-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Open: Risk Appetite Dips With Fiscal Risks Eyed

EXECUTIVE SUMMARY:

- MNI CHINA LIQUIDITY INDEX: CONDITIONS EASE ON PBOC INJECTIONS

- CHANCELLOR SUNAK TO DELIVER U.K. BUDGET STATEMENT TODAY

- DEMOCRATS UNVEIL BILLIONAIRES TAX AIMED AT ANNUAL ASSET GAINS

- RBA LIKELY TO STICK WITH RATE PATH AFTER CPI SURGE (MNI INSIGHT)

- GERMANY CUTS 2021 GROWTH FORECAST, RAISES OUTLOOK FOR 2022

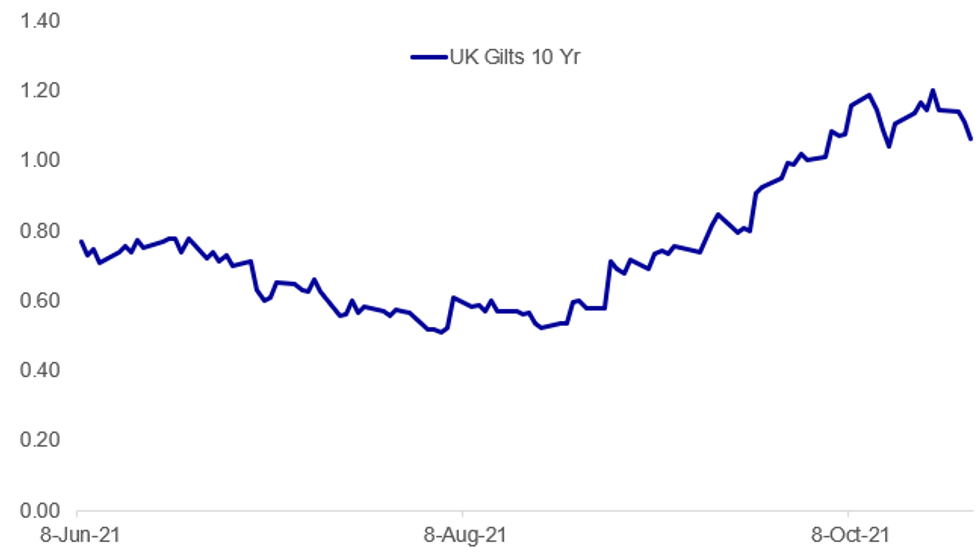

Fig. 1: Gilts Yields Lower Pre-Budget

Source: BBG, MNI

Source: BBG, MNI

NEWS:

MNI CHINA LIQUIDITY INDEX: Conditions in China's interbank eased in late October, soothed by the People's Bank of China's recent fund injections, the latest MNI Liquidity Conditions Index shows. The Liquidity Condition Index eased to 35.7 in October, falling from September's 13-month peak of 79.6, with 57.1% of the traders reporting improved condition. The higher the index reading, the tighter liquidity appears to survey participants. For full article contact sales@marketnews.com

U.K. BUDGET: Political and market focus on Chancellor of the Exchequer Rishi Sunak as he delivers the budget statement in the House of Commons later today. Sunak is presently briefing Cabinet colleagues on the budget, and is set to be on his feet in the Commons at around 1240BST (0740ET, 1340CET) following prime minister's questions. The speech is expected to end at around 1330BST (0830ET, 1430CET). This is being billed as Sunak's first 'real budget', with his statements in the springs of 2020 and 2021 entirely dominated by the pandemic and short-term efforts to keep the economy afloat. This will be the first UK budget since 2019 with a more long-term view. Much to the chagrin of House of Commons speaker Sir Lindsay Hoyle, several of the more headline-grabbing details from the budget have already been leaked to the press. These include an increase to the national living wage (the UK's minimum wage), rising transport spending outside London, and more funding for boosting skills. Sky News estimates that at least 15 budget measures have already been released before Sunak gets to his feet.

