflation, due to omicron, uncertainties, lasting supply side disruptions, higher energy prices, contagion into production prices. And this means that GDP growth risks are to the downside."

UK (FROM OVERNIGHT): Liberal Democrats' candidate Helen Morgan wins a North Shropshire by-election in a setback to PM Johnson, traditionally an ultra-safe Tory seat. The result is a big setback to PM Johnson's leadership. Helen Morgan defeats her Tory rival Neil Shastri-Hurst by a considerablemargin of 17,957 votes to 12,032.

EUROPE BANKS: Euro area banks may not always be able or willing to use their capital buffers to offset losses during stressful periods without triggering minimum leverage ratio (LR), own funds and liabilities (MREL) requirements or risk-weighted capital framework obligations, a report by the European Systemic Risk Board (ESRB) concludes.

CHINA EVERGRANDE (BBG): China Evergrande Group was labeled a defaulter by S&P Global Ratings, the second credit-risk assessor to do so.S&P Global cut Evergrande to “selective default” over its failure to make coupon payments by the end of a grace period earlier this month, a move that may trigger cross defaults on the developer’s $19.2 billion of dollar debt. S&P Global also withdrew its ratings on the group at Evergrande’s request.

AUSTRIA / COVID (BBG): Austria will suspend a lockdown for the unvaccinated during year-end holidays, giving respite from one of the toughest coronavirus policies in Europe.Unvaccinated people will be allowed to meet in groups of up to 10 on three days around Christmas, as well as New Year’s Eve, Health Minister Wolfgang Mueckstein told reporters Friday. Gatherings of between 10 and 25 will still only be permitted for the fully vaccinated or those who have recently recovered from the virus.

DATA:

MNI: UK NOV RETAIL SALES 1.4% M/M, 7.2% Y/Y

MNI BRIEF: UK Nov Retail Sales Soar; Set to Lift Q4 GDP

UK retail sales jumped by 1.4% in November, far exceeding expectations of a 0.8% rise. After the latest gain, the retail sector stands 7.2% ahead of pre-pandemic levels in February of 2020. October sales were revised to show a 1.1% gain, well above the initially-reported 0.8% improvement. That means sales could fall by as much as 4.8% in December and still leave Q4 volumes above the level of Q3.

Friday's data include Black Friday sales on 26 Nov although many retailers ran promotions during the final week of November. The collection period does not include Cyber Monday, which fell on 29 Nov, which will hit the Dec data. Excluding petrol, sales increased by 1.1%.

Supermarket sales remained subdued, declining by 0.2%, but non-food volumes rose by 2.0%, lifted by a 2.8% jump in clothing sales, regaining pre-pandemic levels for the first time. Internet sales as a proportion of the total eased to 26.9%, the lowest ration since March of 2020, from 27.3% in October.

GERMANY DEC IFO BUSINESS CLIMATE +94.7

MNI: GERMANY DEC IFO CURRENT CONDITIONS 96.9; NOV 99.0

MNI: GERMANY NOV PPI +0.8% M/M, +19.2% Y/Y; OCT +18.4% Y/Y

German PPI surges to fresh 70-yr high

- German producer prices came in slightly below forecasts, but still surging 19.2% y/y in Nov, up from last month’s 18.4% y/y jump which was then the strongest increase since 1951.

- On the month, producer prices grew 0.8%, slowing the pace from October’s reading of 3.8%.

- Alarmingly high energy prices are the key culprit, soaring 49.4% y/y in November (1.2% m/m).

- Core PPI was 9.9% y/y in November, with intermediate goods price inflation hitting 19.1% y/y for the month, largely on the back of metal prices.

MNI: EZ NOV FINAL HICP +0.4% M/M, +4.9% Y/Y; OCT +4.1% Y/Y

Eurozone HICP jumped to an annual rate of 4.9% in November from 4.1% in October, confirming the flash estimate released late last month. That's the highest level of inflation since the euro came to life in 1999. HICP rose by 0.4% between October and November, a slight downward revision form the 0.5% initially-reported gain.

FIXED INCOME: Attention turns to Equity expiries.

- EGB and Bund remains range bound this morning, albeit a touch underpinned, and taking their cue from the lower Equities.

- Periphearl spread are tighter versus Germany, albeit by circa 0.4bp across the board.

- Gilt underperforms after BoE Pill said during a CNBC interview that he was uncomfortable with the inflation print.

- This has translated into a wider Gilt/Bund spread, by 1.1bp in early trade.

- Contracts still trade well within this week's ranges.

- Today, is triple witching day, and there will be some focus in US Equities across the pond, with expiry coming later.

- US Treasuries are trading close to flat along the strip,.

- Tnotes is down 2 ticks, at 131.01.

- Looking ahead, we have no US data, focus will be on expires

FOREX: USD/CNH Narrows Gap With 50-DMA

- In early Friday trade, the USD Index is holding the bulk of the post-Fed decision weakness, trading either side of the 96.00 handle. This has kept EUR/USD and GBP/USD within the Thursday range, keeping GBP/USD north of 1.33 and EUR/USD below yesterday's highs of 1.1360.

- CNH stands out slightly, with USD/CNH making headway through the mid-December highs of 6.3893 to narrow the gap with first resistance of 6.3912, the 50-dma.

- NZD sits at the bottom-end of the table, falling against all others in G10 as EUR/NZD narrows the gap with November/December resistance crossing at 1.6762/1.6775. Softer commodities prices so far Friday are driving growth proxies lower, with WTI and Brent off around 1.5% apiece.

- There are no notable data releases due Friday, with market focus turning to the first post-Fed decision commentary from the FOMC, with Waller due just after the London close discussing the economic outlook.

EQUITIES: Tech Stocks Slump

- Asian markets closed sharply weaker: Japan's NIKKEI closed down 520.64 pts or -1.79% at 28545.68 and the TOPIX ended 28.61 pts lower or -1.42% at 1984.47. China's SHANGHAI closed down 42.652 pts or -1.16% at 3632.364 and the HANG SENG ended 282.87 pts lower or -1.21% at 23192.63

- European stocks are weaker, with the German Dax down 89.06 pts or -0.57% at 15604.66, FTSE 100 down 7.68 pts or -0.11% at 7263.75, CAC 40 down 60.23 pts or -0.86% at 6985.47 and Euro Stoxx 50 down 29.78 pts or -0.71% at 4190.79.

- U.S. futures are lower, with the Dow Jones mini down 20 pts or -0.06% at 35882, S&P 500 mini down 6 pts or -0.13% at 4662.75, NASDAQ mini down 90.75 pts or -0.57% at 15779.75.

COMMODITIES: Energy Slips On Omicron Concerns, Russian Gas Supplies

- WTI Crude down $1.12 or -1.55% at $71.27

- Natural Gas down $0.11 or -2.92% at $3.656

- Gold spot up $7.92 or +0.44% at $1808.65

- Copper up $1.65 or +0.38% at $432.1

- Silver up $0.13 or +0.58% at $22.6213

- Platinum down $1.36 or -0.14% at $938.98

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.