U.K. BUDGET (BBG): The U.K. is expected to trim gilt sales this fiscal year by about a tenth from its most recent target, after the government undershot borrowing forecasts. The Debt Management Office will reduce bond issuance to 219.6 billion pounds ($302 billion), according to the median estimate in a Bloomberg survey of analysts at 13 primary dealers. That's a 33-billion-pound cut from a projection of 252.6 billion pounds in April, and down from the government's initial estimate of 295.9 billion pounds in March. Analyst forecasts for full-year issuance range from as low as 200 billion pounds to as much as 232.6 billion pounds.

U.S. FISCAL (BBG): Senate Democrats released the details of a proposed levy on billionaires, a new and logistically risky approach to taxation that lawmakers hope will help fund President Joe Biden's social spending aimed at low- and middle-income Americans. The plan, sponsored by Senate Finance Committee Chairman Ron Wyden, is the result of weeks of negotiations among Democrats about how to find ways to raise taxes on the wealthy that nearly every member of the party can support. Wyden is betting that fellow lawmakers -- and voters -- will broadly back a plan that would shift more of the tax burden to the very wealthiest.

CHINA PROPERTY (RTRS): Some Chinese property developers have voiced their intention to the regulators to extend their offshore bond maturities or undertake a debt restructuring, two sources with knowledge of the matter said, as a growing number of defaults hits the sector. The developers proposed the ideas at a meeting jointly held by the National Development and Reform Commission (NDRC) and the State Administration for Foreign Exchange (SAFE) on Tuesday, said the sources. It was not immediately clear which developers raised those proposals, and what decision the regulators would settle on.

RBA (MNI INSIGHT): Australian inflation data moved into the Reserve Bank of Australia's target range, but MNI understands that this is unlikely to change the central bank's view on the timing of any interest rate hike two years down the line. For full article contact sales@marketnews.com

GERMANY (BBG): Germany expects growth this year to be significantly weaker than predicted, as the lingering effects of the pandemic and a supply squeeze hinder a revival of Europe's biggest economy.The cut in the 2021 outlook to 2.6% -- compared with a prediction of 3.5% published at the end of April -- reflects a scarcity in some raw materials and rising energy prices, particularly for gas, Economy Minister Peter Altmaier said Wednesday in an interview with ARD television.The government expects a "boom" to take effect only next year, and has raised its forecast for 2022 GDP growth to above 4% from 3.6%, added Altmaier.

CHINA - U.S. (BBG): China rebuked U.S. efforts to boost Taiwan's participation in UN organizations, saying the self-ruled island has "no right" to join the world body a half century after it was booted out. "The United Nations is an international governmental organization composed of sovereign states," Ma Xiaoguang, a spokesman for the Taiwan Affairs Office in Beijing, told a regular news briefing Wednesday. "Taiwan is a part of China. The People's Republic of China is the sole legal government representing the whole of China. Taiwan has no right to join the United Nations."

CHINA / COAL (BBG): China plans to limit the price miners sell thermal coal for as it seeks to ease a power crunch that's prompted electricity rationing and even caused a blackout in a major city last month. Beijing aims to cap the price of its most-popular 5,500-NAR grade coal at 440 yuan ($69) a ton at the pithead, according to people familiar with the situation, who asked not to be identified as they aren't authorized to speak publicly. That price, which includes taxes, is a target rate, and there will be an absolute ceiling at 528 yuan, the people said.

PBOC (MNI INTERVIEW): A financing facility on an "impressive scale" for moves lowering carbon emissions is likely to be unveiled soon by the People's Bank of China as part of a green financing packageto support the country's carbon neutrality efforts, Ma Jun, a senior green finance policy advisor to the central bank, told MNI. For full article contact sales@marketnews.com

PORTUGAL (AP): Portugal's parliament was poised to reject Wednesday the minority Socialist government's proposed state budget for 2022, a move that would likely trigger a snap election and put a brake on the country's post-pandemic recovery plans.The moderate Socialists were deserted by their hard-left allies from the Communist Party and the Left Bloc who have helped shore up the government's power over the past six years by voting for its policies or abstaining.Prime Minister António Costa said he wouldn't quit even if he was defeated."The government's duty, my duty, is not to walk away when things become difficult," Costa told lawmakers. "We have to face up to difficulties."

DATA:

MNI: FRANCE OCT CONSUMER CONF IND 99; SEP 101r

MNI: FRANCE SEP PPI +1.7% M/M, +11.6% Y/Y; AUG +10.0 Y/Y

FIXED INCOME: Curve Flattening Bias Amid Heavy Volumes

- Curves trade with a flattening bias ahead of the NY crossover, with EGBs trading firmly amid heavy volumes. Dec-21 Bund futures have seen activity running at around 30% ahead of average for this time of day, pressuring German 10y yields to -0.162%, the lowest level since Oct19.

- Aussie bond markets also took focus overnight, with the curve aggressively flattening thanks to a solid CPI report. While headline CPI was inline with forecast, both the weighted median and trimmed mean figures were well ahead of forecast. The 3yr yield surged over 15bps in response.

- Markets were already trading modestly shakily across early Europe, but the selling pressure accelerated as the US Democrats unveiled the finer details of a Billionaire tax, which would see those with billionaire status taxed 23.8% annually based on asset price gains.

- Focus turns to US prelim durable goods data, seen declining at a pace of 1.1% on the month, shortly followed by the Bank of Canada rate decision at which the board are seen keeping rates unchanged, but slowing the rate of asset purchases as the Bank continues to wean the economy off pandemic-stance policy.

- The US sells 2y floating rate notes and 5yr at auction later today.

FOREX: Risk Appetite and Growth Proxies Dip on Dem's Billionaire Tax

- Risk appetite is seen waning headed into the NY crossover, with equity futures rolling off the overnight (and record) highs as the USD and JPY make headway and erase a small part of the recent weakness. The softer risk outlook has worked against commodity-tied and growth-proxy currencies, putting the likes of NOK, CAD and NZD among the session's poorest performers.

- Markets were already trading modestly shakily across early Europe, but the selling pressure accelerated as the US Democrats unveiled the finer details of a Billionaire tax, which would see those with billionaire status taxed 23.8% annually based on asset price gains.

- A solid underlying inflation report from Australia (trimmed mean and weighted mean numbers came in well ahead of expectations) prompted a sharp re-pricing of the front-end of the Aussie curve, but the read through to the AUD has been more mixed as the risk-off theme pervades. AUD/USD continues to hold below key resistance at the 0.7560 200-dma,

- Focus turns to US prelim durable goods data, seen declining at a pace of 1.1% on the month, shortly followed by the Bank of Canada rate decision at which the board are seen keeping rates unchanged, but slowing the rate of asset purchases as the Bank continues to wean the economy off pandemic-stance policy.

EQUITIES: Energy, Materials Dragging On Stocks

- Asian stocks closed lower, with Japan's NIKKEI down 7.77 pts or -0.03% at 29098.24 and the TOPIX down 4.59 pts or -0.23% at 2013.81. China's SHANGHAI closed down 35.333 pts or -0.98% at 3562.305 and the HANG SENG ended 409.53 pts lower or -1.57% at 25628.74

- European equities are weaker, with the German Dax down 55.41 pts or -0.35% at 15742.57, FTSE 100 down 13.15 pts or -0.18% at 7276.65, CAC 40 down 8.62 pts or -0.13% at 6764.7 and Euro Stoxx 50 down 6.85 pts or -0.16% at 4219.67. Materials (-0.6%) and Energy (-1.1%) leading losses in Euro Stoxx 600.

- U.S. futures are slightly higher, with the Dow Jones mini up 34 pts or +0.1% at 35678, S&P 500 mini up 4.5 pts or +0.1% at 4569.75, NASDAQ mini up 26 pts or +0.17% at 15571.

COMMODITIES: Weaker Across The Board

- WTI Crude down $1.22 or -1.44% at $84.64

- Natural Gas down $0.04 or -0.63% at $5.725

- Gold spot down $8.84 or -0.49% at $1801.61

- Copper down $5.3 or -1.18% at $449.15

- Silver down $0.29 or -1.19% at $24.0325

- Platinum down $16.78 or -1.63% at $1031.43

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.